Server Operating System Market

Server Operating System Market Size, Share & Trends Analysis Report by Operating System (Windows, Linux, Unix, and Others), by Virtualization (Virtual Machines, and Physical), and by Deployment (On-premises, and Cloud) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

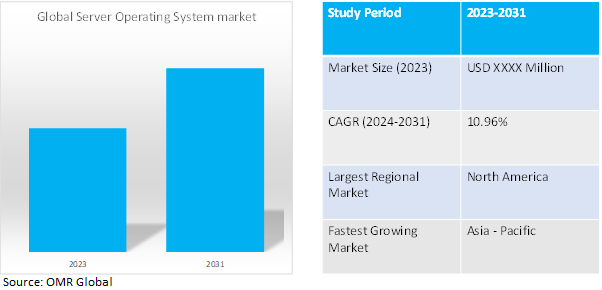

Server Operating System market is anticipated to grow at a CAGR of 10.96% during the forecast period (2024-2031). A Server Operating System (OS) is software designed to manage and control server hardware resources, providing services and facilitating communication between clients and servers in a networked environment.

Market Dynamics

Fortifying the Server Frontier: Modern Server OSes Combat Evolving Cyber Threats

The global server operating system market is seeing a surge due to the ever-present threat of cyberattacks. As hacking techniques become more elaborate, businesses require robust security features to safeguard their sensitive data. For instance, In February 2024, a cyber espionage campaign targeted the embassies of Georgia, Poland, Ukraine, and Iran. The campaign, initiated in 2023 by Russian hackers, involved exploiting a vulnerability in a webmail server to introduce malware into embassy servers. Modern server OS comes equipped with advanced security measures to combat these threats. Features like encryption scramble data into unreadable code, making it useless if intercepted. Access control ensures that only authorized users can access specific systems and data. Additionally, regular vulnerability patching helps plug security holes that hackers might exploit. By offering these crucial security features, modern server operating systems empower businesses to protect their valuable data and maintain smooth operations in the face of evolving cyber threats.

Server Hardware Takes a Leap: Modern OSes Unlock the Potential

The evolution of server hardware is driving a parallel need for advancements in server operating systems. As server technology gets more powerful, with significant leaps in processing power and memory capacity, the server operating systems need to adapt to fully utilize these capabilities. Imagine a powerful sports car with outdated controls it would not be able to perform at its peak. Similarly, an older server OS might not be able to efficiently manage the resources of a modern server, leading to wasted potential. Modern server operating systems are designed to leverage these hardware advancements. They can optimize resource allocation, handle complex workloads more efficiently, and ensure smooth data transfer between components. This synergy between advanced server hardware and cutting-edge server operating systems allows businesses to unlock the full potential of their server infrastructure, leading to improved performance, faster processing times, and ultimately, a better return on investment.

Market Segmentation

Our in-depth analysis of the global Server Operating System includes the following segments by type and by application:

- Based on the operating system, the market is sub-segmented into Windows, Linux, Unix, and others (FreeBSD, OpenSolaris, VMware ESXi).

- Based on virtualization, the market is bifurcated into virtual machines and physical.

- Based on deployment the market is augmented into on-premises and cloud.

The Surging Growth of Linux in Operating Systems Market

Linux is experiencing the highest growth among the operating system segments. Its open-source nature, flexibility, and widespread adoption in various domains such as servers, cloud computing, and embedded systems contribute to its increasing popularity and market share. For instance, Linux powers 96.3% of the world's leading one million servers and runs on all but two of the top 25 websites globally. Additionally, the growing demand for Linux-based solutions in emerging technologies like artificial intelligence, edge computing, and containerization further drives its rapid growth in the market.

Cloud Deployment Dominates Market Growth

The cloud deployment segment is experiencing the highest growth in the market. For instance, in 2022, India's data center capacity reached 637 MW, according to India Briefing. By the end of 2025, the expansion of data centers is expected to result in the establishment of 45 new facilities spanning 13 million square feet, with an additional capacity of 1,015 MW. With the increasing adoption of cloud computing solutions across various industries, organizations are transitioning from traditional on-premises setups to cloud-based infrastructures. The scalability, flexibility, and cost-effectiveness offered by cloud deployments are driving this growth, as businesses seek to leverage the benefits of cloud technology for enhanced efficiency, agility, and accessibility of their software applications and services.

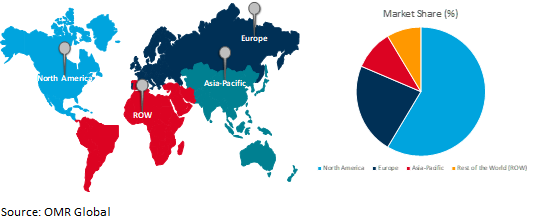

Regional Outlook

The global Server Operating System is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Dominance of North America in the Global Server Operating System Market

North America leads the Global Server Operating Systems market due to its Established IT Infrastructure and Stringent Security Regulations. The region's tech hubs and early cloud adoption fuel demand for robust server OS solutions. Extensive data centre investment necessitates powerful OSes to handle vast datasets. Additionally, stringent data protection laws drive demand for secure server operating systems across industries. For instance, in May 2023, Indiana (US) Governor Eric Holcomb signed the Consumer Data Protection Act into law, aligning Indiana with other US states in enacting comprehensive consumer data privacy legislation. The law, effective January 1, 2026, closely mirrors the Virginia Consumer Data Protection Act and grants Indiana consumers rights regarding their data. Businesses must comply with transparency requirements, obtain consent for sensitive data processing, and conduct data impact assessments. Violations may result in penalties of up to $7,500 per offence, enforceable by the attorney general. Businesses should prepare for compliance by reviewing existing data protection measures and contractual agreements. These factors collectively solidify North America's leadership in the global market.

Global Server Operating System Market Growth by Region 2024-2031

Asia Pacific: A Server OS Powerhouse Fueled by Automotive Boom, Government Initiatives, and Cloud Growth

Fueled by a dynamic pair, Asia Pacific's server OS market is flourishing. The region's booming automotive industry generates massive amounts of data from car manufacturing, necessitating robust server OS for efficient storage and management. For instance, China remains the world's foremost market for vehicle sales and manufacturing, with an anticipated production output of 35 million vehicles by 2025. According to data from the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles, indicating a 7.1% increase from the previous year. This highlights China's significant presence and growth in the automotive sector. Additionally, government initiatives across the Asia Pacific are actively promoting cloud computing adoption and investing in digital infrastructure projects, both of which rely heavily on efficient server operating systems to function effectively, creating a fertile ground for further market growth. For instance, Google has allocated $730 million for a new data center in Japan, while Japan's Nippon Telegraph and Telephone (NTT) is injecting $500 million annually to double its data center capacity in India. Additionally, significant investments have been made by major telecom providers across the Philippines, India, Indonesia, and neighboring countries to expand 5G infrastructure in various regions since late 2022.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Server Operating System include Amazon Web Services, Apple Inc., Dell Technologies Inc., Google LLC, Microsoft Corporation, and Red Hat, Inc. (IBM Corporation) among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2024, Microsoft unveiled Windows Server Insider Preview Build 26040, alongside the official branding for the forthcoming Windows Server 2025. This upcoming release promises enhancements tailored for enterprise users, including SMB over QUIC, Active Directory improvements, hotpatching support, and storage enhancements. Additionally, administrators can now block NTLM authentication for SMB connections. Flighting for Windows Server Insiders allows seamless in-place OS upgrades, preserving applications and data for a smoother transition.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Server Operating System based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Apple Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Lexus (TOYOTA MOTOR CORPORATION)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Dell Technologies Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Google LLC

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Microsoft Corporation

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

3.8. Red Hat, Inc. (IBM Corporation)

3.8.1. Overview

3.8.2. Financial Analysis

3.8.3. SWOT Analysis

3.8.4. Recent Developments

3.9. Key Strategy Analysis

4. Market Segmentation

4.1. Global Server Operating System by Operating System

4.1.1. Windows

4.1.2. Linux

4.1.3. Unix

4.1.4. Others (FreeBSD, OpenSolaris, VMware ESXi)

4.2. Global Server Operating System by Virtualization

4.2.1. Virtual Machines

4.2.2. Physical

4.3. Global Server Operating System by Deployment

4.3.1. On-premises

4.3.2. Cloud

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Broadcom Inc.

6.2. Canonical Ltd

6.3. Canonical Ltd. (Ubuntu)

6.4. Cisco Systems; Inc.

6.5. Fujitsu Ltd.

6.6. Hewlett Packard Enterprise

6.7. NEC Corporation

6.8. Oracle

6.9. SUSE, LLC

6.10. Unisys Corporation

1. GLOBAL SERVER OPERATING SYSTEM BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

2. GLOBAL WINDOWS SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LINUX SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL UNIX SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHERS SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SERVER OPERATING SYSTEM BY VIRTUALIZATION, 2023-2031 ($ MILLION)

7. GLOBAL SERVER OPERATING SYSTEM MARKET FOR VIRTUAL MACHINES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SERVER OPERATING SYSTEM MARKET FOR PHYSICAL MACHINES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SERVER OPERATING SYSTEM BY DEPLOYMENT, 2023-2031 ($ MILLION)

10. GLOBAL ON-PREMISE SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CLOUD SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY OPERATING SYSTEM 2023-2031 ($ MILLION)

15. NORTH AMERICAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY VIRTUALIZATION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

17. EUROPEAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY OPERATING SYSTEM 2023-2031 ($ MILLION)

19. EUROPEAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY VIRTUALIZATION, 2023-2031 ($ MILLION)

20. EUROPEAN SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

23. ASIA- PACIFIC SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY VIRTUALIZATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

25. REST OF THE WORLD SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. REST OF THE WORLD SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

27. REST OF THE WORLD SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY VIRTUALIZATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023-2031 ($ MILLION)

1. GLOBAL SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023 VS 2031 (%)

2. GLOBAL WINDOWS SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL LINUX SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL UNIX SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHERS SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY VIRTUALIZATION, 2023 VS 2031 (%)

7. GLOBAL SERVER OPERATING SYSTEM MARKET FOR VIRTUAL MACHINES RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL SERVER OPERATING SYSTEM MARKET FOR PHYSICAL MACHINES RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023 VS 2031 (%)

10. GLOBAL ON-PREMISE SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL CLOUD SERVER OPERATING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL SERVER OPERATING SYSTEM RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. US SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

15. UK SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD SERVER OPERATING SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)