Polyethylene Terephthalate (PET) Packaging Market

Polyethylene Terephthalate (PET) Packaging Market Size, Share & Trends Analysis Report by Product Types (Bottles and Jars, Bags and Pouches, Trays, and Lids/Caps and Closures), By Packaging (Rigid, and Flexible), By End-User (Food and Beverage, Pharmaceuticals, Personal care, and cosmetics, Industrial goods, Household Products, and Others) Forecast Period 2024-2031

The global market for polyethylene terephthalate (PET) packaging market is projected to have a considerable CAGR of around 6.0% during the forecast period. Polyethylene terephthalate (PET) is the most common plastic resin of polyester made from the combination of two monomers. PET is a remarkable cost and energy-efficient packaging material, which possesses properties of strength versatility, and recyclability, thus being used in various end-use industries such as packaging and textile. Despite the multiple environmental concerns associated with PET use, it is far superior to steel, aluminum, glass, and other packaging materials due to its high weight-bearing capability and lightweight, which decreases transportation costs by consuming less space and weight. The polyethylene terephthalate market also surged due to increasing demand for the material in food and beverage packaging, such as carbonated soft drink containers. Due to its adaptability in any shape and size, polyethylene terephthalate is the only material that can meet the growing demand for bottled drinks and glass and metal container replacements.

Segmental Outlook

The global polyethylene terephthalate (PET) packaging market is segmented based on product type, packaging, and end-user. Based on the product type, the market is further classified into bottles and jars, bags and pouches, trays, and lids/caps and closures. further, based on the packaging the market is classified into rigid, and flexible. Based on end-user, the market is segregated into food and beverage, pharmaceuticals, personal care and cosmetics, industrial goods, household products, and others.

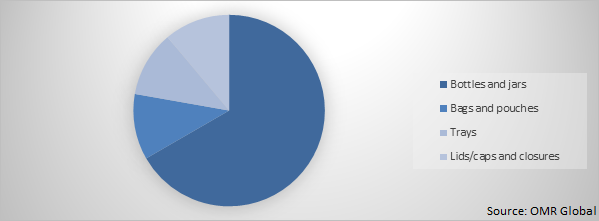

Global Polyethylene Terephthalate (PET) Packaging Market Share by product type, 2023(%)

The Bottles And Jars Segment Is Considered The Dominating Segment in the Global Polyethylene Terephthalate (PET) Packaging Market.

Among product types, the bottles & jars segment is estimated as dominating segment during the forecast period owing to the factor that PET is often used in food packaging due to its strong barrier properties against water vapor, dilute acids, alcohols, and oils. PET is also shatter-resistant, moderately flexible, and easy to recycle. Moreover, the emerging e-commerce industry across the globe is also contributing significantly to the market's growth as transporting PET bottles and jars is easy from a logistics point of view. Moreover, PET bottles are light and do not require additional care, the cost of transportation is significantly reduced. Therefore, the growing inclination of people towards e-commerce is expected to boost the market demand over the forecast period.

Regional Outlook

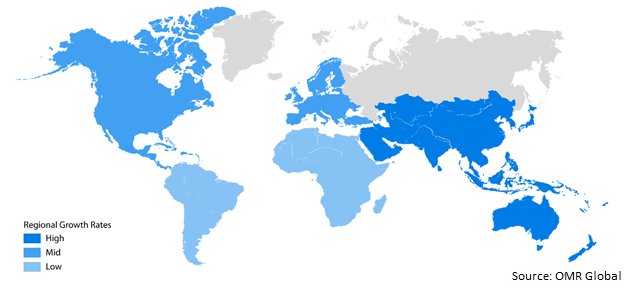

Geographically, the global polyethylene terephthalate (PET) packaging market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is one of the fastest-growing food packaging markets as there is a presence of large packaging companies, such as Amcor Ltd and Mondi PLC. According to the Flexible Packaging Association, flexible packaging represents approximately 19% of the total $177 billion US packaging industry. PET food, in particular, adopted flexible packaging in large numbers, due to convenience factors, such as pouch packaging, fitments for pet food, and innovative slider closures. According to the American Pet Products Association, pet product sales on online channels increased by 57% in the US from 2018 to 2019.

Global Polyethylene Terephthalate (PET) Packaging Market Growth, by region 2024-2031

North America to Witness Significant Growth in the Global Polyethylene Terephthalate (PET) Packaging Market

Geographically, North America is projected to hold a significant growth in the global polyethylene terephthalate (PET) packaging market. The US is one of the largest consumers of polyethylene terephthalate (PET) in North America due to the abundant availability of raw materials and low cost of production that supports the production growth of the engineering plastics, such as PET. Moreover, the use of PET products in the packaging sector is increasing at a tremendous rate, owing to their benefits over conventional packaging plastics. The increasing demand from industries such as consumer goods, food and beverage, and others for packaging materials is growing in major economies of the region due to the rise in exports and domestic consumption. Similarly, the growing demand for high-quality water and health-conscious drinking patterns are predicted to boost bottled water use, which would have a direct influence on the region's packaging market.

Market Players Outlook

The key players in the polyethylene terephthalate (PET) packaging market contribute significantly by providing different types of products and increasing their geographical presence across the globe. Gerresheimer AG, Amcor plc, Sonoco Products Co, Berry Global Inc., Graham Packaging Co among others. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In November 2020, Amcor developed the lightest 900-ml polyethylene terephthalate (PET) bottle for edible oil in Brazil with the help of advanced technology and design technology. This new bottle for Bunge’s Oleo de soja Soya brand represents Amcor’s entry into the edible oil market in Brazil. Additionally, this new bottle is a huge technological achievement as they were able to replicate the current bottle’s shape and specifications at a lighter weight.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Polyethylene Terephthalate (PET) Packaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global PET Packaging Industry

• Recovery Scenario of Global PET Packaging Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global PET Packaging Market by Product Type

5.1.1. Bottles and Jars

5.1.2. Bags and Pouches

5.1.3. Trays

5.1.4. Lids/Caps and Closures

5.2. Global PET Packaging Market by Packaging

5.2.1. Rigid

5.2.2. Flexible

5.3. Global PET Packaging Market by End-User

5.3.1. Food and Beverage

5.3.2. Pharmaceuticals

5.3.3. Personal care and cosmetics

5.3.4. Industrial goods

5.3.5. Household Products

5.3.6. Others (consumer durables)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amcor Ltd.

7.2. Resilux NV

7.3. Gerresheimer AG

7.4. Berry Global Group Inc.

7.5. Silgan Holdings Inc.

7.6. Graham Packaging Co

7.7. GTX Hanex Plastic Sp. z o.o.

7.8. Dunmore Corp

7.9. Comar LLC

7.10. Sonoco Products Co

7.11. Huhtamaki OYJ

7.12. Nampak Ltd

7.13. RTP Co

7.14. BASF SE

7.15. Lanxess Corp

7.16. PET Processors LLC

7.17. M&G Group

7.18. DuPont de Nemours, Inc.

1. GLOBAL PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2024-2031 ($ MILLION)

2. GLOBAL PET PACKAGING FOR BOTTLES AND JARS MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

3. GLOBAL PET PACKAGING FOR BAGS AND POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

4. GLOBAL PET PACKAGING FOR TRAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

5. GLOBAL PET PACKAGING FOR LIDS/CAPS AND CLOSURES MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

6. GLOBAL PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2024-2031($ MILLION)

7. GLOBAL RIGID PET PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031($ MILLION)

8. GLOBAL FLEXIBLE PET PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

9. GLOBAL FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2024-2031 ($ MILLION)

10. GLOBAL PET PACKAGING IN FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

11. GLOBAL PET PACKAGING IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

12. GLOBAL PET PACKAGING IN PERSONAL CARE AND COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031($ MILLION)

13. GLOBAL PET PACKAGING IN INDUSTRIAL GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

14. GLOBAL PET PACKAGING IN HOUSEHOLD PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

15. GLOBAL PET PACKAGING IN OTHERS END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2024-2031 ($ MILLION)

16. GLOBAL PET PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2024-2031 ($ MILLION)

17. NORTH AMERICAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2024-2031 ($ MILLION)

18. NORTH AMERICAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2024-2031($ MILLION)

19. NORTH AMERICAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2024-2031 ($ MILLION)

20. NORTH AMERICAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2024-2031 ($ MILLION)

21. EUROPEAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2024-2031 ($ MILLION)

22. EUROPEAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2024-2031 ($ MILLION)

23. EUROPEAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2024-2031 ($ MILLION)

24. EUROPEAN PET PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2024-2031 ($ MILLION)

25. ASIA-PACIFIC PET PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2024-2031 ($ MILLION)

26. ASIA-PACIFIC PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2024-2031 ($ MILLION)

27. ASIA-PACIFIC PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING,2024-2031 ($ MILLION)

28. ASIA-PACIFIC FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER,2024-2031($ MILLION)

29. REST OF THE WORLD PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2024-2031 ($ MILLION)

30. REST OF THE WORLD PET PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2024-2031 ($ MILLION)

31. REST OF THE WORLD PET PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2024-2031 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PET PACKAGING MARKET, 2024 VS 2031(% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PET PACKAGING MARKET BY SEGMENT, 2024 VS 2031(% MILLION)

3. RECOVERY OF GLOBAL PET PACKAGING MARKET,2024 VS 2031 (%)

4. GLOBAL PET PACKAGING MARKET SHARE BY PRODUCT TYPE, 2024 VS 2031 (%)

5. GLOBAL PET PACKAGING MARKET SHARE BY PACKAGING, 2024 VS 2031 (%)

6. GLOBAL PET PACKAGING MARKET SHARE BY END-USER, 2024 VS 2031 (%)

7. GLOBAL PET PACKAGING MARKET SHARE BY REGION, 2024 VS 2031 (%)

8. GLOBAL PET PACKAGING FOR BOTTLES AND JARS MARKET SHARE BY REGION, 2024 VS 2031 (%)

9. GLOBAL PET PACKAGING FOR BAGS AND POUCHES MARKET SHARE BY REGION, 2024 VS 2031 (%)

10. GLOBAL PET PACKAGING FOR TRAYS MARKET SHARE BY REGION, 2024 VS 2031 (%)

11. GLOBAL PET PACKAGING FOR LIDS/CAPS AND CLOSURES MARKET SHARE BY REGION, 2024 VS 2031 (%)

12. GLOBAL RIGID PET PACKAGING MARKET SHARE BY REGION, 2024 VS 2031 (%)

13. GLOBAL FLEXIBLE PET PACKAGING MARKET SHARE BY REGION, 2024 VS 2031 (%)

14. GLOBAL PET PACKAGING IN FOOD AND BEVERAGE MARKET SHARE BY REGION, 2024 VS 2031 (%)

15. GLOBAL PET PACKAGING IN PHARMACEUTICALS MARKET SHARE BY REGION, 2024 VS 2031 (%)

16. GLOBAL PET PACKAGING IN PERSONAL CARE AND COSMETICS MARKET SHARE BY REGION, 2024 VS 2031 (%)

17. GLOBAL PET PACKAGING IN INDUSTRIAL GOODS MARKET SHARE BY REGION, 2024 VS 2031 (%)

18. GLOBAL PET PACKAGING IN HOUSEHOLD PRODUCTS MARKET SHARE BY REGION, 2024 VS 2031 (%)

19. GLOBAL PET PACKAGING IN OTHERS END-USER MARKET SIZE, 2024-2031 ($ MILLION)

20. US PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

21. CANADA PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

22. UK PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

23. FRANCE PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

24. GERMANY PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

25. ITALY PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

26. SPAIN PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

27. ROE PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

28. INDIA PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

29. CHINA PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

30. JAPAN PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

31. ASEAN PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

32. SOUTH KOREA PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

33. REST OF ASIA-PACIFIC PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)

34. REST OF THE WORLD PET PACKAGING MARKET SIZE, 2024-2031 ($ MILLION)