Squalene Market

Squalene Market Size, Share & Trends Analysis Report by Type (Animal-Sourced, Vegetable-Sourced, and Biosynthetic), and by End-Use (Cosmetics, Pharmaceuticals, Food & Beverages, and Others) Forecast Period (2022-2028)

Squalene market is anticipated to grow at a considerable CAGR of 9.1% during the forecast period. According to UN trade and development experts UNCTAD, the e-commerce sector saw a prominent rise in its share of all retail sales, from 16% to 19% in 2020-2021. Thus, the growth of the squalene market is attributed to factors such as the proliferation of squalene-based products due to the rapid expansion of e-commerce industries across the region. Furthermore, the growing launches of new and innovative products by market players is another factor bolstering the demand for the squalene market. For instance, in December 2020, SOPHIM launched a natural emollient named Phytosqualan, which is a high-quality squalene produced from an unsaponifiable fraction of olive oil, and fatty acids and has applications in cosmetics such as face creams, dry oils for body care, makeup and skin care.

Segmental Outlook

The global squalene market is segmented based on type and end-use. Based on type, the market is segmented into animal-sourced, vegetable-sourced, and biosynthetic. Based on the end-use, the market is sub-segmented into cosmetics, pharmaceuticals, food & beverages, and others. Among the end-use segment, the cosmetics sub-segment is anticipated to register significant growth during the forecast period. The growing use of squalene in cosmetic products due to its beneficial effects such as anti-oxidation, anti-aging, and others is the major factor driving the market growth.

Among the type segment, the biosynthetic sub-segment is anticipated to register significant growth during the forecast period. The growth is attributed to various product innovations such as squalene production with natural and organic ingredients and growing research on the efficacy of naturally derived squalene products. For instance, in March 2020, Amyris, Inc. presented clinical data showcasing the efficacy of its natural sugarcane squalane (marketed and sold as Neossance Squalane) as a carrier of CBD versus other oils. The company claimed that its Amyris sugarcane squalane improves the efficacy of CBD by 10-40X as the carrier oil for the skin care market based on new data.

Regional Outlooks

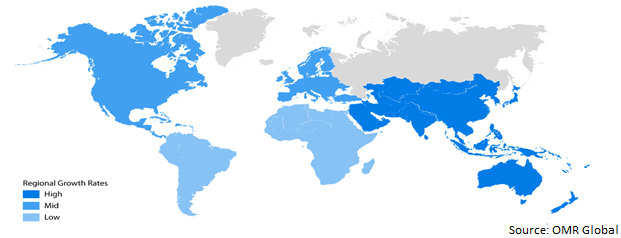

The global squalene market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the Europe market is expected to cater to a prominent growth over the forecast period. However, the North America region is projected to experience considerable growth in the squalene market.

Global Squalene Market Growth, by Region 2022-2028

The European Region is Expected to Hold a prominent Share in the Global Squalene Market

The European region is anticipated to account for a prominent share of the market during the forecast period. The growth of the squalene market share in the region is primarily driven by the growing cosmetic and personal care industry in the region. According to Cosmetics Europe, the personal care association, it is estimated that the cosmetics and personal care industry contributes at least $29 billion in added value to the European economy annually. Additionally, around $11 billion is contributed directly by the manufacture of cosmetic products and $18 billion indirectly through the supply chain. Thus, the well-established cosmetics market in the region is driving the use of squalene in cosmetics and personal care products, further boosting the regional market growth.

Market Players Outlook

The major companies serving the global squalene market include Amyris, Inc., SOPHIM, Henry Lamotte Oils GmbH, KURARAY CO., LTD., Croda International Plc, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Amyris, Inc. launched a hand sanitizer named Pipette under its No Compromise Pipette baby care branded products. Additionally, the company also completed initial testing of a leading vaccine adjuvant. Amyris leveraging its existing capabilities to fast-track the availability of a safe and clean No Compromise® Pipette Baby branded hand sanitizer.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global squalene market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Squalene Market by Type

4.1.1. Animal-Sourced

4.1.2. Vegetable-Sourced

4.1.3. Biosynthetic

4.2. Global Squalene Market by End-Use

4.2.1. Cosmetics

4.2.2. Pharmaceuticals

4.2.3. Food & Bevereges

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aasha Biochem

6.2. Advonex International Corp.

6.3. Amyris, Inc.

6.4. Arbee group

6.5. Arista Industries, Inc.

6.6. Blueline Foods (India Pvt. Ltd.)

6.7. Carbomer, Inc.

6.8. Cibus, Ltd.

6.9. Clariant AG

6.10. Coastal Group

6.11. Croda International Plc

6.12. efpbiotek

6.13. Empresa Figueirense De Pesca, LDA

6.14. Evonik Industries

6.15. Henry Lamotte Oils GmbH

6.16. Issho Genki International Inc.

6.17. KISHIMOTO SPECIAL LIVER OIL CO., LTD.

6.18. KURARAY CO., LTD.

6.19. Maypro Group

6.20. Merck KGAA

6.21. NZ green health ltd.

6.22. Oleicfat, s.l.

6.23. Otto chemie pvt. ltd

6.24. SOPHIM

6.25. SpecialChem S.A. (Caroi'line cosmetica)

6.26. Tianjin Winning Health Products ltd.

1. GLOBAL SQUALENE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ANIMAL-SOURCED SQUALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL VEGETABLE-SOURCED SQUALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BIOSYNTHETIC SQUALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SQUALENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

6. GLOBAL SQUALENE FOR COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SQUALENE FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL SQUALENE FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SQUALENE FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SQUALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. NORTH AMERICAN SQUALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN SQUALENE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

13. NORTH AMERICAN SQUALENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

14. EUROPEAN SQUALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN SQUALENE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. EUROPEAN SQUALENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC SQUALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC SQUALENE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC SQUALENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD SQUALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD SQUALENE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD SQUALENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. GLOBAL SQUALENE MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL ANIMAL-SOURCED SQUALENE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL VEGETABLE-SOURCED SQUALENE MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL BIOSYNTHETIC SQUALENE BY MARKET SHARE REGION, 2021 VS 2028 (%)

5. GLOBAL SQUALENE MARKET SHARE BY END-USE, 2021 VS 2028 (%)

6. GLOBAL SQUALENE FOR COSMETICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL SQUALENE FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL SQUALENE FOR FOOD & BEVERAGES MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL SQUALENE FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL SQUALENE MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. US SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

13. UK SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD SQUALENE MARKET SIZE, 2021-2028 ($ MILLION)