Construction Equipments Rental Market

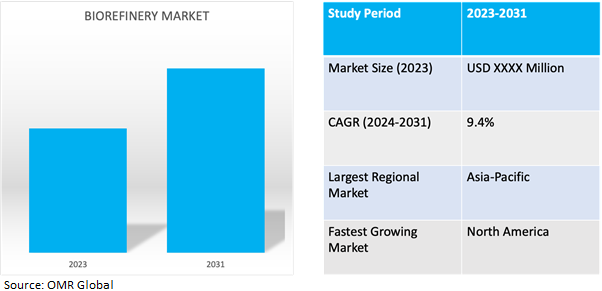

Construction Equipments Rental Market Size, Share & Trends Analysis Report by Type (First Generation, Second Generation, and Third Generation), by Product (Energy Driven and Material Drive), and by Technology (Industrial Biotechnology, Physico-Chemical, and Thermochemical) Forecast Period (2024-2031)

Construction Equipments Rental market is anticipated to grow at a CAGR of 9.4% during the forecast period (2024-2031). The global construction equipment rental market refers to the industry that provides construction machinery and equipment to contractors and construction companies on a rental basis rather than selling the equipment outright. This allows construction firms to access expensive and specialized equipment without the financial burden of purchasing it.

Market Dynamics

Driving Factors Behind the Growth of the Global Construction Equipment Rental Market

The global construction equipment rental market is experiencing growing demand such as infrastructure development initiatives, rapid urbanization, and the need for cost-efficient solutions. Construction companies increasingly opt for renting equipment due to its flexibility, scalability, and ability to access advanced technology without significant upfront investment. The trend towards environmental sustainability and energy efficiency encourages the adoption of rental equipment with eco-friendly features. Additionally, the market benefits from opportunities in disaster recovery and reconstruction efforts worldwide. By catering to these demands and trends, construction equipment rental companies can capitalize on expanding markets and contribute to sustainable development goals. For instance, in February 2024, The global construction equipment rental market value is projected to reach US$ 121 billion in fiscal 2022, rising from US$ 115 billion in fiscal 2021, reflecting a 4.3% year-over-year growth.

Navigating Seasonal Swings: Managing Demand in the Construction Equipment Rental Market

Seasonal variations in the global construction equipment rental market refer to fluctuations in demand due to weather conditions and project schedules. Cold winters may slow construction in colder climates, while warmer seasons see increased activity. Certain projects, like outdoor renovations, are more prevalent during optimal weather, affecting demand for associated equipment. Rental companies adjust by managing inventory and staffing levels accordingly. Anticipating seasonal shifts ensures they meet demand, optimize resources, and maintain profitability. Understanding these variations is vital for adapting pricing strategies and rental terms to accommodate fluctuating needs, ultimately sustaining growth and customer satisfaction throughout the year.

Market Segmentation

Our in-depth analysis of the global Construction Equipments Rental market includes the following segments by equipments and by product:

- Based on equipments, the market is sub-segmented into earthmoving, material handling and Road Building & Concrete

- Based on product, the market is sub-segmented into Backhoes, Excavators, Loaders, Crawler Dozers, Cranes and Others (concrete pumps, compactors)

Crane is Projected to Emerge as the Largest Segment

The crane sub-segment dominates the global construction equipment rental market due to its indispensable role in various construction projects, including high-rise buildings, bridges, and infrastructure. With their versatility and heavy lifting capabilities, cranes fulfil critical tasks, ensuring consistent demand. Moreover, their high rental rates contribute significantly to industry revenue, making them a lucrative asset for rental companies. Accessibility also plays a key role, as smaller construction firms or those with occasional crane needs find renting more cost-effective than ownership. As urbanization and infrastructure projects persist worldwide, the demand for cranes remains robust, cementing their position as the market's largest segment. For instances, in October 2022 Action Construction Equipment (ACE) Limited received the Innovative Construction Equipment 2022 Award at the esteemed CE & CR Awards 2022 for its versatile Piling Crane Model FP210.

Crawler Dozers to Hold a Considerable Market Share

Rising investments in crawl dozers stem from their versatility in construction, mining, and infrastructure projects. With the ability to navigate rough terrain and handle various materials, they enhance productivity on job sites. Technological advancements further bolster their appeal, attracting customers seeking modern and efficient equipment. Additionally, crawl dozers' combination of versatility, efficiency, and technological prowess solidifies their pivotal role in the construction equipment rental market. For instance, in January 2021, Komatsu introduced iMC 2.0 on D51-24 and D61i-24 dozers, offering 131 and 168 horsepower, respectively. New features include proactive dozing control for automated cutting or stripping, lift layer control for spreading fill, tilt steering for straight travel, and quick surface creation for temporary design surfaces, enhancing productivity and reducing operator input.

Regional Outlook

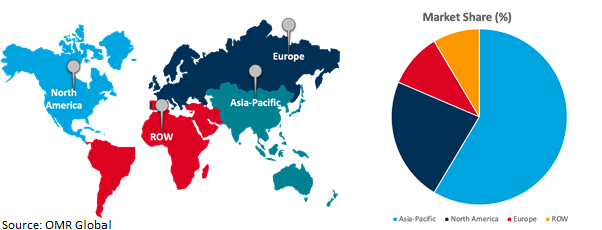

The global Construction Equipments Rental market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in the construction equipments market

- The US is the key investor and user of construction equipment rental based products around the globe.

- Canada is shifting in the construction equipment rental market due to advancements in technology, evolving construction needs and regulatory standards.

Global Construction Equipments Rental Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rising demand for the construction equipments rental market. The growth is driven by increased infrastructure development efforts by governments, including the construction of Special Economic Zones (SEZs), hydropower projects, and transportation networks. Additionally, China, in particular, stands out with its booming construction equipment rental industry, fueled by government investments in public infrastructure and residential projects to accommodate a growing population. As a result, international companies are increasingly investing in the region to capitalize on its expanding market opportunities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global construction equipment rental market include Ashtead Group Plc, Aktio Corp., United Rentals, Inc., Mitsubishi Corp., Komatsu, John Deere, Nishio Rent All Co. Ltd., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024, John Deere partners with Leica Geosystems to advance digital transformation in heavy construction, offering SmartGrade™ solutions. The collaboration enhances productivity, efficiency, and safety on construction sites through innovative technology integration.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global construction equipment rental market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ashtead Group Plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Aktio Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. United Rentals, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Construction Equipment Rental Market by Equipment

4.1.1. Earthmoving

4.1.2. Material Handling

4.1.3. Road Building & Concrete

4.2. Global Construction Equipment Rental Market by Product

4.2.1. Backhoes

4.2.2. Excavators

4.2.3. Loaders

4.2.4. Crawler Dozers

4.2.5. Cranes

4.2.6. Others (Concrete Pumps, Compactors)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Access Industries

6.2. Ahern Rentals, Inc.

6.3. Aktio Corp.

6.4. American Equipment Co. (Ameco)

6.5. Ashtead Group Plc

6.6. Battlefield Equipment Rentals

6.7. Boels Rentals

6.8. Caterpillar Inc.

6.9. Conquest Equipment

6.10. Cramo Group

6.11. Finning

6.12. GEAR

6.13. Gemini Equipment and Rentals

6.14. H&E Equipment Services, Inc

6.15. Herc Holdings Inc.

6.16. Hub Equipmen

6.17. J.R. Construction Equipment Sales & Rentals

6.18. John Deere

6.19. Kanamoto Co. Ltd.

6.20. Kiloutou Group

6.21. Komatsu Ltd.

6.22. Liebherr

6.23. Loxam group

6.24. Maxim Crane Works, L.P.

6.25. Mitsubishi Corporation

6.26. Neff Rental

6.27. Nikken

6.28. Nishio Rent All Co. Ltd.

6.29. Quippo

6.30. Ramirent Pic

6.31. Sarens NV

6.32. Speedy Hire Plc

6.33. Sunbelt

6.34. Sunstate Equipment Company

6.35. Taiyokenki Rental Co., Ltd.

6.36. United Rentals Inc.

1. GLOBAL CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

2. GLOBAL EARTHMOVING CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MATERIAL HANDLING CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ROAD BUILDING AND CONCRETE CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

6. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR BACKHOES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR EXCAVATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR LOADERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR CRAWLER DOZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR CRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR OTHERS PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. EUROPEAN CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

18. EUROPEAN CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. REST OF THE WORLD CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

24. REST OF THE WORLD CONSTRUCTION EQUIPMENT RENTAL MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

1. GLOBAL CONSTRUCTION EQUIPMENT RENTAL MARKET SHARE BY EQUIPMENT, 2023 VS 2031 (%)

2. GLOBAL EARTHMOVING CONSTRUCTION EQUIPMENT RENTAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MATERIAL HANDLING CONSTRUCTION EQUIPMENT RENTAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ROAD BUILDING AND CONCRETE CONSTRUCTION EQUIPMENT RENTAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CONSTRUCTION EQUIPMENT RENTAL MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

6. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR BACKHOES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR EXCAVATORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR LOADERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR CRAWLER DOZERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR CRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CONSTRUCTION EQUIPMENT RENTAL FOR OTHERS PRODUCT MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CONSTRUCTION EQUIPMENT RENTAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

15. UK CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA CONSTRUCTION EQUIPMENT RENTAL MARKET SIZE, 2023-2031 ($ MILLION)