Digestive Health Drinks and Food Market

Digestive Health Drinks and Food Market Size, Share &Trends Analysis Report, By Ingredients (Prebiotics, Probiotics, and Food Enzymes), By Product Type (Dairy Products, Bakery and Cereals, Non-alcoholic Beverages, and Others), Forecast Period (2022-2028)

Digestive health drinks and food market is anticipated to grow at a CAGR of 7.4% during the forecast period. The increasing awareness among consumers about the health benefits and convenience associated with the consumption of digestive health drinks and food are some key factors influencing its popularity among consumers and manufacturers. Digestive health drinks and food promote the growth of gastrointestinal microflora which eases the digestion process along with support in treating various digestive disorders. Consumers are increasingly becoming conscious which is inclining them towards opting for prebiotics and probiotics for maintaining and improving their gut health. Owing to increasing consumer awareness regarding gut health, manufacturers are focusing on new gut-friendly product development with functional ingredients. For instance, in 2019, Good Culture announced the launch of its Wellness Probiotic Gut Shots, combining the efficacious probiotics in cultured kefir with functional ingredients such as turmeric, matcha, chaga, and collagen. Good Culture Wellness Probiotic Gut Shots are available in four varieties: Pineapple + Turmeric, Vanilla + Collagen, Chai + Matcha, Chocolate + Chaga.

Segmental Outlook

The global digestive health drinks and food market is segmented based on the ingredients and product type. Based on ingredients, the market is segmented into prebiotics, probiotics, and food enzymes. Further, based on product type, the market is categorized into dairy products, bakery and cereals, non-alcoholic beverages, and others. Among the product type segment, the non-alcoholic beverages segment is expected to cater to a prominent market share during the forecast period.

Non-Alcoholic Beverages Segment to Witness Prominent Share in the Global Digestive Health Drinks and Food Market

Food and beverage companies are continuously introducing innovative offerings such as drinkable yogurt, kefir and kombucha, celery juice, which aid in improving gut health. The goal of using the additives such as enzymes, prebiotics, and probiotics in the beverage industry is to increase its nutritional and fiber content. Likewise, unique beverage launches featuring prebiotics, probiotics or both (referred to as synbiotics) are contributing to growth in the space. For instance, in January 2020, Ferm Fatale officially launched a line of shelf-stable, raw, vegan, organic, probiotic non-alcoholic beverages. Ferm Fatale’s mocktails have only 22 calories and zero sugar per bottle and come with a unique mixture of “Shrub” (vinegar-based fruit juice) and “Kombucha” (fermented caffeine-free black tea). Moreover, these mocktails are filled with live bacteria, yeast, enzymes, vitamins and antioxidants.

Regional Outlook

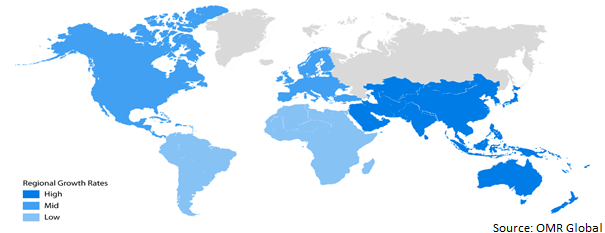

The global digestive health drinks and food market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to prominent growth over the forecast period. However, the Asia-Pacific region is projected to experience considerable growth in the global digestive health drinks and food market.

Global Digestive Health Drinks and Food Market Growth, by Region 2022-2028

North American Region Holds Prominent Share in the Global Digestive Health Drinks and Food Market

North American region is expected to hold a prominent share in the global digestive health drinks owing to the presence of major key players such as General Mills, Kellogg’s, and NextFoods Inc., among others in this region. Moreover, the growing popularity of digestive health drinks among the health-conscious population in the US is another factor driving the growth of the market in the region. Companies operating in the food and beverage industry are inclining their efforts to support this demand by introducing products that maintain and improve digestive health. For instance, in July 2021, PepsiCo launched an on-the-go fermented beverage in the US designed to promote gut health. KeVita Prebiotic Shots is a three-strong range of water-kefir-culture drinks packaged in 2oz (5.9cl) bottles with each bottle containing 3g of prebiotic fibre.

Market Players Outlook

The major companies serving the global digestive health drinks and food market include Kellogg’s Co., Nestlé S.A., General Mills Inc., Danone S.A., and International Flavors & Fragrances Inc. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in May 2022, Sunwink announced the launch of Digestion Lemon Sparkling Tonic. Sunwink’s new sparkling beverage was crafted alongside clinical herbalists to deliver its popular Digestion Lemonade Powder in a new, sparkling tonic form.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digestive health drinks and food market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Digestive Health Drinks and Food Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. International Flavors & Fragrances Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Development

3.2. Kellogg’s Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Nestlé S.A.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. General Mills Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Danone S.A.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digestive Health Drinks and Food Market by Ingredients

4.1.1. Prebiotics

4.1.2. Probiotics

4.1.3. Food Enzymes

4.2. Global Digestive Health Drinks and Food Market by Product Type

4.2.1. Dairy Products

4.2.2. Bakery and Cereals

4.2.3. Non-Alcoholic Beverages

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Arla Foods amba

6.2. BioGaia AB

6.3. Chr. Hansen Holding A/S

6.4. CLOVER S.A. (PTY) LTD.

6.5. Danone S.A.

6.6. Ferm Fatale LLC

6.7. Fonterra Co-Operative Group Ltd.

6.8. Health-Ade Kombucha

6.9. Kerry Group plc

6.10. Lallemand Inc.

6.11. Living Foods LLC

6.12. Lifeway Foods, Inc.

6.13. NextFoods Inc.

6.14. Yakult Danone India Pvt Ltd.

1. GLOBAL DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2021-2028 ($ MILLION)

2. GLOBAL PREBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PROBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL FOOD ENZYMES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

6. GLOBAL DIGESTIVE HEALTH DAIRY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL DIGESTIVE HEALTH BAKERY AND CEREALS PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL DIGESTIVE HEALTH NON-ALCOHOLIC BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL OTHER DIGESTIVE HEALTH PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2021-2028 ($ MILLION)

13. NORTH AMERICAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

14. EUROPEAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2021-2028 ($ MILLION)

16. EUROPEAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2021-2028 ($ MILLION)

22. REST OF THE WORLD DIGESTIVE HEALTH DRINKS AND FOOD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

1. GLOBAL DIGESTIVE HEALTH DRINKS AND FOOD MARKET SHARE BY INGREDIENTS, 2021 VS 2028 (%)

2. GLOBAL PREBIOTICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL PROBIOTICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL PROBIOTICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL FOOD ENZYMES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL DIGESTIVE HEALTH DRINKS AND FOOD MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

7. GLOBAL DIGESTIVE HEALTH DAIRY PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL DIGESTIVE HEALTH BAKERY AND CEREALS PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL DIGESTIVE HEALTH NON-ALCOHOLIC BEVERAGES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL OTHER DIGESTIVE HEALTH PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL DIGESTIVE HEALTH DRINKS AND FOOD MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

14. UK DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD DIGESTIVE HEALTH DRINKS AND FOOD MARKET SIZE, 2021-2028 ($ MILLION)