Medical Implant Market

Global Medical Implant Market Size, Share & Trends Analysis Report by Type (Orthopedic Implants, Cardiac Implants, Dental Implant, Ophthalmic Implants, Cochlear Implants, Cosmetic Implant, Neurological Implant, and Others), By Material (Metallic, Ceramic, Polymer, and Natural Biomaterials), and Forecast 2019-2025

The medical implant market is expected to grow at a CAGR of 7.5% during the forecast period. Medical Implant is used to replace a body structure, support a damaged structure, or enhance an existing structure of a part of the body. Factors driving the growth of the global medical implant industry include rising geriatric population globally coupled with the rise in chronic diseases, improvement of healthcare infrastructure and rising per capita healthcare expenditure especially in the emerging economies. In addition, rising insurance coverage in developing economies is also projected to augment market growth.

Moreover, technological advancement coupled with rising FDA approvals creates ample opportunities for the growth of the market in the near future. Companies are focusing more on minimally invasive and non-surgical procedures to provide better healthcare facilities to the patients. However, certain factors may hamper the growth of the global medical implant market. One of the major factors that may limit the market growth is a high cost associated with the medical implant procedure, especially for the implants which are not covered in the insurance.

Segmental Outlook

The medical Implant market is segmented on the basis of type and material. By type, the market is further divided into orthopedic implants, cardiac implants, dental implants, ophthalmic implants, cochlear implants, cosmetic implants, neurological implants, and other implants. The orthopedic implant includes knee replacement implants, hip replacement implants, extremities, cranial implants, and others. The knee replacement market is expected to have a major market share globally during the forecast period. The cardiac implant includes pacemakers, implantable cardioverter defibrillators (ICDs), and stents.

The dental implant market is bifurcated into endosteal and subperiosteal. The hearing aids market is not considered in the cochlear implant market. Cosmetic Implant is expected to have a significant growth due to the rising prevalence of breast cancer as well as raising the consciousness of individual physical appearance is driving the market of cosmetics implant.

Neurological Implant (Neurostimulators) is further segmented into spinal cord stimulators, vagus nerve stimulators, deep brain stimulators, and other neurostimulators. Neurostimulator cannot cure diseases, however, can treat them up to a certain level. They are used widely to curb diseases including epilepsy, Parkinson's diseases, depression, and other neuro diseases. Other implants have small; however, notable markets that include birth control implant, speech-related Implant, and hernia surgical mesh Implants.

By material, the market is segmented into Metallic, Ceramic, Polymer and Natural Biomaterials. Metallic implants of steel and titanium are used widely in most of the implants whereas natural biomaterials are widely used in cosmetic implants. Metallic implants are expected to contribute significantly to the market growth.

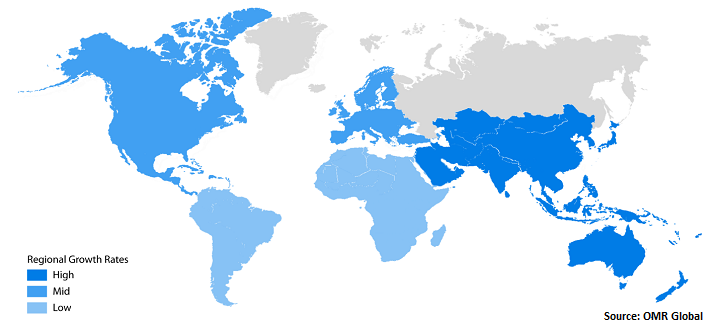

Regional Outlook

On the basis of geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is expected to have a major market share due to high insurance coverage in the developed economies. Most of the countries in North America have a national insurance program that reimburses necessary implants. However, some cosmetics implants are not covered under insurance. High-end products such as neurostimulators, cochlear implants, cosmetic implants are expected to have a significant market globally.

Global Medical Implant Market Growth, by Region 2019-2025

- In August 2019, Institut Straumann AG (The Straumann Group) signed an investment deal with Yuhan Corp. and acquired a 34% stack in Warantec, a Yuhan subsidiary specializing in dental implants. The company also got the distribution rights of its product outside South Korea.

- In July 2019, Medin Technologies, a contract manufacturer announced the acquisition of Advantage Manufacturing Technologies (AMT), an orthopedic implant manufacturer. The aim of the acquisition was to broaden its product portfolio.

- In June 2019, NuVasive, Inc., a medical device company commercially launched Modulus TLIF-O. It is a porous titanium spine implant for the transforaminal lumbar interbody fusion (TLIF) procedure. It provides a favorable environment for bone in-growth and on-growth.

- In May 2019 Medtronic PLC acquired Titan Spine. It is a titanium spine interbody implant and surface technology company. The aim of the acquisition was to broaden their spin implant portfolio and to provide complete procedural solutions to surgeons.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical implants market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Investment strategies by identifying the key market segments expected to register strong growth in the near future.

- Understand the key distribution channels and identifying the most preferred mode of product distribution.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Zimmer Biomet Holdings, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Johnson & Johnson Services, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Medtronic PLC

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Smith & Nephew Orthopaedic Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Stryker Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. By Type

5.1.1. Orthopedic Implants

5.1.1.1. Knee Replacement Implants

5.1.1.2. Hip Replacement Implants

5.1.1.3. Cranial Implant

5.1.1.4. Extremities

5.1.1.5. Other (Trauma Implants, Orthobiologics)

5.1.2. Cardiac Implants

5.1.2.1. Pacemaker

5.1.2.2. Implantable Cardioverter Defibrillators (ICDs)

5.1.2.3. Stents

5.1.3. Dental Implant

5.1.3.1. Endosteal

5.1.3.2. Subperiosteal

5.1.4. Ophthalmic (Ocular) Implants

5.1.5. Cochlear Implants

5.1.6. Cosmetic Implant

5.1.6.1. Face

5.1.6.2. Breast

5.1.6.3. Other (Fat, Pectoral, Buttock, Penile)

5.1.7. Neurological Implant (Neurostimulators)

5.1.7.1. Spinal Cord Stimulators

5.1.7.2. Vagus Nerve Stimulators

5.1.7.3. Deep Brain Stimulators

5.1.7.4. Other Neurostimulators (Sacral Nerve Stimulators)

5.1.8. Other (Birth Control Implant, Speech Implant, Hernia Surgical Mesh Implants)

5.2. By Material

5.2.1. Metallic

5.2.2. Ceramic

5.2.3. Polymer

5.2.4. Natural Biomaterials

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Abbott Laboratories, Inc.

7.3. Advantage Manufacturing Technologies, Inc.

7.4. Alcon Inc.

7.5. Allergan PLC

7.6. Alphatec Spine, Inc.

7.7. Amedica Corp.

7.8. Arthrex, Inc.

7.9. B Braun Melsungen AG

7.10. Bausch & Lomb Inc.

7.11. Becton, Dickinson and Co.

7.12. Biotronik SE & Co. KG

7.13. Boston Scientific Corp.

7.14. C. R. Bard, Inc.

7.15. Cardinal Health, Inc.

7.16. Charles River Laboratories International Inc.

7.17. Cochlear Ltd.

7.18. Conformis, Inc.

7.19. CONMED Corp.

7.20. CTL Amedica Corp.

7.21. Danher Corp. (Implant Direct Sybron International LLC, Nobel Biocare)

7.22. Demant A/S

7.23. Dentsply Sirona NV

7.24. DJO Global, Inc.

7.25. FOCUS Laboratories, Inc

7.26. Globus Medical, Inc.

7.27. GPC Medical Ltd.

7.28. Institut Straumann AG

7.29. Johnson & Johnson Services, Inc.

7.30. K2M Group Holdings, Inc.

7.31. Kinamed Inc.

7.32. Koninklijke Philips N.V.

7.33. Medtronic PLC

7.34. Merck KGaA

7.35. MORCHER GmbH

7.36. Nexxt Spine LLC

7.37. Norman Noble, Inc.

7.38. NuVasive, Inc.

7.39. RTI Surgical Holdings, Inc.

7.40. Sientra, Inc.

7.41. Sivantos Pte. Ltd

7.42. Smith & Nephew PLC

7.43. Sonova Holding AG

7.44. STAAR Surgical Co.

7.45. Stryker Corp.

7.46. Tecomet, Inc.

7.47. Wright Medical Group N.V.

7.48. Zimmer Biomet Holdings, Inc.

1. GLOBAL MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY TYPE 2018-2025 ($ MILLION)

2. GLOBAL ORTHOPEDIC IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CARDIAC IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DENTAL IMPLANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL COCHLEAR IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL COSMETIC IMPLANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL NEUROLOGICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHER IMPLANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

10. GLOBAL METALLIC MEDICAL IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL CERAMIC MEDICAL IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL POLYMER MEDICAL IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL NATURAL BIOMATERIALS MEDICAL IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

17. NORTH AMERICAN MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

18. EUROPEAN MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEAN MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. EUROPEAN MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

24. REST OF THE WORLD MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

25. REST OF THE WORLD MEDICAL IMPLANT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

1. GLOBAL MEDICAL IMPLANT MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL MEDICAL IMPLANT MARKET SHARE BY MATERIAL, 2018 VS 2025 (%)

3. GLOBAL MEDICAL IMPLANT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

6. UK MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD MEDICAL IMPLANT MARKET SIZE, 2018-2025 ($ MILLION)