Patient lifting Equipment Market

Global Patient lifting Equipment Market Size, Share & Trends Analysis Report by Product (Ceiling Lifts, Star & Wheelchair Lifts, Mobile Lifts, Sit-To-Stand Lifts, Bath & Pool Lifts, Lifting Slings, and Lifting Accessories), By End-User (Hospitals, Home Care Settings, Elderly Care Facilities, and Others), Forecast Period 2019-2025

The patient lifting equipment market is anticipated to grow at a CAGR of more than 10.0% during the forecast period. A patient lifting is an assistive device that enables a caregiver to transfer a patient with limited mobility from bed to chair. It is operated through hydraulic manual pumping and electric motor. The factors that are anticipated to create demand for patient lifting equipment including a growing geriatric population along with the large risk of injuries to caregivers in the process of manual handling of patients. However, the lack of training provided to the caregiver for the efficient operation of patient handling equipment is hampering the growth of the market during the forecast period.

Further, the implementation of regulations that ensure the safety of healthcare personnel during manual lifting has resulted in the growing adoption of patient lifting equipment. For instance, the regulations include lifting equations with recommended weight limits by the National Institute of occupational safety and Health (NIOSH) to ensure the effective handling of patients. Additionally, guidelines by Centers for Diseases Control and Prevention (CDC, manual handling Code of practice, Workplace safety and health Council and European Agency for Safety & Health at work are significantly growing the usage of patient handling equipment.

Segmental Outlook

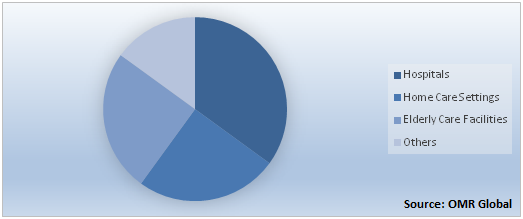

The global patient lifting equipment market is segmented on the basis of product and end-user. Based on product, the market is diversified into ceiling lifts, star & wheelchair lifts, mobile lifts, sit-to-stand lifts, bath & pool lifts, lifting slings and lifting accessories. Mobile lift is anticipated to have a significant share owing to its sling based and cost-effective and effortless transfer of heavy patients from one place to another without the need for professional as required for ceiling lifts. These benefits enable the adoption of mobile lifts in-home care settings and elderly care facilities. Ceiling lifts are expected to hold significant growth rates due to rising adoption of ceiling lifts in bariatric patient handling practices with the rising installation of ceiling lifts in hospitals. Based on end-user, the market is diversified into hospitals, home care settings, elderly care facilities, and others. Home care setting has a significant growth rate owing to growing focus on reducing healthcare cost and supportive government initiatives to promote home healthcare facilities which create the demand for patient lifting equipment.

The hospital will be the largest segment by End-User

Based on end-user, the market is segmented into hospitals, home care settings, elderly care facilities, and others. The hospital segment is expected to hold the largest share due to the increasing patient population, growing aging population, and the growing number of disabled people. Along with it, improvement in healthcare infrastructure and increasing preference of patients lifts over manual handling in hospitals is significantly boost the demand of patient lifting equipment in hospitals. Moreover, rising implementation of safety guidelines and government authorities follow these guidelines is driving the growth of the market.

Global Patient Lifting Equipment Market Share by End-User, 2018 (%)

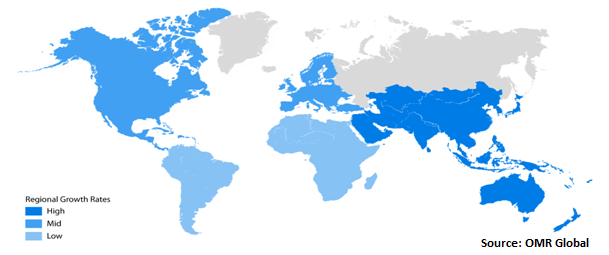

Regional Outlook

The global patient lifting equipment market is further segmented based on geography including North America, Europe, Asia-Pacific, and Rest of the World.North America is expected to hold a significant market share owing to supportive government policies for improvisation in healthcare infrastructure and medical facilities, increasing demand for home care equipment, the growing rate of musculoskeletal disorder and rising aging population is boosting the growth of the region during the forecast period. Moreover, disabilities from noncommunicable diseases, increasing prevalence of lifestyle disease and various initiatives taken by government programs and procedure for the safety of patients is propelling the demand for patient lifting equipment.

Europe also holds significant share in the patient lifting equipment industry due to the presence of a large number of healthcare facilities, rising demand for better services with supportive government policy and procedures for the safety of patients and trained professionals. Whereas, the market in the Asia-Pacific region is expected to be the fastest-growing region mainly due to the rising prevalence of chronic diseases, rising number of healthcare establishments, increasing demand for better healthcare services and advancement in technology.

Global Patient Lifting Equipment Market Growth, by Region 2019-2025

Market Players Outlook

The key players in the patient lifting equipment market includes Arjo, Inc., DJOGlobal, Drive DeVilbiss International, ETAC, Ltd., GF Health Products, Guldmann, Inc., Handicare Group AB, Hill-Rom Service, Inc., Invacare Corp., Medline Industries, Inc., Prism Medical UK., Benmor Medical Ltd., Getinge Group and Stryker Corp.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global patient lifting equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Arjo, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Handicare Group AB

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Invacare Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Guldmann, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Hill-Rom Service, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Patient Lifting Equipment Market by Product

5.1.1. Ceiling Lifts

5.1.2. Star & Wheelchair Lifts

5.1.3. Mobile Lifts

5.1.4. Sit-To-Stand Lifts

5.1.5. Bath & Pool Lifts

5.1.6. Lifting Slings

5.1.7. Lifting Accessories

5.2. Global Patient Lifting Equipment Market by End-User

5.2.1. Hospitals

5.2.2. Home Care Settings

5.2.3. Elderly Care Facilities

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arjo, Inc.

7.2. Benmor Medical, Ltd.

7.3. Colfax Corp. (DJOGlobal, Inc.)

7.4. Drive DeVilbissInternational

7.5. Etac Ltd.

7.6. Getinge AB

7.7. GF Health Products, Inc.

7.8. Guldmann, Inc.

7.9. Handicare Group AB

7.10. Hill-Rom Service, Inc.

7.11. Invacare Corp.

7.12. Joerns Healthcare, LLC

7.13. Medline Industries, Inc.

7.14. Prism Medical UK, Ltd.

7.15. Stryker Corp.

1. GLOBAL PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL CEILING LIFTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL STAR & WHEELCHAIR LIFTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL MOBILE LIFTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL SIT-TO-STAND LIFTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL BATH & POOL LIFTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL LIFTING SLINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL LIFTING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

10. GLOBAL HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL HOME CARE SETTINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ELDERLY CARE FACILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. NORTH AMERICA PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

16. NORTH AMERICAN PATIENT LIFTING EQUIPMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

17. EUROPE PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPE PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

19. EUROPE PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. ASIA PACIFIC PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA PACIFIC PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

22. ASIA PACIFIC PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

23. REST OF THE WORLD PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

24. REST OF THE WORLD PATIENT LIFTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL PATIENT LIFTING EQUIPMENTMARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL PATIENT LIFTING EQUIPMENT MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL PATIENT LIFTING EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. THE US PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PATIENT LIFTING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)