Neurology Devices Market

Global Neurology Devices Market Size, Share & Trends Analysis Report, By Product (Cerebrospinal Fluid Management Devices, Neurostimulation Devices, Interventional Neurology Devices, Neurosurgery Devices, and Others), By End-User (Hospitals, Neurology Clinics, and Ambulatory Surgical Centers) and Forecast, 2019-2025

The global neurology devices market is estimated to grow at a CAGR of nearly 9.0% during the forecast period. The major factors contributing to the market growth include rising demand for minimally invasive procedures and a significant rise in the prevalence of neurological disorders, including Parkinson’s and Alzheimer’s disease. There is an increasing demand for minimally invasive techniques for neurological procedures owing to its significant benefits as compared to traditional procedures. Minimally invasive neurological surgery normally involves tiny incisions (1-2 cm holes). Under the procedure, surgeons use highly specialized instruments to lower disruption of brain tissue, blood vessels and nerves.

With these incisions, instruments with tiny video cameras are inserted that provides an inside view to the surgeons and allowing surgical access to the affected areas of the brain. Moreover, it uses small, flexible, lighted tubes, known as endoscopes for visualization of several parts of the skull base, brain and spinal cord with small openings. Endoscopic neurosurgery has highly made easier the management of various intracranial ailments among adults and children. It has reduced surgical complications, reduced cosmetic concerns and shortened hospital stay, which is concerned with neurosurgical conditions.

The adoption of minimally invasive surgery is expected to grow significantly coupled with the increasing prevalence of Parkinson’s disease (PD). According to Parkinson’s Foundation, approximately one million Americans live with PD, which is over the combined number of patients diagnosed with muscular dystrophy, multiple sclerosis and Lou Gehrig's disease. Each year, nearly 60,000 Americans are diagnosed with PD and over 10 million people globally are living with PD. In addition, the incidence of PD grows with age, however, an estimated 4% of people are diagnosed with PD, before the age of 50 years. For the treatment of PD, DBS, a minimally invasive surgical procedure can be used for the treatment of neurological symptoms of PD, such as rigidity, movement control and tremors. DBS employs a neurostimulation device, like a heart pacemaker that enables to transmit electrical pulses to a very exact location in the brain circuits which influence PD symptom. The electrical pulses generated from the DBS device obstruct the activity of these circuits. As a result, the rest of the brain can work more normally.

Market Segmentation

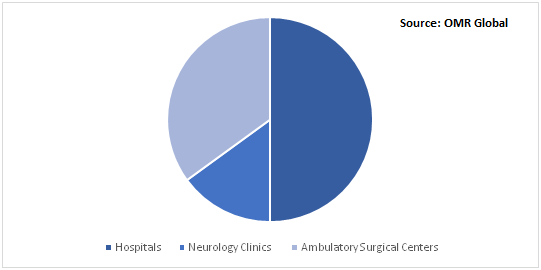

The global neurology devices market is segmented based on product and end-user. Based on the product, the market is classified into cerebrospinal fluid management devices, neurostimulation devices, interventional neurology devices, neurosurgery devices, and others. Based on end-user, the market is classified into hospitals, neurology clinics, and ambulatory surgical centers (ASCs).

Hospitals are anticipated to hold significant share in the end-user segment

In 2018, hospitals are anticipated to contribute significantly in the end-user segment owing to the increasing number of multi-specialty hospitals and the availability of skilled professionals in the hospitals. As a result, patients mainly prefer to visit hospitals for the treatment of neurological disorders. However, Ambulatory surgical centers (ASCs) are estimated to witness potential growth during the forecast period owing to the increasing demand for minimally invasive surgeries for neurological diseases. Neurostimulation therapy can be performed in an outpatient setting in which DBS, spinal cord stimulation and other neurostimulation devices are completely implanted under the skin. The procedure is performed on an outpatient basis and often does not need hospitalization.

Global Neurology Devices Market Share by End-User, 2018 (%)

Regional Outlook

The global neurology devices market is classified into North America, Europe, Asia-Pacific, and Rest of the World. North American neurology devices market is estimated to hold the prominent share in the market owing to the rising demand for minimally invasive neurosurgery and favorable reimbursement policy for medical devices. Increasing demand for neurostimulation procedures coupled with the increasing prevalence of Parkinson’s and Alzheimer’s disease is supporting to drive the market growth in the region. In addition, the increasing presence of key manufacturers of medical devices, including Abbott Laboratories and Boston Scientific Corp. are further contributing to the market growth in the region.

Global Neurology Devices Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include Medtronic plc, Abbott Laboratories, Boston Scientific Corp., B. Braun Melsungen AG, and Stryker Corp. The market players are using certain strategies, including mergers and acquisitions, partnerships and collaborations, and product launches, to expand market share and gain a competitive advantage. For instance, in January 2019, Boston Scientific Corp. introduced Vercise Primary Cell (PC) and Vercise Gevia DBS Systems that features the Vercise Cartesia Directional Lead. This is designed to support physicians to control the position, shape, range, position, and direction of electrical stimulation for the treatment of PD symptoms with highly personalized therapy.

In 2015, the first directional lead, The Vercise Cartesia Directional Lead was launched to the global market. The Vercise Gevia DBS System is a rechargeable device that features at least 15 years of battery life and Vercise PC DBS System is a non-rechargeable device which offers the similar stimulation capability, with estimated battery longevity of minimum three years with typical settings.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neurology devices market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Medtronic plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Abbott Laboratories

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boston Scientific Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. B. Braun Melsungen AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Stryker Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Neurology Devices Market by Product

5.1.1. Cerebrospinal Fluid Management Devices

5.1.2. Neurostimulation Devices

5.1.2.1. Deep Brain Stimulation

5.1.2.2. Spinal Cord Stimulation

5.1.2.3. Sacral Nerve Stimulation

5.1.2.4. Others

5.1.3. Interventional Neurology Devices

5.1.3.1. Aneurysm Coiling and Embolization

5.1.3.2. Neurothrombectomy Devices

5.1.3.3. Neurovascular Catheters

5.1.3.4. Cerebral Balloon Angioplasty &Stents

5.1.4. Neurosurgery Devices

5.1.4.1. Neuroendoscopes

5.1.4.2. Aneurysm Clips

5.1.4.3. Stereotactic Systems

5.1.4.4. Others

5.1.5. Others

5.2. Global Neurology Devices Market by End-User

5.2.1. Hospitals

5.2.2. Neurology Clinics

5.2.3. Ambulatory Surgical Centers (ASCs)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Allergan plc

7.3. Axonics Modulation Technologies, Inc.

7.4. B. Braun Melsungen AG

7.5. Boston Scientific Corp.

7.6. Dispomedica GmbH

7.7. Integra LifeSciences Holdings Corp.

7.8. Johnson & Johnson Services Inc.

7.9. LivaNova PLC

7.10. Magstim Co. Ltd.

7.11. Medtronic plc

7.12. Möller Medical GmbH

7.13. Natus Medical Inc.

7.14. NeuroPace, Inc.

7.15. Nevro Corp.

7.16. Nihon Kohden Corp.

7.17. Penumbra, Inc.

7.18. Saluda Medical Pty Ltd.

7.19. Smith & Nephew plc

7.20. Stryker Corp.

7.21. W. L. Gore & Associates, Inc.

1. GLOBAL NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL CEREBROSPINAL FLUID MANAGEMENT DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL NEUROSTIMULATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INTERVENTIONAL NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL NEUROSURGERY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL NEUROLOGY DEVICES I MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL NEUROLOGY DEVICES IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL NEUROLOGY DEVICES IN NEUROLOGY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL NEUROLOGY DEVICES IN AMBULATORY SURGICAL CENTERS (ASCs) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

14. NORTH AMERICAN NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

15. EUROPEAN NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. EUROPEAN NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. REST OF THE WORLD NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

22. REST OF THE WORLD NEUROLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL NEUROLOGY DEVICES MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL NEUROLOGY DEVICES MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL NEUROLOGY DEVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD NEUROLOGY DEVICES MARKET SIZE, 2018-2025 ($ MILLION)