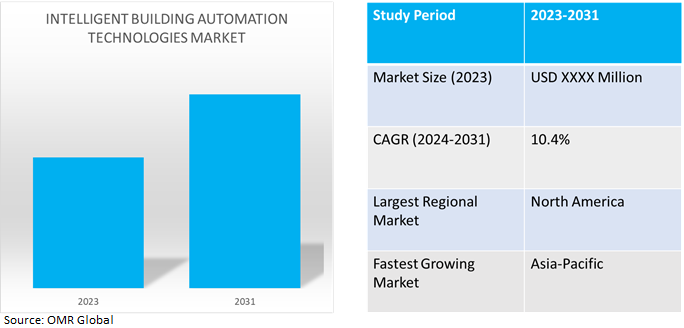

Intelligent Building Automation Technologies Market

Intelligent Building Automation Technologies Market Size, Share & Trends Analysis Report by Component (Hardware, Software, and Service), by Product (Security Systems, Life Safety Systems, Facility Management Systems, and Building Energy Management Systems), and by Application (Residential, Commercial and Industrial) Forecast Period (2024-2031)

Intelligent building automation technologies market is anticipated to grow at a significant CAGR of 10.4% during the forecast period (2024-2031). The market growth is attributed to the growing demand for building automation systems (BAS) that balance maximum efficiency with productivity and occupant comfort by combining energy, lighting, safety, and security into a single, user-friendly system. The increasing application of building automation technologies provides access, control, and monitor all connected building systems from a single interface. Building automation systems are installed in buildings and are in charge of lighting, shading, life safety, alarm security systems, heating, cooling, ventilation, air conditioning, and many more building services.

Market Dynamics

Growing Demand for Cloud-Based Solutions

The increasing adoption of cloud-based solutions in building automation systems can be accessed remotely via cloud computing, which facilitates facility managers' ability to oversee and manage building operations from any location. In addition, cloud-based systems have the advantage of scalability, making it possible to handle numerous sites or buildings effectively. With the help of cloud-based technologies, connected buildings can now have that solution. Data from building systems and equipment can be assembled to present unified, normalized information that can be tailored to the demands of the user. Information that originates from outside a facility, like utility bills, and information that impacts a facility's operations, such as weather forecasts or energy pricing, can be combined and evaluated with data from BAS sensors, smart equipment, chiller plants, and meters.

Increasing Connectivity of Building Automation Systems (BAS)

The integration of 5G connectivity, edge computing, and advanced analytics enhances the capabilities of BAS, creating more responsive and intelligent building environments. With more efficient integration techniques, new applications have emerged such as advanced energy management and intelligent fire and evacuation control. The modern building aims to maximize energy use while enhancing occupant comfort. Building automation systems (BAS) that are made to handle the intricate requirements of intelligent buildings grow increasingly vital as the idea of smart buildings becomes more widely accepted globally. To increase productivity and identify weaknesses in a linked system of equipment, building automation systems (BAS) are being utilized more and more as a single-pane-of-glass user interface for command and control of various building functions.

Market Segmentation

Our in-depth analysis of the global intelligent building automation technologies market includes the following segments by component, product, and application.

- Based on components, the market is sub-segmented into hardware, software, and service.

- Based on product, the market is sub-segmented into security systems, life safety systems, facility management systems, and building energy management systems.

- Based on application, the market is sub-segmented into residential, commercial, and industrial.

Hardware is projected to Emerge as the Largest Segment

Based on the components, the global intelligent building automation technologies market is sub-segmented into hardware, software, and service. Among these hardware sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes increased demand for hardware equipment including actuators, controllers, and sensors. All of these devices work together to ensure that the building climate stays within permissible bounds and that HVAC systems are appropriately maintained through automated control. For instance, in July 2022, SAUTER Group expanded its range with a new generation of IoT-capable actuators. The Smart Actuator enables autonomous or semi-autonomous control in heating, ventilation, and air conditioning. The new Smart Actuator from SAUTER simplifies the planning, installation, and operation of HVAC systems in new or modernized buildings.

Commercial Sub-segment to Hold a Considerable Market Share

Based on application, the global intelligent building automation technologies market is sub-segmented into residential, commercial, and industrial. Among these, the commercial sub-segment is expected to hold a considerable share of the market. The segmental growth is attributed to the increasing demand for automation technologies in industrial zones, office parks, shopping malls, airports, and seaports, intelligent building automation technology significantly lowers the cost of energy, maintenance, and space management. For instance, Infineon Technologies AG offers connected smart buildings with Infineon’s broad portfolio of solutions in commercial applications. To defend smart buildings against online intrusion with hardware-embedded IoT security, Infineon’s OPTIGATM portfolio offers end-to-end protection for cloud-connected smart buildings and IoT devices with hardware solutions.

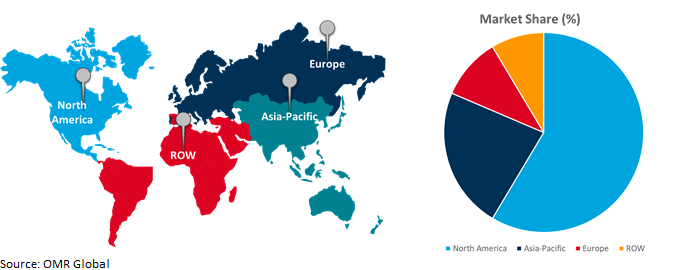

Regional Outlook

The global intelligent building automation technologies market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Intelligent Building Automation Technologies in Asia-Pacific

- In emerging countries like China and India, the use of intelligent building automation technologies is rapidly utilized for connectivity, power consumption, data integrity, and resilience to interference.

- Governments in countries such as India, South Korea, and China are investing in developing smart cities. According to the National Investment Promotion and Facilitation Agency, under the smart city mission, the Government of India invested $26.4 billion.

Global Intelligent Building Automation Technologies Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and intelligent building automation technologies providers in the region. The growth is mainly attributed to the growing adoption of innovative solutions and advancements in intelligent building automation technologies using AI and ML contributing the regional growth. Automation and machine learning fuel a streamlined operation system featuring built-in cybersecurity and technology to deliver faster network speeds to boost the growth of the intelligent building automation technologies market. For instance, in January 2024, Honeywell International Inc. introduced advanced control for buildings, to automate building management and provide the foundation for a building's energy efficiency strategy, advance control combines the latest technologies with innovation and domain expertise.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global intelligent building automation technologies market include Cisco Systems, Inc., General Electric Company, Honeywell International Inc., Schneider Electric SE, and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2022, Bosch Building Technologies acquired building automation specialist Hoerburger AG. Bosch is expanding its portfolio of solutions to increase security, safety, comfort, and efficiency. A major focus of its activities is the efficient and sustainable operation of buildings. The solutions are used in numerous sectors, including in large industrial companies, healthcare facilities, and retail chains.

Recent Development

- In December 2023, Johnson Controls introduced smart buildings solutions equipped with advanced technologies like artificial intelligence, IoT, cloud, and cybersecurity to help enterprises create a future where buildings integrate with human and environmental ecosystems. Smart buildings offer a harmonized environment that prioritizes both well-being and sustainability, using technology to adapt and unlock potential, and support productivity.

- In June 2022, View, Inc. introduced a smart building cloud to deliver the platform and all software components to connect, manage, and optimize a portfolio of smart buildings with strong cybersecurity protection and maximum flexibility. The digital transformation of real estate promises healthier and more sustainable buildings, better experiences for occupants, and greater operational efficiencies for building owners.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global intelligent building automation technologies market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cisco Systems, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schneider Electric SE

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Intelligent Building Automation Technologies Market by Component

4.1.1. Hardware

4.1.2. Software

4.1.3. Service

4.2. Global Intelligent Building Automation Technologies Market by Product

4.2.1. Security Systems

4.2.2. Life Safety Systems

4.2.3. Facility Management Systems

4.2.4. Building Energy Management Systems

4.3. Global Intelligent Building Automation Technologies Market by Application

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. ABB Ltd.

6.2. Analog Devices, Inc.

6.3. Automated Logic Corp.

6.4. Axiomtek Co., Ltd.

6.5. Azbil Corp.

6.6. Bihl+Wiedemann GmbH

6.7. Buildings IOT

6.8. Delta Electronics, Inc.

6.9. Eaton Corp. plc

6.10. HMS Industrial Networks

6.11. Infineon Technologies AG

6.12. Ingersoll Rand Inc.

6.13. Johnson Controls

6.14. L&T Electrical & Automation

6.15. Nagarro

6.16. Rockwell Automation Inc.

6.17. Semtech Corp.

6.18. Texas Instruments Inc.

6.19. United Technologies Corp.

1. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

4. GLOBAL INTELLIGENT BUILDING AUTOMATION SECURITY SYSTEMS TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL INTELLIGENT BUILDING AUTOMATION LIFE SAFETY SYSTEMS TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL INTELLIGENT BUILDING AUTOMATION FACILITY MANAGEMENT SYSTEMS TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INTELLIGENT BUILDING AUTOMATION ENERGY MANAGEMENT SYSTEMS TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

15. NORTH AMERICAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

19. EUROPEAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY product, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

27. REST OF THE WORLD INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. REST OF THE WORLD INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

6. GLOBAL INTELLIGENT BUILDING AUTOMATION Security Systems TECHNOLOGIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INTELLIGENT BUILDING AUTOMATION LIFE SAFETY SYSTEMS TECHNOLOGIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL INTELLIGENT BUILDING AUTOMATION Facility Management Systems TECHNOLOGIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INTELLIGENT BUILDING AUTOMATION Energy Management Systems TECHNOLOGIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES FOR Residential MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES FOR Commercial MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES FOR Industrial MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

16. UK INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET SIZE, 2023-2031 ($ MILLION)