Medical Waste Management Market

Global Medical Waste Management Market Size, Share & Trends Analysis Report by Waste Type (Hazardous Waste and Non-Hazardous Waste), by Treatment Site (Off-Site Treatment and On-Site Treatment), and by Services (Transportation & Storage, Waste Treatment and Disposal Services, and Recycling Services) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global medical waste management market is growing modestly, at a CAGR of 5.7% during the forecast period (2019-2025). Medical waste refers to any solid or liquid waste which is produced during the diagnosis, treatment or immunization of human beings or animals. It involves waste generated from medical research activities or during the manufacturing or testing of biological products. The medical waste consists of waste sharps (broken glass, hypodermic needles, scalpels, and syringes), human anatomical waste (organs, tissues, and body parts). In addition, it involves liquid waste from an infected area, and solid waste (bandages, dressings, material contaminated with catheters, tubes, and blood, and biotechnology and microbiology wastes). Under the Environment Protection Act (EPA), infectious or potentially infectious biomedical waste is a contaminant and must be managed as a hazardous waste.

There are various pivotal factors that drive the global medical waste management market, which includes the continuous increase in the healthcare waste due to the growing prevalence of infectious diseases; there is a significant demand for treatment in hospitals and clinics. According to the WHO, every year approximately 16 billion injections are administered across the globe. In addition, there are nearly 42,000 facilities in Florida that produce biomedical waste, including hospitals, clinics, laboratories, nursing homes, physicians, dentists, pharmacies, funeral homes, and veterinarians, as per the Florida Department of Health. Therefore, such rising number of medical facilities is increases the medical waste; therefore, there is a significant market of medical waste treatment across the globe. However, the high capital investment required in the waste management will affect the market growth during the forecast period.

Segmental Outlook

The medical waste management market is classified on the basis of waste type, treatment site, and services. Based on waste type, the market is bifurcated into hazardous waste and non-hazardous waste. Based on the treatment site, the market is segmented into off-site treatment and on-site treatment. Based on services, the market is segmented into transportation & storage, waste treatment and disposal services, and recycling services. The waste treatment and disposal service is further segmented into incineration, autoclaving, chemical treatment, and others.

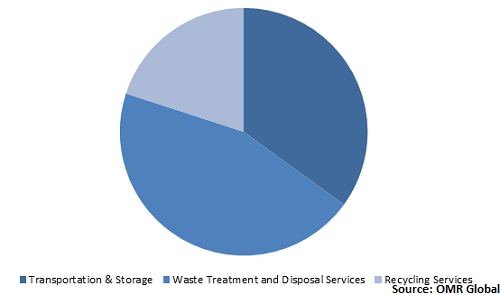

Global Medical Waste Management Market Share by Services, 2018 (%)

Waste treatment and disposal services contributes a significant share in the medical waste management market

Waste treatment and disposal services are expected to be the largest segment in the medical waste management market globally. The waste treatment procedure includes the adoption of any method or process that can change chemical, physical, or biological characteristics of any hazardous waste, in order to neutralize such waste; make it safer to transport, dispose, or store. According to the WHO, out of the total sampled facilities across 24 countries, 58% had suitable systems for the disposal of healthcare waste. The adoption rate of waste management activities is improving due to stringent government regulations and growing awareness among people for infections. There are several processes involved in the treatment of medical waste, among which, the incineration treatment process is most significantly used as it is a traditional and easy method.

Regional Outlook

The global medical waste management market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America is estimated to have considerable share in the global medical waste management market. The major countries which are contributing in the North American market growth include the US and Canada. There are various factors driving the market growth in the region, which includes government initiatives for waste management and increasing waste disposal activities in the region. There are several medical waste management regulations in the US, the ‘Medical Waste Tracking Act’, under which, any solid waste that is generated in the diagnosis, treatment, or immunization of human beings or animals, in research pertaining thereto, or in the production or testing of biologicals is considered as hazardous medical waste. Therefore, such strict regulations possess to the significant demand for medical waste management services in the country, which in turn, offers growth to the medical waste management market in North America.

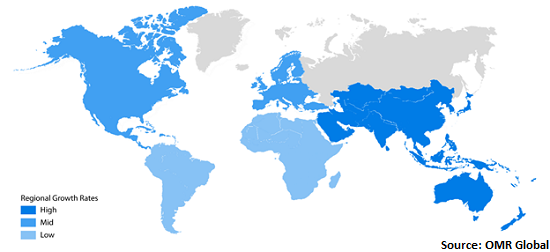

Global Medical Waste Management Market Growth, by Region 2019-2025

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the medical waste management market during the forecast period. Asia-Pacific countries including China and India are among the significant market for medical waste management across the globe. China, being the largest and one of the fastest developing economies face challenges regarding medical waste management. According to the National Institute of Health in 2018, the health system of China generated nearly 650,000 tons of medical waste each year. Further, the amount of medical waste is increasing at a rapid rate at an annual rate of around 20%. Such increasing medical waste boosts the growth of the medical waste management market.

Indian medical waste management market is driven by an increase in medical tourism in the last decade, propelling a need to find better ways for disposing of the hazardous medical waste. The medical tourism increases the quantity of medical waste and infectious waste in India, as it augments the need for extensive medical and non-medical disposals. Many states in India have a large number of healthcare facilities and institutions that generate a huge amount of waste. Therefore, such continuous growth in the medical waste in these countries is expected to drive the medical waste management market in Asia-Pacific during the forecast period.

Market Players Outlook

The key players in the medical waste management market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global medical waste management market include Stericycle, Inc., Clean Harbors, Inc., Covanta Holding Corp., SUEZ SA, and Veolia Environnement S.A. Apart from these key market players, several other companies are contributing significant share in the market, including Sharps Compliance, Inc., Republic Services, Inc., MedPro Disposal, LLC, BioMedical Waste Solutions, LLC, and REMONDIS SE & Co. KG. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical waste management market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Stericycle, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Clean Harbors, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Covanta Holding Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. SUEZ SA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Veolia Environnement S.A.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Medical Waste Management Market by Waste Type

5.1.1. Hazardous Waste

5.1.2. Non-Hazardous Waste

5.2. Global Medical Waste Management Market by Treatment Site

5.2.1. Off-Site Treatment

5.2.2. On-Site Treatment

5.3. Global Medical Waste Management Market by Services

5.3.1. Transportation & Storage

5.3.2. Waste Treatment and Disposal Services

5.3.2.1. Incineration

5.3.2.2. Autoclaving

5.3.2.3. Chemical Treatment

5.3.2.4. Others (Microwave and Vitrification)

5.3.3. Recycling Services

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AMB Ecosteryl

7.2. Bertin Medical Waste (CNIM Group)

7.3. BioMedical Waste Solutions, LLC

7.4. Biotic Waste Ltd.

7.5. BWS Inc.

7.6. Clean Harbors, Inc.

7.7. Covanta Holding Corp.

7.8. Daniels Sharpsmart, Inc.

7.9. EcoMed Services

7.10. GRP & Associates, Inc.

7.11. MedPro Disposal, LLC

7.12. PegEx Inc.

7.13. REMONDIS SE & Co. KG

7.14. Republic Services, Inc.

7.15. Sharps Compliance, Inc.

7.16. SMS Envocare Ltd.

7.17. Stericycle, Inc.

7.18. SUEZ SA

7.19. Veolia Environnement S.A.

7.20. Verisk 3E

1. GLOBAL MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2018-2025 ($ MILLION)

2. GLOBAL HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL NON-HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT SITE, 2018-2025 ($ MILLION)

5. GLOBAL OFF-SITE MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ON-SITE MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2018-2025 ($ MILLION)

8. GLOBAL TRANSPORTATION & STORAGE SERVICES FOR MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL WASTE TREATMENT AND DISPOSAL SERVICES FOR MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL RECYCLING SERVICES FOR MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT SITE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2018-2025 ($ MILLION)

16. EUROPEAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2018-2025 ($ MILLION)

18. EUROPEAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT SITE, 2018-2025 ($ MILLION)

19. EUROPEAN MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT SITE, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2018-2025 ($ MILLION)

24. REST OF THE WORLD MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY WASTE TYPE, 2018-2025 ($ MILLION)

25. REST OF THE WORLD MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT SITE, 2018-2025 ($ MILLION)

26. REST OF THE WORLD MEDICAL WASTE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2018-2025 ($ MILLION)

1. GLOBAL MEDICAL WASTE MANAGEMENT MARKET SHARE BY WASTE TYPE, 2018 VS 2025 (%)

2. GLOBAL MEDICAL WASTE MANAGEMENT MARKET SHARE BY TREATMENT SITE, 2018 VS 2025 (%)

3. GLOBAL MEDICAL WASTE MANAGEMENT MARKET SHARE BY SERVICE, 2018 VS 2025 (%)

4. GLOBAL MEDICAL WASTE MANAGEMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. USMEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. UKMEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD MEDICAL WASTE MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)