Medical Cart Market

Medical Cart Market Size, Share & Trends Analysis Report by Technology (TaqMan Medical cart, Massarray Medical cart, SNP GeneChip Arrays, and Other Techniques), and by End-User (Pharmacogenomics and Diagnostic Field) Forecast Period (2023-2030)

Medical cart market is anticipated to grow at a significant CAGR of 16.5% during the forecast period. The rising prevalence of Musculoskeletal Injury (MSI) and the growing implementation of Electronic Medical Records (EMR) in hospitals are the major promoters of the global medical cart market growth. According to the World Health Organization (WHO), approximately 1.71 billion people have musculoskeletal conditions across the globe. Musculoskeletal conditions are the leading contributor to disability worldwide, with low back pain being the single leading cause of disability in 160 countries. Due to population growth and ageing, the number of people living with musculoskeletal conditions and associated functional limitations, is rapidly increasing. Thereby, the growing prevalence MSI diseases across the globe is driving the growth of the global medical cart market.

The usage of mobile carts is expanding due to constantly evolving technology that provides better layout, construction, alternatives, and features that fulfill the needs of consumers. For instance, in August 2021, Ergotron Introduces updated CareFit Pro Medical Cart to improve caregiver well-being and enhance quality of care. The CareFit Pro Medical Cart includes integrated, cloud-based software to simplify fleet management, improve uptime, and alleviate power anxiety. Additional key product benefits include efficient workflows, ergonomic working, promotes uptime, enhanced security, professional grade, and long-term investment.

Segmental Outlook

The global medical cart market is segmented based on product type. Based on product type, the market is segmented into anesthesia cart, emergency cart, procedure cart, and other. Emergency cart held major market share in 2022. This dominance is due to the presence of several emergency care units and the use of these carts in emergency rooms. These carts are equipped with medical devices, supplies, or drugs for emergencies such as ischemic stroke and severe injuries with profuse bleeding.

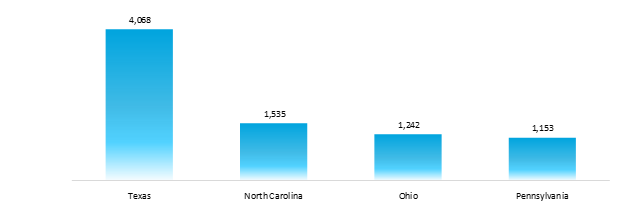

According to the Insurance Institute for Highway Safety (IIHS), there were 39,508 fatal motor vehicle crashes in the US in 2021 in which 42,939 mortalities occurred. This resulted in 12.9 mortalities per 100,000 people and 1.37 mortalities per 100 million miles traveled. The fatality rate per 100,000 people ranged from 5.7 in Rhode Island to 26.2 in Mississippi. This data shows a requirement for the readiness of the emergency department, where emergency carts play a vital role. Thus, the factors such as a rise in accident and trauma cases are expected to contribute to the growth of the emergency cart market during the forecast period.

Number of Road Accidents in the US by Region, 2021

Source: Insurance Institute for Highway Safety (IIHS)

Regional Outlook

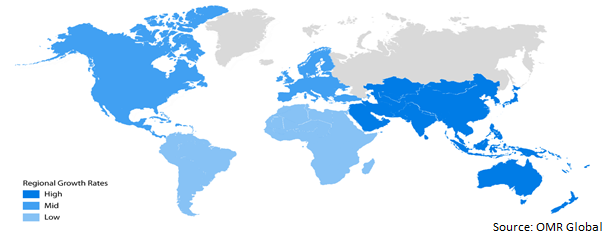

The global medical cart market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, Asia-Pacific is estimated to be the fastest-growing region owing to the rapidly developing healthcare infrastructure and growing disposable incomes in the region. Besides, favourable government policies, rising geriatric population, presence of key market players, and rise in the demand for surgical procedures are some of the major factors that contributed towards the fueling of regional market growth.

Global Medical Cart Market Growth by Region 2023-2030

The North America Region held Considerable Share in the Global Medical Cart Market

North America held a considerable share in the global medical cart market. In North America, the US held a major market share in the regional market. The significant investments by government and private players for the development of innovative medical devices, presence of key participants, and the existence of favorable reimbursement policies are the factors contributing to the regional market growth. According to the Centers for Disease Control and Prevention (CDC), in 2023, more than 1 in 7 US adults–about 35.5 million people, or 14.0%–are estimated to have chronic kidney diseases (CKD). Due to the rising incidence of chronic kidney diseases CKD, there is increasing demand for home dialysis. Presence of streamlined processes, such as hospital admissions and claiming reimbursements, in healthcare facilities along with availability of integrated healthcare IT products to maintain Electronic Health Records (EHRs) are some of the factors responsible for the regional market growth.

Market Players Outlook

The major companies serving the global medical cart market include Advantech Co Ltd., ITD GmbH, Capsa Healthcare, AFC Industries Inc., and Jaco Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical cart market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Advantech Co Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ITD GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. AFC Industries Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Creative Virtual Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Jaco Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medical Carts Market by Cart Type

4.1.1. Anesthesia Cart

4.1.2. Emergency Cart

4.1.3. Procedure Cart

4.1.4. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advantech Co. Ltd

6.2. AFC Industries Inc.

6.3. Auxo Investment Partners (Altus, Inc.)

6.4. Capsa Healthcare

6.5. Ergotron Inc.

6.6. Harloff Manufacturing Co.

6.7. ITD GmbH

6.8. Jaco Inc.

6.9. Joson-care Enterprise Co., Ltd

6.10. Joy Factory Inc.

6.11. Market Lab Inc.

6.12. Midmark Corp.

6.13. Midwest Products & Engineering

6.14. Omni Cell Inc.

6.15. Parity Medical

6.16. The Bergmann Group

6.17. Tianjin Xuhua Medical Equipment Factory

1. GLOBAL MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY CART TYPE,2022-2030 ($ MILLION)

2. GLOBAL ANESTHESIA CART MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL EMERGENCY CART MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL PROCEDURE CART MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL OTHER MEDICAL CART MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. NORTH AMERICAN MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

8. NORTH AMERICAN MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY CART TYPE, 2022-2030 ($ MILLION)

9. EUROPEAN MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. EUROPEAN MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY CART TYPE, 2022-2030 ($ MILLION)

11. ASIA-PACIFIC MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. ASIA-PACIFIC MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY CART TYPE, 2022-2030 ($ MILLION)

13. REST OF THE WORLD MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. REST OF THE WORLD MEDICAL CARTS MARKET RESEARCH AND ANALYSIS BY CART TYPE, 2022-2030 ($ MILLION)

1. GLOBAL MEDICAL CARTS MARKET SHARE BY CART TYPE, 2022 VS 2030(%)

2. GLOBAL ANESTHESIA CART MARKET SHARE BY REGION, 2022 VS 2030(%)

3. GLOBAL EMERGENCY CART MARKET SHARE BY REGION, 2022 VS 2030(%)

4. GLOBAL PROCEDURE CART MARKET SHARE BY REGION, 2022 VS 2030(%)

5. GLOBAL OTHER MEDICAL CART MARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBAL MEDICAL CARTS MARKET SHARE BY REGION, 2022 VS 2030(%)

7. US MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

8. CANADA MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

9. UK MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

10. FRANCE MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

11. GERMANY MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

12. ITALY MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

13. SPAIN MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

14. REST OF EUROPE MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

15. INDIA MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

16. CHINA MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

17. JAPAN MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

18. SOUTH KOREA MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

19. REST OF ASIA-PACIFIC MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF THE WORLD MEDICAL CARTS MARKET SIZE, 2022-2030 ($ MILLION)