LiDAR Drones Market

LiDAR Drones Market Size, Share & Trends Analysis Report by Drone Type (Fixed Wing and Rotary Wing), by Range (Short, Medium, and Long), and by Application (Corridor Mapping, Archaeology, Construction, Entertainment, Defense, Precision Agriculture and Others) Forecast Period (2025-2035)

Industry Overview

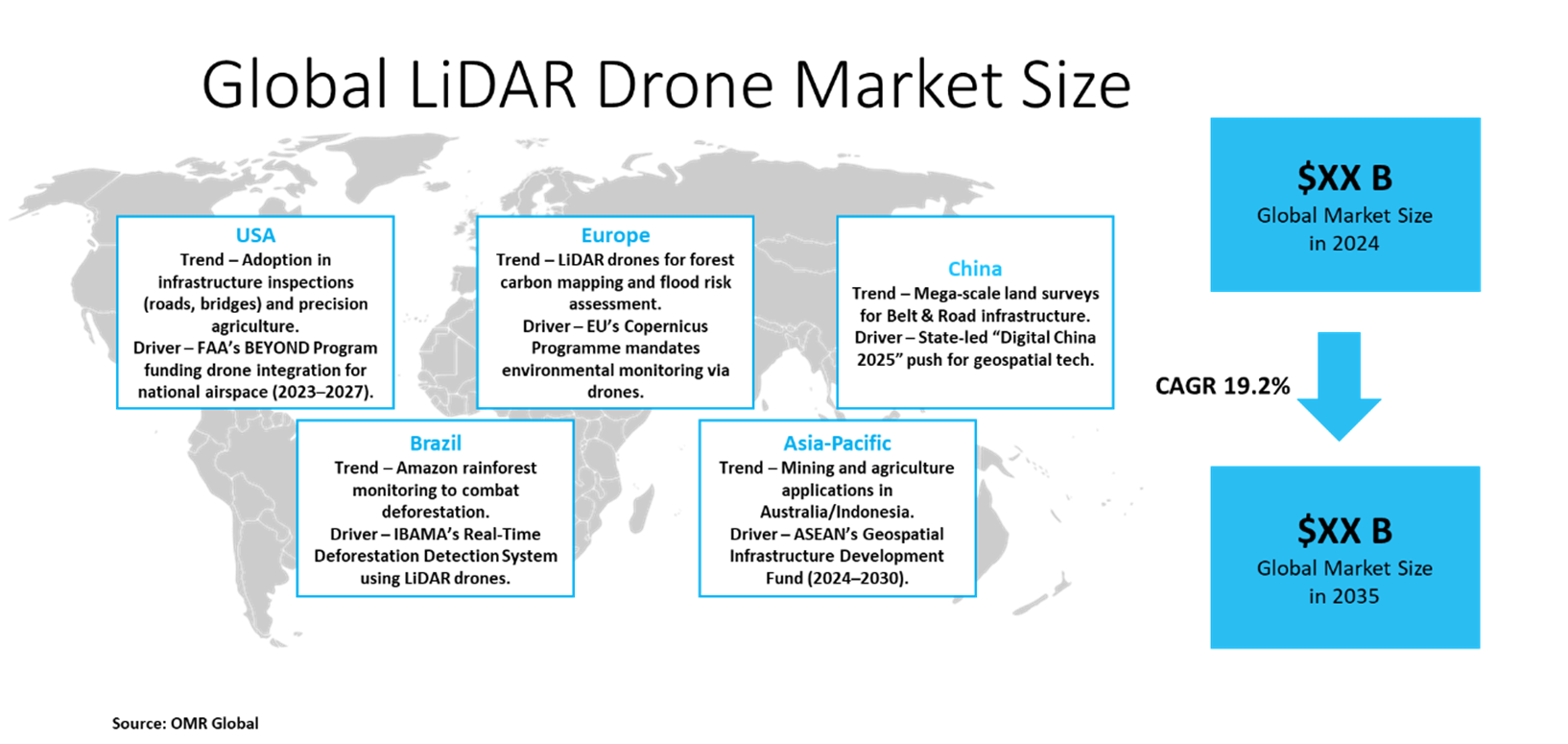

LiDAR drone market is projected to grow at a CAGR of 19.2% during the forecast period (2025–2035). LiDAR is useful in a range of environments and spaces as it can capture data that may be difficult for other methods of scanning, such as areas with dense vegetation. Light Detection and Ranging (LiDAR) sensors use light energy, emitted from a laser, to scan the ground and measure variable distances. The growing adoption of LiDAR drones’ bathymetric equipment, with the improving high-precision Lidar equipment, is the key factor supporting the growth of the market globally. The key advantage of the new LiDAR drone bathymetric equipment is to capture a riverbed with centimeter-level accuracy, at high speed in fully automatic mode, and without using any boat. It allows us to work in hard-to-access and shallow water areas. Hence, the market players are also focusing on introducing LiDAR drone-based solutions that further bolster the market growth.

Market Dynamics

Technological Advancements Expanding Application Possibilities

The integration of IoT and AI in Lidar Drone, such as real-time monitoring, enhanced sensor capabilities, and improved battery life, is driving the development of more efficient and accurate LIDAR drones. Furthermore, modern LiDAR drones can now collect up to one million data points per second, compared to early systems that captured only 5,000 points per second. This technological advancement has created new use cases and improved the actionable intelligence derived from collected data, driving further market expansion across both established and emerging application segments. For instance, RIEGL USA Offers VUX-240 which makes use of RIEGL's unique Waveform-LiDAR technology, allowing echo digitization and online waveform processing.

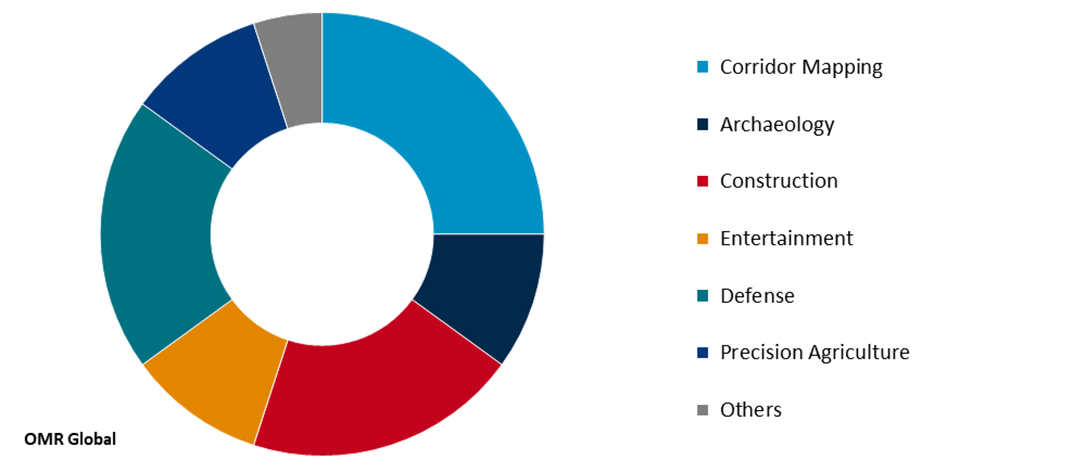

LiDAR Drone Market Share by Applications 2024

Rising Demand for LiDAR Drone across Diverse Industries

Simultaneously, rising demand for the use of LIDAR drones for corridor mapping, construction site monitoring, defense and security sectors, and precision agriculture is boosting the demand for LiDAR drones in these sectors. In the construction sector, LiDAR drones provide comprehensive site surveys, progress monitoring, and volumetric calculations that significantly improve project efficiency In the agricultural sector, LiDAR drones enable precision agriculture such as LiDAR drones for crop monitoring, yield optimization, and resource management, enabling data-driven farming practices that maximize productivity while minimizing environmental impact. Additionally, in the defense and security sectors, the demand for LiDAR drones continues to grow for applications including terrain mapping, surveillance, and tactical planning. Similarly, utility companies are deploying LiDAR drones for infrastructure inspection and maintenance planning, dramatically reducing costs and improving safety compared to traditional manual inspection methods.

Market Segmentation

- Based on the drone type, the market is segmented into fixed-wing and rotary-wing.

- Based on the range, the market is segmented into (short, medium, and long).

- Based on the application, the market is segmented into (corridor mapping, archaeology, construction, entertainment, defense, precision agriculture, and others).

Short Range is Anticipated to Hold a Considerable Share of the Global LiDAR Drones Market

Among the range, the short sub-segment is expected to hold a considerable share of the global LiDAR drone market. The segmental growth is attributed to the growing influence of the LiDAR drone system that operates in a raster scan mode for surveillance missions and a side-to-side line scan mode for area mapping. The intuitive command and control, and high-brightness display integrated into the ground control station (GCS) allow operators to monitor and optimize data collection missions, an offering that is unique in the global market of small UAV LiDAR systems. Moreover, Short-range LiDAR drones, typically operating within 500 meters, serve applications requiring detailed scanning of confined areas, including construction site monitoring, archaeological excavations, and structural inspections. The medium-range segment, covering operations between 500 meters and 2 kilometers, represents the largest market share, balancing operational range with data density for applications such as industrial facility mapping and urban planning. Additionally, Long-range LiDAR drones, operating beyond 2 kilometers, are used in specialized applications such as extensive corridor mapping, forest inventory assessment, and large-scale topographical surveys. This segment is experiencing significant growth due to technological advancements improving battery life, sensor capabilities, and autonomous navigation systems.

Regional Outlook

The global LiDAR drones market is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The North American Region is Expected to Grow at a Significant CAGR in the Global LiDAR Drones Market

Among all regions, the North America region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to growing demands in varying industries, from mining to agriculture and construction to forestry. The prevalence of high military budgets coupled with rising investment in technological innovations in the defense sector are the major factors attributable to the growth of the LIDAR drone market in this region. According to the Foundation for Defense and Democracies the global (FDD) in December 2024, the global LiDAR market is projected to exceed $2.8 billion in the upcoming year, driven by demand for high-resolution mapping, autonomous systems, and automation technologies. Moreover, North America accounted for 36.6 percent of LiDAR-related revenue in 2021, the highest percentage in the world. Additionally, according to the Federal Aviation Administration (FAA) in 2023, drones by the numbers, 863,728 drones registered, 352,222 commercial drones registered, and 506,635 recreational drones registered in the US. Furthermore, LiDAR sensor technology has been advancing, with improved accuracy, range, and point cloud density, enabling more precise mapping and data collection. This has significantly contributed to the adoption of LiDAR drone technology and its applications, such as drones.

Asia-Pacific Shows Highest Growth Rate

The Asia-Pacific region, particularly emerging countries such as China and India, represents the fastest-growing regional market. This growth is driven by rapid industrialization, infrastructure development programs, and increasing technology adoption across multiple sectors. China's ambitious infrastructure initiatives, including smart city development and transportation network expansion, create substantial demand for LiDAR drone technology. As per the Observer Research Foundation (ORF) until 2018, the global LiDAR market was largely dominated by US-based companies. However, since 2018, Chinese technology firms such as Hesai, Robosense, Seyond, and Livox have been rapidly expanding their global presence. This growth has been strongly supported by China's strategic industrial policies, including government subsidies and favorable tariffs, aligned with the broader civil-military integration framework. Notably, Hesai has emerged as a key market leader, accounting for approximately 47% of the global LiDAR market share by sales revenue, reflecting the rising influence of Chinese players in the international LiDAR ecosystem.

Market Players Outlook

The major companies operating in the global LiDAR Drones market include Leica Geosystems AG - Part of Hexagon, Ouster Inc., SZ DJI Technology Co., Ltd., and Teledyne FLIR LLC, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In February 2025, GeoCue, a leader in LiDAR acquisition and data processing solutions, announced a strategic partnership with Clogworks Technologies Limited. This partnership brings together GeoCue’s TrueView LiDAR and LP360 software solutions with Clogworks’ best-in-class Dark Matter range of multi-rotor UAVs, delivering a unique and highly efficient mapping and surveying solution to professionals around the world.

- In April 2024, Inertial Labs announced a collaboration with Sony to develop a LiDAR system specifically for Sony’s Airpeak drone. This innovative venture revolutionizes drone capabilities in various applications, including surveying, mapping, and cinematic videography.

- In February 2024, Quantum-Systems GmbH introduced the latest LiDAR solution—the Qube 640—developed in collaboration with YellowScan. Specifically designed for the Trinity Pro eVTOL fixed-wing drone, the Qube 640 offers high-precision scanning in a compact and lightweight form, enabling cost-efficient operations without compromising data accuracy.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global LiDAR drones market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Lidar Drones Market Sales Analysis – Drone Type | Range | Application ($ Million)

• Lidar Drones Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Lidar Drones Market Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Lidar Drones Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Lidar Drones Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Lidar Drones Market Revenue and Share by Manufacturers

• Lidar Drones Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Leica Geosystems AG - Part of Hexagon

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. SZ DJI Technology Co., Ltd.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Teledyne FLIR LLC

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Lidar Drones Market Sales Analysis By Drone Type($ Million)

5.1. Fixed Wing

5.2. Rotary Wing

6. Global Lidar Drones Market Sales Analysis By Range($ Million)

6.1. Short

6.2. Medium

6.3. Long

7. Global Lidar Drones Market Sales Analysis By Application ($ Million)

7.1. Corridor Mapping

7.2. Archaeology

7.3. Construction

7.4. Entertainment

7.5. Defense

7.6. Precision Agriculture

7.7. Others

8. Regional Analysis

8.1. North American Lidar Drones Market Sales Analysis – Drone Type | Range | Application ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Lidar Drones Market Sales Analysis – Drone Type | Range | Application ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Lidar Drones Market Sales Analysis – Drone Type | Range | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Lidar Drones Market Sales Analysis – Drone Type | Range | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Chengdu JOUAV Automation Tech Co., Ltd

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. DELAIR SAS

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Draganfly Innovations Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Flyability SA

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. GreenValley International Inc

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Harris Aerial

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Hoverfly Technologies

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Inertial Labs, Inc.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. LiDARUSA

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Leica Geosystems AG - Part of Hexagon

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Microdrones (mdGroup Germany GmbH)

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Ouster Inc.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Phoenix LiDAR Systems.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Quantum-Systems GmbH

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Quanergy Solutions, Inc.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Skyfront

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. SZ DJI Technology Co., Ltd.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Teledyne FLIR LLC

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Wingtra AG

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. YELLOWSCAN

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

1. Global Lidar Drones Market Research And Analysis By Drone Type, 2024-2035 ($ Million)

2. Global Fixed Wing Lidar Drones Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Rotary Wing Lidar Drones Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Lidar Drones Market Research And Analysis By Range, 2024-2035 ($ Million)

5. Global Short-Range Lidar Drones Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Medium Range Lidar Drones Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Long Range Lidar Drones Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Lidar Drones Market Research And Analysis By Application, 2024-2035 ($ Million)

9. Global Lidar Drones For Corridor Mapping Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Lidar Drones For Archaeology Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Lidar Drones For Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Lidar Drones For Entertainment Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Lidar Drones For Defence Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Lidar Drones For Precision Agriculture Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Lidar Drones For Others Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Lidar Drones Market Research And Analysis By Region, 2024-2035 ($ Million)

17. North American Lidar Drones Market Research And Analysis By Country, 2024-2035 ($ Million)

18. North American Lidar Drones Market Research And Analysis By Drone Type, 2024-2035 ($ Million)

19. North American Lidar Drones Market Research And Analysis By Range, 2024-2035 ($ Million)

20. North American Lidar Drones Market Research And Analysis By Application, 2024-2035 ($ Million)

21. European Lidar Drones Market Research And Analysis By Country, 2024-2035 ($ Million)

22. European Lidar Drones Market Research And Analysis By Drone Type, 2024-2035 ($ Million)

23. European Lidar Drones Market Research And Analysis By Range, 2024-2035 ($ Million)

24. European Lidar Drones Market Research And Analysis By Application, 2024-2035 ($ Million)

25. Asia-Pacific Lidar Drones Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Asia-Pacific Lidar Drones Market Research And Analysis By Drone Type, 2024-2035 ($ Million)

27. Asia-Pacific Lidar Drones Market Research And Analysis By Range, 2024-2035 ($ Million)

28. Asia-Pacific Lidar Drones Market Research And Analysis By Application, 2024-2035 ($ Million)

29. Rest Of The World Lidar Drones Market Research And Analysis By Drone Type, 2024-2035 ($ Million)

30. Rest Of The World Lidar Drones Market Research And Analysis By Range, 2024-2035 ($ Million)

31. Rest Of The World Lidar Drones Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Lidar Drones Market Share By Drone Type, 2024 Vs 2035 (%)

2. Global Fixed Wing Lidar Drones Market Share By Region, 2024 Vs 2035 (%)

3. Global Rotary Wing Lidar Drones Market Share By Region, 2024 Vs 2035 (%)

4. Global Lidar Drones Market Share By Range, 2024 Vs 2035 (%)

5. Global Short Range Lidar Drones Market Share By Region, 2024 Vs 2035 (%)

6. Global Medium Range Lidar Drones Market Share By Region, 2024 Vs 2035 (%)

7. Global Long Range Lidar Drones Market Share By Region, 2024 Vs 2035 (%)

8. Global Lidar Drones Market Share By Application, 2024 Vs 2035 (%)

9. Global Lidar Drones For Corridor Mapping Market Share By Region, 2024 Vs 2035 (%)

10. Global Lidar Drones For Archaeology Market Share By Region, 2024 Vs 2035 (%)

11. Global Lidar Drones For Construction Market Share By Region, 2024 Vs 2035 (%)

12. Global Lidar Drones For Entertainment Market Share By Region, 2024 Vs 2035 (%)

13. Global Lidar Drones For Defence Market Share By Region, 2024 Vs 2035 (%)

14. Global Lidar Drones For Precision Agriculture Market Share By Region, 2024 Vs 2035 (%)

15. Global Lidar Drones For Others Market Share By Region, 2024 Vs 2035 (%)

16. Global Lidar Drones Market Share By Region, 2024 Vs 2035 (%)

17. US Lidar Drones Market Size, 2024-2035 ($ Million)

18. Canada Lidar Drones Market Size, 2024-2035 ($ Million)

19. UK Lidar Drones Market Size, 2024-2035 ($ Million)

20. France Lidar Drones Market Size, 2024-2035 ($ Million)

21. Germany Lidar Drones Market Size, 2024-2035 ($ Million)

22. Italy Lidar Drones Market Size, 2024-2035 ($ Million)

23. Spain Lidar Drones Market Size, 2024-2035 ($ Million)

24. Rest Of Europe Lidar Drones Market Size, 2024-2035 ($ Million)

25. India Lidar Drones Market Size, 2024-2035 ($ Million)

26. China Lidar Drones Market Size, 2024-2035 ($ Million)

27. Japan Lidar Drones Market Size, 2024-2035 ($ Million)

28. South Korea Lidar Drones Market Size, 2024-2035 ($ Million)

29. ASEAN Lidar Drones Market Size, 2024-2035 ($ Million)

30. Australia and New Zealand Lidar Drones Market Size, 2024-2035 ($ Million)

31. Rest Of Asia-Pacific Lidar Drones Market Size, 2024-2035 ($ Million)

32. Rest Of The World Lidar Drones Market Size, 2024-2035 ($ Million)

33. Latin America, Lidar Drones Market Size, 2024-2035 ($ Million)

34. Middle East and Africa Lidar Drones Market Size, 2024-2035 ($ Million)

FAQS

The size of the LiDAR Drones market in 2024 is estimated to be around USD 272.44 million.

Asia-Pacific holds the largest share in the LiDAR Drones market.

Leading players in the LiDAR Drones market include Leica Geosystems AG - Part of Hexagon, Ouster Inc., SZ DJI Technology Co., Ltd., and Teledyne FLIR LLC, among others.

LiDAR Drones market is expected to grow at a CAGR of 19.2% from 2025 to 2035.

Advancements in LiDAR and drone technologies, along with rising demand for precise mapping in construction, agriculture, and mining, are driving the LiDAR drones market growth.