Electric Ships Market

Electric Ships Market Size, Share & Trends Analysis Report by Type (Fully Electric and Hybrid), by Mode of Operation (Manned and Autonomous), by Application (Passenger, Cargo, and Defense), by Range (< 50 KM, 50-100 KM, 101-1000 KM and 1000 KM) and by End-User (Line fit and Retrofit), Forecast Period (2025-2035)

Industry Overview

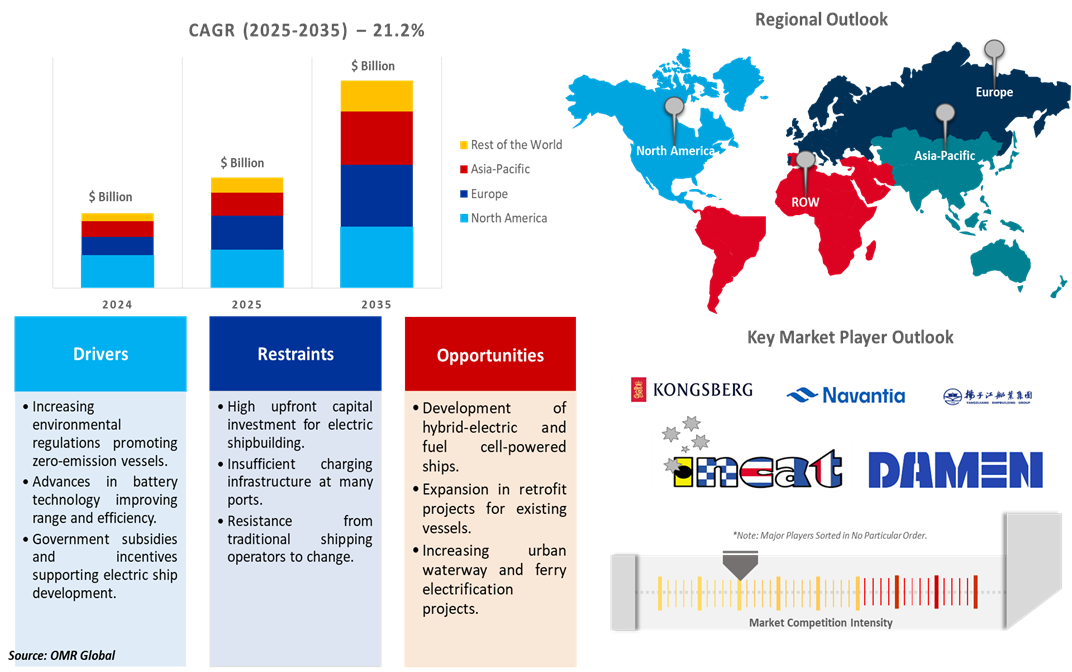

Electric ships market was valued at $4.02 billion in 2024 and is projected to reach $39.81 billion by 2035, growing at a CAGR of 21.2% during the forecast period (2025–2035). Global electric ships market is gaining strong momentum owing to the environmental regulations & emissions targets, advances in battery & propulsion technologies, government support & infrastructure investment, and growing use of electric propulsion in naval fleets. As part of their larger decarbonization and maritime sustainability objectives, European nations have been steadily progressing in the development of electric ships. Through infrastructure development, regulatory incentives, and financing programs, governments are facilitating this transition. A nation such as Norway has approximately. 70 electric ferries in service. Sweden and the Netherlands have also started using electric passenger boats in places such as Stockholm and Amsterdam to reduce emissions and noise.

Market Dynamics

High Initial Investment Cost and Limited Charging Facilities Challenge

Although adopting electric propulsion technology can result in long-term cost reductions, there may be a substantial upfront expense. The initial costs of electric ships are usually higher than those of traditional ships with internal combustion engines. For instance, the electric autonomous container ship Yara Birkeland cost about $25 million to build, which is roughly three times the price of a conventional vessel of similar size. Many shipowners and operators may find the expense of electric propulsion technology and advanced battery systems prohibitive, especially for smaller businesses or those with limited resources.

Another significant challenge for electric ships is the need for adequate charging infrastructure. In contrast to traditional fuelling stations, electric ship charging stations necessitate specialized facilities and a significant financial expenditure. It may require time and significant financial resources to develop an effective charging infrastructure in ports and along shipping lanes. The range and adaptability of electric ships may be restricted by the lack of a strong charging network, which may make them less desirable for some long-distance or isolated routes.

Development of Electric Autonomous Ships is the Ongoing Trend in the Market

Autonomous ships are built to operate with minimal or no human intervention. These ships use advanced technology, artificial intelligence, machine learning, sensor fusion, and more to navigate waters independently, with very little aid from human crew members. In 2022, the autonomous container ship Yara Birkeland traveled a 13 km course between Herøya and Brevik in Norway to provide proof that autonomous commercial shipping is indeed feasible. Digitalization in the marine industry provides operation automation, business process automation, and information processing.

Autonomous electric ships are a significant and fast-growing trend in the marine industry, combining the environmental benefits of electric power with the operational advantages of autonomy. In addition to global trade, autonomous electric passenger ferries are quickly becoming more and more popular as coastal areas and cities search for smarter, more environmentally friendly mobility options.

Growing interest in incorporating these ferries into public transit networks is demonstrated by recent experiments in Stockholm, Trondheim, Helsinki, and Canada. These ferries can offer regular, dependable, and clean transportation for both commuters and visitors. For instance, in 2023, Zeabuz and ferry operator Torghatten launched the first commercial, emissions-free autonomous passenger ferry in Stockholm, Sweden, under the name Zeam (Zero Emission Autonomous Mobility). Zeam's ferries use AI algorithms and sensor data to understand their environment and make intelligent judgments, such as identifying and avoiding various types of obstacles in all visual circumstances. Zeabuz’s ferries are powered by electricity and solar panels, offering environmental benefits such as reduced emissions and a lighter burden on the power grid.

Market Segmentation

- Based on the type, the market is segmented into fully electric and hybrid.

- Based on the mode of operation, the market is segmented into manned and autonomous.

- Based on the application, the market is segmented into passenger, cargo, and defense.

- Based on the range, the market is segmented into <50 KM, 50-100 KM, 101-1000 KM, and 1000. KM.

- Based on the end-user, the market is segmented into linefit and retrofit.

Passenger Segment Dominates the Global Electric Ship Market

Passenger accounts for the largest share of the global electric ship market, driven by their frequent operation on short, fixed routes, which are ideal for electric propulsion. These vessels include ferries, cruise ships, and water taxis, which are frequently utilized for urban and coastal transportation. Ferries are leading the charge in battery power, with a wave of newbuilding orders demonstrating how this sort of propulsion is swiftly gaining traction demonstrates the accelerating trend. As of May 2024, the global fleet of passenger ferries reached 8,704. The China Zorrilla catamaran ferry, built to sail between Argentina and Uruguay on a 200-kilometer route at 25 knots multiple times each day, demonstrates this rising trend.

The passenger electric ship category is rapidly evolving, with manufacturers and operators pushing the limits of size, range, and sustainability. As technological advances in battery technologies and vessel design accelerate, shipbuilders are demonstrating more efficient electric vessels designed for commercial operations. For instance, in May 2025, Incat launched its Hull 096, which is claimed to be the largest battery-electric ship globally, at its Hobart shipyard in Australia. Constructed for the South American ferry operator Buquebus, the vessel’s launch represents the ninth collaboration between Incat and Buquebus. At 130m long, Hull 096 is the largest electric vehicle of its type ever constructed.

Regional Outlook

The global electric ships market is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe Leading the Global Electric Ships Market Growth

Europe dominates the electric ships market owing to stringent environmental regulations & ambitious emission targets, strong government support & financial incentives, robust maritime ecosystem & skilled workforce, and renewable energy integration & green infrastructure. Enova, Norway's governmental body for energy transition support, has allocated substantial funds to advance the development of zero-emission maritime vessels, including electric ships, ammonia, and as well as hydrogen carriers. For instance, in June 2025, Brim Explorer received 40 million NOK in support from Enova to build what will be the first two all-electric high-speed trimarans for passenger transport. This project is part of a larger transition in Norway's marine sector, which is quickly electrifying both passenger and cargo vessels. The trimarans will start sailing across the iconic and soon-to-be emission-free Geirangerfjord in 2027, setting a new standard for electric transport.

Asia-Pacific’s Strategic Shift toward Electric Propulsion Technology

The Asia-Pacific region maintains a strong market position in the electric ship market owing to rapid naval modernization, strong government support & financial incentives, and strong shipbuilding infrastructure. A nation such as China has accelerated the use of electric vessels as part of a larger effort to modernize its naval fleet and advance green technology. The Chinese Navy and commercial sectors are boosting their investment in electric and hybrid propulsion systems to improve energy efficiency, reduce emissions, and improve operating stealth. By the end of 2023, China's total number of electric boats will approach 700, with over 200 new vessels launched that year alone.

Furthermore nations such as Japan, Singapore and India is taking a substantial stride toward navy modernization with a focus on electric propulsion technology, aligning itself with global trends in advanced marine capabilities For instance, in November 2024, The Indian and UK Defense Ministries signed a Statement of Intent (SoI) regarding Cooperation on the Design and development of Integrated Electric Propulsion (IEP) Systems. The SoI would serve as a broader framework for collaboration in the co-design and co-production of electric propulsion capabilities for future military ships. The Landing Platform Docks, which will be built in an Indian shipyard, are expected to have a full electric propulsion system.

Several nations have deployed IEP warships. These include China’s Type 055 Destroyers and the French Navy’s Horizon-class Frigates and Mistral-class Amphibious Assault Ships, among others. Most current-generation Indian warships use traditional propulsion systems, such as gas turbines, diesel engines, or combined gas turbine and diesel engines. The Indian Navy is eager to utilize locally produced IEP for its next-generation warships, considering they provide superior stealth due to significant noise reduction, more agility, cheaper fuel consumption, higher speed, and lower environmental concerns.

Market Players Outlook

The major companies operating in the global electric ships Market include Kongsberg Gruppen ASA, Navantia SA, SM.E, and Yangzijiang Shipbuilding Group, among others. Market players are leveraging partnerships, collaborations, mergers and acquisitions strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In March 2023, Far East Boats announced the launch of their first all-electric catamaran, the FarEast 42C, powered by two 20kW ePropulsion motors. The boat was unveiled at the China (Shanghai) International Boat Show. The FAREAST 42C electric catamaran was designed by Simonis Voogd Design.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric ships Market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Global Electric Ships Market Sales Analysis – Type | Mode of Operation | Application | Range | End-User ($ Million)

- Electric Ships Market Sales Market Sales Performance of Top Countries

- Research Methodology

- Primary Research Approach

- Secondary Research Approach

- Market Snapshot

- Market Overview and Insights

- Scope of the Study

- Analyst Insight & Current Market Trends

- Key Electric Ships Market Trends

- Market Recommendations

- Market Determinants

- Market Drivers

- Drivers For Global Electric Ships Market: Impact Analysis

- Market Pain Points and Challenges

- Restraints For Global Electric Ships Market: Impact Analysis

- Market Opportunities

- Opportunities For Global Electric Ships Market: Impact Analysis

- Market Drivers

- Competitive Landscape

- Competitive Dashboard – Electric Ships Market Revenue and Share by Manufacturers

- Electric Ships Comparison Analysis

- Top Market Player Ranking Matrix

- Key Company Analysis

- Kongsberg Gruppen ASA

- Overview

- Battery Type Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Navantia SA SM.E

- Overview

- Battery Type Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Yangzijiang Shipbuilding Group

- Overview

- Battery Type Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Kongsberg Gruppen ASA

- Key Company Analysis

- Top Winning Strategies by Market Players

- Merger and Acquisition

- Product Launch

- Partnership And Collaboration

- Global Electric Ships Market Sales Analysis By Type ($ Million)

- Fully Electric

- Hybrid

- Global Electric Ships Market Sales Analysis By Mode of Operation ($ Million)

- Manned

- Autonomous

- Global Electric Ships Market Sales Analysis By Application ($ Million)

- Passenger

- Cargo

- Defense

- Global Electric Ships Market Sales Analysis By Range ($ Million)

- < 50 KM

- 50-100 KM

- 101-1000 KM

- 1000 KM

- Global Electric Ships Market Sales Analysis By Application ($ Million)

- Linefit

- Retrofit

- Regional Analysis

- North American Electric Ships Market Sales Analysis – Propulsion Type | Seat | Application | Country ($ Million)

- Macroeconomic Factors for North America

- United States

- Canada

- European Electric Ships Market Sales Analysis – Propulsion Type | Seat | Application | Country ($ Million)

- Macroeconomic Factors for Europe

- UK

- Germany

- Italy

- Spain

- France

- Russia

- Rest of Europe

- Asia-Pacific Electric Ships Market Sales Analysis – Propulsion Type | Seat | Application | Country ($ Million)

- Macroeconomic Factors for Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

- Rest of Asia-Pacific

- Rest of the World Electric Ships Market Sales Analysis – Propulsion Type | Seat | Application ($ Million)

- Macroeconomic Factors for the Rest of the World

- Latin America

- Middle East and Africa

- Company Profiles

- Arc Boat Company

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Artemis Technologies Ltd

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Cemre Mühendislik Gemi- ?n?aat Sanayi ve Ticaret Ltd ?irketi (Cemre Shipyard)

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Damen Shipyards Group

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Candela Technology AB

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Holland Shipyards Group

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- HD HYUNDAI MIPO

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Kongsberg Gruppen ASA

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Incat Tasmania Pty Ltd,

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Jiangxi Jiangxin Shipbuilding Corporation

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Mitsubishi Heavy Industries, Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Nantong Xiangyu Shipbuilding & Offshore Engineering Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Navantia SA SM.E

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Nautique Boat Company, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Oshima Shipbuilding Co., Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- RAND Boats

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Remontowa Shipbuilding S.A.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Sanmar Denizcilik A.S

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Scheepswerf Talsma b.v

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Sefine Shipyard

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- VARD AS. (Fincantieri)

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Business Strategies

- Yangzijiang Shipbuilding Group

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Business Strategies

- Arc Boat Company

1. Global Electric Ships Market Research and Analysis By Type, 2024-2035 ($ Million)

2. Global Fully Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

3. Global Hybrid Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

4. Global Electric Ships Market Research and Analysis By Mode of Operation, 2024-2035 ($ Million)

5. Global Manned Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

6. Global Autonomous Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

7. Global Electric Ships Market Research and Analysis By Application, 2024-2035 ($ Million)

8. Global Passenger Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

9. Global Cargo Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

10. Global Defense Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

11. Global Electric Ships Market Research and Analysis By Application, 2024-2035 ($ Million)

12. Global Electric Ships For Passenger Market Research and Analysis By Region, 2024-2035 ($ Million)

13. Global Electric Ships For Cargo Market Research and Analysis By Region, 2024-2035 ($ Million)

14. Global Electric Ships For Defence Market Research and Analysis By Region, 2024-2035 ($ Million)

15. Global Electric Ships Market Research and Analysis By Range, 2024-2035 ($ Million)

16. Global Below 50 KM Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

17. Global 50-100 KM Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

18. Global 101-1000 KM Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

19. Global 1000 KM Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

20. Global Electric Ships Market Research and Analysis By End-User, 2024-2035 ($ Million)

21. Global Electric Ships For Linefit Market Research and Analysis By Region, 2024-2035 ($ Million)

22. Global Electric Ships For Retrofit Market Research and Analysis By Region, 2024-2035 ($ Million)

23. Global Electric Ships Market Research and Analysis By Region, 2024-2035 ($ Million)

24. North American Electric Ships Market Research and Analysis By Country, 2024-2035 ($ Million)

25. North American Electric Ships Market Research and Analysis By Type, 2024-2035 ($ Million)

26. North American Electric Ships Market Research and Analysis By Mode of Operation, 2024-2035 ($ Million)

27. North American Electric Ships Market Research and Analysis By Application, 2024-2035 ($ Million)

28. North American Electric Ships Market Research and Analysis By Range, 2024-2035 ($ Million)

29. North American Electric Ships Market Research and Analysis By End-User, 2024-2035 ($ Million)

30. European Electric Ships Market Research and Analysis By Country, 2024-2035 ($ Million)

31. European Electric Ships Market Research and Analysis By Type, 2024-2035 ($ Million)

32. European Electric Ships Market Research and Analysis By Mode of Operation, 2024-2035 ($ Million)

33. European Electric Ships Market Research and Analysis By Application, 2024-2035 ($ Million)

34. European Electric Ships Market Research and Analysis By Range, 2024-2035 ($ Million)

35. European Electric Ships Market Research and Analysis By End-User, 2024-2035 ($ Million)

36. Asia-Pacific Electric Ships Market Research and Analysis By Country, 2024-2035 ($ Million)

37. Asia-Pacific Electric Ships Market Research and Analysis By Type, 2024-2035 ($ Million)

38. Asia-Pacific Electric Ships Market Research and Analysis By Mode of Operation, 2024-2035 ($ Million)

39. Asia-Pacific Electric Ships Market Research and Analysis By Application, 2024-2035 ($ Million)

40. Asia-Pacific Electric Ships Market Research and Analysis By Range, 2024-2035 ($ Million)

41. Asia-Pacific Electric Ships Market Research and Analysis By End-User, 2024-2035 ($ Million)

42. Rest of The World Electric Ships Market Research and Analysis By Country, 2024-2035 ($ Million)

43. Rest of The World Electric Ships Market Research and Analysis By Type, 2024-2035 ($ Million)

44. Rest Of The World Electric Ships Market Research and Analysis By Mode of Operation, 2024-2035 ($ Million)

45. Rest of The World Electric Ships Market Research and Analysis By Application, 2024-2035 ($ Million)

46. Rest of The World Electric Ships Market Research and Analysis By Range, 2024-2035 ($ Million)

47. Rest of The World Electric Ships Market Research and Analysis By End-User, 2024-2035 ($ Million)

1. Global Electric Ships Market Share By Type, 2024 Vs 2035 (%)

2. Global Fully Electric Ships Market Share By Region, 2024 Vs 2035 (%)

3. Global Hybrid Electric Ships Market Share By Region, 2024 Vs 2035 (%)

4. Global Electric Ships Market Share By Mode of Operation, 2024 Vs 2035 (%)

5. Global Manned Electric Ships Market Share By Region, 2024 Vs 2035 (%)

6. Global Autonomous Electric Ships Market Share By Region, 2024 Vs 2035 (%)

7. Global Electric Ships Market Share By Application, 2024 Vs 2035 (%)

8. Global Electric Ships For Passenger Market Share By Region, 2024 Vs 2035 (%)

9. Global Electric Ships For Cargo Market Share By Region, 2024 Vs 2035 (%)

10. Global Electric Ships For Defense Market Share By Region, 2024 Vs 2035 (%)

11. Global Electric Ships Market Share By Range, 2024 Vs 2035 (%)

12. Global Below 50 KM Electric Ships Market Share By Region, 2024 Vs 2035 (%)

13. Global 50-100 KM Electric Ships Market Share By Region, 2024 Vs 2035 (%)

14. Global 101-1000 KM Electric Ships Market Share By Region, 2024 Vs 2035 (%)

15. Global 1000 KM Electric Ships Market Share By Region, 2024 Vs 2035 (%)

16. Global Electric Ships Market Share By End-User, 2024 Vs 2035 (%)

17. Global Electric Ships For Linefit Market Share By Region, 2024 Vs 2035 (%)

18. Global Electric Ships For Retrofit Market Share By Region, 2024 Vs 2035 (%)

19. US Electric Ships Market Size, 2024-2035 ($ Million)

20. Canada Electric Ships Market Size, 2024-2035 ($ Million)

21. UK Electric Ships Market Size, 2024-2035 ($ Million)

22. France Electric Ships Market Size, 2024-2035 ($ Million)

23. Germany Electric Ships Market Size, 2024-2035 ($ Million)

24. Italy Electric Ships Market Size, 2024-2035 ($ Million)

25. Spain Electric Ships Market Size, 2024-2035 ($ Million)

26. Russia Electric Ships Market Size, 2024-2035 ($ Million)

27. Rest of Europe Electric Ships Market Size, 2024-2035 ($ Million)

28. India Electric Ships Market Size, 2024-2035 ($ Million)

29. China Electric Ships Market Size, 2024-2035 ($ Million)

30. Japan Electric Ships Market Size, 2024-2035 ($ Million)

31. South Korea Electric Ships Market Size, 2024-2035 ($ Million)

32. Australia and New Zealand Electric Ships Market Size, 2024-2035 ($ Million)

33. ASEAN Economies Electric Ships Market Size, 2024-2035 ($ Million)

34. Rest of Asia-Pacific Electric Ships Market Size, 2024-2035 ($ Million)

35. Latin America Electric Ships Market Size, 2024-2035 ($ Million)

36. Middle East and Africa Electric Ships Market Size, 2024-2035 ($ Million)

FAQS

The size of the Electric Ships market in 2024 is estimated to be around $4.02 billion.

Europe holds the largest share in the Electric Ships market.

Leading players in the Electric Ships market include Kongsberg Gruppen ASA, Navantia SA, SM.E, and Yangzijiang Shipbuilding Group, among others.

Electric Ships market is expected to grow at a CAGR of 21.2% from 2025 to 2035.

Growing demand for eco-friendly maritime transport, stringent emission regulations, and advancements in electric propulsion technologies are driving the Electric Ships Market growth.