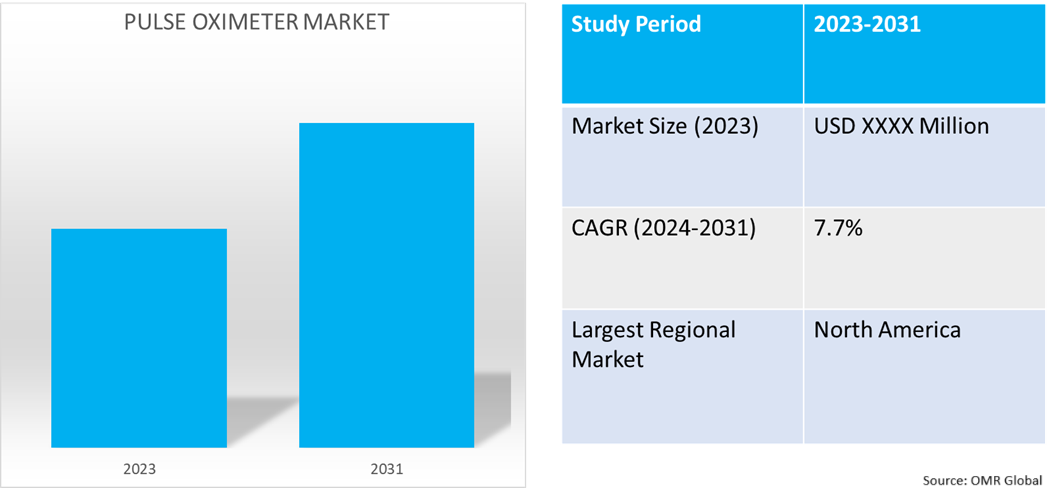

Pulse Oximeter Market

Pulse Oximeter Market Size, Share & Trends Analysis Report by Product Type (Portable Pulse Oximeters (Fingertip And Wearable), Handheld Oximeter, and Others (Tabletop Pulse Oximeters, Pediatric and Neonatal Oximeters, and Smartphone-Connected Oximeters)), and by End-User (Hospitals, Homecare, and Others (ASCs and Clinics)) Forecast Period (2024-2031)

Pulse oximeter market is anticipated to grow at a CAGR of 7.7% during the forecast period (2024-2031). The increase in chronic respiratory illnesses has increased the need for pulse oximeters, especially for remote use. The development of technology, most notably in the application of AI algorithms and Bluetooth, has made it more efficient in its performance. It further has telemedicine applications for chronic disease management and emergency services. Allowances by regulatory bodies assist in personal healthcare by connecting health monitoring equipment.

Market Dynamics

Increasing Prevalence of Respiratory and Cardiovascular Diseases

The rise in respiratory and cardiovascular diseases such as chronic obstructive pulmonary disease (COPD), asthma, and COVID-19 necessitates continuous oxygen monitoring devices. According to the American Heart Association, in June 2024, the prevalence of cardiovascular disease in the US is projected to rise significantly by 2050, with an estimated 61% of adults, or over 184 million individuals, expected to be affected. The increase is attributed to factors such as aging, diverse populations, and rising rates of high blood pressure, which are expected to grow from 51.2% to 61.0% from 2020 to 2050. Additionally, the prevalence of CVD, excluding high blood pressure, is anticipated to rise from 11.3% to 15.0%, impacting 45 million adults, up from 28 million in 2020.

- In August 2024, Prevounce Health launched its first blood oxygen device for remote patient monitoring, Pylo OX1-LTE. The clinically validated device offers advantages over other pulse oximeters for chronic respiratory conditions, COPD, asthma, COVID-19, and heart rate monitoring, even in weak signal areas.

Technological Development in Pulse Oximeters

The market for pulse oximeters has been growing widely, mainly owing to the increasing demands for portable, accurate, and easy-to-use devices both in clinical and home care. Recent developments in wearables and wireless technologies have allowed pulse oximeters to enter consumer markets and remote patient settings. Features such as automatic shutdown, improved display, and timely alerts are just a few among many that contribute to the higher uptake of such devices while improving patient monitoring and at large, healthcare management. For instance, in February 2023, Healers Force introduced the Healers Force FS series Pulse Oximeter that can be used in the measurement of saturation of blood oxygen in residents. The device is compact and lightweight and is equipped with an automatic shutdown and battery low voltage indication. It additionally comes equipped with a color display screen and allows prompt function with limits.

Market Segmentation

- Based on the product type, the market is segmented into portable pulse oximeters (fingertip and wearable), handheld oximeters, and others.

- Based on the end-user, the market is segmented into hospitals, home care, and others (ASCs and clinics).

Portable Pulse Oximeters (Fingertip And Wearable) Segment is projected to Hold the Largest Market Share

Portable pulse oximeters are small, non-invasive instruments that measure pulse rate and blood oxygen saturation. It can be useful in many applications due to its user-friendly interface and ability to provide accurate, real-time data. The devices comprise interfaces with color displays, alarms, and low-battery notifications, in addition, to running on either rechargeable or disposable batteries. For collecting and storing data, several models integrate with smartphone apps. It can be easily controlled by individuals without medical expertise and is widely utilized in a variety of disciplines, including pediatric care, occupational health, sports, emergency services, hospital settings, aircraft, home healthcare, remote monitoring, sleep research, and post-surgical care.

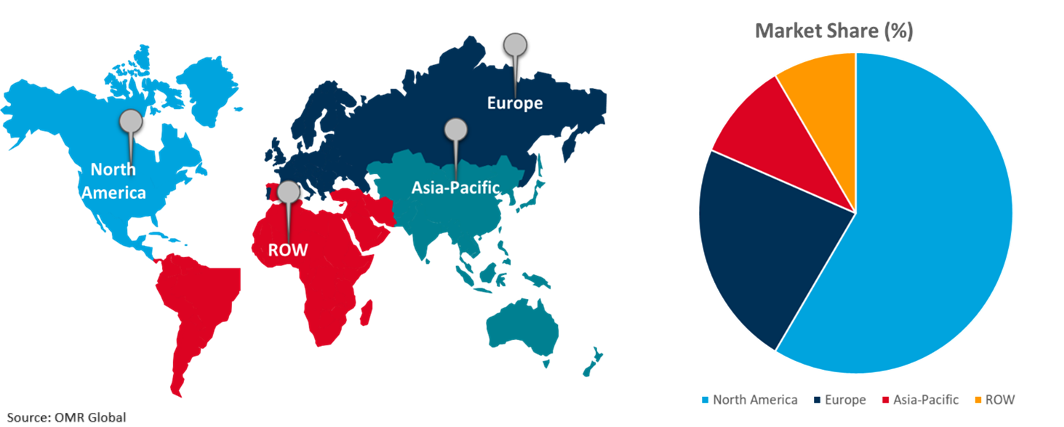

Regional Outlook

The global pulse oximeter market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Spain, Germany, Italy, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Pulse Oximeter Market Growth by Region 2024-2031

North America Holds Major Market Share

The demand for wearable and over-the-counter devices with immediate precise monitoring of the patient's vital signs is driving the pulse oximeter market in North America. Companies continue to focus on innovations and regulatory clearances toward consolidation and expansion of the market positions, increasing portfolios of products focused on chronic disease management and home-based care. For instance, in August 2024, OxiWear announced that it had received FDA 510(k) clearance for an ear pulse oximeter designed for continuous, real-time measurement of blood oxygen saturation (SpO2) and pulse rate. It is a non-invasive, ambulatory, real-time monitoring device for blood oxygen saturation and pulse rate. The device has been designed to give convenient and accurate data that will indicate early low oxygen levels through haptic and emergency messaging alerts.

- In February 2024, Masimo announced FDA clearance of MightySat Medical, making it the first and only FDA-cleared medical fingertip pulse oximeter available Over-The-Counter (OTC) directly to consumers without a prescription. The device employs Masimo SET pulse oximetry technology, a product used in hospitals and clinics to monitor over 200 million patients every year. The MightySat Medical Pulse Oximeter is available on masimo.com and also in retail stores.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the pulse oximeter market include GE HealthCare Technologies Inc., Koninklijke Philips N.V., Medtronic Inc., Nihon Kohden Corp., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In October 2024, Tenovi and Nonin Medical collaborated to improve health equity by remote patient monitoring for patients with chronic care. Fingertip pulse oximeters of Nonin perform better under the conditions of dyspnea and low perfusion ensuring equitable care.

- In November 2023, GE HealthCare and Masimo collaborated to integrate Masimo Signal Extraction Technology (SET) pulse oximetry into Portrait Mobile wireless and wearable patient monitoring solution. It allows clinicians to utilize Masimo's Measure-through Motion and low-perfusion oxygen saturation technology for noninvasive monitoring of patient status.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pulse oximeter market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. GE Healthcare Technologies Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Koninklijke Philips N.V.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Medtronic PLC.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Nihon Kohden Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pulse Oximeter Market by Product Type

4.1.1. Portable Pulse Oximeters (Fingertip and Wearable)

4.1.2. Handheld Oximeter

4.1.3. Others (Tabletop Pulse Oximeters, Pediatric and Neonatal Oximeters, and Smartphone-Connected Oximeters)

4.2. Global Pulse Oximeter Market by End-User

4.2.1. Hospitals

4.2.2. Homecare

4.2.3. Others (ASCs and Clinics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Beurer GmbH

6.2. CONTEC Medical Systems Co., Ltd

6.3. Criticare Technologies, Inc.

6.4. Drägerwerk AG & Co. KGaA

6.5. DrTrust (Nureca Ltd.)

6.6. Edan Instruments, Inc.

6.7. Honeywell International, Inc.

6.8. ICU Medical, Inc.

6.9. iHealth Labs Inc

6.10. Masimo Corp.

6.11. Meditech Equipment Co., Ltd.

6.12. Nonin Medical, Inc.

6.13. OSI Systems, Inc.

6.14. Promed Technology Co., Ltd.

6.15. SPENGLER HOLTEX Group

6.16. Vyaire Medical, Inc.

1. Global Pulse Oximeter Market Research And Analysis By Product Type, 2023-2031 ($ Million)

2. Global Portable Pulse Oximeter Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Handheld Pulse Oximeter Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Other Pulse Oximeter Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Pulse Oximeter Market Research And Analysis By End-User, 2023-2031 ($ Million)

6. Global Pulse Oximeter For Hospitals Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Pulse Oximeter For Homecare Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Pulse Oximeter For Other End-User Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Pulse Oximeter Market Research And Analysis By Region, 2023-2031 ($ Million)

10. North American Pulse Oximeter Market Research And Analysis By Country, 2023-2031 ($ Million)

11. North American Pulse Oximeter Market Research And Analysis By Product Type, 2023-2031 ($ Million)

12. North American Pulse Oximeter Market Research And Analysis By End-User, 2023-2031 ($ Million)

13. European Pulse Oximeter Market Research And Analysis By Country, 2023-2031 ($ Million)

14. European Pulse Oximeter Market Research And Analysis By Product Type, 2023-2031 ($ Million)

15. European Pulse Oximeter Market Research And Analysis By End-User, 2023-2031 ($ Million)

16. Asia-Pacific Pulse Oximeter Market Research And Analysis By Country, 2023-2031 ($ Million)

17. Asia-Pacific Pulse Oximeter Market Research And Analysis By Product Type, 2023-2031 ($ Million)

18. Asia-Pacific Pulse Oximeter Market Research And Analysis By End-User, 2023-2031 ($ Million)

19. Rest Of The World Pulse Oximeter Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Rest Of The World Pulse Oximeter Market Research And Analysis By Product Type, 2023-2031 ($ Million)

21. Rest Of The World Pulse Oximeter Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Pulse Oximeter Market Share By Product Type, 2023 Vs 2031 (%)

2. Global Portable Pulse Oximeter Market Share By Region, 2023 Vs 2031 (%)

3. Global Handheld Pulse Oximeter Market Share By Region, 2023 Vs 2031 (%)

4. Global Other Pulse Oximeter Market Share By Region, 2023 Vs 2031 (%)

5. Global Pulse Oximeter Market Share By End-User, 2023 Vs 2031 (%)

6. Global Pulse Oximeter For Hospitals Market Share By Region, 2023 Vs 2031 (%)

7. Global Pulse Oximeter For Homecare Market Share By Region, 2023 Vs 2031 (%)

8. Global Pulse Oximeter For Other End-User Market Share By Region, 2023 Vs 2031 (%)

9. Global Pulse Oximeter Market Share By Region, 2023 Vs 2031 (%)

10. US Pulse Oximeter Market Size, 2023-2031 ($ Million)

11. Canada Pulse Oximeter Market Size, 2023-2031 ($ Million)

12. UK Pulse Oximeter Market Size, 2023-2031 ($ Million)

13. France Pulse Oximeter Market Size, 2023-2031 ($ Million)

14. Germany Pulse Oximeter Market Size, 2023-2031 ($ Million)

15. Italy Pulse Oximeter Market Size, 2023-2031 ($ Million)

16. Spain Pulse Oximeter Market Size, 2023-2031 ($ Million)

17. Rest Of Europe Pulse Oximeter Market Size, 2023-2031 ($ Million)

18. India Pulse Oximeter Market Size, 2023-2031 ($ Million)

19. China Pulse Oximeter Market Size, 2023-2031 ($ Million)

20. Japan Pulse Oximeter Market Size, 2023-2031 ($ Million)

21. South Korea Pulse Oximeter Market Size, 2023-2031 ($ Million)

22. Rest Of Asia-Pacific Pulse Oximeter Market Size, 2023-2031 ($ Million)

23. Latin America Pulse Oximeter Market Size, 2023-2031 ($ Million)

24. Middle East And Africa Pulse Oximeter Market Size, 2023-2031 ($ Million)