Fiberglass Market

Fiberglass Market Size, Share & Trends Analysis Report, By Glass Type (S-glass, E-glass, AR-glass, D-glass, and others), By End-User (Automobile, Aerospace & Defense, Food & Beverage, Energy, Construction, and others) and Forecast, 2020-2026

The fiberglass market is estimated to grow at a CAGR of around 10% during the forecast period. The extensive use of fiberglass for manufacturing applications in the construction and automobile industry is a key factor attributing to the growth of the global fiberglass market. Additionally, fiberglass is used on a large scale in industries like aerospace & defense, marine, food, electronics body part, and more to produce lightweight body parts. Fiberglass has significant applications in the construction sector. It is used in commercial, industrial as well as in residential construction for both exterior and interior components. From the swimming pool fence to the skylight to solar heating elements it is largely used for making its body parts. Vetrotex fiberglass is one of the fiberglasses that is used in the construction industry, for its flexible, hard, water-resistant, and fire-resistant properties. Also for its lightweight property fiberglass is used as a structural shell.

The stringent government regulations across the globe also play a significant growth factor for the growth of the global fiberglass market. Many industries like construction, automobile, and electronics have regulations to use fiberglass for its body parts owing to its very hard and eco-friendly nature of the fiberglass. The growing market for electric cars is one of the key factors creating demand for fiberglass owing to its lightweight characteristics, thereby, driving the growth of the fiberglass market. Moreover,now renewable energy is a global trend that increased installations of wind turbines across the globe. Moreover, due to fiberglass’s hard and lightweight characteristics, it is being extensively used in manufacturing the blades of wind turbines and other parts.

However, the availability of its substitute products, such as carbon fiber and aluminum is the major factor restraining market growth. In comparison with fiberglass, carbon fiber is stronger and lighter, though it is costlier than fiberglass. Easy availability of aluminum is one of the major restraining factor market growth, though it is heavier than fiberglass, and aluminum is not that much heat-resistant as fiberglass, also aluminum makes reactions with water, but fiberglass not.

Segmentation

The global fiberglass market is segmented based on type and end-user. Based on type, the market is classified into S-glass, E-glass, AR-glass, D-glass, and other-glass market. Based on the end-user, the market is classified into automobile, aerospace & defense, food & beverage, energy, construction, and market. Based on end-user the automobile segment is anticipated to hold considerable market share during the forecast period. The increasing adoption of electric vehicles owing to the cohesive government policies, eco-friendly nature, and purchase incentives is a key factor propelling the growth of the electric vehicle, which in turn is driving the growth of this market segment.

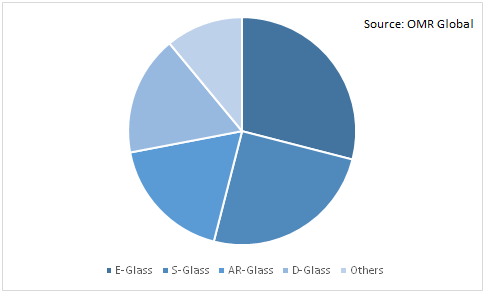

E-glass segment held considerable share based on the type

E-glass is the most used fiberglass that contains little alkali. The key properties of this glass type are it is very low in cost, high production rates, low density, fire-resistant, and electrical insulation. This glass is mainly used for the fields, includes electrical applications, packaging, automobiles, marine, constructions, and more. Therefore, the growing application of this kind of fiberglass in these industries is a major factor contributing to the high market share of this segment in the global market.

Fiberglass Market Share by Glass Type, 2019 (%)

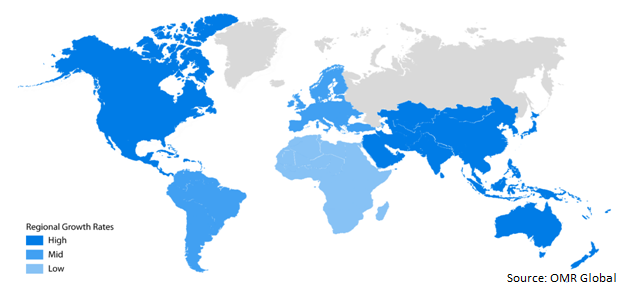

Regional Outlook

The global fiberglass market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. Asia Pacific market is anticipated to hold considerable market share based on geography. India, China, and Japan are the main consumers of fiberglass in the Asia Pacific region. Growth of the construction industry, installation of the solar panel and wind turbine along with the growing demand for electric cars are the major driver for the growth of the fiberglass market in this region. The major companies that manufacture wind turbines are Ming Yang, Goldwind and Uniter power from China, and Sulzon Group from India. In the solar panel market currently, China is the largest market player across the globe, major companies are JinkoSolar, Trina Solar, LONGi Solar and more. Furthermore, three major global constructions are from the Asia Pacific region only, which are Power China, China Communications Constructions Company and L&T Construction. Moreover, Nissan, headquartered in Japan is one of the major manufacturers of the electric car that will create demand for the fiberglass market in the region. Furthermore, in Kerala, India in a bid to curtail the spread of the coronavirus all taxi drivers are suggested to install a fiberglass partition between the driver and second-row passengers, which will further contribute to the market growth in the region.

Fiberglass Market Growth,by Region 2020-2026

Competitive Landscape

Owens Corning, Binani Industries Ltd., Compagniede Saint-Gobain S.A., Nippon Electric Glass Co. Ltd, and Taiwan Glass Industry Corp. are the key players operating in the global fiberglass market. Mergers and acquisitions and product launches are considered as crucial strategies adopted by the market players to expand market share and gain a competitive advantage in the global fiberglass market. For instance, in 2020, Compagniede Saint-Gobain introduced a new fiberglass brick cladding, co-developed with Weberwall, a British startup. It is lightweight brick’s look-alike product, which can be used in both interior and exterior construction. Moreover, its installation process is three times faster than the In October 2017, Owens Corning acquired Paroc Group, a Finland-based company, manufacturer of energy-insulation solutions. Moreover, it also invested an amount of $110 million and $50 million in the Indian and European fiberglass market in the respective year 2016 and 2017.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fiberglass market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Owens Corning

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Binani Industries, Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Compagnie de Saint-Gobain S.A.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Nippon Electric Glass Co., Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Taiwan Glass Industry Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Fiberglass Market by Type

5.1.1. S-Glass

5.1.2. E-Glass

5.1.3. AR-Glass

5.1.4. D-Glass

5.1.5. Others

5.2. Global Fiberglass Market by End-User

5.2.1. Automobile

5.2.2. Aerospace and Defense

5.2.3. Food & Beverage

5.2.4. Energy

5.2.5. Construction

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Glassfiber Yarns Holding Corp.

7.2. Asahi Fiberglass CO., Ltd.

7.3. Binani Industries Ltd.

7.4. Chongqing Polycomp International Corp. (CPIC)

7.5. Compagnie de Saint-Gobain S.A.

7.6. Fiberglass Building Products Inc.

7.7. Jiangsu Jiuding New Material Co., Ltd.

7.8. Johns Manville Corp.

7.9. Jushi Co. Ltd

7.10. Knauf Insulation

7.11. Lanxess AG

7.12. Nippon Electric Glass Co., Ltd.

7.13. Owens Corning

7.14. PFG FIBER GLASS Corp.

7.15. Phelps

7.16. Sichuan Weibo New Materials Group Co., Ltd.

7.17. Taishan Fiberglass Inc.

7.18. Taiwan Glass Ind Corp.

1. GLOBAL FIBERGLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL S-GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($MILLION)

3. GLOBAL E-GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL AR-GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL D-GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FIBERGLASS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

8. GLOBAL AUTOMOBILE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FOOD& BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL FIBERGLASS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN FIBERGLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN FIBERGLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN FIBERGLASS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

18. EUROPEAN FIBERGLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN FIBERGLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN FIBERGLASS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC FIBERGLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC FIBERGLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC FIBERGLASS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

24. REST OF THE WORLD FIBERGLASS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD FIBERGLASS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL FIBERGLASS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL FIBERGLASS MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL FIBERGLASS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FIBERGLASS MARKET SIZE, 2019-2026 ($ MILLION)