Construction and Design Software Market

Construction and Design Software Market Size, Share & Trends Analysis Report by Function (Safety & Reporting, Project Management & Scheduling, Project Design, Field Service Management, Cost Accounting, Construction Estimation, On-across Bid Management and Others (Asset Management and Building System Analysis).by Deployment (Cloud and On-premise).and by End-Users (Architects & Builders, Remodelers, Designers and Others).Forecast Period (2024-2031).

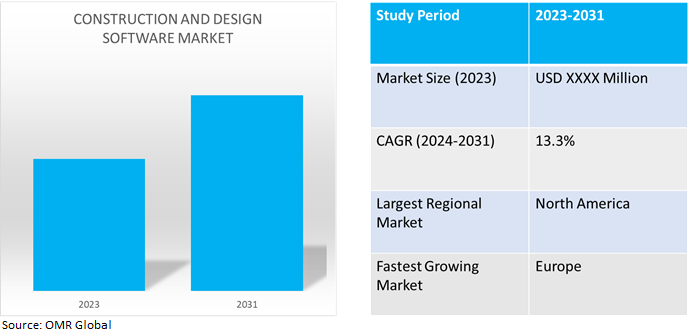

Construction and design software market is anticipated to grow at a significant CAGR of 13.3% during the forecast period (2024-2031).The growth of the construction and design software market is attributed to the increasing demand for large-scale project management, as is the use of smart devices and cloud-based solutions globally. The development of software for construction speeds up corporate growth and facilitates the construction process including estimating, planning, accounting, project costing, risk factor maintenance, and many other areas that will all benefit from it.

Market Dynamics

Growing Utilization of Building Information Modeling (BIM)

The digital revolution of the architecture, engineering, and construction (AEC) sector is based on building information modelling, (BIM). The comprehensive process of generating and maintaining data for a built object is known as BIM. BIM integrates structured, multidisciplinary data, based on an intelligent model and is made possible by a cloud platform, to create a digital representation of an asset that spans its entire lifecycle, from planning and design to building and operations. BIM facilitates the digital exploration of alternative design decisions, increased detail capture, and improved coordination for civil engineers. Through the use of BIM, project life cycles become more accurate, predictable, and understandable, producing results that are persuasive and giving stakeholders data-driven certainty that projects will be completed on time and within budget.

Increasing Integration of Cloud-Based Solutions

Construction organizations may improve the project lifecycle from the outset using cloud-based planning tools. These specialist solutions ensure accuracy, efficiency, and teamwork by streamlining and automating several operations. Professionals in the construction industry were able to operate remotely more productively and free from any location with an internet connection to advent cloud-based software. Their devices could ensure that they were always up to date, which would drastically reduce mistakes, travel time between the office and the field, and misunderstandings. All of the systems, storage, tools, techniques, and procedures required to oversee any building project are included in cloud-based construction management technology. Much to the advantage of project workers, cloud-based construction management technology is revolutionizing the way the construction industry operates.

Market Segmentation

Our in-depth analysis of the global construction and design software market includes the following segments by function, deployment and end-users.

- Based on function, the market is sub-segmented into safety & reporting, project management & scheduling, project design, field service management, cost accounting, construction estimation, on-across bid management and others (asset management and building system analysis).

- Based on deployment, the market is sub-segmented into cloud and on premise.

- Based on end-users, the market is sub-segmented into architects & builders, remodelers, designers and others (consultants, facility managers, and automatic exposure control (AEC) professionals.)

Project Management & Scheduling is Projected to Emerge as the Largest Segment

Based on the function, the global construction and design software market is sub-segmented into safety & reporting, project management & scheduling, project design, field service management, cost accounting, construction estimation, on-across bid management and others (asset management and building system analysis).Among these project management & scheduling sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include growing demand for project activity management and control, including resource allocation, time delay reduction, and progress tracking is the major factor driving the demand for project management & scheduling globally. For instance, in July 2022, Procore Technologies, Inc. introduced a new solution, Procore Workforce Management, which features two key products, field productivity as well as, workforce planning, formerly known as LaborChart. When combined, field productivity and workforce planning provide the most complete construction workforce management solution available. This gives contractors insight into their workforce, enabling them to effectively anticipate and manage human resources to help them meet or surpass projected budgets and timelines.

Architects & Builders Sub-segment to Hold a Considerable Market Share

Based on the end-users, the global construction and design software market is sub-segmented into architects & builders, remodelers, designers and others (consultants, facility managers, and automatic exposure control (AEC) professionals). Among these, the architects & builders sub-segment is expected to hold a considerable share of the market. The growing demand for design expertise to capitalize on project opportunities such as planned construction, development, and building parameter approval. Moreover, synchronization of design and construction planning, conflict detection, and visualization are made possible by architects' increasing use of Building Information Modeling (BIM), which will aid in the more efficient planning, designing, and management of building projects. In addition to this, architects and builders provide designs that are tailored to the budgets of their clients and help them save costs by providing comprehensive construction information and ensuring that the project is completed on schedule.

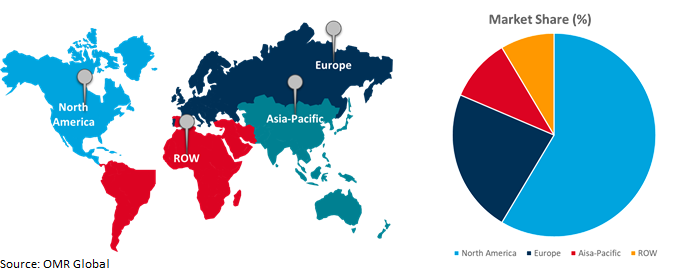

Regional Outlook

The global construction and design software market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Construction and Design Software Adoption in Europe

- The regional growth is attributed to increasing utilization of CAD software by the construction sector, rising focus on smart manufacturing, and growing need for fast production of goods. Moreover, the region has a major market for construction and design software owing to the increasing construction activities.

- According to the Office of National Statistics, in November 2023, the value of construction new work in current prices in Great Britain in 2022 increased 15.8% to a record high of £132.9billion. ($140.1 billion)This was driven by growth in both private sector work of £14.1billion ($14.8 billion) and in the public sector of £4.1billion ($4.2 billion).

Global Construction and Design Software Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and construction and design software providers. The growth is attributed to the increasing demand for construction activities is driving the growth of construction design software in the region. According to the Lighting Control Association, in January 2024, According to the U.S. Commerce Department, US put-in-place construction spending grew to a seasonally adjusted annual rate of $2.1 trillion as of November 2022. Private nonresidential construction spending achieved a seasonally adjusted annual rate of $698.2 billion in November 2023. Private residential construction spending achieved a seasonally adjusted annual rate of $896.8 billion. Public construction spending achieved a seasonally adjusted annual rate of $455.1 billion.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global construction and design software market include Autodesk Inc., Bentley Systems, Inc., Oracle Corp., Siemens AG and Trimble Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, Trimble acquired Ryvit, an integration Platform-as-a-Service (iPaaS) provider for the construction industry. Ryvit provides a platform for software solution providers and construction stakeholders to rapidly build and deploy workflows, enabling the automatic flow of critical information across organizations and teams in real-time.

Recent Development

- In April 2023, Sustaira and Sellen Construction announced their collaboration around innovative sustainability data tracking and reporting within the construction industry. In addition to Sellen’s use of Sustaira’s Carbon Accounting and ESG KPI Tracking apps, the two organizations co-created a new application within Sustaira’s suite of powerful sustainability and ESG tools.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global construction and design software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Autodesk Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Siemens AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Trimble Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Construction and Design Software Market by Function

4.1.1. Safety & Reporting

4.1.2. Project Management & Scheduling

4.1.3. Project Design

4.1.4. Field Service Management

4.1.5. Cost Accounting

4.1.6. Construction Estimation

4.1.7. On-across Bid Management

4.1.8. Others (Asset Management and Building System Analysis)

4.2. Global Construction and Design Software Market by Deployment

4.2.1. Cloud

4.2.2. On-premise

4.3. Global Construction and Design Software Market by End-Users

4.3.1. Architects & Builders

4.3.2. Remodelers

4.3.3. Designers

4.3.4. Others (Consultants, Facility Managers, and Automatic Exposure Control (AEC) Professionals).

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Accruent, LLC

6.2. Asite Solutions Ltd.

6.3. Bentley Systems, Inc.

6.4. Bluebeam, Inc.

6.5. ConstructConnect

6.6. Dassault Systèmes SE

6.7. Hexagon AB

6.8. Hilti Fieldwire, Inc.

6.9. Intellectsoft LLC

6.10. Intelvision LLC

6.11. Jonas Construction Software Inc.

6.12. Nemetschek SE

6.13. Newforma, Inc.

6.14. Oracle Corp.

6.15. Procore Technologies, Inc.

6.16. Revizto SA

6.17. Rhumbix, Inc.

6.18. RIB Software GmbH

1. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

2. GLOBAL SAFETY & REPORTING CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PROJECT MANAGEMENT & SCHEDULING CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PROJECT DESIGN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FIELD SERVICE MANAGEMENT CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL COST ACCOUNTING CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CONSTRUCTION ESTIMATION CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ON-ACROSS BID MANAGEMENT CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OTHER FUNCTION CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

11. GLOBAL CLOUD-BASED CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ON-PREMISE CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

14. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR ARCHITECTS & BUILDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR REMODELERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR DESIGNERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

22. NORTH AMERICAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

23. EUROPEAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

25. EUROPEAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

26. EUROPEAN CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

34. REST OF THE WORLD CONSTRUCTION AND DESIGN SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY FUNCTION, 2023 VS 2031 (%)

2. GLOBAL SAFETY & REPORTING CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PROJECT MANAGEMENT & SCHEDULING CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PROJECT DESIGN CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FIELD SERVICE MANAGEMENT CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL COST ACCOUNTING CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONSTRUCTION ESTIMATION CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ON-ACROSS BID MANAGEMENT CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL OTHERS FUNCTION CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY DEPLOYMENT, 2023 VS 2031 (%)

11. GLOBAL CLOUD-BASED CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ON-PREMISE BASED CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

14. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR ARCHITECTS & BUILDERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR REMODELERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR DESIGNERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CONSTRUCTION AND DESIGN SOFTWARE FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

20. UK CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA CONSTRUCTION AND DESIGN SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)