Insulin Delivery Devices Market

Global Insulin Delivery Devices Market Size, Share & Trends Analysis Report, By Type (Insulin Syringes, Insulin Pens, Insulin Jet Injectors, and Insulin Pumps), By End-User (Hospitals & Clinics and Homecare), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global insulin delivery devices market is projected to grow at a CAGR of 8.7% during 2019-2025. Various pivotal factors are boosting the market growth such as rising incidence and prevalence rate of diabetes, increasing awareness among the population towards diabetes and availability of a variety of insulin delivery devices in the market. Insulin is a necessary element required for the treatment of diabetes patients. Insulin enables a person’s body to use glucose from carbohydrates in the food consumed by the patient for future use.

Rising diabetes patients are considered to be a key driver in the growth of the global insulin delivery devices market. According to the International Diabetes Federation (IDF), around 425 million people had diabetes across the globe in 2017, and this number is further estimated to rise to 6 million by 2045. This significant increase in the diabetes population will increase the demand for insulin, which in turn, will spur the growth of the global insulin delivery devices industry in the near future.

Additionally, government support and their reimbursement policies in some countries such as the US are positively driving the market growth. The federal government offers financial support to diabetes patients by providing them various health insurance. Medicare, the Children's Health Insurance Program (CHIP), TRICARE, and veterans' health care programs are some programs that support patients. Moreover, some acts such as the Affordable Care Act (ACA) prevents insurers from denying coverage or charging higher premiums to people with preexisting conditions, such as diabetes are also fueling the market considerably. The features of insulin delivery devices including its accuracy, efficiency, and cost-effectiveness attract customers from different regions and thus drive market growth.

However, there is a lack of reimbursement policies in some emerging economies such as Bulgaria; the Czech Republic and others which do not give so much priority to diabetes. In addition to policies, the risk of infections associated with some devices such as insulin pens and syringes acts as a restraint for the market. The adoption of oral insulin as an alternative to these devices, which is negatively impacting the growth of the insulin delivery devices market. Besides, technological advancement and innovations to prevent diabetes and the significant rise in the amount of spending on diabetes are expected to create opportunities in the near future.

Segmental Outlook

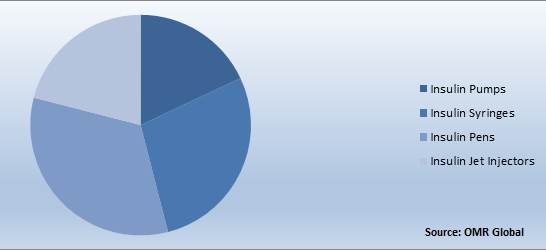

The global insulin delivery devices market is segmented on the basis of type and end-user. Based on the end-user, the homecare usage segment held the major market share in 2018. Easy and convenient usage of these devices at home is anticipated to boost the segmental growth of the market during the forecast period. Based on type, the global insulin delivery devices market is segmented into insulin syringes, insulin pens, insulin jet injectors, and insulin pumps. Insulin pumps are anticipated to exhibit considerable growth during the forecast period owing to the introduction of advanced insulin devices such as portable insulin pumps.

Global Insulin Delivery Devices Market Share by Type, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insulin delivery devices market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Novo Nordisk A/S

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Development

3.3.2. Eli Lilly and Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Sanofi SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Becton Dickinson, and Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Medtronic PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Insulin Delivery Devices Market by Type

5.1.1. Insulin Syringes

5.1.2. Insulin Pens

5.1.3. Insulin Jet Injectors

5.1.4. Insulin Pumps

5.2. Global Insulin Delivery Devices Market by End-User

5.2.1. Hospitals & Clinics

5.2.2. Homecare

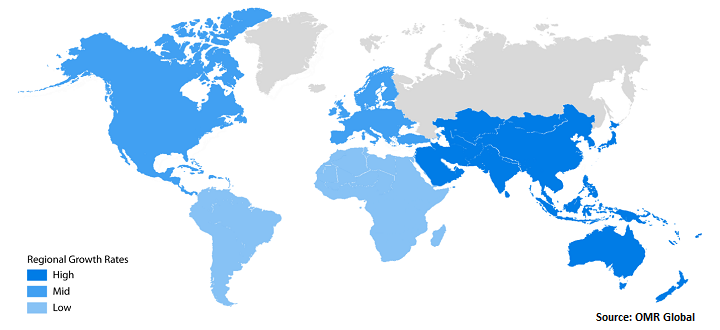

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Animas LLC

7.2. Abbott Laboratories, Inc.

7.3. B. Braun Melsungen AG

7.4. Becton, Dickinson and Co.

7.5. Bigfoot Biomedical Inc.

7.6. Biocon Ltd.

7.7. Eli Lilly and Co.

7.8. F. Hoffmann-La Roche AG

7.9. Gerresheimer AG

7.10. Insulet Corp.

7.11. Julphar

7.12. MannKind Corp.

7.13. Medtronic PLC

7.14. Novo Nordisk A/S

7.15. Sanofi SA

7.16. SciGen Pte Ltd.

7.17. Tandem Diabetes Care, Inc.

7.18. Valeritas Holdings, Inc.

7.19. Wockhardt Ltd.

7.20. Ypsomed AG

1. GLOBAL INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL INSULIN SYRINGES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INSULIN PENS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INSULIN JET INJECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL INSULIN PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

7. GLOBAL INSULIN DELIVERY DEVICES IN HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL INSULIN DELIVERY DEVICES IN HOMECARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. EUROPEAN INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. REST OF THE WORLD INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL INSULIN DELIVERY DEVICES MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL INSULIN DELIVERY DEVICES MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL INSULIN DELIVERY DEVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD INSULIN DELIVERY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)