Medical Electrodes Market

Global Medical Electrodes Market Size, Share & Trends Analysis Report by Usability (Disposable Medical Electrodes and Reusable Medical Electrodes), by Product Type (Microelectrodes, Needle Electrodes, and Body Surface Electrodes), by Modality Type (Electrocardiography (ECG), Electroencephalography (EEG), Electromyography (EMG), and Others), and by Application (Cardiology, Neurophysiology, Sleep Disorders, Muscle Disorders, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global medical electrodes market is growing at a significant CAGR of around 4.6% during the forecast period (2020-2026). Medical electrodes are rapidly becoming a vital component in every hospital facility, owing to the rising prevalence of CVD (cardiovascular disease)and neurological disorder across the globe. Heart diseases such as CVD, CHD (congenital heart disease), and stroke; among other heart diseases are the leading causes of mortalities across the globe. According to the American Health Association (AHA), in January 2018, around 103 million US adults were suffering from high blood pressure, which is nearly half of all adults in the US. This increases the monitoring and testing of CVD, which in turn, offers growth to the global medical electrodes market. However, there are certain stringent regulations and biocompatibility issues associated with medical electrodes, which in turn, will affect the market growth during the forecast period.

Segmental Outlook

The medical electrodes market is classified on the basis of usability, product type, modality type, and application. Based on usability, the market is bifurcated into disposable medical electrodes and reusable medical electrodes. Based on product type, the market is segmented into microelectrodes, needle electrodes, and body surface electrodes. Based on modality type, the market is segmented into electrocardiography (ECG), electroencephalography (EEG), electromyography (EMG), and others. Based on application, the market is segregated into cardiology, neurophysiology, sleep disorders, muscle disorders, and others.

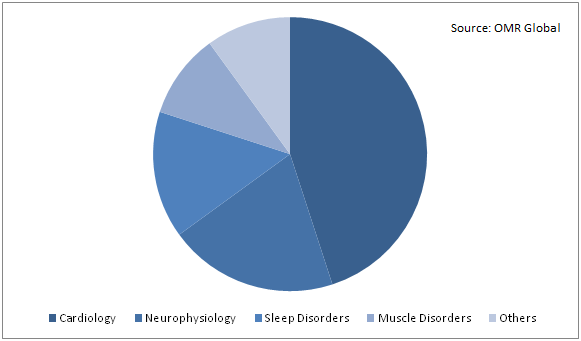

Global Medical Electrodes Market Share by Application, 2019 (%)

Medical electrodes have major application in cardiology monitoring

The cardiology application segment contributes a major share in the medical electrodes market and is expected to contribute significantly, by exhibiting a fastest CAGR, during the forecast period. This growth is attributed to the rising geriatric population and prevalence of CVD across the globe. According to WHO, around 17.9 million fatalities occur each year due to heart diseases, which is estimated to be around 31.0% of the global fatalities. Amongst these fatalities, around 7.4 million had CHD and approx. 6.7 million fatalities occurred due to a stroke. By 2030, it has been projected that CVDs will be responsible for around 23.6 million mortalities across the globe. Around 80.0% of the deaths caused due to CVD take place in low-middle income group regions, such as Africa, Latin America, and Asia-Pacific. Such predictions of high prevalence and growth of CVD across the globe will certainly drive the CVD diagnostic market across the globe. This, in turn, will drive the global medical electrodes market for the monitoring and testing of CVD.

Regional Outlook

The global medical electrodes market is classified on the basis of geography,which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global medical electrodes market. The US plays the critical role in geographic contribution of North America in global medical electrodes market. The major factors associated with the dominance of the US in medical electrodes market includes its well-developed healthcare infrastructure, which certainly leads to the adoption od advanced technological solutions in healthcare industry. In addition, the country has a significant diagnostic rate for diseases associated with CVD and neurological disorders, owing to the significant prevalence of these diseases in the region. According to American Heart Association, stroke is the fifth leading cause of death, around 129,000 mortalities every year in the US. Such statistics indicates the significant prevalence of CVD and neurological disorders in the US, which in turn, is offering growth to the medical electrodes market in the region.

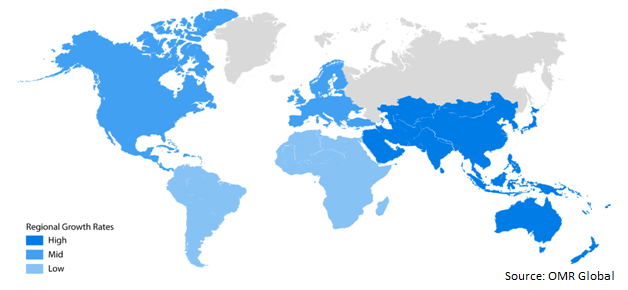

Global Medical Electrodes Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global medical electrodes market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. The increase in spending for the enhancement of healthcare infrastructure in the emerging economies of the region, such as India and China, are leading to the growth of the medical electrodes market in the region. The continuous rise in geriatric population in the region is expected to further propel the market growth during the forecast period. As per the United Nations (UN), in 2019, the percentage of the population aged 65 years and over in the country was 11.5%, which is expected to reach 16.9% by 2030. This increase in geriatric population is leading to the rising prevalence of CVD and other age related disorders, which in turn, is expected to drive the global medical electrodes market during the forecast period.

In addition, the increasing workplace stress and the prevalence of various mental health disorders such as anxiety, depression, and others, which substantially raises the risk of sleep disorders. Among all the factors, the major factors that are contributing to the market in the country include the significant prevalence of behavioral health disorders such as depression, anxiety, and stress in the country coupled with various initiatives and programs for the sleep-wake disorder. According to the WHO, a total of 54 million people in China suffered from depression and 41 million people suffered from anxiety disorders in 2017. Furthermore, as per the Healthy China 2019-2030 targets, at least 30% of patients suffering from depression are to access treatment by 2022 and around 80% by 2030. This increases the need for the diagnostics of sleep wake disorder and other disorders related with mental health. The growth in the diagnostic rate is expected to ultimately lead to the growth in the medical electrodes market during the forecast period.

Market Players Outlook

The key players in the medical electrodes market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global medical electrodes market include 3M Co., Koninklijke Philips N.V., Medtronic PLC, CONMED Corp., General Electric Co., Ambu A/S, Nihon Kohden Corp., Compumedics Ltd., and Cognionics, Inc. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.For instance, in April 2020, Nihon Kohden Corp. launched a new Premium Disposable Gold Cup EEG Electrode. These electrodes will prevent cross contamination between patients and healthcare workers while maintaining high quality EEG signals.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical electrodes market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. 3M Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Koninklijke Philips N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Medtronic PLC

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. CONMED Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. General Electric Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Medical Electrodes Market by Usability

5.1.1. Disposable Medical Electrodes

5.1.2. Reusable Medical Electrodes

5.2. Global Medical Electrodes Market by Product Type

5.2.1. Microelectrodes

5.2.2. Needle Electrodes

5.2.3. Body Surface Electrodes

5.3. Global Medical Electrodes Market by Modality Type

5.3.1. Electrocardiography (ECG)

5.3.2. Electroencephalography (EEG)

5.3.3. Electromyography (EMG)

5.3.4. Others (Brainstem Auditory Evoked Potentials (BAEPS))

5.4. Global Medical Electrodes Market by Application

5.4.1. Cardiology

5.4.2. Neurophysiology

5.4.3. Sleep Disorders

5.4.4. Muscle Disorders

5.4.5. Others (Intraoperative Monitoring)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Ad-Tech Medical Instrument Corp.

7.3. Ambu A/S

7.4. Cognionics, Inc.

7.5. Compumedics Ltd.

7.6. CONMED Corp.

7.7. EMOTIV, Inc.

7.8. General Electric Co.

7.9. Koninklijke Philips N.V.

7.10. Leonhard Lang GmbH

7.11. Medtronic PLC

7.12. Natus Medical Inc.

7.13. NeuroSky, Inc.

7.14. NeuroWave Systems Inc.

7.15. Nihon Kohden Corp.

7.16. Nikomed

7.17. Nissha Medical Technologies

7.18. Rhythmlink International, LLC

7.19. SOMNOmedicsGmbH

7.20. VectraCor, Inc.

1. GLOBAL MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY USABILITY, 2019-2026 ($ MILLION)

2. GLOBAL DISPOSABLE MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL REUSABLE MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

5. GLOBAL MICROELECTRODES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL NEEDLE ELECTRODES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BODY SURFACE ELECTRODES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY MODALITY TYPE, 2019-2026 ($ MILLION)

9. GLOBAL ECG MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL EEG MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL EMG MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHER MODALITY TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. GLOBAL MEDICAL ELECTRODES FOR CARDIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL MEDICAL ELECTRODES FOR NEUROPHYSIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL MEDICAL ELECTRODES FOR SLEEP DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL MEDICAL ELECTRODES FOR MUSCLE DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

20. NORTH AMERICAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. NORTH AMERICAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY USABILITY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

23. NORTH AMERICAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY MODALITY TYPE, 2019-2026 ($ MILLION)

24. NORTH AMERICAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. EUROPEAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

26. EUROPEAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY USABILITY, 2019-2026 ($ MILLION)

27. EUROPEAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

28. EUROPEAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY MODALITY TYPE, 2019-2026 ($ MILLION)

29. EUROPEAN MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY USABILITY, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY MODALITY TYPE, 2019-2026 ($ MILLION)

34. ASIA-PACIFIC MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

35. REST OF THE WORLD MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY USABILITY, 2019-2026 ($ MILLION)

36. REST OF THE WORLD MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

37. REST OF THE WORLD MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY MODALITY TYPE, 2019-2026 ($ MILLION)

38. REST OF THE WORLD MEDICAL ELECTRODES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MEDICAL ELECTRODES MARKET SHARE BY USABILITY, 2019 VS 2026 (%)

2. GLOBAL MEDICAL ELECTRODES MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

3. GLOBAL MEDICAL ELECTRODES MARKET SHARE BY MODALITY TYPE, 2019 VS 2026 (%)

4. GLOBAL MEDICAL ELECTRODES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

5. GLOBAL MEDICAL ELECTRODES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

6. US MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

7. CANADA MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

8. UK MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

9. FRANCE MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

10. GERMANY MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

11. ITALY MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

12. SPAIN MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

13. ROE MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

14. INDIA MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

15. CHINA MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

16. JAPAN MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF ASIA-PACIFIC MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD MEDICAL ELECTRODES MARKET SIZE, 2019-2026 ($ MILLION)