Graphic Processor Market

Graphic Processor Market Size, Share & Trends Analysis Report, by Type (Dedicated graphic card, Integrated graphic solutions, Hybrid Solutions), by Deployment Mode (On-Premise, Cloud-Based) by Application (Media & Entertainment, Automobiles, Smartphones, Tablets & Notebooks, Workstation, Gaming PC), Forecast Period (2023-2030)

Graphic processor market is anticipated to grow at a considerable CAGR of 34.2% during the forecast period. The increasing usage of graphic processors to support graphics applications and 3D content in various industrial verticals such as manufacturing, automotive, real estate, and healthcare is a key factor driving the global market growth. For instance, to support manufacturing and design applications in the automotive sector, CAD and simulation software leverages GPUs to create photorealistic images or animations.

The advancements in the Artificial Intelligence (AI)/Machine Learning (ML) industry, increasing adoption of cloud-based services, and growing R&D in the automotive industry to offer distinct services is further contributing to the global market growth. For instance, In May 2023, NVIDIA Corp and MediaTek Inc. announced a collaborative effort aimed at developing technology for advanced vehicle infotainment systems. These systems will have the capability to stream video or games and engage with drivers through artificial intelligence. As part of this agreement, which was revealed at the Computex technology trade show in Taipei, MediaTek will incorporate an NVIDIA graphics processing unit chipset and NVIDIA software into the system-on-chips that it provides to automakers for use in their infotainment displays.

Segmental Outlook

The global graphic processor market is segmented based on type, deployment mode, and application. Based on type, the market is segmented into dedicated graphic card, integrated graphic solutions, and hybrid solutions. Based on deployment mode, the market is segmented into cloud-based and on-premises. Based on application, the market is segmented into media & entertainment, automobiles, smartphones, tablets & notebooks, workstation, and gaming PC.

Gaming PC Held Considerable Share in Global Graphic processor Market

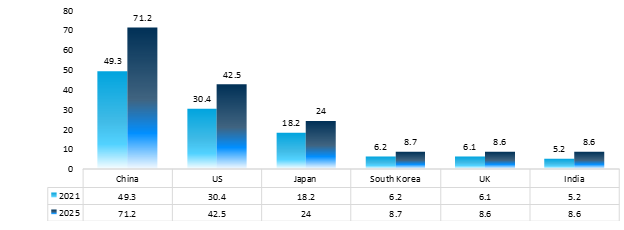

The gaming PC primarily require powerful graphic processor resolution rendering and frame rates. Additionally, the demand and affordability for gaming devices are increasing continuously due to the growth of the gaming industry and the increasing availability of high-speed internet. Additionally, the growing demand for high-graphics gaming is also contributing to the growth of this market segment. For instance, in March 2023, NVIDIA announced its AI-powered Deep Learning Super Sampling (DLSS) technology, DLSS 3, which is now supported in a variety of games, and game engine 3 is being integrated into Unreal Engine. NVIDIA is also publicly releasing the DLSS Frame Generation plug-in to make it easier for developers to adopt the technology. The increasing number of video game players across the globe is further contributing to the growth of this market segment. Estimated Revenue of Video Games per Country (in $) for 2021 & 2025

Source: World Economic Forum

Regional Outlook

The global graphic processor market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America).

Global Graphic Processor Market Growth, by Region 2023-2030

Asia-Pacific Held Considerable Share in the Global Graphic Processor Market

Asia-Pacific held considerable share in the global market. According to Invest India, India’s media & entertainment industry is expected to reach $35.4 billion by 2025. Additionally, online gaming grew 34% in 2022 to reach $1.6 billion, and is expected to reach $2.8 billion by 2025. The growing media & entertainment industry of the region along with growing focus of market players in catering the vast regional market is further contributing to the regional market share. For instance, in April 2023, Dell has launched four new laptops in India: the Alienware m18, Alienware x16 R1, Inspiron 2-in-1, and Inspiron 16. The Alienware models are the most powerful, powered by 13th Generation Intel Core Processors and NVIDIA GeForce RTX 40series GPUs.

Market Players Outlook

The major companies serving the global graphic processor market including NVIDIA Corp., Advanced Micro Devices Inc., Intel Corp., Samsung Electronics Co. Ltd., and Qualcomm Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

For instance, in May 2023, Asus has expanded its gaming laptop portfolio with the launch of five new modes under Republic of Gamers (ROG) and TUF series laptop lineup. The refreshed lineup includes Flow Z13 ACRONYM Edition, TUF A16 Advantage Edition, Zephyrus G16, Strix G16 and Strix G18. The laptops come with updated internals such as latest generation Intel and AMD processors, latest RTX 40 series graphics from Nvidia, improved thermal management, gaming features and more.

Apart from these, Asus has also updated its Flow X/Z, TUF A15/17, TUF F15/F17, Zephyrus G14 and Strix G17 series with latest generation processors and graphics.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global graphic processor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Advanced Micro Devices Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Intel Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. NVIDIA Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Qualcomm Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Samsung Electronics Co. Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Graphic Processor Market by Type

4.1.1. Dedicated graphic card

4.1.2. Integrated graphic solutions

4.1.3. Hybrid Solutions

4.2. Global Graphic Processor Market by Deployment Mode

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. Global Graphic Processor Market by Application

4.3.1. Media & Entertainment

4.3.2. Automobiles

4.3.3. Smartphones

4.3.4. Tablets & Notebooks

4.3.5. Workstation

4.3.6. Gaming PC

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Apple Inc.

6.2. ARM Limited

6.3. ASPEED Technology Inc.

6.4. Broadcom Corp.

6.5. Cirrus Logic Inc.

6.6. Fujitsu Ltd.

6.7. IBM Corp.

6.8. Imagination Technologies

6.9. Matrox Electronic Systems Ltd.

6.10. MediaTek Inc.

6.11. Rambus Inc.

6.12. SiFive, Inc.

6.13. Silicon Integrated Systems

6.14. Sony Corp.

6.15. Taiwan Semiconductor Manufacturing Company Ltd.

6.16. Texas Instruments Inc.

6.17. VIA Technologies, Inc.

1. GLOBAL GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL DEDICATED GRAPHIC CARD IN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL GRAPHIC PROCESSOR INTEGRATED GRAPHIC SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL GRAPHIC PROCESSOR HYBRID GRAPHIC SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE,2022-2030 ($ MILLION)

6. GLOBAL ON-PREMISE BASED GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL CLOUD-BASED GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION,2022-2030 ($ MILLION)

9. GLOBAL GRAPHIC PROCESSOR FOR MEDIA & ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL GRAPHIC PROCESSOR FOR AUTOMOBILES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL GRAPHIC PROCESSOR FOR SMARTPHONES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL GRAPHIC PROCESSOR FOR TABLETS & NOTEBOOKS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL GRAPHIC PROCESSOR FOR WORKSTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL GRAPHIC PROCESSOR FOR GAMING PC MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

18. NORTH AMERICAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. EUROPEAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. EUROPEAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

22. EUROPEAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

23. EUROPEAN GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. REST OF THE WORLD GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

29. REST OF THE WORLD GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD GRAPHIC PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL GRAPHIC PROCESSOR MARKET SHARE BY TYPE, 2022 VS 2030(%)

2. GLOBAL DEDICATED GRAPHIC CARD IN GRAPHIC PROCESSOR MARKET SHARE BY REGION, 2022 VS 2030(%)

3. GLOBAL GRAPHIC PROCESSOR INTEGRATED GRAPHIC SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030(%)

4. GLOBAL GRAPHIC PROCESSOR MARKET SHARE BY DEPLOYMENT MODE, 2022 VS 2030(%)

5. GLOBAL ON-PREMISE BASED GRAPHIC PROCESSOR MARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBAL CLOUD-BASED GRAPHIC PROCESSOR MARKET SHARE BY REGION, 2022 VS 2030(%)

7. GLOBAL GRAPHIC PROCESSOR MARKET SHARE BY APPLICATION, 2022 VS 2030(%)

8. GLOBAL GRAPHIC PROCESSOR FOR MEDIA & ENTERTAINMENT MARKET SHARE BY REGION, 2022 VS 2030(%)

9. GLOBAL GRAPHIC PROCESSOR FOR AUTOMOBILES MARKET SHARE BY REGION, 2022 VS 2030(%)

10. GLOBAL GRAPHIC PROCESSOR FOR SMARTPHONES MARKET SHARE BY REGION, 2022 VS 2030(%)

11. GLOBAL GRAPHIC PROCESSOR FOR TABLETS & NOTEBOOKS MARKET SHARE BY REGION, 2022 VS 2030(%)

12. GLOBAL GRAPHIC PROCESSOR FOR WORKSTATION MARKET SHARE BY REGION, 2022 VS 2030(%)

13. GLOBAL GRAPHIC PROCESSOR FOR GAMING PC MARKET SHARE BY REGION, 2022 VS 2030(%)

14. GLOBAL GRAPHIC PROCESSOR MARKET SHARE BY REGION, 2022 VS 2030(%)

15. US GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

17. UK GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD GRAPHIC PROCESSOR MARKET SIZE, 2022-2030 ($ MILLION)