Menopause Treatment Market

Menopause Treatment Market Size, Share & Trends Analysis by Treatment (Dietary Supplements, OTC Pharma Products, Hormonal, and Non-hormonal), by Route of Administration (Topical, Injectable, and Oral), and by Distribution Channel (Institutional Sales, Retail Sales, and Online Sales) Forecast Period (2025-2035)

Industry Overview

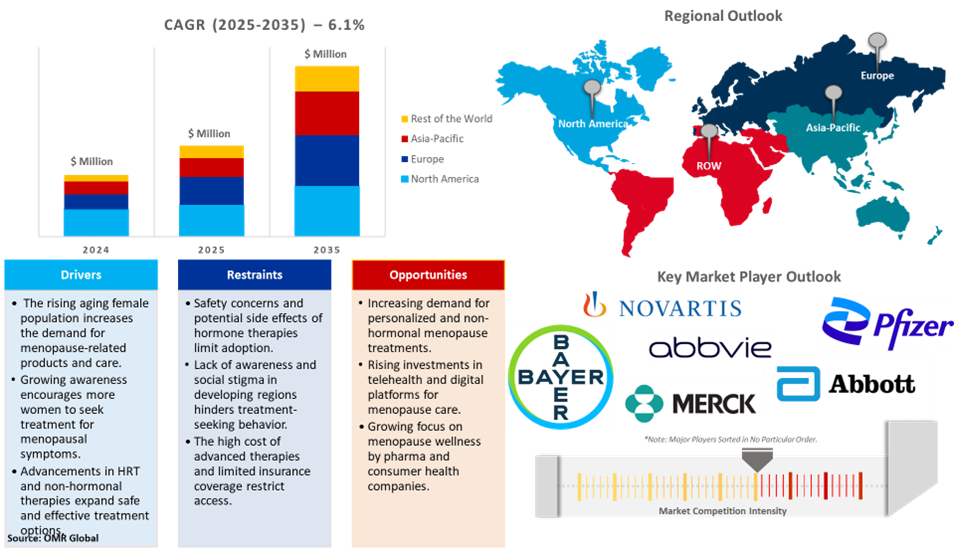

Menopause treatment market size was $17.2 billion in 2024 and is growing at a CAGR of 6.1% during the forecast period (2025-2035). The growing female aging population globally directly contributes to a growing demand for menopause-related products and services contributing to the growth of the market during the forecast period. The number of women is increasing entering the menopause phase, as the global population ages. For instance, according to the study published by PubMed (National Library of Medicine) each year approx. 25 million women pass through menopause. The study estimated that by 2030, the global women population of menopausal and postmenopausal is predicted to increase to 1.2 billion, with 47 million new entrants each year. Additionally, according to the World Health Organization (WHO), the global population aged 60 years and older is expected to double by 2050.

Market Dynamics

Growing Awareness of Menopausal Health

Women are now getting more informed about the wide range of physical and emotional symptoms associated with menopause through various platforms. The growing awareness across the globe is significantly encouraging women to seek treatments and support. For instance, in 2024, Propaganda Brand Consultancy delivered a powerful Above-the-Line (ATL) campaign for GenM, ‘Live Your Best Menopause.’ The campaign consists of 6-sheet and 96-sheet billboards to target commuters. The campaign will see important conversations brought to millions of women. The campaign ‘Live Your Best Menopause’ focuses on inspiring and empowering women to thrive during their menopause journey. Additionally, in February 2023, Boots campaign 'Our Health Is As Individual As We Are.' This six-week campaign focuses on women's health, including menopause, by increasing awareness and highlighting the support available through their services. The campaign also expanded the Price Advantage scheme for Pregnacare and Menopace supplements.

Advancements in Hormone Replacement Therapy (HRT)

Hormone replacement therapy replaces hormones that the body no longer produces naturally after a woman stops menstruating. HRT is a type of medical treatment used to treat menopause symptoms such as hot flashes, night sweats, mood swings, and more. Recent advancements have modernized HRT and is now more customizable and safer to address the symptoms. For instance, in February 2025, Noom expanded into hormone replacement therapy to support women's health through menopause. The company’s Noom + HRT offers a proven behavior change program with HRT medication to achieve whole-person health. The expansion into HRT offers critical support for women as they navigate menopausal hormone shifts.

Market Segmentation

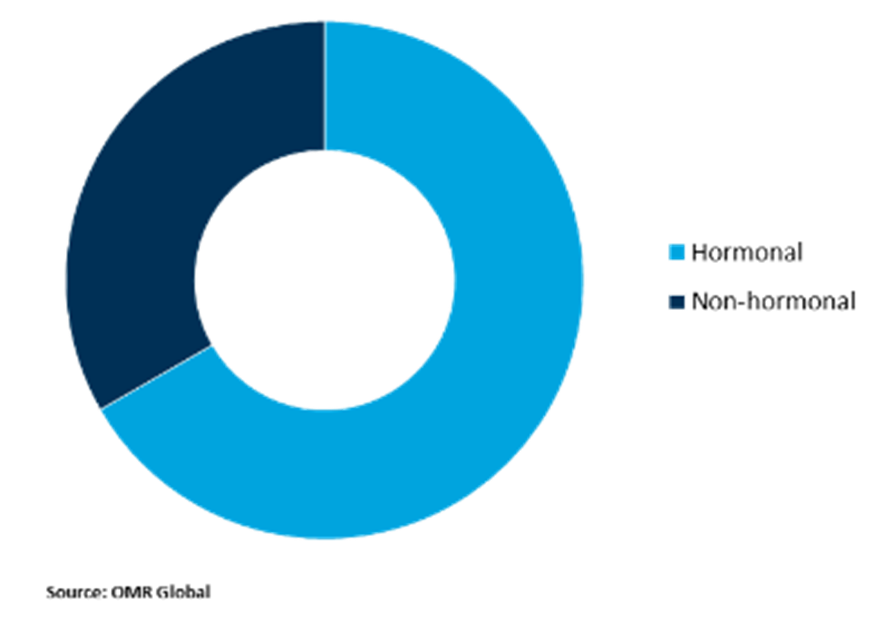

- Based on the treatment, the market is segmented into dietary supplements, OTC pharma products, hormonal, and non-hormonal.

- Based on the route of administration, the market is segmented into topical, injectable, and oral.

- Based on the distribution channel, the market is segmented into institutional sales, retail sales, and online sales.

OTC Pharma Product Segment to Lead the Market with the Largest Share

Among treatments, the market for OTC pharma products is growing owing to its accessibility, convenience, and increasing consumer trust. The company’s global strategic initiatives and expansion in the OTC menopause product line are contributing to the growth of the market during the forecast period. For instance, in September 2024, Bonafide Health launched Thermella to reduce vasomotor symptoms. The product provides quick access to safe, effective menopause relief. It is the hormone-free, prescription-free nk3r antagonist for menopause symptom management.

Global Menopause Market Share by Treatment, 2024 (%)

Dietary Supplements: A Key Segment in Market Growth

The rising demand for natural, hormone-free solutions to manage menopause symptoms is driving the dietary supplements menopause market during the forecast period. The growing awareness among women for their wellness approved by clinical research, and influencer advocacy will significantly drive the segment’s growth. For instance, in October 2024, Gytree launched protein specifically for peri/menopause for women over 40. The product fulfills the nutritional needs of women transitioning through menopause. The product encourages a range of physical and emotional challenges related to the menopause phase.

Regional Outlook

The global menopause treatment market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Rising Focus on Women’s Wellness and Preventive Care Boosts Product Innovation in Europe

The growing focus on women's wellness and preventive care boosts, the market players in the region are boosting products. The companies in the region are increasingly developing natural, holistic, and personalized solutions which is expected to propel the market growth during the forecast period. For instance, in August 2023, Theramex announced the expansion of its menopause product portfolio and geographic presence in Europe to improve access to menopause care.

North America Region Dominates the Market with Major Share

North America is expected to hold a significant share owing to the advanced healthcare infrastructure, growing awareness, and increasing healthcare expenditure in the region. For instance, according to the US Centers for Medicare & Medicaid Services, in 2023, the US healthcare spending grew by 7.5% reaching $4.9 trillion or $14,570 per person. Thus, the increased spending in Medicaid and private health insurance sectors has driven the healthcare expenditure. The enhanced healthcare infrastructure and rising services to improve accessibility and quality of care are further driving the market growth.

Market Players Outlook

The major companies operating in the global menopause treatment market include Abbott Laboratories, Bayer AG, Merck & Co., Inc., Pfizer Inc., AbbVie, and Novartis AG, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- For instance, in September 2024, Emcure Pharma launched a product that addressed the challenges and difficulties faced by women during menopause. The company launched Arth which is designed to treat the common symptoms of menopause such as hot flashes, night sweats, and mood swings. With Arth, the company focuses on raising awareness and increasing access to affordable products to help women navigate menopause with good health and self-strength.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global menopause treatment market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Menopause Treatment Market Sales Analysis – Treatment | Route of Administration | Distribution Channel | ($ Million)

• Menopause Drugs Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Menopause Industry Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Menopause Treatment Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Menopause Treatment Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Menopause Treatment Market Revenue and Share by Manufacturers

• Menopause Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Abbott Laboratories

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Bayer AG

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Merck & Co., Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Novartis AG

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Pfizer Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Menopause Treatment Market Sales Analysis by Treatment ($ Million)

5.1. Dietary Supplements

5.2. OTC Pharma Products

5.2.1. Hormonal

5.2.2. Non-Hormonal

6. Global Menopause Treatment Market Sales Analysis by Route of Administration ($ Million)

6.1. Topical

6.2. Injectable

6.3. Oral

7. Global Menopause Treatment Market Sales Analysis by Distribution Channel ($ Million)

7.1. Institutional Sales

7.2. Retail Sales

7.3. Online Sales

8. Regional Analysis

8.1. North American Menopause Treatment Market Sales Analysis – Treatment | Route of Administration | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Menopause Treatment Market Sales Analysis – Treatment | Route of Administration | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Menopause Treatment Market Sales Analysis – Treatment | Route of Administration | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Menopause Treatment Market Sales Analysis Treatment | Route of Administration | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Abbott Laboratories

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. AbbVie, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Astellas Pharma Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Bayer AG

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Bionova

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Biosante

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Dr. Reddy’s Laboratories Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Duchesnay USA

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Eli Lilly and Company

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Evernow, Inc.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Merck & Co., Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Novo Nordisk A/S

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Novartis AG

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Noven Pharmaceuticals, Inc.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Organon Canada

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Pfizer Inc.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Procter & Gamble

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Pure Encapsulations

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Teva Pharmaceutical Industries Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Theramex HQ UK Ltd.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

1. Global Menopause Treatment Market Research And Analysis By Treatment, 2024-2035 ($ Million)

2. Global Menopause Dietary Supplements Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Menopause OTC Pharma Products Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Hormonal Menopause Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Non-hormonal Menopause Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Menopause Treatment Market Research And Analysis By Route of Administration, 2024-2035 ($ Million)

7. Global Menopause Topical Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Menopause Injectable Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Menopause Oral Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Menopause Treatment Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

11. Global Menopause For Institutional Sales Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Menopause For Retail Sales Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Menopause For Online Sales Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Menopause Treatment Market Research And Analysis By Geography, 2024-2035 ($ Million)

15. North American Menopause Treatment Market Research And Analysis By Country, 2024-2035 ($ Million)

16. North American Menopause Treatment Market Research And Analysis By Treatment, 2024-2035 ($ Million)

17. North American Menopause Treatment Market Research And Analysis By Route of Administration, 2024-2035 ($ Million)

18. North American Menopause Treatment Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

19. European Menopause Treatment Market Research And Analysis By Country, 2024-2035 ($ Million)

20. European Menopause Treatment Market Research And Analysis By Treatment, 2024-2035 ($ Million)

21. European Menopause Treatment Market Research And Analysis By Route of Administration, 2024-2035 ($ Million)

22. European Menopause Treatment Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

23. Asia-Pacific Menopause Treatment Market Research And Analysis By Country, 2024-2035 ($ Million)

24. Asia-Pacific Menopause Treatment Market Research And Analysis By Treatment, 2024-2035 ($ Million)

25. Asia-Pacific Menopause Treatment Market Research And Analysis By Route of Administration, 2024-2035 ($ Million)

26. Asia-Pacific Menopause Treatment Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

27. Rest Of The World Menopause Treatment Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Rest Of The World Menopause Treatment Market Research And Analysis By Treatment, 2024-2035 ($ Million)

29. Rest Of The World Menopause Treatment Market Research And Analysis By Route of Administration, 2024-2035 ($ Million)

30. Rest Of The World Menopause Treatment Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

1. Global Menopause Treatment Market Share By Treatment, 2024 Vs 2035 (%)

2. Global Menopause Dietary Supplements Products Market Share By Region, 2024 Vs 2035 (%)

3. Global Menopause OTC Pharma Market Share By Region, 2024 Vs 2035 (%)

4. Global Hormonal Menopause Treatment Market Share By Region, 2024 Vs 2035 (%)

5. Global Non-Hormonal Menopause Treatment Market Share By Region, 2024 Vs 2035 (%)

6. Global Menopause Treatment Market Share By Route of Administration, 2024 Vs 2035 (%)

7. Global Menopause Topical Treatment Market Share By Region, 2024 Vs 2035 (%)

8. Global Menopause Injectable Treatment Market Share By Region, 2024 Vs 2035 (%)

9. Global Menopause Oral Treatment Market Share By Region, 2024 Vs 2035 (%)

10. Global Menopause Treatment Market Share By Distribution Channel, 2024 Vs 2035 (%)

11. Global Menopause For Institutional Sales Market Share By Region, 2024 Vs 2035 (%)

12. Global Menopause For Retail Sales Market Share By Region, 2024 Vs 2035 (%)

13. Global Menopause For Online Sales Market Share By Region, 2024 Vs 2035 (%)

14. Global Menopause Treatment Market Share By Region, 2024 Vs 2035 (%)

15. Global Menopause Treatment Market Share By Region, 2024 Vs 2035 (%)

16. US Menopause Treatment Market Size, 2024-2035 ($ Million)

17. Canada Menopause Treatment Market Size, 2024-2035 ($ Million)

18. UK Menopause Treatment Market Size, 2024-2035 ($ Million)

19. France Menopause Treatment Market Size, 2024-2035 ($ Million)

20. Germany Menopause Treatment Market Size, 2024-2035 ($ Million)

21. Italy Menopause Treatment Market Size, 2024-2035 ($ Million)

22. Spain Menopause Treatment Market Size, 2024-2035 ($ Million)

23. Russia Menopause Treatment Market Size, 2024-2035 ($ Million)

24. Rest Of Europe Menopause Treatment Market Size, 2024-2035 ($ Million)

25. India Menopause Treatment Market Size, 2024-2035 ($ Million)

26. China Menopause Treatment Market Size, 2024-2035 ($ Million)

27. Japan Menopause Treatment Market Size, 2024-2035 ($ Million)

28. South Korea Menopause Treatment Market Size, 2024-2035 ($ Million)

29. ASEAN Menopause Treatment Market Size, 2024-2035 ($ Million)

30. Australia and New Zealand Menopause Treatment Market Size, 2024-2035 ($ Million)

31. Rest Of Asia-Pacific Menopause Treatment Market Size, 2024-2035 ($ Million)

32. Latin America Menopause Treatment Market Size, 2024-2035 ($ Million)

33. Middle East And Africa Menopause Treatment Market Size, 2024-2035 ($ Million)

FAQS

The size of the Menopause Treatment market in 2024 is estimated to be around $17.2 billion.

North America holds the largest share in the Menopause Treatment market.

Leading players in the Menopause Treatment market include Abbott Laboratories, Bayer AG, Merck & Co., Inc., Pfizer Inc., AbbVie, and Novartis AG, among others.

Menopause Treatment market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

Increasing awareness, aging population, and demand for effective symptom management are driving the growth of the menopause treatment market.