Diagnostic Imaging Market

Global Diagnostic Imaging Market Size, Share & Trends Analysis Report by Product (MRI, CT-Scan, X-Ray SPECT, PET, Mammography, and Others) by Application (OB/Gyn, Cardiology, Oncology, and Others) By End-User ( Hospitals, Imaging Centers, Others) Forecast Period (2021-2027)

The global diagnostic imaging market is anticipated to grow at a significant CAGR of around 6.5% during the forecast period. The increase in the need for early diagnosis for effective treatment, and early detection in several chronic diseases such as cancer are increasing the demand for imaging across the globe, which in trun, driving the global diagnostic imaging market. According to the report of the World Health Organization (WHO) 9.6 million people globally died from cancer in 2018 and in 400,000 children cancer is detected each year. Rapidly growing geriatric population and the subsequent increase in the prevalence of associated diseases, technological advancements in diagnostic imaging industry are further supporting the market growth.

Technology limitations with standalone imaging such as PET has a lower spatial resolution, MRI take longer time to scan large volumes and ultrasound are operator dependent are hampering the market growth. Moreover, emerging economies such as China, India, South Korea, and among others offer high opportunities for market players to expand their business due to presence of huge population base.

Impact of COVID-19 Pandemic on Global Diagnostic Imaging Market

COVID-19 has impacted the global diagnostic imaging market negatively due to various reasons such operations of many manufacturing companies were stopped, limited workforce, several limited buying of instruments by hospitals and imaging centers. Furthermore, turn around time of delivering products and services is affected due to newer packing protocols by governments also hospitals have to free up the space and make resources for potential COVID-19, due to this routine and elective procedures decreased. According to a report of the National Center for Biotechnology Information (NCBI) an article published by Fleischner Society in February 2020, a diagnostic approach for COVID-19 is both chest CT along PCR tests to ensure the highest sensitivity.

Segmental Outlook

The global diagnostic imaging market is segmented based on the product, application, and end-user. Based on the product, the market is segmented into (MRI, CT-Scan, X-Ray, SPECT, PET, Mammography, and Others). Based on the application, the market is sub-segmented into the Ob/Gyn, cardiology, oncology, and others. Based on the end-user, the market is sub-segmented into the hospitals, imaging centers, and others.

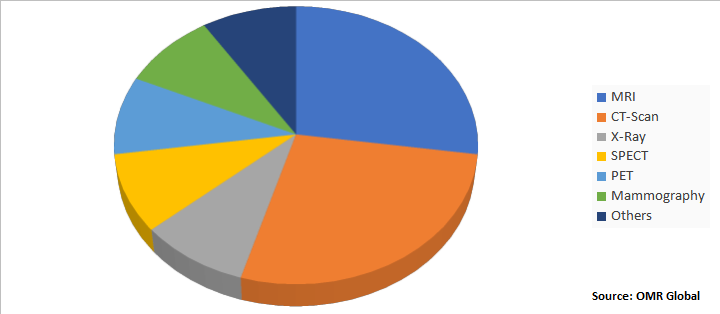

Global Diagnostic Imaging Market Share by Product, 2020 (%)

The CT-Scan Segment Holds the Major Share in the Global Diagnostic Imaging Market

The CT-Scan segment is anticipated to dominate due to the high growth of this CT owing to the growing demand for early and accurate diagnosis and across the globe, their is peak adoption of CT Scanners by hospitals and diagnostic centers. Moreover, there is an increase in demand for CT Scanners since COVID-19 started as CT of the chest plays a vital role in diagnosing COVID-19, almost each and every patient needs CT scan to monitor diseases progression. For instance, In February 2020, Samsung NeuroLogica increased the production of CT Scanners "mobile BodyTom Due to it allows COVID-19 patients to care internal shielded design at a time that minimizes exposure to diseases. Moreover, Mid-Range Ct Scanners are better than low-end Ct scanners, for performing angiography. Furthermore to grow presence companies are also engaged in the development of new products. For instance, in April 2019 Columbia Asia Hospital Mysuru, India developed a CT-64 slice in its hospitals to enhance the diagnostic procedures. The rising demand for CT scanners is expected to grow the global diagnostic imaging market.

Regional Outlooks

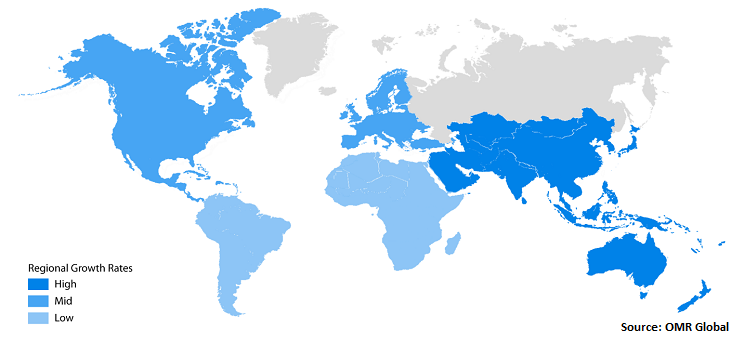

The global diagnostic imaging market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America). North America is dominating the diagnostic imaging market due to the high adoption of technological advancements in healthcare owing to annual healthcare expenditure by the US government.

Global Diagnostic Imaging Market Growth, by Region 2021-2027

The Asia-Pacific Region is Fastest Growing in the Global Diagnostic Imaging Market

Asia Pacific region is anticipated to fastest-growing over the forecast period in the diagnostic imaging market due to an increase in the number of hospitals and diagnostics centers, various favorable government policies. In January 2022, the Government of Assam has introduced a Chief Minister's Free Diagnostic Service Programme to ensure the availability of diagnostic services at government hospitals, and CT scans, X-Ray and laboratory services will be provided free of cost to all APL/BPLstatus people. Moreover increasing health care expenditure, improving infrastructure in countries such as China, India, and Japan. For Instance, In May 2020, Insight Technology had developed an AI system to assist computer-aided tomographic diagnostic screening of the lungs for COVID-19. The system is capable of doing 600 people radiographs a day and takes only 10-20 seconds to check the image.

Market Players Outlook

The major companies serving the global diagnostic imaging market include Canon Medical Systems Corp., FUJIFILM Holdings America Corp., General Electric Company, Philips International B.V., Siemens Healthineer, Shimadzu Corp., and STRATO AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In August 2021, TeamViewer and Siemens Healthineers, partnered to enable new remote scanning service WeScan for diagnostic imaging. WeScan is new service to TeamViewersconnectivity technology, that helps healthcare to perform MRI examinations if there is a lack of radiology staff.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global diagnostic imaging market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Diagnostic Imaging Market

• Recovery Scenario of Global Diagnostic Imaging Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Canon Medical Systems Corp.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. FUJIFILM Holdings America Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Philips International B.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens Healthineers

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Diagnostic Imaging Market by Product

4.1.1. MRI

4.1.2. CT-Scan

4.1.3. X-Ray

4.1.4. SPECT

4.1.5. PET

4.1.6. Mammography

4.1.7. Others

4.2. Global Diagnostic Imaging Market by Application

4.2.1. OB/Gyn

4.2.2. Cardiology

4.2.3. Oncology

4.2.4. Others

4.3. Global Diagnostic Imaging Market by End-User

4.3.1. Hospitals

4.3.2. Imaging Centers

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agfa group

6.2. Allengers Medical Systems Ltd

6.3. Bruker

6.4. Carestream Health, Inc.

6.5. Cubresa Inc.

6.6. ESAOTE SPA

6.7. Hitachi, Ltd.

6.8. Konica Minolta Group

6.9. MILabs B.V.

6.10. MIM Software Inc.

6.11. MR Solutions

6.12. Neusoft Corp.

6.13. Northridge Tri-Modality Imaging, Inc

6.14. Philips International B.V.

6.15. Planmeca Group

6.16. Samsung Electronics Co., Ltd.

6.17. Shenzhen Mindray Bio-Medical Electronics Co.

6.18. Shimadzu Corp.

6.19. STRATO AG

1. GLOBAL DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

2. GLOBAL MRI IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ULTRASOUND IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CT-SCAN IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL X-RAY IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL SPECT IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL PET IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL MAMMOGRAPHY IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHER DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

11. GLOBAL DIAGNOSTIC IMAGING IN OB/GYN MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL DIAGNOSTIC IN CARDIOLOGY IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL DIAGNOSTIC IMAGING IN ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL DIAGNOSTIC IMAGING IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

16. GLOBAL DIAGNOSTIC IMAGING IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL DIAGNOSTIC IMAGING IN IMAGING CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL DIAGNOSTIC IMAGING IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

20. NORTH AMERICAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. NORTH AMERICAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

22. NORTH AMERICAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

23. NORTH AMERICAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

24. EUROPEAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. EUROPEAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

26. EUROPEAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

27. EUROPEAN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

32. REST OF THE WORLD DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

33. REST OF THE WORLD DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

34. REST OF THE WORLD DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

35. REST OF THE WORLD DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL DIAGNOSTIC IMAGING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL DIAGNOSTIC IMAGING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL DIAGNOSTIC IMAGING MARKET, 2021-2027 (%)

4. GLOBAL DIAGNOSTIC IMAGING MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL MRI IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL ULTRASOUND IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL CT-SCAN IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL LOW-END CT-SCAN IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL X-RAY IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL SPECT IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL PET IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL MAMMOGRAPHY IN DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL OTHER DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL DIAGNOSTIC IMAGING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

15. GLOBAL DIAGNOSTIC IMAGING IN OB/GYN MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL DIAGNOSTIC IMAGING IN CARDIOLOGY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL DIAGNOSTIC IMAGING IN ONCOLOGY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL DIAGNOSTIC IMAGING IN OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL DIAGNOSTIC IMAGING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

20. GLOBAL DIAGNOSTIC IMAGING IN HOSPITALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL DIAGNOSTIC IMAGING IN IMAGING CENTERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. GLOBAL DIAGNOSTIC IMAGING IN OTHER END-USER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

23. GLOBAL DIAGNOSTIC IMAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

24. US DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

25. CANADA DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

26. UK DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

27. FRANCE DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

28. GERMANY DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

29. ITALY DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

30. SPAIN DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF EUROPE DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

32. INDIA DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

33. CHINA DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

34. JAPAN DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

35. SOUTH KOREA DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

36. REST OF ASIA-PACIFIC DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)

37. REST OF THE WORLD DIAGNOSTIC IMAGING MARKET SIZE, 2020-2027 ($ MILLION)