Fortified Wine Market

Global Fortified Wine Market Size, Share & Trends Analysis Report, By Type (Port Wine, Sherry, Vermouth, Madeira, and Others), By Distribution Channel (Online and Offline) and Forecast, 2020-2026

The global fortified wine market is estimated to grow at a CAGR of nearly 4.8% during the forecast period. The major factors contributing to the growth of the market include emerging demand for premium alcoholic beverages and growing disposable income across emerging countries. As per the State Council of the People's Republic of China, the country’s per capita disposable income stood at $1,265 in the first three months of 2019, up 6.8% year-on-year in real terms. Urban and rural per capita disposable income reached nearly $1735 and $686 in the first quarter of 2019, up 5.9% and 6.9% in real terms, respectively.

Chinese per capita consumer spending increased by 5.4% year-on-year in real terms to reach nearly $826 in the first quarter of 2019. This rising per capita income is further supporting to drive the market growth in the country. This, in turn, is expected to contribute to the adoption of premium fortified wine products. Further, the adoption of fortified wine are being primarily led by significant alcoholic consumption across the countries and increasing demand for beverages with different natural flavors. Millennials are primarily buying innovative alcoholic beverages products and therefore, the manufacturers are using natural flavors that enables to enhance the taste and fragrance of their alcoholic beverages.

The comprehensive range of fortified wine with innovative natural flavors is providing multiple options for consumers which allows them to select the product of their choice. There is an increasing trend towards celebrity-owned brands available in the market that is bound to attract a large number of the customer base. Most people prefer to consume premium alcohol beverage of their favorite celebrities. Therefore, it is expected that more new launches of celebrities-owned premium alcohol brands will occur in the near future, which in turn, will likely propel the market growth. Fortified wine contains higher alcohol content and features a unique aroma and flavor that makes it different from regular varieties, which in turn, is encouraging the growth of the market.

Market Segmentation

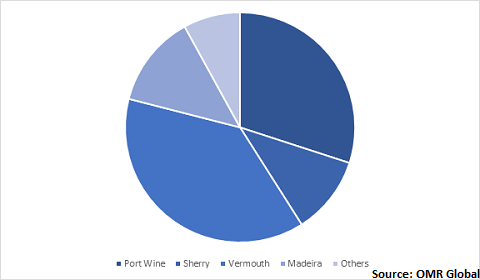

The global fortified wine market is segmented based on type and distribution channel. Based on type, the market is classified into port wine, sherry, vermouth, madeira, and others. Based on the distribution channel, the market is classified into online and offline. Offline is further classified into specialty stores, supermarkets and hypermarkets, liquor stores, and others.

Vermouth is anticipated to hold significant share in the market

In 2019, vermouth is anticipated to grow considerably during the forecast period. Rising consumers consciousness towards alcohol intake have been witnessing an emerging demand for lower alcohol content offerings. Vermouth-based beverages meet this demand, as it offers a substitute for the punchy flavors of a spirit, however, with far lower alcohol by volume (ABV) and botanical flavors. In a nutshell, vermouth consists of minimum 75% wine, infused with botanical extracts and fortified with distilled alcohol for flavoring.

Owing to its increasing popularity, a large number of alcohol manufacturers have started producing vermouth to gain a position in the market. This leads to the availability of a wide range of vermouth brands with innovative creations, which is contributing to the growth of the market. People tend to drink vermouth after exercise owing to its digestive benefits and as a pleasant way to reduce stress and the immune system. This results in the increasing share of vermouth in fortified wine.

Global Fortified Wine Market Share by Type, 2019 (%)

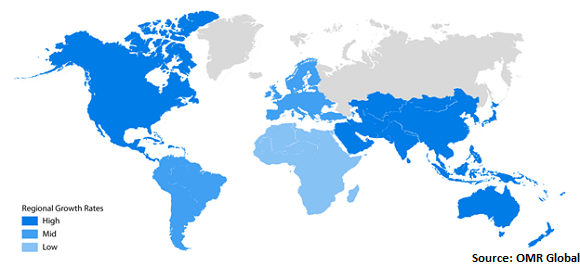

Regional Outlook

Geographically, the market is segmented into North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, Europe is estimated to witness significant growth in the market owing to the increasing demand for alcoholic beverages coupled with an increasing shift of millennials towards premium alcoholic beverages in the region, which is driving the market growth in the region. A considerable production of fortified wine is further leveraging the market growth in the region. Asia-Pacific is estimated to witness potential growth during the forecast period owing to the rising per-capita income and significant alcohol consumption in the region.

Global Fortified Wine Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include Bacardi Ltd., E. & J. Gallo Winery, Symington Family Estates Vinhos SA, Davide Campari-Milano S.p.A., and Taylor’s Port. The major players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in April 2019, E. & J. Gallo Winery signed an agreement with Constellation Brands, Inc. to acquire over 30 wine and spirits brands, along with six wine-producing facilities located in New York, California, and Washington. E. & J. Gallo Winery is continuously focusing on the growth in the wine industry and therefore significantly investing in its premium and luxury businesses. This acquisition will offer a tremendous opportunity for the company to bring new consumers into the wine category.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fortified wine market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Bacardi Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. E. & J. Gallo Winery

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Symington Family Estates Vinhos SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Davide Campari-Milano S.p.A.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Taylor’s Port

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Fortified Wine Market by Type

5.1.1. Port Wine

5.1.2. Sherry

5.1.3. Vermouth

5.1.4. Madeira

5.1.5. Others

5.2. Global Fortified Wine Market by Distribution Channel

5.2.1. Online

5.2.2. Offline

5.2.2.1. Specialty Stores

5.2.2.2. Supermarkets and Hypermarkets

5.2.2.3. Liquor Stores

5.2.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Atsby Vermouth

7.2. Bacardi Ltd.

7.3. Backsberg

7.4. Contratto s.r.l.

7.5. Davide Campari-Milano S.p.A.

7.6. E. & J. Gallo Winery

7.7. Fratelli Gancia & C. S.p.A.

7.8. Imbue Cellars

7.9. Liberty Wines Ltd.

7.10. Sogevinus Fine Wines S.L.

7.11. Sogrape Group

7.12. Symington Family Estates Vinhos SA

7.13. Taylor’s Port

7.14. The Dolin Co.

7.15. The Wine Group

7.16. Vinbros and Co.

1. GLOBAL FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PORT WINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SHERRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL VERMOUTH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MADEIRA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

8. GLOBAL FORTIFIED WINE IN ONLINE CHANNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL FORTIFIED WINE IN IN OFFLINE CHANNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

14. EUROPEAN FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

20. REST OF THE WORLD FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD FORTIFIED WINE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL FORTIFIED WINE MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL FORTIFIED WINE MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL FORTIFIED WINE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD FORTIFIED WINE MARKET SIZE, 2019-2026 ($ MILLION)