Hip Replacement Market

Hip Replacement Market Size, Share & Trends Analysis Report by Product Type (Total Hip Replacement, Partial Hip Replacement, and Hip Resurfacing), and by End-User (Hospitals, Specialized Orthopedic Clinics, and Ambulatory Surgical Centers (ASCs)) Forecast Period (2024-2031)

Hip replacement market is anticipated to grow at a moderate CAGR of 3.9% during the forecast period. The rising hip replacement procedures have created demand for the global market. According to the Agency for Healthcare Research and Quality, more than 450,000 total hip replacements are performed each year in the US. The rising prevalence of osteoporosis and, arthritis globally is further aiding the market demand. According to the International Osteoporosis Foundation estimation, 75 million people in Europe, the US, and Japan are affected by osteoporosis. In Asia, osteoporosis is greatly underdiagnosed and under-treated, even in the most high-risk patients who have already fractured. The increasing number of road accident cases that led to joint replacement surgeries is further aiding the market growth.

The ongoing trend of AR/VR integration and robotic-assisted surgery is anticipated to offer lucrative opportunities for the growth of the global market. Oyster & Pearls Hospitals, Jehangir Specialty Hospital has introduced AR-guided robotic joint replacement surgery. This integration has enabled surgeons to overlay vital information directly onto their field of vision in real time. This includes 3D models of the patient’s hip anatomy and live data about implant positioning.

The US FDA approval is mandatory for the commercial introduction of hip replacement surgical devices. In January 2022, the US FDA warned healthcare providers not to use the Synovo Total Hip System, a medical device for total hip replacements. The agency issued a warning letter to Synovo ordering the manufacturer to stop manufacturing the Total Hip System because the device had been modified without FDA approval.

Segmental Outlook

The global hip replacement market is segmented based on product type, and end-user. Based on product type, the market is segmented into total hip replacement, partial hip replacement, and hip resurfacing. Based on end-users, the market is segmented into hospitals, specialized orthopedic clinics, and ASCs.

Total Hip Replacement to Hold Considerable Share in the Global Hip Replacement Market

According to the American Academy of Orthopaedic Surgeons, in a total hip replacement (also called total hip arthroplasty), the damaged bone and cartilage are removed and replaced with prosthetic components. Hip replacement is the option when joint damage is irreparable and hinders the joint's function. Osteoarthritis and other hip injuries caused due to accident cases are key factors creating demand for total hip replacement surgeries. New product launches to cater to the demand for total hip replacement are further contributing to the growth of this market segment. For instance, in February 2021, OrthoGrid Systems, Inc. launched the OrthoGrid Hip, which is a distortion-correcting, implant-agnostic, intraoperative-alignment technology for direct anterior hip total hip arthroplasty.

Regional Outlook

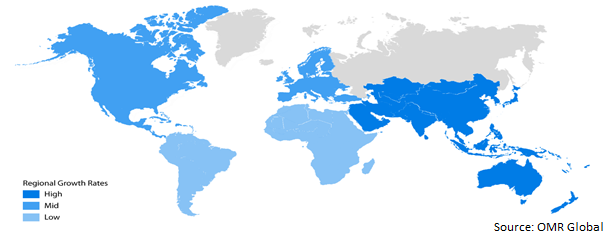

The global hip replacement market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Asia-Pacific is anticipated to exhibit considerable growth in the global market. The growing medical expenditure, rising accident cases, favorable reimbursement policies, and growing medical tourism in emerging economies a key factors driving the regional market growth.

Global Hip Replacement Market Growth, by Region 2024-2031

North America Held Considerable Share in the Global Market

The regional market share is driven by the high prevalence of osteoarthritis and the high demand for hip replacement surgeries. Key product launches and a high concentration of major market players are further aiding the regional market growth. For instance, in August 2021, Zimmer Biomet Holdings, Inc. received US FDA 510(k) clearance of the ROSA Hip System for robotically-assisted direct anterior total hip replacement. cost of total hip replacement surgery in the US varies greatly, with prices between $20,000 and $42,000. The high cost of this surgery can restrain its market growth. However, most health plans cover total hip replacement surgery. Therefore, the growing demand for these procedures along with favorable reimbursement policies is anticipated to offer lucrative opportunities to the market growth.

Market Players Outlook

The major companies serving the global hip replacement market include SurgTech Inc., Corin Group, Smith & Nephew Plc, Zimmer Biomet Holdings Inc., and Stryker Corp. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and advancement in their product offerings to stay competitive in the market. For instance, in December 2023, Stryker Corp. executed a binding offer to Menix to acquire SERF SAS, a France-based joint replacement company. This acquisition would complement Stryker's existing presence in France and across Europe as well as its global joint replacement portfolio, allowing Stryker to serve a wider range of patients.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hip replacement market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Corin Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Smith & Nephew Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Stryker Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Zimmer Biomet Holdings Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hip Replacement Market by Product Type

4.1.1. Total Hip Replacement

4.1.2. Partial Hip Replacement

4.1.3. Hip Resurfacing

4.2. Global Hip Replacement Market by End-User

4.2.1. Hospitals

4.2.2. Specialized Orthopedic Clinics

4.2.3. Ambulatory Surgical Centers (ASCs)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.4. Rest of Asia-Pacific

5.5. Rest of the World

6. Company Profiles

6.1. AAP Implantate AG

6.2. Aesculap, Inc. (B. Braun Co.)

6.3. Allegra Orthopaedics Ltd.

6.4. Alphatec Spine, Inc.

6.5. B.Braun

6.6. Conmed Corp.

6.7. DJO, LLC

6.8. Enovis

6.9. Exactech, Inc.

6.10. Integra LifeSciences Corp.

6.11. Johnson & Johnson (DePuy Synthes Companies)

6.12. Limacorporate S.p.A

6.13. Medtronic plc

6.14. NuVasive, Inc.

6.15. Orthofix Medical Inc.

6.16. SurgTech Inc.

6.17. TriMed Inc.

6.18. Wright Medical Group N.V.

1. GLOBAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL TOTAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PARTIAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HIP RESURFACING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

6. GLOBAL HIP REPLACEMENT IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HIP REPLACEMENT IN SPECIALIZED ORTHOPEDIC CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HIP REPLACEMENT IN AMBULATORY SURGICAL CENTERS (ASCS) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

12. NORTH AMERICAN HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. EUROPEAN HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

15. EUROPEAN HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. ASIA- PACIFIC HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA- PACIFIC HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

18. ASIA- PACIFIC HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. REST OF THE WORLD HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL TOTAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL PARTIAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL HIP RESURFACING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023 VS 2031 (%)

6. GLOBAL HIP REPLACEMENT IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL HIP REPLACEMENT IN SPECIALIZED ORTHOPEDIC CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL HIP REPLACEMENT IN AMBULATORY SURGICAL CENTERS (ASCS) MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL HIP REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. US HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

12. UK HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD HIP REPLACEMENT MARKET SIZE, 2023-2031 ($ MILLION)