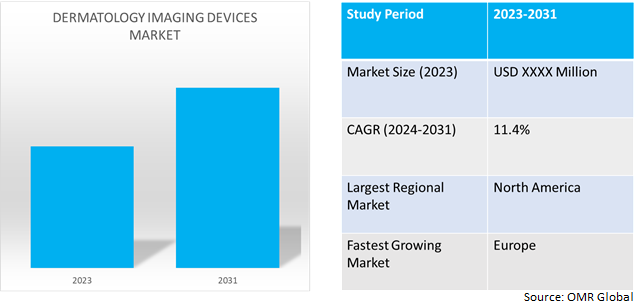

Dermatology Imaging Devices Market

Dermatology Imaging Devices Market Size, Share & Trends Analysis Report by Modality (Digital Photographic Imaging, Optical Coherence Tomography (OCT), Dermatoscope, High-Frequency Ultrasound, and Others), by Application (Skin Cancers, Inflammatory Dermatoses, Plastic and Reconstructive Surgery, and Others), and by End-Users (Hospitals, Dermatology Centers, and Specialty Clinics) Forecast Period (2024-2031)

Dermatology imaging devices market is anticipated to grow at a CAGR of 11.4% during the forecast period (2024-2031). The growing adoption of optical coherence tomography (OCT), dermatoscopes, and digital photographic imaging devices is the key factor supporting the growth of the market globally. Dermatologists and surgeons can diagnose and treat skin diseases with the aid of dermatology devices. Numerous healthcare facilities, including hospitals, dermatology clinics, medical clinics, and university research centers, use these devices.

Market Dynamics

Increasing Adoption of optical coherence tomography (OCT) and confocal microscopy

Optical coherence tomography (OCT) and confocal laser endomicroscopy (CLE) are novel imaging techniques with near-microscopic resolution that can be easily and safely combined with conventional bronchoscopy. Line-field confocal optical coherence tomography (LC-OCT) is a non-invasive optical imaging technique based on a combination of the principles of optical coherence tomography and reflectance confocal microscopy with line-field illumination, which can generate cell-resolved images of the skin in vivo. The main techniques currently used clinically for in-depth skin imaging are ultrasonography, reflectance confocal microscopy, optical coherence tomography, nonlinear optical microscopy and, more recently, line-field confocal optical coherence tomography.

Growing demand for noninvasive imaging tools for diagnosing and treatment of skin cancers

The increasing demand for real-time skin cancer diagnosis accuracy has significantly increased owing to noninvasive medical imaging technologies. Even though it takes training to recognize particular dermoscopic patterns, algorithm-based dermoscopy is a more accurate way to diagnose melanocytic disease than a clinical examination with the naked eye. The response of the patient to the treatment can be easily monitored with the same noninvasive medical device, thereby enabling further modulation of the therapy.

Market Segmentation

Our in-depth analysis of the global dermatology imaging devices market includes the following segments by modality, application and end-users:

- Based on modality, the market is sub-segmented into digital photographic imaging, optical coherence tomography (OCT), dermatoscope, high-frequency ultrasound and others (microscopes, imagining devices).

- Based on application, the market is sub-segmented into skin cancers, inflammatory dermatoses, plastic and reconstructive surgery and others (skin rejuvenation and resurfacing).

- Based on end-users, the market is sub-segmented into hospitals, dermatology centers and specialty clinics.

Dermatoscope is Projected to Emerge as the Largest Segment

Based on the modality, the global dermatology imaging devices market is sub-segmented into digital photographic imaging, optical coherence tomography (OCT), dermatoscope, high-frequency ultrasound and others (microscopes, imagining devices). Among these, dermatoscope sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing adoption of dermatoscopes by dermatologists to see subsurface structures and spot patterns that could lead to an improved diagnosis of a variety of skin conditions. Early detection of skin cancer and other skin conditions is another purpose for dermotoscopes. Extra features include the capacity to take pictures for later examination, polarized and non-polarized illumination options, and movable magnification levels that enhance its features as a dermatology imaging device.

Application Sub-segment to Hold a Considerable Market Share

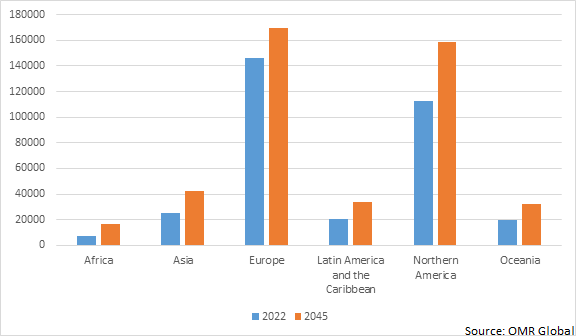

Based on application, the global dermatology imaging devices market is sub-segmented into skin cancers, inflammatory dermatoses, plastic and reconstructive surgery and others (skin rejuvenation and resurfacing) sub-segment is expected to hold a considerable market share. Among these, skin cancers sub-segment is expected to hold a considerable share of the market. According to the International Agency for Research on Cancer (IARC), in May 2022, an estimated 325,000 new cases of melanoma were diagnosed globally and about 57,000 mortality from melanoma in 2020. Imaging tools for dermatology aid in the early detection and treatment of skin malignancies. For instance, Dermatologists can identify early indications of skin cancer owing to the MoleMax HD system from Derma Medical Systems, which employs digital dermoscopy to produce high-resolution skin images.

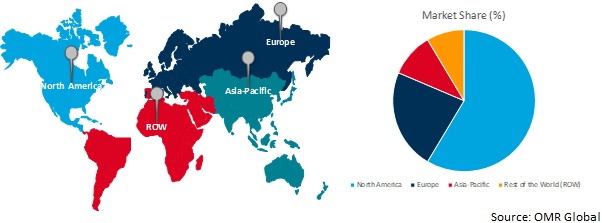

Regional Outlook

The global dermatology imaging devices market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

An increasing number of European companies and governments investment

- Increasing dermatology infrastructure as many NHS hospitals and clinics are providing skin care services. According to the British Association of Dermatologists, in 2021, there are approximately 626 consultant dermatologists, followed by 250 specialists in the UK.

- Increasing incidence of skin diseases, growing consciousness regarding skin cancer, and expanding need for minimally invasive treatments. According to the European Academy of Dermatology and Venereology (EADV), in May 2022, 1.71% of the adult European general population reported having skin cancer, meaning some 7,304,000 Europeans are estimated to have the disease.

Estimated Number of Melanoma Skin New Cases From 2022 to 2045

Source: International Agency for Research on Cancer (IARC)

Global Dermatology Imaging Devices Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of an enormous number of providers offering dermatology imaging devices such as Caliber Imaging and Diagnosis, Canfield Scientific, Inc., e-con Systems Inc., GE HealthCare, Longport, Inc. and others. According to the American Cancer Society's (ACS) estimates for melanoma in the US for 2024, About 100,640 new melanomas will be diagnosed (about 59,170 in men and 41,470 in women). About 8,290 expected fatalities will be owing to melanoma (about 5,430 men and 2,860 women). The market for dermatology imaging devices is being driven by the improved diagnosis and treatment of skin problems brought about by easy access to dermatology imaging devices. For instance, in December 2023, Canfield Scientific, Inc. introduced VISIA Skin Analysis, a facial imaging device. VISIA is an AI-integrated device used to capture high-quality standardized images to analyze the results.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global dermatology imaging devices market include Barco NV, Bausch Health Companies Inc., Carl Zeiss AG, EBOS Group Ltd.m, and Olympus Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In June 2022, Barco partnered with MediPortal, the Belgian-based healthcare software developer. The partnership allows a clinician to access patient demographics from Mediris on Demetra’s point-of-care diagnostics device and then provide access to the diagnostic imaging via Mediris’ EHR platform.

- In June 2023, DeepX Diagnostics Inc. announced digital dermatoscope DermoSightTM received clearance from the US Food and Drug Administration (FDA) for teledermatology screening of suspect skin cancer lesions in the US. DermoSight is currently cleared to acquire skin lesion images for teledermatology assessment, like existing digital dermatoscopes.

- In January 2021, Casio Computer Co., Ltd. introduced DZ-D100 DERMOCAMERA that allows close-up shots with the lens directly touching the skin as well as ordinary shots, all using a single camera. The captured images can also be automatically transferred to a PC by connecting the DZ-D100 to the D’z IMAGE Viewer image management software via Wi-Fi.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global dermatology imaging devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bausch Health Companies Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Carl Zeiss AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Olympus Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Dermatology Imaging Devices Market by Modality

4.1.1. Digital Photographic Imaging

4.1.2. Optical Coherence Tomography (OCT)

4.1.3. Dermatoscope

4.1.4. High-Frequency Ultrasound

4.1.5. Others (Microscopes, Imagining Devices)

4.2. Global Dermatology Imaging Devices Market by Application

4.2.1. Skin Cancers

4.2.2. Inflammatory Dermatoses

4.2.3. Plastic and Reconstructive Surgery

4.2.4. Others (Skin Rejuvenation and Resurfacing)

4.3. Global Dermatology Imaging Devices Market by End-Users

4.3.1. Hospitals

4.3.2. Dermatology Centers

4.3.3. Specialty Clinics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advin Health Care

6.2. Barco NV

6.3. Canfield Scientific, Inc.

6.4. DERMA MEDICAL SYSTEMS

6.5. DermLite LLC

6.6. Dino-Lite Europe IDCP B.V

6.7. EBOS Group Ltd.

6.8. FotoFinder Systems GmbH

6.9. FUJIFILM VisualSonics, Inc.

6.10. HEINE Optotechnik GmbH & Co. KG

6.11. KIRCHNER & WILHELM GmbH + Co. KG

6.12. Leica Microsystems

6.13. Longport, Inc.

6.14. Michelson Diagnostics UK Ltd.

6.15. Miiskin Group ApS

6.16. Miravex Ltd.

6.17. Physik Instrumente (PI) GmbH & Co. KG

6.18. SCARLETRED Inc.

1. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2023-2031 ($ MILLION)

2. GLOBAL DIGITAL PHOTOGRAPHIC IMAGING FOR DERMATOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OPTICAL COHERENCE TOMOGRAPHY (OCT) FOR DERMATOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DERMATOSCOPE FOR DERMATOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HIGH-FREQUENCY ULTRASOUND FOR DERMATOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER MODALITIES FOR DERMATOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL DERMATOLOGY IMAGING DEVICES FOR SKIN CANCERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DERMATOLOGY IMAGING DEVICES FOR INFLAMMATORY DERMATOSES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DERMATOLOGY IMAGING DEVICES FOR PLASTIC AND RECONSTRUCTIVE SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DERMATOLOGY IMAGING DEVICES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

13. GLOBAL DERMATOLOGY IMAGING DEVICES FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL DERMATOLOGY IMAGING DEVICES FOR DERMATOLOGY CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL DERMATOLOGY IMAGING DEVICES FOR SPECIALTY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

21. EUROPEAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2023-2031 ($ MILLION)

23. EUROPEAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. EUROPEAN DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

29. REST OF THE WORLD DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2023-2031 ($ MILLION)

31. REST OF THE WORLD DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD DERMATOLOGY IMAGING DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET SHARE BY MODALITY, 2023 VS 2031 (%)

2. GLOBAL DIGITAL PHOTOGRAPHIC IMAGING FOR DERMATOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL OPTICAL COHERENCE TOMOGRAPHY (OCT) FOR DERMATOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DERMATOSCOPE FOR DERMATOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL HIGH-FREQUENCY ULTRASOUND FOR DERMATOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER MODALITIES FOR DERMATOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL DERMATOLOGY IMAGING DEVICES FOR SKIN CANCERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DERMATOLOGY IMAGING DEVICES FOR INFLAMMATORY DERMATOSES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DERMATOLOGY IMAGING DEVICES FOR PLASTIC AND RECONSTRUCTIVE SURGERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DERMATOLOGY IMAGING DEVICES FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

13. GLOBAL DERMATOLOGY IMAGING DEVICES FOR HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL DERMATOLOGY IMAGING DEVICES FOR HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL DERMATOLOGY IMAGING DEVICES FOR DERMATOLOGY CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL DERMATOLOGY IMAGING DEVICES FOR SPECIALTY CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL DERMATOLOGY IMAGING DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

20. UK DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

32. THE MIDDLE EAST AND AFRICA DERMATOLOGY IMAGING DEVICES MARKET SIZE, 2023-2031 ($ MILLION)