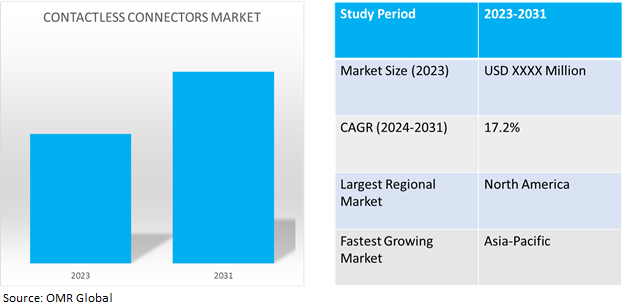

Contactless Connectors Market

Contactless Connectors Market Size, Share & Trends Analysis Report by Product Type (NFC connectors, RFID connectors, Wireless charging connectors, Wireless Data Transfer Connectors, and Infrared Wireless Connections), by Mode of Operation (Full-duplex Connectivity, Half-Duplex Connectivity, and Simplex Connectivity), and by Industry Vertical (Automotive, Consumer Electronics, Healthcare, and Industrial). Forecast Period (2024-2031).

Contactless connectors market is anticipated to grow at a CAGR of 17.2% during the forecast period (2024-2031). Contactless connectors are electronic components broadly used to transmit both data and power without direct physical contact enabling completely sealed product designs and minimizing potential damage caused by dust, dirt, and moisture. It is used in industries including consumer electronics, automotives, healthcare, automation, and others. The market has seen steady demand in recent years due to constant technological innovation and efforts by technology companies to replace wire and cable-based transmissions with wireless transmission across sectors.

Market Dynamics

Rising Investment in Smart Infrastructure

The growth in the contactless connectors market is driven by rising investment in building smart infrastructure and cities. Most countries are planning to develop smart cities and infrastructure based on future requirements, which include smart traffic management systems, power management systems, resource management systems, administrative systems, and others. According to Press Information Bureau of India’s August 2021 release, the Government of India launched the Smart Cities Mission (SCM) 2015 for the development of 100 cities as Smart Cities. The selection of 100 Smart Cities has been completed through 4 rounds of selection from January 2016 to June 2018. The cities under SCM have shown considerable progress since their selection. As of July 2021, these cities tendered out 6,017 projects worth $21.6 billion, out of which work orders have been issued for 5,375 projects worth $17.9 billion out of these, 2,781 projects worth $5.8 billion were completed. There is more than 260.0% growth in projects tendered and more than 380.0% growth in projects grounded/completed between 2018-2021.

Growth of Wireless Communication Industry

The growth of wireless communication protocols such as Wi-Fi 6 (802.11ax) and 5G technology is driving demand for contactless connectors that can sustain larger data speeds to fulfill the needs of next-generation wireless networks. Moreover, growing sales of smartphones alongside demand for high-speed communication have benefited both wireless communication and contactless connectors industries. For instance, according to the Cellular Telecommunications Industry Association (CTIA) 2022 annual wireless industry survey. The US wireless industry invested nearly $35.0 billion to grow, improve, and run their networks in 2021, the record-high investment marked the fourth straight year of increased capital expenditure. While prices across industries were increasing, the cost of wireless decreased, continuing a 10-year trend that has seen the price of wireless service drop 43.0% with speeds increasing to 85 times faster. Survey results again showed increases in wireless data use, cell sites, and data-only devices indicating the ongoing shift to the 5G economy.

Segmental Outlook

Our in-depth analysis of the global Contactless Connectors market includes the following segments by product type, application, use case, deployment, and component.

- Based on product type, the market is sub-segmented into NFC connectors, RFID connectors, wireless charging connectors, wireless data transfer connectors, and infrared wireless connections.

- Based on mode of operation, the market is sub-segmented into full-duplex connectivity, half-duplex connectivity, and simplex connectivity

- Based on industry vertical, the market is sub-segmented into automotive, consumer electronics, healthcare, and industrial.

Wireless Charging Connectors to Emerge as a Bigger Market

Among contactless connectors product types, the wireless charging connectors sub-segment is expected to emerge as the biggest market attributed to growing sales for wireless charging supported consumer electronics devices, automotive, and advancement in wireless charging technology. For instance, in July 2023, WiTricity Corp. launched the FastTrack Integration Program for vehicle manufacturers. This simplified initiative enables automobile OEMs to begin evaluating and testing electric vehicles with wireless charging in just 90 days. Wireless charging will be completely enabled and operational on the automaker's EV platform, utilizing the company's Halo receiver and 11kW charger.

Full Duplex is the Prominent Mode of Operation

In full duplex mode, the sender can send and receive the data simultaneously providing better performance, and utilization of transmission bandwidth than simplex and half duplex mode. Also, it is suitable for those transmissions when there is a requirement of sending and receiving data simultaneously in both directions, which is the most effective and required transmission for most communication devices including telephones, and cell phones making it a prominent mode among the sub-segments.

Consumer Electronics Leads the Industry Vertical Sub-Segment

Undoubtedly, the consumer electronics, sub-segment dominates the contactless connector market by its high demand, rising utility, and innovation. Most product types including wireless charging connectors, NFC connectors, RFID connectors, and wireless data transfer connectors are utilized in consumer electronics to enhance user experience, connectivity, and product features. Moreover, the demand for the sub-segment is expected to rise in the coming years. For instance, as per IBEF India, by 2025, India's consumer electronics and appliances Industry is predicted to be the fifth largest in the world. The Indian Appliances and Consumer Electronics (ACE) market is predicted to nearly double in the next 3 years, reaching approximately $17.9 billion by 2025.

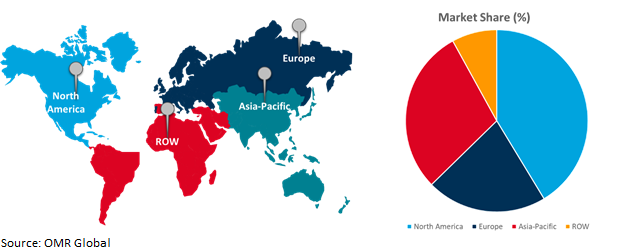

Regional Outlook

The global contactless connectors market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Contactless Connectors Market

North America holds the highest share of the global contactless connectors market share. The key factors contributing to the growth are investments in IoT and wireless technology, favorable market dynamics for advanced technology, the presence of major electronic component manufacturers, and growing end-user industries. For instance, in February 2024, the Department of Commerce’s National Telecommunications and Information Administration (NTIA) awarded $42.0 million in the final award from the Public Wireless Supply Chain Innovation Fund’s first notice of funding opportunity. The award will fund a project by a consortium of US carriers, foreign carriers, universities, and equipment suppliers to establish a testing, evaluation, and R&D center in the Dallas Technology Corridor and a satellite facility in the Washington, D.C. area. The center will focus testing on network performance, interoperability, and security, and facilitate research into new testing methods.

Global Contactless Connectors Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing Contactless Connectors market

- The Asia-Pacific region is undergoing rapid transformation, driven by factors such as growing internet penetration, smartphone adoption, and the rising demand for smart devices. The region is also one of the biggest manufacturers and consumers of electronics globally.

- Asia-Pacific countries have increased their investment in smart city projects and telecommunications networks to promote smooth communication and data exchange; these investments are accelerating the adoption of IoT devices, connected sensors, and automation systems.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global contactless connectors market are STMicroelectronics International N.V., TE Connectivity Corp., Molex LLC, Radiall SA, and Rosenberger Hochfrequenztechnik GmbH & Co. KG, among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in October 2021, Rosenberger and STMicroelectronics announced their collaboration on a contactless connector for ultra-reliable, short-range, point-to-point full-duplex data exchanges in industrial and medical applications. Rosenberger’s innovative contactless connector, the RoProxCon, leverages ST’s 60GHz RF transceiver, the ST60A2, to deliver high-speed data transmission while providing immunity to movement, vibration, rotation, and contaminants such as moisture and dust, which can disrupt conventional pin-and-receptacle interconnects.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Contactless Connectors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. STMicroelectronics International N.V.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. TE Connectivity Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Molex, LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Radiall SA

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Rosenberger Hochfrequenztechnik GmbH & Co. KG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Contactless Connector Market by Product Type

4.1.1. NFC connectors

4.1.2. RFID connectors

4.1.3. Wireless charging connectors

4.1.4. Wireless data transfer connectors

4.1.5. infrared wireless connections

4.2. Global Contactless Connector Market by Mode of Operation

4.2.1. Full-duplex Connectivity

4.2.2. Half-duplex Connectivity

4.2.3. Simplex Connectivity

4.3. Global Contactless Connector Market by Industry Vertical

4.3.1. Automotive

4.3.2. Consumer Electronics

4.3.3. Healthcare

4.3.4. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Schleifring Gmbh

6.2. Moog Inc.

6.3. Spinner GmbH

6.4. Phoenix Contact

6.5. Cobham Ltd.

6.6. NSD Corp.

6.7. Weidmüller Interface GmbH & Co.KG

6.8. Mercotac Inc.

6.9. YAZAKI Corp.

6.10. Uniqconn Inc.

6.11. Induct EV Inc.

6.12. Jonhon Optronic Technology Co., Ltd

6.13. TXGA LLC

6.14. Mojo Mobility Inc.

6.15. Samtec Inc.

1. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL NFC CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL RFID CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL WIRELESS CHARGING CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL WIRELESS DATA TRANSFER CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL WIRELESS CHARGING CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INFRARED WIRELESS CONNECTIONS MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2023-2031 ($ MILLION)

8. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS FOR FULL-DUPLEX CONNECTIVITY BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS FOR HALF-DUPLEX CONNECTIVITY BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS FOR SIMPLEX CONNECTIVITY BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

12. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS IN AUTOMOTIVES BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS IN CONSUMER ELECTRONICS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS IN HEALTHCARE BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS IN INDUSTRIES BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

21. EUROPEAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2023-2031 ($ MILLION)

24. EUROPEAN CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY MODE OF OPERATION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD CONTACTLESS CONNECTOR MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2023-2031 ($ MILLION)

1. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL NFC CONNECTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL RFID CONNECTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL WIRELESS CHARGING CONNECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL WIRELESS DATA TRANSFER CONNECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL INFRARED WIRELESS CONNECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE BY MODE OF OPERATION, 2023 VS 2031 (%)

8. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE FOR FULL-DUPLEX CONNECTIVITY BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE FOR HALF-DUPLEX CONNECTIVITY BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE FOR SIMPLEX CONNECTIVITY BY REGION, 2023 VS 2031 (%)

11. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE BY INDUSTRY VERTICAL, 2023 VS 2031 (%)

12. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE IN AUTOMOTIVES BY REGION, 2023 VS 2031 (%)

13. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE IN CONSUMER ELECTRONICS BY REGION, 2023 VS 2031 (%)

14. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE IN HEALTHCARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE IN INDUSTRIES BY REGION, 2023 VS 2031 (%)

16. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CONTACTLESS CONNECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

20. UK CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

32. THE MIDDLE EAST AND AFRICA CONTACTLESS CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)