Prosthetics and Orthotics Market

Global Prosthetics and Orthotics Market Size, Share & Trends Analysis Report, By Type (Orthotics {Upper Limb, Lower Limb, and Spinal Orthotics}, By Prosthetics {Upper Extremity, Lower Extremity, Liners, Sockets, and Modular Components}) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global prosthetics and orthotics market is estimated to grow at a CAGR of nearly 4.8% during the forecast period. Some key factors contributing to the growth of the market include the rising number of sports injuries, rising number of accidents, and the significant number of patients with musculoskeletal conditions. As per the Versus Arthritis, in 2017, musculoskeletal conditions including back pain and arthritis affected nearly 18.8 million people in UK. Low back and neck were the major cause of ill health across all age group individuals. Musculoskeletal conditions are also associated with a work-related injury.

For instance, as per the Health and Safety Executive (HSE), in 2018/2019, the total number of cases related to work-related musculoskeletal disorders was 498,000 in UK. Construction and agriculture, forestry and fishing have the highest rates of work-related musculoskeletal disorders in UK. The significant prevalence of musculoskeletal conditions increases the need for orthotics for the treatment of foot, leg, or back problems. The orthosis works to control deformed or weakened parts of the body. It may be used in several parts of the body such as the lower and upper limbs, spine, or cranium. Orthoses have been designed to significantly restore the bones of the skull among infants with positional plagiocephaly.

An orthosis enables to control and immobilize a joint, extremity, or body portion. It supports rehabilitation from fractures after the removal of a cast and corrects the shape and function of the body, to reduce pain and facilitate movement capability. Prosthetics refers to the use of artificial limbs to augment the function and lifestyle of individuals with limb loss. It is a unique combination of suitable design, materials, and alignment, to fulfill the functional requirements of the individual. It is an artificial alternative for a limb lost due to illness, accident, congenital defect, and wartime injury.

Market Segmentation

The global prosthetics and orthotics market is segmented based on type, including orthotics and prosthetics. Orthotics are classified into the upper limb, lower limb, and spinal orthotics. Prosthetics are classified into upper extremity, lower extremity, liners, sockets, and modular components.

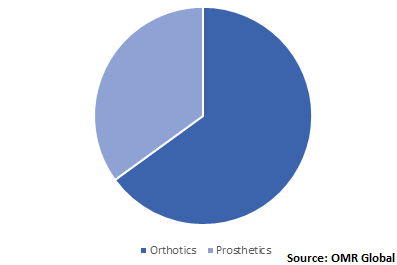

Orthotics are estimated to hold the major share in 2018

Orthotic devices are anticipated to hold a significant share in the type segment as these are normally used for the treatment of several conditions of the foot and ankle. Orthotic devices are recommended for multiple reasons, such as preventing, correcting, or accommodating foot deformities, supporting and aligning the ankle or foot, and improving the total function of the ankle or foot. These solutions can be highly potential at minimizing pain and addressing other postural or physical problems. The increasing number of spine injuries and rising incidences of osteoarthritis is further encouraging the demand for orthotics. It allows to increase spinal stability in all anatomical planes and supports the correction of spinal deformities.

Global Prosthetics and Orthotics Market Share by Type, 2018 (%)

Regional Outlook

The global prosthetics and orthotics market is segmented into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2018, North America is anticipated to hold the largest share in the market owing to the significant prevalence of osteoporosis and the rising number of sports injuries are further strengthening the market growth in the region. As per the National Safety Council (NSC), in the US, in 2017 personal exercise accounted for nearly 526,000 injuries, which is among the largest category of sports and recreation injuries.

This is followed by basketball with nearly 500,000 injuries, while bicycling ranked third, with 457,000 injuries and football ranked fourth, with 341,000 injuries. This, in turn, results in the demand for orthotics and prosthetics to stabilize and correct deformities and restore the normal functioning of the body part. Asia-Pacific is estimated to witness potential growth during the forecast period owing to the increasing prevalence of musculoskeletal disorders and significant ageing population base in the region. The increasing number of accidents is expected to further encourage the demand for prosthetics and orthotics.

Global Prosthetics and Orthotics Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include Össur, Ottobock SE & Co. KGaA, Zimmer Biomet Holdings, Inc., Fillauer LLC, and Shapeways, Inc. Mergers and acquisitions, partnerships and collaborations, and product launches are considered as crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in March 2019, Ottobock acquired a majority stake in medica OT and thereby gained an effective partner in the area of 3D printing. medica OT is engaged in the marketing of 3D-printed orthoses, such as dynamic ankle-foot orthoses that are designed especially for children. Along with medica OT, the company will work on key advances in digitization in the orthopedic field.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global prosthetics and orthotics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Össur

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Ottobock SE & Co. KGaA

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Zimmer Biomet Holdings, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Fillauer LLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Shapeways, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Prosthetics and Orthotics Market by Type

5.1.1. Orthotics

5.1.1.1. Upper Limb

5.1.1.2. Lower Limb

5.1.1.3. Spinal Orthotics

5.1.2. Prosthetics

5.1.2.1. Upper Extremity

5.1.2.2. Lower Extremity

5.1.2.3. Liners

5.1.2.4. Sockets

5.1.2.5. Modular Components

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. aNImaKe d.o.o.’

7.2. Bauerfeind USA Inc.

7.3. Blatchford Ltd.

7.4. Fillauer LLC

7.5. Footlabs Ltd.

7.6. Howard Orthopedics, Inc.

7.7. Invent Medical Group

7.8. medi GmbH & Co. KG

7.9. Mercuris GmbH

7.10. Össur

7.11. OT4 Orthopädietechnik GmbH

7.12. Ottobock SE & Co. KGaA

7.13. Podfo Ltd.

7.14. Scientifeet

7.15. Shapeways, Inc.

7.16. Ultraflex Systems, Inc.

7.17. WillowWood Global LLC

7.18. Xkelet Holdings Ltd.

7.19. Zimmer Biomet Holdings, Inc.

1. GLOBAL PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL ORTHOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PROSTHETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

5. NORTH AMERICAN PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

6. NORTH AMERICAN PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

7. EUROPEAN PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

8. EUROPEAN PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

9. ASIA-PACIFIC PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. ASIA-PACIFIC PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

11. REST OF THE WORLD PROSTHETICS AND ORTHOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

1. GLOBAL PROSTHETICS AND ORTHOTICS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL PROSTHETICS AND ORTHOTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

5. UK PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD PROSTHETICS AND ORTHOTICS MARKET SIZE, 2018-2025 ($ MILLION)