Mobile Crane Market

Mobile Crane Market Size, Share & Trends Analysis Report, By Type (All Terrain Crane, Crawler Crane, Rough Terrain Crane, and Truck Crane), By Application (Construction, Oil and Gas, Manufacturing, Power and Utilities, and Others) Forecast Period (2025-2035)

Industry Overview

Mobile crane market was valued at $14,890 million in 2024 and is projected to reach $30,300 million by 2035, growing at a CAGR of 6.7% during the forecast period from 2025 to 2035. One of the key factors that are driving the market includes the rising government and private sectors’ initiatives to make large funds in constructing new commercial and residential buildings and public infrastructure across the globe, thus contributing to the growth of the construction industry. As per the Institute of Civil Engineers (ICE) of the UK, in 2018, the global construction market is expected to reach $8 trillion by the end of 2030, mainly driven by the infrastructure expansion throughout China, the US, and India. The growth in infrastructure projects is, in turn, driving the demand for mobile cranes. Furthermore, in November 2021, President Biden signed the Infrastructure Investment and Jobs Act (IIJA), aka Bipartisan Infrastructure Law (BIL). The law authorizes $1.2 trillion for transportation and infrastructure spending, with $550 billion of that figure going toward "new" investments and programs.

Market Dynamics

Rising Construction Industry Facilitates Mobile Crane Demand

The construction industry is highly dynamic owing to multiple factors such as high investments, overall economy, and global economic scenario that are prompting the segment’s growth in the market. The demand for construction equipment and machines is promising to witness growth during the forecast period. Moreover, numerous countries are perceiving significant Foreign Direct Investment (FDI) for the construction sector. For instance, in 2020, there was nearly $1.5 billion in foreign direct investment into Australia’s construction sector. Moreover, the funds for infrastructure in both private and public, such as the Vietnam Socio-Economic Development Plan ($61.5 billion), Indonesian National Medium-term Development Plan ($460 billion), and the Philippine Development Plan “Build, Build, and Build” ($71.8 billion), are expecting to raise the demand for construction machinery such as mobile crane in the region. Additionally, under the Interim Budget 2024-25, India's infrastructure sector is set for robust growth, with planned investments of US$ 1.4 trillion by 2025. The government's National Infrastructure Pipeline (NIP) program aims to channel significant capital into key areas such as energy, roads, railways, and urban development, as this will encourage the demand for mobile cranes. As per Green Finance & Development Center (GFDC), in November 2024, Chinese BRI engagement has reached USD 1.175 trillion since 2013 also Chinese enterprises invested about $29.5 billion in non-financial direct investments in countries “along the Belt and Road”.

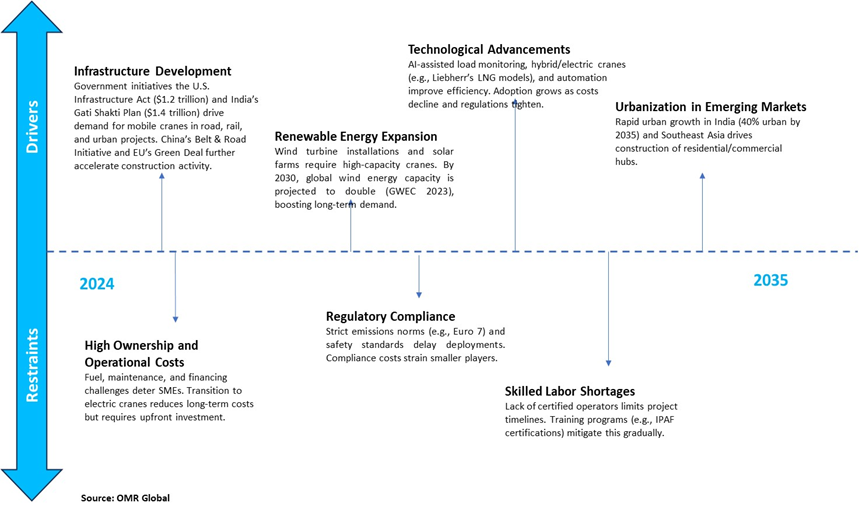

Global Mobile Crane Market Dynamic Snapshot

Technological Advancements in Mobile Cranes

The integration of IoT, Telematics, and Hybrid/Electric, Automation Cranes These Innovations in crane technology are enhancing efficiency and safety. For Instance, in October 2022, Liebherr launched a fleet data management solution for its mobile and crawler cranes, Liebherr fleet data management solution enables to monitor in real time – from the office or while on the road – the current location of specific machines, to determine whether the current prevailing wind force allows safe working, and to see the weight of the load currently hanging from the hook. Additionally, Tadano is offering an environmentally friendly solution designed to provide sustainable solutions that can help reduce Emissions and noise. The e-PACK is powered through the grid via a 400 V / 63 A connection. A mode that makes it possible to operate the crane with a 400 V / 32 A connection with a reduced crane power system, and that will enhance the efficiency of cranes.

Market Segmentation

- Based on the type, the market is segmented into all-terrain crane, crawler crane, rough terrain crane, and truck crane.

- Based on the applications, the market is segmented into construction, oil and gas, manufacturing, power and utilities, and others.

- Based on the End-User, the market is segmented into men and women.

Crawler Cranes Dominate Heavy Lifting

The growing demand for crawler cranes in industrial applications will dominate the market owing to carrying large and heavy loads, such as steel beams, concrete blocks, and other construction materials, and enormous lifting capability and long reach. Crawler cranes are commonly used for road and bridge-building in emerging countries where expansion of metros, smart cities, roads, and bridges continues to support a high demand for crawler cranes.

Regional Outlook

The global mobile crane market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Continue to Dominate the Mobile Crane Market

North America continue to dominate the mobile crane market, largely driven by high construction activity and robust industrial growth. In North America, stringent safety standards and ongoing infrastructure projects have fostered a conducive environment for market growth. Furthermore, in Europe, initiatives under the European Commission’s Green Deal are encouraging investments in modern, eco-friendly mobile cranes. As per the Construction Management Association of America (CMAA) in 2022, with a membership of 16,500 construction and corporate owners, countries of the region are anticipating experiencing potential investments in the power and utility, construction, and manufacturing sectors. For instance, in April 2021, the Supplying Help to Infrastructure in Ports, Yards, and America’s Repair Docks (SHIPYARD) Act approved to invest of $21 billion for the recapitalization of the US Navy’s four public shipyards in Virginia, Hawaii, Maine, and Washington and further added $4 billion for private repair and construction shipyards. This has resulted in opportunities for mobile crane manufacturers to witness potential demand as such machines are used in developing shipbuilding, bridges, roads, buildings, and other. Moreover, over the past years, the exports from the US to other parts of the country have also increased drastically, which is further anticipated to positively influence the growth of the market in the region.

Market Players Outlook

The major companies operating in the global mobile crane market include Liebherr-International Deutschland GmbH, The Manitowoc Company, Inc., Tadano Ltd., Terex Global GmbH, and XCMG (H.L.D. Machinery & Equipment Ltd.), among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In September 2024, Brown Gibbons Lang & Company (BGL) is pleased to announce that Manitex International, Inc. (Manitex) has signed a definitive agreement to be acquired by Tadano Ltd. (Tadano).

- In January 2020, Konecranes completed the acquisition of MHE-Demag. With the acquisition, Konecranes increases its presence and market coverage in strategically important and fast-growing Southeast Asia. In addition, the acquisition allows Konecranes to target total annual synergies of approximately EUR 10 million at the EBITA level by 2022.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mobile crane market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Mobile Crane Market Sales Analysis –Type | Application ($ Million)

• Mobile Crane Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Mobile Crane Industry Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Mobile Crane Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Mobile Crane Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Mobile Crane Market Revenue and Share by Manufacturers

• Mobile Crane Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Liebherr-International Deutschland GmbH

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. The Manitowoc Company, Inc

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Tadano Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Terex Global GmbH

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. XCMG (H.L.D. Machinery & Equipment Ltd.)

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Mobile Crane Market Sales Analysis by Type ($ Million)

5.1. All Terrain Crane

5.2. Crawler Crane

5.3. Rough Terrain Crane

5.4. Truck Crane

6. Global Mobile Crane Market Sales Analysis by Application ($ Million)

6.1. Construction

6.2. Oil and Gas

6.3. Manufacturing

6.4. Power and Utilities

6.5. Others

7. Regional Analysis

7.1. North American Mobile Crane Market Sales Analysis – Facility Type | Service | End-User |Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Mobile Crane Market Sales Analysis – Facility Type | Service | End-User |Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Mobile Crane Market Sales Analysis – Facility Type | Service | End-User |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Mobile Crane Market Sales Analysis – Facility Type | Service | End-User |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Altec Inc.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Cargotec Corp.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Elliott Equipment Company

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Furukawa UNIC Corp.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Favelle Favco Group

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. H.L.D. Machinery & Equipment Import Export Trading (Xuzhou) Co., Ltd.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Kobelco Construction Machinery Co., Ltd.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Konecranes Oyj

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Liebherr-International Deutschland GmbH

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Manitex International Inc.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Palfinger Ag

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.12. SANY Global

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. SENNEBOGEN Maschinenfabrik GmbH

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Sumitomo Heavy Industries, Ltd. (HSC)

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Tadano Ltd.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Terex Global GmbH

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. The Manitowoc Co., Inc

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Zoomlion Heavy Industry Science & Technology Co., Ltd

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

1. Global Mobile Crane Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global All-Terrain Mobile Crane Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Crawler Mobile Crane Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Rough Terrain Mobile Crane Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Truck Mobile Crane Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Mobile Crane Market Research And Analysis By Application, 2024-2035 ($ Million)

7. Global Mobile Crane For Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Mobile Crane For Oil And Gas Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Mobile Crane For Manufacturing Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Mobile Crane For Power And Utilities Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Mobile Crane For Other Applications Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Mobile Crane Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Mobile Crane Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Mobile Crane Market Research And Analysis By Type, 2024-2035 ($ Million)

15. North American Mobile Crane Market Research And Analysis By Application, 2024-2035 ($ Million)

16. European Mobile Crane Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Mobile Crane Market Research And Analysis By Type, 2024-2035 ($ Million)

18. European Mobile Crane Market Research And Analysis By Application, 2024-2035 ($ Million)

19. Asia-Pacific Mobile Crane Market Research And Analysis By Country, 2024-2035 ($ Million)

20. Asia-Pacific Mobile Crane Market Research And Analysis By Type, 2024-2035 ($ Million)

21. Asia-Pacific Mobile Crane Market Research And Analysis By Application, 2024-2035 ($ Million)

22. Rest Of The World Mobile Crane Market Research And Analysis By Country, 2024-2035 ($ Million)

23. Rest Of The World Mobile Crane Market Research And Analysis By Type, 2024-2035 ($ Million)

24. Rest Of The World Mobile Crane Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Mobile Crane Market Share By Type, 2024 Vs 2035 (%)

2. Global All-Terrain Crane Market Share By Region, 2024 Vs 2035 (%)

3. Global Crawler Crane Market Share By Region, 2024 Vs 2035 (%)

4. Global Rough Terrain Crane Market Share By Region, 2024 Vs 2035 (%)

5. Global Truck Crane Market Share By Region, 2024 Vs 2035 (%)

6. Global Mobile Crane Market Share By Application, 2024 Vs 2035 (%)

7. Global Mobile Crane For Construction Market Share By Region, 2024 Vs 2035 (%)

8. Global Mobile Crane For Oil And Gas Market Share By Region, 2024 Vs 2035 (%)

9. Global Mobile Crane For Manufacturing Market Share By Region, 2024 Vs 2035 (%)

10. Global Mobile Crane For Power And Utilities Market Share By Region, 2024 Vs 2035 (%)

11. Global Mobile Crane For Other Applications Market Share By Region, 2024 Vs 2035 (%)

12. Global Mobile Crane Market Share By Region, 2024 Vs 2035 (%)

13. Us Mobile Crane Market Size, 2024-2035 ($ Million)

14. Canada Mobile Crane Market Size, 2024-2035 ($ Million)

15. Uk Mobile Crane Market Size, 2024-2035 ($ Million)

16. France Mobile Crane Market Size, 2024-2035 ($ Million)

17. Germany Mobile Crane Market Size, 2024-2035 ($ Million)

18. Italy Mobile Crane Market Size, 2024-2035 ($ Million)

19. Spain Mobile Crane Market Size, 2024-2035 ($ Million)

20. Russia Mobile Crane Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Mobile Crane Market Size, 2024-2035 ($ Million)

22. India Mobile Crane Market Size, 2024-2035 ($ Million)

23. China Mobile Crane Market Size, 2024-2035 ($ Million)

24. Japan Mobile Crane Market Size, 2024-2035 ($ Million)

25. South Korea Mobile Crane Market Size, 2024-2035 ($ Million)

26. Australia and New Zealand Mobile Crane Market Size, 2024-2035 ($ Million)

27. ASEAN Mobile Crane Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Mobile Crane Market Size, 2024-2035 ($ Million)

29. Rest Of The World Mobile Crane Market Size, 2024-2035 ($ Million)

30. Latin America Mobile Crane Market Size, 2024-2035 ($ Million)

31. Middle East And Africa Mobile Crane Market Size, 2024-2035 ($ Million)

FAQS

The size of the Mobile Crane market in 2024 is estimated to be around $14,890 million.

North America holds the largest share in the Mobile Crane market.

Leading players in the Mobile Crane market include Liebherr-International Deutschland GmbH, The Manitowoc Company, Inc., Tadano Ltd., Terex Global GmbH, and XCMG (H.L.D. Machinery & Equipment Ltd.), among others.

Mobile Crane market is expected to grow at a CAGR of 6.7% from 2025 to 2035.

Rising infrastructure development, renewable energy projects, and demand for flexible lifting solutions are driving the mobile crane market growth.