Insurance Platform Market

Insurance Platform Market Size, Share & Trends Analysis Report by Offering (Software and Services), by Application (Claim Management, Underwriting & Rating, Customer Relationship Management (CRM), Billing & Payments, Compliance & Reporting, Policy Administration, Collection & Disbursement, Sales & Marketing, Property Estimation, and Others), by Insurance Type (General Insurance, Life Insurance, Cybersecurity Insurance, and Others), by Technology (Artificial Intelligence (AI) & Machine Learning (ML), Internet-of-Things (IoT), Blockchain, Data Analytics & Big Data, Regulatory Technologies (Regtech), and Others), and by End-User (Insurance Companies, Insurance Agencies & Brokers, Third-Party Administrators (TPAs), and Actuators & Reinsurers) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

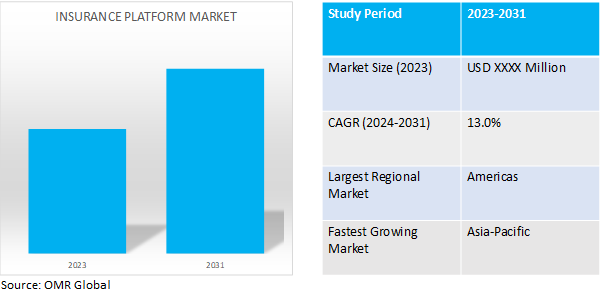

insurance platform market is anticipated to grow at a CAGR of 13.0% during the forecast period (2024-2031). The term refers to a comprehensive system that is designed to manage and streamline various processes within the insurance industry. It offers several benefits such as reduced cost, fraud detection, low-code capabilities, and transaction convenience along with a competitive advantage.

Market Dynamics

Growing demand for Advanced Insurance Channels

The insurance platform market has been witnessing a considerable surge in the demand for digital insurance channels over the past few years. Customers are more focused on seeking convenience and accessibility in their interactions with insurance companies. Digital channels including mobile applications and online portals provide policyholders with the ability to manage their insurance policies. For instance, in August 2021, Medi Assist launched its portal named me.medibuddy.in for its retail policyholders. The MediBuddy retail portal aims at giving retail policyholders complete charge of their health benefits management and giving them access to various self-help features.

Rise in Integration of Advanced Technologies for Real-Time Data Analysis

The rise in the adoption of cloud-based digital solutions supports the market to gain a competitive advantage. The insurance sector includes data-intensive processes coupled with evolving customer expectations, thus integrating new, innovative, and advanced technologies provides an edge to the sector. Using cloud-based solutions enhances scalability and flexibility, by which insurance platforms can utilize their computing resource easily and more efficiently for handling changing workloads. Some of the major cloud-based insurance platforms are EZLynx, AgencySmart, HawkSoft, ePay Policy, and others.

Market Segmentation

Our in-depth analysis of the global insurance platform market includes the following segments by offering, application, insurance type, technology, and end-user:

- Based on offerings, the market is bifurcated into software and services.

- Software such as intelligent document processing, insurance lead management, insurance workflow automation, policy management, video KYC/ eKYC, and API & microservices.

- Services such as professional and managed services.

- Based on application, the market is sub-segmented into claim management, underwriting & rating, CRM, billing & payments, compliance & reporting, policy administration, collection & disbursement, sales & marketing, property estimation, and others.

- Based on insurance type, the market is sub-segmented into general insurance, life insurance, cybersecurity insurance, and others (health and automotive insurance).

- Based on technology, the market is augmented into AI & ML, IoT, blockchain, data analytics & big data, RegTech, and others.

- Based on end-users, the market is segmented into insurance companies, insurance agencies & brokers, TPAs, and actuators & reinsurers.

Claim Management is Projected to Emerge as the Largest Segment

Claims management in insurance involves the systematic process of handling and resolving insurance claims made by policyholders. It is a critical function in the insurance industry, encompassing everything from the initial claim filing to the final settlement or denial. Thus, it is anticipated to hold a significant share of the global market. Within the segment, there is a huge demand for virtual claim handling and processing, which is the primary factor supporting the segment’s growth. Traditional claim procedures take longer time and have strained customer satisfaction, along with testing the limitations of digital tools for the same. For example, the average claims cycle time is now 22 days, which is more than 4 days longer than a year ago and a week longer in 2021.

Regional Outlook

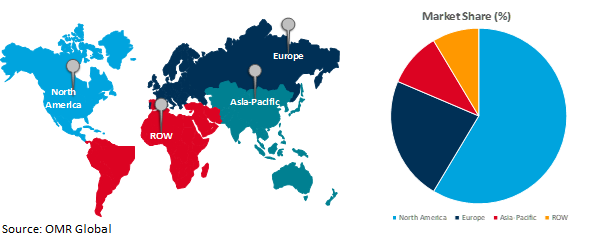

The global insurance platform market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Economies Investing in Digital Insurance Platforms

India’s government organizations are increasingly focusing on developing and launching new insurance platforms. For instance, in December 2023, the Insurance Regulatory and Development Authority of India (IRDAI) announced the rollout of Bima Vistaar in the first quarter of FY2025. Bima Vistaar is an all-in-one affordable insurance product for life, health, and property cover. Currently, the officials stated the technology platform is being developed by the Life and General Insurance Councils of the country, which is in process.

In July 2023, PhonePe Insurance Broking Services launched health insurance plans in India which offer monthly subscriptions. The platform was developed to reduce the issues of one-time payments amid price pressures. For the same, PhonePe in partnership with several health insurance companies introduced UPI's monthly mode of payment.

Global Insurance Platform Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, the North American region is expected to hold a major share of the global market. The region covers a vast and diverse geographical landscape which includes developed economies such as the US and Canada. Both countries are considered as one of the pioneers in insurance technology solutions. This is primarily owing to the presence of several technological giants in the region coupled with a tech-savvy consumer base.

Furthermore, over the past years regional regulatory organizations have adopted a forward-thinking approach, leading Insurtech advancements which creates a supportive environment for startups. For instance, as per the Insurance-Canada (.gov) article published in February 2024, around 75.0% of insurance organizations are preparing to implement a new core insurance management platform by 2025.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global insurance platform market include Adobe Inc., IBM, Microsoft Corp., Oracle, Corp., Next Insurance, Inc. (Delaware Corp.), Acko Technology and Service Pvt. Ltd., and Salesforce, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in May 2023, WTW globally launched Neuron, a sophisticated digital insurance platform. The platform utilizes cutting-edge technology to support underwriters and brokers to connect and trade more easily.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global insurance platform market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Adobe Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Oracle Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Salesforce, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Insurance Platform Market by Offering

4.1.1. Software

4.1.1.1. Intelligent Document Processing

4.1.1.2. Insurance Lead Management

4.1.1.3. Insurance Workflow Automation

4.1.1.4. Policy Management

4.1.1.5. Video KYC/ eKYC

4.1.1.6. API & Microservices

4.1.1.7. Others

4.1.2. Services

4.1.2.1. Professional Services

4.1.2.2. Managed Services

4.2. Global Insurance Platform Market by Application

4.2.1. Claim Management

4.2.2. Underwriting & Rating

4.2.3. Customer Relationship Management (CRM)

4.2.4. Billing & Payments

4.2.5. Compliance & Reporting

4.2.6. Policy Administration, Collection & Disbursement

4.2.7. Sales & Marketing

4.2.8. Property Estimation

4.2.9. Others (Predictive Modeling/ Extreme Event Forecasting)

4.3. Global Insurance Platform Market by Insurance Type

4.3.1. General Insurance

4.3.2. Life Insurance

4.3.3. Cybersecurity Insurance

4.3.4. Others (Health Insurance, Automotive Insurance)

4.4. Global Insurance Platform Market by Technology

4.4.1. Artificial Intelligence (AI) & Machine Learning (ML)

4.4.2. Internet-of-Things (IoT)

4.4.3. Blockchain

4.4.4. Data Analytics & Big Data

4.4.5. Regulatory Technologies (Regtech)

4.4.6. Others

4.5. Global Insurance Platform Market by End-User

4.5.1. Insurance Companies

4.5.2. Insurance Agencies & Brokers

4.5.3. Third-Party Administrators (TPAs)

4.5.4. Actuators & Reinsurers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Acko Technology and Service Pvt. Ltd.

6.2. BOLT Solutions

6.3. Clearcover, Inc.

6.4. Corvus Insurance Holdings Inc./ Corvus Insurance Agency, LLC

6.5. Coverfox

6.6. GoHealth, LLC

6.7. INSUREDHQ

6.8. Inzura Ltd.

6.9. Lemonade Insurance Co.

6.10. Metromile (Lemonade, Inc.)

6.11. Next Insurance, Inc. (Delaware Corp.)

6.12. Policygenius LLC

6.13. SAP SE

6.14. Shift Technology

6.15. Zipari, Inc.

1. GLOBAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

2. GLOBAL INSURANCE PLATFORM SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INSURANCE PLATFORM SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL INSURANCE PLATFORM FOR CLAIMS MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL INSURANCE PLATFORM FOR UNDERWRITING & RATING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INSURANCE PLATFORM FOR CRM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL INSURANCE PLATFORM FOR BILLING & PAYMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INSURANCE PLATFORM FOR COMPLIANCE & REPORTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INSURANCE PLATFORM FOR POLICY ADMINISTRATION, COLLECTION & DISBURSEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL INSURANCE PLATFORM FOR SALES & MARKETING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INSURANCE PLATFORM FOR PROPERTY ESTIMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL INSURANCE PLATFORM FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2023-2031 ($ MILLION)

15. GLOBAL GENERAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL LIFE INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CYBERSECURITY INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL OTHER INSURANCE PLATFORM TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

20. GLOBAL AI & ML-BASED INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL IOT-BASED INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL BLOCKCHAIN-BASED INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL DATA ANALYTICS & BIG DATA-BASED INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. GLOBAL REGTECH-BASED INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. GLOBAL OTHER TECHNOLOGY-BASED INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. GLOBAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. GLOBAL INSURANCE PLATFORM FOR INSURANCE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. GLOBAL INSURANCE PLATFORM FOR INSURANCE AGENCIES & BROKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. GLOBAL INSURANCE PLATFORM FOR TPAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. GLOBAL INSURANCE PLATFORM FOR ACTUATORS & REINSURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. GLOBAL INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. NORTH AMERICAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. NORTH AMERICAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

34. NORTH AMERICAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

35. NORTH AMERICAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2023-2031 ($ MILLION)

36. NORTH AMERICAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

37. NORTH AMERICAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

38. EUROPEAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

39. EUROPEAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

40. EUROPEAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

41. EUROPEAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2023-2031 ($ MILLION)

42. EUROPEAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

43. EUROPEAN INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

44. ASIA-PACIFIC INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

45. ASIA-PACIFIC INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

46. ASIA-PACIFIC INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

47. ASIA-PACIFIC INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2023-2031 ($ MILLION)

48. ASIA-PACIFIC INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

49. ASIA-PACIFIC INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

50. REST OF THE WORLD INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

51. REST OF THE WORLD INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

52. REST OF THE WORLD INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

53. REST OF THE WORLD INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2023-2031 ($ MILLION)

54. REST OF THE WORLD INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

55. REST OF THE WORLD INSURANCE PLATFORM MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL INSURANCE PLATFORM MARKET SHARE BY OFFERING, 2023 VS 2031 (%)

2. GLOBAL INSURANCE PLATFORM SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INSURANCE PLATFORM SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INSURANCE PLATFORM MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL INSURANCE PLATFORM FOR CLAIMS MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL INSURANCE PLATFORM FOR UNDERWRITING & RATING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INSURANCE PLATFORM FOR CRM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL INSURANCE PLATFORM FOR BILLING & PAYMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INSURANCE PLATFORM FOR COMPLIANCE & REPORTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL INSURANCE PLATFORM FOR POLICY ADMINISTRATION, COLLECTION & DISBURSEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL INSURANCE PLATFORM FOR SALES & MARKETING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INSURANCE PLATFORM FOR PROPERTY ESTIMATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL INSURANCE PLATFORM FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL INSURANCE PLATFORM MARKET SHARE BY INSURANCE TYPE, 2023 VS 2031 (%)

15. GLOBAL GENERAL INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL LIFE INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CYBERSECURITY INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL OTHER INSURANCE PLATFORM TYPES MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL INSURANCE PLATFORM MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

20. GLOBAL AI & ML-BASED INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL IOT-BASED INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL BLOCKCHAIN-BASED INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL DATA ANALYTICS & BIG DATA-BASED INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL REGTECH-BASED INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL OTHER TECHNOLOGY-BASED INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

26. GLOBAL INSURANCE PLATFORM MARKET SHARE BY END-USER, 2023 VS 2031 (%)

27. GLOBAL INSURANCE PLATFORM FOR INSURANCE COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

28. GLOBAL INSURANCE PLATFORM FOR INSURANCE AGENCIES & BROKERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

29. GLOBAL INSURANCE PLATFORM FOR TPAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

30. GLOBAL INSURANCE PLATFORM FOR ACTUATORS & REINSURERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

31. GLOBAL INSURANCE PLATFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

32. US INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

33. CANADA INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

34. UK INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

35. FRANCE INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

36. GERMANY INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

37. ITALY INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

38. SPAIN INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

39. REST OF EUROPE INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

40. INDIA INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

41. CHINA INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

42. JAPAN INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

43. SOUTH KOREA INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

44. REST OF ASIA-PACIFIC INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

45. LATIN AMERICA INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)

46. THE MIDDLE EAST AND AFRICA INSURANCE PLATFORM MARKET SIZE, 2023-2031 ($ MILLION)