Joint Reconstruction Market

Global Joint Reconstruction Market Size, Share & Trends Analysis Report by Joint type (Knee, hip, shoulders, ankle, and others), and By Technique (Joint Replacement, Osteotomy, Arthroscopy, Resurfacing, and Arthrodesis) Forecast Period (2022-2028)

The global joint reconstruction market is anticipated to grow at a significant CAGR of 5.4% during the forecast period. The major driving factor for the growth of the joint reconstruction market is the increase in the number of joint replacement procedures due to the rising geriatric population. According to American Joint Replacement Surgical Registry (AJRSR), there were 1,897,050 hips and knee Arthroplasty procedures performed between 2012 and 2019. This rising number of joint replacement procedures is fueling the demand for joint reconstruction devices among end-users, which in turn, is propelling the growth of the overall joint reconstruction industry. Another factor contributing to the growth of the Joint reconstruction market is the growing elderly population, and sports-related injury in the youngster as well as adults leading to joint reconstruction or replacement surgeries. However, the high cost of implants and alternative options is a major factor hindering the growth of the joint reconstruction market.

Furthermore, the rising demand for minimally invasive procedures for the treatment of orthopedic conditions is further contributing to the growth of the market as it reduces surgical trauma, brings relief to patients, and shortens recovery time. Furthermore, the adoption of advanced technology has been observed for surgeries. The trend toward robotics and high-precision instrumentation and the constant development of minimally invasive surgeries facilitate surgeons to offer improved patient outcomes.

Impact of COVID-19 Pandemic on Global Joint Reconstruction Market

The global joint reconstruction market is hit by the outbreak of COVID-19 since December 2019. It has a sudden and dramatic impact on healthcare. The joint reconstruction market has declined especially in the first half of 2020 as a vast number of elective joint replacement procedures were postponed. The pandemic has had an impact on how people function and how different surgical procedures are performed. The number of joint reconstructions has significantly declined during the pandemic, due to the strict guidelines by the regulatory authorities to avoid all non-emergent surgeries. The outbreak of COVID-19 has disrupted the supply of raw materials and products across the globe. In March 2020, due to the nationwide lockdown, the Centers for Disease Control and Prevention and the American College of Surgeons recommended delaying non-urgent surgeries including joint replacement until the situation was better controlled. However, some companies such as Exactech continue to build instruments and implants to be ready when everything opens.

Segmental Outlook

The global joint reconstruction market is segmented based on basis of joint type, and technique. Based on the joint type, it is further classified into the knee, hip, shoulders, ankle, and others. Based on the technique, it is further classified into joint replacement, osteotomy, arthroscopy, resurfacing, and arthrodesis.

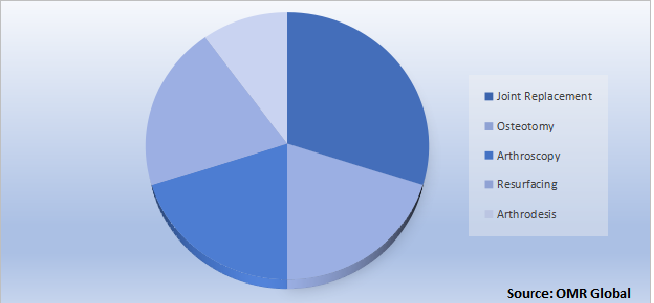

Global Joint Reconstruction Market Share by Technique, 2021 (%)

The Joint Replacement Technique Sub-Segment is Anticipated to Hold a Prominent Share in the Global Joint Reconstruction Market

The joint replacement technique segment is anticipated to hold a prominent share in the market during the forecast period. The primary factor contributing to the growth of the market is the rising number of joint replacement surgeries across the globe. As mentioned earlier, there were 1,897,050 hips and knee Arthroplasty procedures performed between 2012 and 2019 according to American Joint Replacement Surgical Registry (AJRSR).

Regional Outlooks

The global joint reconstruction market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American joint reconstruction market is expected to cater to considerable growth during the forecast period owing to the increasing number of joint replacement surgeries, well-developed healthcare infrastructure, and the presence of major players, such as Stryker Corp., Zimmer Biomet Holdings, Inc., and Johnson & Johnson Services, Inc.

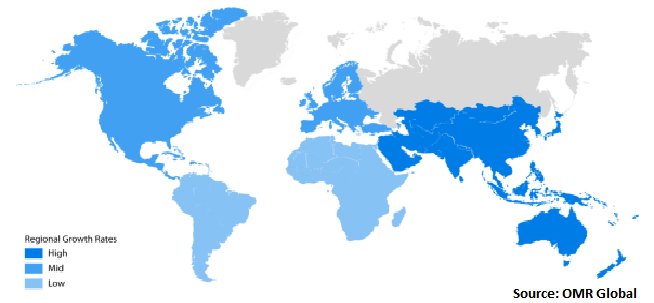

Global Joint Reconstruction Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold a Prominent Share in the Global Joint Reconstruction Market

The Asia-Pacific region is expected to hold a prominent share in the global defibrillators market. The significant presence of the geriatric population and rising incidences of orthopedic disorders coupled with rising joint replacement surgeries is primarily encouraging the market growth in the region as elderly people suffer more from joint pains and arthritis problems. With the advancement of age, bones become more prone to fractures and injuries that can lead to the replacement of joints in a particular area. Japan's market is expected to grow significantly due to the growing geriatric population in Japan, as 30.0% of the population is elderly inhabitants. In Addition, according to Aging Asia Organization, Thailand is ranked the third most rapidly aging population in the world. The number of people aged 60 and over is 13 million, which is 20.0% of the population.

Market Players Outlook

The major companies serving the global joint reconstruction market include Stryker Corp., Zimmer Biomet Holdings, Inc., Medtronic PLC, Ortho Development Corp., and ABS Corp, among others. These companies adopt various strategies such as partnerships, collaborations, finding a new market, and product innovations in their core competency to stay competitive in the market. For an instance, in January 2021, DJO a subsidiary of Colfax Corporation acquired Trilliant Surgical, which is a national provider of foot and ankle implants. Through this acquisition, Trilliant's portfolio complements DJO’s STAR system creating a dedicated foot and ankle business.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global joint reconstruction market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Joint Reconstruction Industry

- Recovery Scenario of Global Joint Reconstruction Industry

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Overview

3.1.2.Financial Analysis

3.1.3.SWOT Analysis

3.1.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Determinants

4.1.Motivators

4.2.Restraints

4.3.Opportunities

5.Market Segmentation

5.1.Global Joint Reconstruction Market by Joint Type

5.1.1.Knee

5.1.2.Hip

5.1.3.Shoulders

5.1.4.Ankle

5.1.5.Others

5.2.Global Joint Reconstruction Market by Technique

5.2.1.Joint Replacement

5.2.2.Osteotomy

5.2.3.Arthroscopy

5.2.4.Resurfacing

5.2.5.Arthrodesis

6. Regional Analysis

6.1.North America

6.1.1.United States

6.1.2.Canada

6.2.Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3.Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4.Rest of the World

7.Company Profiles

7.1.ABS Corp.

7.2.Acumed, LLC (A Colson Company)

7.3.Arthrex Inc.

7.4.B. Braun Melsungen AG

7.5.Conformis, Inc.

7.6.ConMed Corp.

7.7.DJO Global, Inc.

7.8.Exactech, Inc.

7.9.Integra LifeSciences Corp.

7.10.Johnson & Johnson Services, Inc.

7.11.Microport Orthopedics Inc.

7.12.Ortho Development Corp.

7.13.Skeletal Dynamics, LLC

7.14.Smith & Nephew PLC

7.15.Globus Medical Corning

7.16.Stryker Corp.

7.17.Wright Medical Group N.V.

7.18.Zimmer Biomet Holdings,

7.19Aesculap Implant Systems, LLC

1.GLOBAL JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS, 2021-2028 ($ MILLION)

2. GLOBAL JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY JOINT TYPE, 2021-2028 ($ MILLION)

3.GLOBAL KNEE JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL HIP JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL SHOULDER JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.GLOBAL ANKLE JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL OTHER JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2021-2028 ($ MILLION)

9.GLOBAL JOINT REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.GLOBAL OSTEOTOMY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.GLOBAL ARTHROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12.GLOBAL RESURFACING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13.GLOBAL ARTHRODESIS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14.GLOBAL JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15.NORTH AMERICAN JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16.NORTH AMERICAN JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY JOINT TYPE, 2021-2028 ($ MILLION)

17.NORTH AMERICAN JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2021-2028 ($ MILLION)

18.EUROPEAN JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19.EUROPEAN JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY JOINT TYPE, 2021-2028 ($ MILLION)

20.EUROPEAN JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2021-2028 ($ MILLION)

21.ASIA-PACIFIC JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22.ASIA-PACIFIC JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY JOINT TYPE, 2021-2028 ($ MILLION)

23.ASIA-PACIFIC JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2021-2028 ($ MILLION)

24.REST OF THE WORLD JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY JOINT TYPE, 2021-2028 ($ MILLION)

25.REST OF THE WORLD JOINT RECONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL JOINT RECONSTRUCTION MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL JOINT RECONSTRUCTION MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL JOINT RECONSTRUCTION MARKET, 2022-2028(%)

4.GLOBAL JOINT RECONSTRUCTION MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

GLOBAL KNEE JOINT RECONSTRUCTION MARKET SHARE BY REGION, 2020 VS 2027(%)

6.GLOBAL HIP JOINT RECONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

7.GLOBAL SHOULDER JOINT RECONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

8.GLOBAL ANKLE JOINT RECONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

9.GLOBAL OTHERS JOINT RECONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

10.GLOBAL JOINT RECONSTRUCTION MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

GLOBAL JOINT REPLACEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

12.GLOBAL OSTEOTOMY MARKET SHARE BY REGION, 2021 VS 2028 (%)

13.GLOBAL ARTHROSCOPY MARKET SHARE BY REGION, 2021 VS 2028 (%)

14.GLOBAL RESURFACING MARKET SHARE BY REGION, 2021 VS 2028 (%)

15.GLOBAL ARTHRODESIS MARKET SHARE BY REGION, 2021 VS 2028 (%)

16.GLOBAL JOINT RECONSTRUCTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

US JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

18.CANADA RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

19.UK JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

20.FRANCE JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

21.GERMANY JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

22.ITALY JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

23.SPAIN JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

24.REST OF EUROPE JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

25.INDIA JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

26.CHINA JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

27.JAPAN JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

28.SOUTH KOREA JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

29.REST OF ASIA-PACIFIC JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)

30.REST OF THE WORLD JOINT RECONSTRUCTION MARKET SIZE, 2021-2028 ($ MILLION)