Preparative and Process Chromatography Market

Preparative and Process Chromatography Market Size, Share & Trends Analysis Report, by Type (Preparative Chromatography and Process Chromatography), by End-User (Biotechnology and Pharmaceutical Companies, Food and Nutrition Industry, Research Institutes and Laboratories, and Others), and Forecast, 2019-2025

Preparative and process chromatography market is growing significantly at a CAGR of 6.2% during the forecast period. Chromatography is referred to as the process of separation of the mixture in which the mixture is passed through two phases i.e. mobile phase and stationary phase. The fluid is dissolved into the fluid (mobile phase) and passed through another material (stationary phase) and the constituents of the mixture travel at different speeds, resulting in the separation of the components. The preparative chromatography involves the isolation and purification of the specific substance from the sample, whereas, process chromatography involves the separation of the component of the sample. Moreover, mixtures that are being subjected to separation may be aqueous (soluble in water) and non-aqueous (soluble in oil, paint or any other solvent).

Preparative and process chromatography finds its applications in various fields such as synthetic chemistry for the fingerprinting of peptides, proteins, and oligonucleotides, in cosmetics for the detection of flavors and fragrances or odoriferous substances and in environmental chemistry, pharmaceuticals, and food industry. The increasing prevalence of appendicitis along with the rising investment in biotechnology and pharmaceuticals industry by major players tends to drive the preparative and process chromatography market. However, the with the improvements in chromatography products, the inclusion of modern technologies have led the increase overall cost of the product resulting in the manufacturer’s preference for alternate separation techniques which may hinder the growth of the market.

Segmental Outlook

The preparative and process chromatography market is segmented on the basis of type and end-user. Based on the type, the market is segmented into preparative and process chromatography. Based on end-user, the market is segmented into biotechnology and pharmaceutical companies, food and nutrition industry, research institutes and laboratories, and others which include government. The government uses preparative and process chromatography for environmental testing and forensic testing.

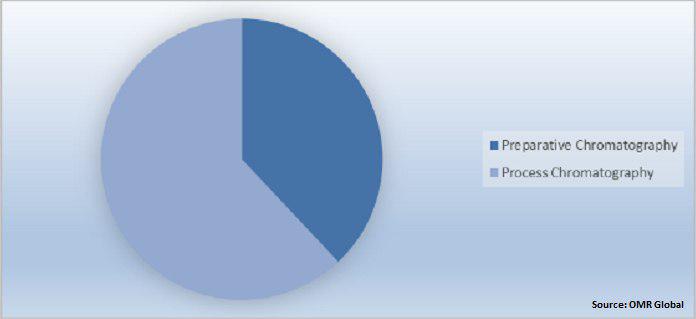

Preparative and Process Chromatography Market Share by Type, 2018(%)

Preparative chromatography segment is estimated to have a significant market size

Preparative chromatography segment is expected to register significant market share over the forecast period owing to the preferred solution for the purification of small drugs and valuable chemical components at the <10 kg-level. Technological improvement in computer technology along with the development of nonchiral and chiral stationary phases have surged the demand for preparative chromatography. Preparative chromatography finds its application in various industry verticals such as pharmaceutical, biotechnology, biomedical, energy, food & cosmetics along with many others. Moreover, favorable government initiatives to modernize the regulation guidelines of pharmaceutical manufacturing is also driving the market growth. Additionally, the increasing demand for liquid preparative chromatography techniques has accelerated the demand for preparative chromatography.

Significant application in forensic science

Application of preparative and process chromatography in forensic testing is growing owing to the collection and analysis of evidence pertaining to a court case or an investigation. Chromatography is used in forensic science for the separation of compounds. Various types of chromatography techniques are involved in forensic testing such as planar chromatography, high-performance liquid chromatography (HPLC), and gas chromatography. Basic planar chromatography is used to identify two identical ink samples. Planar chromatography is further used to identify the stolen money by detecting the ink on the thief's hands.

HPLC is used to analyze explosives as a different substance used in explosives will have different retention times. Various drugs are also detected with the help of HPLC resulting in the increased demand for preparative and process chromatography in forensic tests. Gas chromatography is used to identify if the deceased person has consumed any alcohol or drugs prior to death as well as samples from the crime scene such as blood and fibers from clothes can also be analyzed to further aid the investigation.

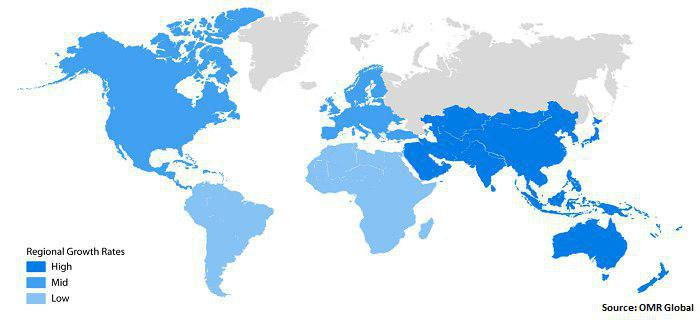

Regional Outlook

Moreover, the preparative and process chromatography market is further classified based on geography including North America, Europe, Asia-Pacific and Rest of the World (RoW). North America is expected to register significant growth over the forecast period owing to rising investment by major players towards research & development programs in the region. Presence of major players in the region tends to increase the market share of preparative and process chromatography in North America. Moreover, technological improvement in biotechnology research along with the favorable government initiatives has led to the increasing demand for preparative and process chromatography.

Preparative and Process Chromatography Market Growth, by Region 2019-2025

- In October 2018, Servier has launched InnoPreP, a new preparative chromatography service offered under its contract development and manufacturing business. The new service offered the company to extend the company’s geographical outreach.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global preparative and process chromatography market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. GE Healthcare

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Merck KGaA

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Danaher Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Agilent Technologies, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Thermo Fisher Scientific, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Preparative and Process Chromatography Market by Type

5.1.1. Preparative Chromatography

5.1.2. Process Chromatography

5.2. Global Preparative and Process Chromatography Market by End-User

5.2.1. Biotechnology and Pharmaceutical Companies

5.2.2. Food & Nutrition Industry

5.2.3. Research Institutes and Laboratories

5.2.4. Other End-User

6. REGIONAL ANALYSIS

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. COMPANY PROFILES

7.1. Agilent Technologies, Inc.

7.2. Bio-Rad Laboratories, Inc.

7.3. Bruker Corp.

7.4. BUCHI Labortechnik AG

7.5. Buck Scientific Instrument Manufacturing Co.

7.6. Chiral Technologies, Inc.

7.7. Daicel Corp.

7.8. Danaher Corp.

7.9. GE Healthcare

7.10. Ingenieria Analítica, S.L.

7.11. LES LABORATORIES SERVIER SAS

7.12. Merck KGaA

7.13. Novasep SAS

7.14. Parker Hannifin Corp.

7.15. PerkinElmer, Inc.

7.16. Shimadzu Corp.

7.17. SRI Instruments

7.18. Teledyne ISCO

7.19. Thermo Fisher Scientific, Inc.

7.20. Waters Corp.

LIST OF TABLES

1. GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL PREPARATIVE CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

5. GLOBAL BIOTECHNOLOGY AND PHARMACEUTICALS COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL FOOD NUTRITION INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL RESEARCH INSTITUTES AND LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. EUROPEAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. REST OF THE WORLD PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

LIST OF FIGURES

1. GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

11. REST OF EUROPE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)