Soy Beverages Market

Global Soy Beverages Market Size, Share & Trends Analysis Report by Product (Soy Milk and Soy Yogurt), By Type (Plain Soy Beverages and Flavoured Soy Beverages), By Distribution Channel (Retail & Supermarket and Online Platform), and Forecast 2020-2026

The soy beverages market is anticipated to grow at a CAGR of around 6% during the forecast period. Soy beverages such as soy milk contain as much protein as cow's milk; however, these are lower in calories as compared to whole milk. Additionally, the adoption of soy-beverages is high among the population with dietary or allergy concerns, which in turn, will drive the soy beverages market. In recent years, the availability of soy beverages has risen significantly in location stores to supermarkets in developed as well as developing economies. This is anticipated to drive the soy beverages market significantly during the forecast period.

However, soy allergen is a very common food allergy among populations across the globe, which presents a challenge for the growth of soy beverages market significantly. In addition to this, according to The Non-GMO Project analysis, Soybean is the number one genetically modified crop across the globe, representing half of all the global biotech crop acreage with an 82% adoption rate among soy farmers. The genetic modification of soy crops concerns a wide range of population and hence, owing to this, the soy beverages market growth will be hampered significantly during the forecast period.

Segmental Outlook

The global soy beverages market is segmented based on the product, type, and distribution channel. Based on the product, the market is bifurcated into soy milk and soy yogurt. Based on the type, the market is sub-segmented into plain soy beverages and flavored soy beverages. Further, based on the distribution channel the market is sub-segmented into retail & supermarket and online platform.

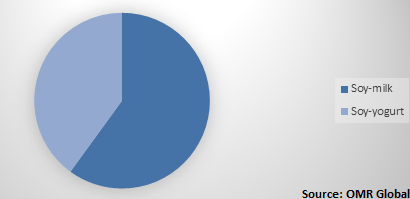

Global soy beverages Market Share by type, 2019 (%)

Soy-Milk Segment to Contribute a Prominent Share in the Market

The soy-milk segment is anticipated to contribute a prominent share in the market owing to the increasing adoption of animal milk alternative beverages across the globe. Soy-milk popularity is rising significantly owing to the fact that it is cholesterol-free and has less saturated fat than cow's milk that promotes good health. Additionally, in recent years the easy availability of soy-milks in various flavors such as chocolate, vanilla, and many more options, will also drive the soy-milk segment in the soy beverages market. Moreover, the increasing adoption of soy-milk by the vegan population is also anticipated to drive the growth of the soy-milk segment during the forecast period.

Regional Outlooks

The global soy beverages market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to contribute significantly to the market growth during the forecast period. The growth of the market in the region is owing to the high demand for processed food coupled with high disposable income. In addition to this, the changing lifestyle and aging population will also drive the soy beverages market across the region. Europe along with North America is also anticipated to be a considerable region for the growth of the soy beverages market. The growth of the market is owing to the increasing population with lactose intolerance that is adopting alternative beverages such as soy-based beverages.

Global Soy Beverages Market Growth, by Region 2020-2026

Asia-Pacific to Contribute Significantly During the Forecast Period

Asia-Pacific is anticipated to contribute significant share in the soy beverages market during the forecast period. The regional growth is attributed to the increasing government support for the production of soy-based products across the region. For instance, Indian Government loans up to 80% on Soya milk production and business to new Agri-business in the country in order to fuel the rising demand for the current market. Additionally, the rising prevalence of obesity and related disorder in countries such as China and India are also raising the adoption of soy beverages across the region. Moreover, the increasing millennial population is also driving the soy beverages market owing to their inclination towards fitness and willingness to purchase healthy products.

Market Players Outlook

Some of the key players of the soy beverages market include Danone S.A., The Hain Celestial Group, Inc., Otsuka Pharmaceutical Co., Ltd., Vitasoy International Holdings Ltd., Kikkoman Corp., and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, merger, and acquisition, collaborations to stay competitive in the market.

Recent Activities

- In March 2020, Asahi Group Holdings Ltd. launched a soymilk version of cultured milk beverage Calpis. The company is targeting potential health-conscious female customers especially between the age of 30-40 years.

- In May 2019, Hain Celestial Group, Inc. completed the strategic divestiture of its soy-based beverages subsidiary WestSoy to the Natural Holdings. This will aid the company to reduce complexity and drive sustainable growth of its existing portfolios.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Soy beverages market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Business Functions and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Danone S.A.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. The Hain Celestial Group, Inc.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. VITASOY International Holdings Limited

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Kikkoman Corp.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints/Challenges

4.1. Opportunities

5. Market Segmentation

5.1. Global Soy Beverages Market by Product

5.1.1. Soy Milk

5.1.2. Soy Yogurt

5.2. Global Soy Beverages Market by Type

5.2.1. Plain Soy Beverages

5.2.2. Flavored Soy Beverages

5.3. Global Soy Beverages Market by Distribution Channel

5.3.1. Retail & Supermarkets

5.3.2. Online Platform

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adisoy Foods & Beverages Pvt. Ltd.

7.2. Asahi Group Holdings Ltd.

7.3. Bio Nutrients (India) Pvt.Ltd.

7.4. Dairy Farmers of America, Inc.

7.5. Danone S.A.

7.6. Devansoy Inc.

7.7. DuPont de Nemours, Inc.

7.8. Kikkoman Corp.

7.9. Marusan-AI CO., LTD.

7.10. Natur-a Foods

7.11. Otsuka Pharmaceutical Co., Ltd.

7.12. Pacific Foods of Oregon, LLC.

7.13. Spiral Foods Pty Ltd

7.14. SunOpta Inc.

7.15. The Coco-Cola Company (AdeS)

7.16. The Hain Celestial Group, Inc.

7.17. The Hershey Co.

7.18. VITASOY International Holdings Limited

1. GLOBAL SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL SOY MILK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SOY YOGURT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

5. GLOBAL PLAIN SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL FLAVORED SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

8. GLOBAL SOY BEVERAGES AT RETAIL & SUPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL SOY BEVERAGES AT ONLINE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICA SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

13. NORTH AMERICAN SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

15. EUROPE SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPE SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

17. EUROPE SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. EUROPE SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

23. REST OF THE WORLD SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

24. REST OF THE WORLD SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD SOY BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL SOY BEVERAGES MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL SOY BEVERAGES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL SOY BEVERAGES MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

4. GLOBAL SOY BEVERAGES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

7. UK SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD SOY BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)