Personal Finance Software Market

Personal Finance Software Market Size, Share & Trends Analysis Report by Product Type (Web-based Software and Mobile-based Software), and by End-User (Small Business Users, and Individual Consumers) Forecast Period (2022-2028)

Personal finance software market is anticipated to grow at a considerable CAGR of 5.6% during the forecast period. Personal finance software offers functionalities such as tracking finances in real-time organizing the budget, managing bank records, accounting finances and assisting in making financial decisions to meet long-term financial goals. In addition to this, personal finance software assists in monitoring the bank accounts, credit cards, loans, investment balances, and late payments by providing scheduled reminders for bills and deposits. All these features support an individual in managing their finances and improving investments. Moreover, various banks, fintech companies, financial services, and insurance (BFSI) institutions adopt this software to manage their financial module, increase their productivity, reduce human error, and complete a complicated tasks more efficiently thereby fuelling the market growth.

Segmental Outlook

The global personal finance software market is segmented based on the product type and end-user. Based on the product type, the market is segmented into a web-based software, and mobile-based software. Based on the end-user the market is categorized into small business users and individual consumers. Among the end-user segment, the individual consumer segment is expected to cater to a prominent market share over the forecast period.

Among the end-user, the small business users segment is anticipated to exhibit the fastest CAGR during the forecast period owing to the upsurge in demand from small businesses for safe, secure, and efficient finance tracking solutions. The increasing requirement among small businesses to proficiently cope with financial challenges is propelling the segment growth. Personal finance software enables business owners to focus more on business activities as personal finance software can track all the liabilities, and assets effectively in a balance sheet and assist in creating tax reports on business income, deductions, and expenses. Moreover, it can aid in creating a custom report for tax schedules, tracks bills, and invoices automatically and as a result speeds up the workflow, which is invigorating the growth of the software industry. Due to increasing demand from businesses, major key players are also contributing to the market growth by offering finance management solutions specifically catering to the needs of small business users. For instance, in 2020, FriendlyScore announced the launch of the Personal Finance Management (PFM) toolkit, an agile software solution offering businesses the opportunity to deliver open banking analytics directly to their customers. It provides a host of features to businesses including open banking data enrichment and leading-edge financial modeling. It offers benefits such as tracking key financial metrics, viewing breakdowns of income and expenditure, monitoring financial credibility and affordability scores, obtain future predictions of balance.

Regional Outlooks

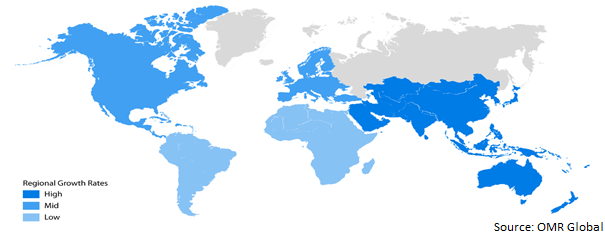

The global personal finance software market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to a prominent growth over the forecast period. However, the Asia-Pacific region is projected to experience considerable growth in the personal finance software market.

Global Personal Finance Software Market Growth, by Region 2022-2028

The North American Region Is Expected to Hold Prominent Share in the Global Personal Finance Software Market

The North American region is expected to hold a prominent share in the global personal finance software market owing to the presence of developed IT infrastructure, greater use of digital technology, and growing demand for effective financial management solutions. Moreover, the rising number of high-net-worth individuals is further increasing the adoption of finance software among the region’s population. The US has the presence of some major players in the market including Quicken Inc. and Personal Capital Corp.

Market Players Outlook

The major companies serving the global personal finance software market include Buxfer, Inc, Intuit Inc., Money Dashboard Ltd., Quicken Inc., You Need A Budget LLC, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2022, the smart European personal finance app, Plum announced its official launch in Belgium. The app is connected to nine major Belgian banks including BNP Paribas, ING, and Fortis. As the inflation rate continues to grow in all European countries, Plum enters the Belgium market at unsettling times, when people try to increase their financial stability and literacy.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global personal finance software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Buxfer, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Intuit Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. Money Dashboard Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Quicken Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. You Need A Budget LLC

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Development

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Personal Finance Software Market by Product Type

4.1.1. Web-based Software

4.1.2. Mobile-based Software

4.2. Global Personal Finance Software Market by End-User

4.2.1. Small Businesses Users

4.2.2. Individual Consumers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. BankTree Software Ltd.

6.2. BlackRock, Inc.

6.3. Buddi

6.4. doxo inc.

6.5. HomeBank

6.6. MechCAD.net

6.7. Microsoft Corp.

6.8. Mint (Intuit Inc.)

6.9. Moneyspire Inc.

6.10. Personal Capital Advisors Corporation ("PCAC")

6.11. PocketGuard, Inc.

6.12. PocketSmith Ltd.

6.13. The GnuCash Project

6.14. The Infinite Kind Ltd.

6.15. The Lampo Group, LLC d/b/a Ramsey Solutions

6.16. Tiller

6.17. TurboTax (Intuit Inc.)

6.18. WalletIQ, Inc.

1. GLOBAL PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL WEB-BASED PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MOBILE-BASED PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

5. GLOBAL PERSONAL FINANCE SOFTWARE FOR SMALL BUSINESSES USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL PERSONAL FINANCE SOFTWARE FOR INDIVIDUAL CONSUMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. NORTH AMERICAN PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

10. NORTH AMERICAN PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

11. EUROPEAN PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. EUROPEAN PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

13. EUROPEAN PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

14. ASIA-PACIFIC PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. REST OF THE WORLD PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. REST OF THE WORLD PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

19. REST OF THE WORLD PERSONAL FINANCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL PERSONAL FINANCE SOFTWARE MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL WEB-BASED PERSONAL FINANCE SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL MOBILE-BASED PERSONAL FINANCE SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL PERSONAL FINANCE SOFTWARE MARKET SHARE BY END-USER, 2021 VS 2028 (%)

5. GLOBAL PERSONAL FINANCE SOFTWARE FOR SMALL BUSINESSES USERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL PERSONAL FINANCE SOFTWARE FOR INDIVIDUAL CONSUMERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL PERSONAL FINANCE SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. US PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

9. CANADA PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

10. UK PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

11. FRANCE PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

12. GERMANY PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

13. ITALY PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

14. SPAIN PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

15. REST OF EUROPE PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

16. INDIA PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

17. CHINA PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

18. JAPAN PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

19. SOUTH KOREA PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF ASIA-PACIFIC PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD PERSONAL FINANCE SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)