Premium Alcoholic Beverage Market

Global Premium Alcoholic Beverage Market Size, Share & Trends Analysis Report, by Type (Beer, Spirit, Wine), By Packaging (Canned, Glass Bottle, and Others), and Forecast, 2020-2026

The premium alcoholic beverage market is anticipated to show at a lucrative growth at a CAGR of around 7.0% during the forecast period. An increase in the youth population, rising per capita disposable income, and innovation to the alcoholic product range are some of the major factors for the growth of the market. Moreover, shifting toward online sales channels is also providing access to the premium beverage market. The alcohol market is a mature market and as per OMR analysis, it is expected to grow at a CAGR of around 3% during the forecast period and rising demand of premium alcoholic beverage is one of the key factors for the growth of the market as it is augmenting at a CAGR of around 7.0% during the forecast period.

However, increasing preference for non-alcoholic beverages, health-related issues due to high consumption of alcohol are some of the major restraining factors for the market growth. Moreover, the impact of the COVID-19 on alcoholic consumption is also coved in the report. During the lockdown, restaurants, pubs, sports venues, beaches, and other tourist places have been shut down which are the major places of retail point of sales of premium alcohol. Moreover, as the people were more residing in their homes during the lockdown, the online sales channel has experienced a boom in the alcohol orders. Even in some countries, alcohol consumption has been increased during the lockdown. For instance, as per a survey by Opinium for Direct Line Life Insurance, with a sample of 2,000 UK’s adults, 50% of the drinkers have increased in the number of days of consuming alcohol per week whereas around a third of the responders have reported an increase in binge drinking. However, the type of alcohol is not mentioned in the survey.

Market Segmentation

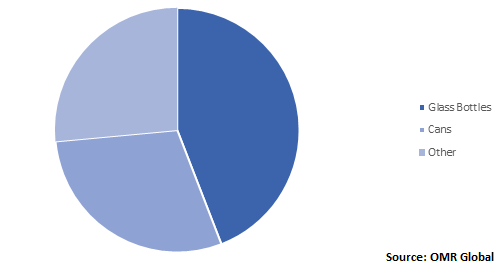

The premium alcoholic beverage market is segmented on the basis of type, and packaging. By type, the market is further segmented into beer, spirit, and wine. Beer is expected to hold a major market share during the forecast period with significant market growth during the forecast period. By packaging, the market is segmented into canned, glass bottle, and others. Glass bottle is expected to hold a major market share with substantial growth during the forecast period.

Global Premium Alcoholic Beverage Market Share by Packaging, 2019 (%)

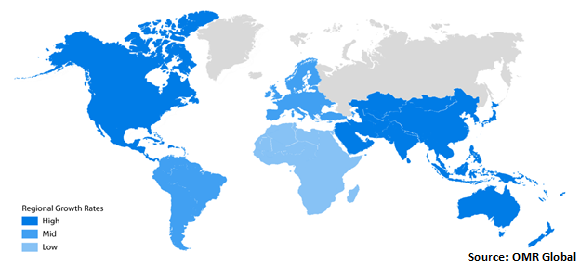

Regional Outlook

On the basis of geography, the global premium alcoholic beverage market is studied in North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America and Europe are the mature markets of the premium alcoholic beverage and is expected to hold a major market share in the global market. High purchasing power, high consumption of alcohol are some of the major factors for the significant market share of these regions.

Asia-Pacific is expected to show lucrative growth during the forecast period. Increasing disposable income, the high share of the young population, and rising acceptance of alcohol among the younger people are some of the major causes of significant growth of the region. Emerging economies in Asia-Pacific such as China and India are expected to show significant growth during the forecast period. However, a downfall in 2020’s revenue can be witnessed in India as during the nationwide lockdown due to the COVID-19 pandemic, the sales of alcoholic drinks were also restricted in the country.

Global Premium Alcoholic Beverage Market Growth, by Region 2020-2026

Market Players Outlook

Some of the major market players operating in the premium alcoholic beverage market include Asahi Group Holdings, Ltd., Anheuser-Busch Inbev SA/NV, Bacardi, Ltd., Brown-Forman Corp., Carlsberg Breweries A/S, Constellation Brands Inc., Diageo PLC, Heineken Holding N.V., Pernod Ricard SA, Suntory Holdings Ltd., United Breweries, Ltd. and so on. These market players are adopting various growth strategies including mergers and acquisitions, product launches, expansions, partnerships & collaborations, innovative packaging, and unique flavors to gain a competitive edge in the market. For instance, in January 2020 Constellation Brands Inc., acquired a minority stake in PRESS Premium Alcohol Seltzer (PRESS). The company’s beverage portfolio includes premium flavors such as Blackberry Hibiscus, Pomegranate Ginger, Lime Lemongrass, and Grapefruit Cardamom.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Premium Alcoholic Beverage market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Pernod Ricard SA

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Diageo PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Bacardi, Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Brown-Forman Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Anheuser-Busch Inbev Sa/Nv

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Premium Alcoholic Beverage Market by Type

5.1.1. Beer

5.1.2. Wine

5.1.3. Spirit

5.2. Global Premium Alcoholic Beverage Market by P

5.2.1. Canned

5.2.2. Glass Bottle

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Rest of North America

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Anheuser-Busch Inbev SA/NV

7.2. Asahi Group Holdings, Ltd.

7.3. Bacardi, Ltd.

7.4. Bronco Wine Co.

7.5. Brown-Forman Corp.

7.6. Carlsberg Breweries A/S

7.7. Constellation Brands Inc.

7.8. Davide Campari-Milano S.p.A

7.9. DGB (Pty) Ltd.

7.10. Diageo PLC

7.11. Halewood International, Ltd.

7.12. Heineken Holding N.V.

7.13. Kirin Holdings Co. Ltd.

7.14. Molson Coors Brewing Co.

7.15. Pernod Ricard SA

7.16. Suntory Holdings Ltd.

7.17. The Boston Beer Co, Inc.

7.18. The Wine Group, Inc.

7.19. United Breweries, Ltd.

7.20. Wuliangye Yibin Co. Ltd.

1. GLOBAL PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PREMIUM BEER MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL PREMIUM WINE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL PREMIUM SPIRIT MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

5. GLOBAL PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2019-2026 ($ MILLION)

6. GLOBAL CANNED PREMIUM ALCOHOLIC DRINKS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL GLASS BOTTLE PREMIUM ALCOHOLIC DRINKS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

8. GLOBAL OTHERS PREMIUM ALCOHOLIC DRINKS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

9. NORTH AMERICAN PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

11. NORTH AMERICAN PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2019-2026 ($ MILLION)

12. EUROPEAN PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2019-2026 ($ MILLION)

15. ASIA PACIFIC PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA PACIFIC PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. ASIA PACIFIC PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2019-2026 ($ MILLION)

18. REST OF THE WORLD PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. REST OF THE WORLD PREMIUM ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2019-2026 ($ MILLION)

1. GLOBAL PREMIUM ALCOHOLIC BEVERAGE MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL PREMIUM ALCOHOLIC BEVERAGE MARKET SHARE BY PACKAGING, 2019 VS 2026 (%)

3. GLOBAL PREMIUM ALCOHOLIC BEVERAGE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC PREMIUM ALCOHOLIC BEVERAGE MARKET SIZE, 2019-2026 ($ MILLION)