Sterilization Equipment Market

Sterilization Equipment Market Size, Share & Trends Analysis Report by Type (Heat Sterilization, Low-Temperature Sterilizers, Sterile Membrane Filters, Radiation Sterilization Devices and Consumables and Accessories) and End-User (Hospitals and Clinics, Pharmaceuticals and Biotechnology Companies, Food and Beverages Companies, and Others) Forecast Period (2024-2031)

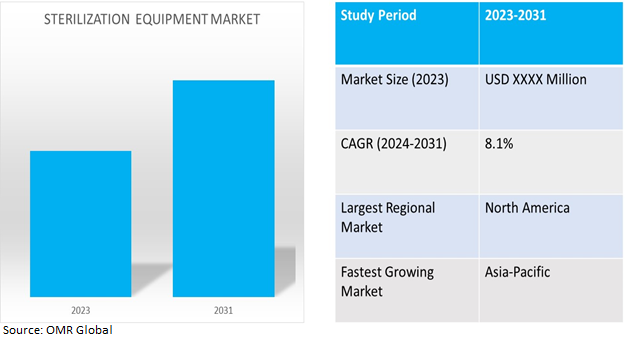

Sterilization equipment market is anticipated to grow at a considerable CAGR of 8.1% during the forecast period (2024-2031). Sterilization is an essential technique industry for controlling microbial populations that can hinder product quality. The market growth is stimulated by the rising use of sterilization equipment in the food & beverage industry, increasing R&D in pharmaceutical and biotechnology companies, the growing rate of health-conscious customers, and the development of healthcare infrastructure in developing countries. Furthermore, the market will likely gain traction as health officials impose stronger regulations and end-user industries integrate better sterilization techniques and equipment.

Growth in the Pharmaceutical and Biotechnology Industry

Sterilizing equipment market is growing as pharmaceutical and biotech companies invest in new R&D and manufacturing facilities. In particular, sterilization is required at several stages of the product development lifecycle, including R&D samples, clinical trial batches, stability and routine tests, APIs, excipients, and final pharmaceutical formulations. As the investment and capacity of manufacturing increases, the market is expected to benefit. For instance, in late 2022, GSK, Sanofi, and Takeda signed a partnership with local agencies to advance biologic manufacturing in Singapore. A little more than a year later, in January 2024, AbbVie began building on a $223.0 million extension to its Singapore manufacturing facility. The effort is intended to increase AbbVie's global biologics manufacturing capacity.

Increasing Surgical Procedures

The need for sterilization equipment is increasing attributed to the rising rate of surgeries. Further, there is an increase in the rates of various surgeries, including minimally invasive surgeries, driving the demand for sterilization equipment to ensure the safety and sterility of surgical instruments and medical devices. According to the International Society of Aesthetic Plastic Surgery (ISAPS) 2023 report, plastic surgeons globally performed more than 14.9 million surgical and 18.8 million non-surgical procedures, resulting in an 11.2% overall increase compared to the previous year.

Segmental Outlook

Our in-depth analysis of the global sterilization equipment market includes the following segments by type and end-user.

- Based on product type, the market is segmented into heat sterilization, low-temperature sterilizers, sterile membrane filters, radiation sterilization devices, and consumables and accessories.

- Based on end-user, the market is segmented into hospitals and clinics, pharmaceuticals and biotechnology companies, food and beverages companies, and others.

Heat-Sterilizers segment to Hold a Considerable Market Share

Heat sterilization is the preferred sterilizing type, particularly steam autoclaves, which are widely used in several industries, including medicine, laboratories, and food since it is safe, cheap, swiftly microbicide and sporicidal, and quickly heats and penetrates materials. Further, heat-based sterilizers can penetrate barriers, such as biofilm, tissue, and blood, to attain organism kill, whereas liquid-based sterilizers cannot adequately penetrate these barriers giving it an edge in the segment.

Pharmaceutical and Biotechnology Company are the Biggest End-User

The pharmaceuticals and biotechnology companies segment is expected to hold a considerable share of the market. The increasing adoption of sterilization equipment by pharmaceuticals and biotechnology companies owing to the development offinished medication products is a major contributor to the growth. Also, most countries are extensivelyinvesting in increasingR&D for new drugs and biotech products requiring high consumption of sterilization equipment. For instance, in the recent Indian Union Budget, R&D has been highlighted as a priority for the pharmaceutical industry, with proposed pharma research innovation programs through centers of excellence. Additionally, facilities in select Indian Council of Medical Research (ICMR) labs will be made available for research by public and private medical college faculty and private sector R&D teams, encouraging collaborative research and innovation.

Regional Outlook

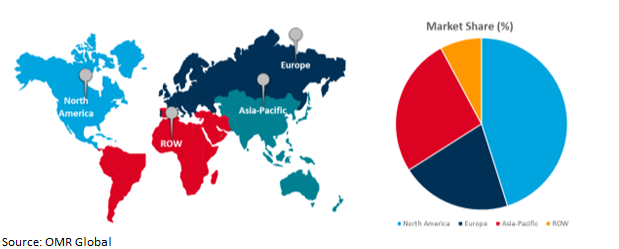

Sterilization equipment market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Sterilization Equipment Market

North America holds the highest share of sterilization equipment market. The key factor contributing to the growth is huge share of the North American market is primarily driven by the increasing prevalence of infectious diseases and the presence of key players in the sterilizing equipment market such as Fortive, and 3M. Also, the North American government has stringent regulations regarding food and beverages and the healthcare industry for product approval and public health safety. For instance, in January 2024, Ahlstrom recently received FDA 510(k) clearance from the United States Food and Drug Administration for Reliance® Fusion, a next-generation sterilization wrap that improves the efficiency of surgical equipment tray sterilization in hospitals.

Global Sterilization Equipment Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Sterilization Equipment market

- The demand in the Asia-Pacific region is driven by an increasing number of healthcare facilities, andsurgeries. For instance, as per IBEF India, the Indian government is planning to introduce a credit incentive program worth $6.8 billion to boost the country’s healthcare infrastructure.

- The region is also one of the significant markets for pharmaceutical, and biotechnology manufacturing attributed to low-cost labor, and materials. Also, the pharmaceutical R&D market in expect6ed to grow in the region, stimulating demand for sterilization equipment. For instance, In terms of R&D investment intensity, the ratio of its R&D expenditure to Gross Domestic Product (GDP) reached 2.4% in 2021, an increase of 0.03% point over the previous year in China.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving sterilization equipment market include Getinge AB, 3M Co., STERIS PLC, Fortive Corp., and Asahi Kasei Corp., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in December 2021, STERIS plc and Cantel Medical Corp announced that STERIS had signed a definitive agreement to acquire Cantel, through a US subsidiary. Cantel is a global provider of infection prevention products and services primarily to endoscopy and dental Customers.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in sterilization equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Asahi Kasei Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fortive Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Getinge AB

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. STERIS PLC

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Sterilized Equipment Market by Type

4.1.1. Heat Sterilization

4.1.1.1. Depyrogenayion Oven

4.1.1.2. Steam Autoclaves

4.1.2. Low-temperature Sterilizers

4.1.2.1. Ethylene Oxide Sterilizers

4.1.2.2. Hydrogen Peroxide Sterilizers

4.1.2.3. Others

4.1.3. Sterile Membrane Filters

4.1.4. Radiation Sterilization Devices

4.1.4.1. Gamma Rays

4.1.4.2. Electron Beams

4.1.4.3. Others

4.1.5. Consumables Accessories

4.2. Global Sterilized Equipment Market by End-User

4.2.1. Hospitals and Clinics

4.2.2. Pharmaceuticals and Biotechnology Companies

4.2.3. Food and Beverages Companies

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Acmas Technologies Inc.

6.2. Andersen Sterilizers, Inc.

6.3. ANTONIO MATACHANA, S. A.

6.4. Belimed Life Science AG

6.5. Cardinal Health

6.6. Celitron Medical Technologies Kft.

6.7. E-BEAM Services, Inc.

6.8. GPC Medical Ltd

6.9. MMM Group (MMM Münchener Medizin Mechanik GmbH)

6.10. Omxie Corp.

6.11. SAKURA SEIKI Co. Ltd

6.12. Sotera Health Co.

6.13. Stryker Corp.

6.14. Ventilex B.V.

6.15. Weiss Technik North America, Inc.

1. GLOBAL STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE,2023-2031 ($ MILLION)

2. GLOBAL HEAT STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LOW-TEMPERATURE STERILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL STERILE MEMBRANE FILTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL RADIATION STERILIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALSTERILIZATION CONSUMABLES & ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL STERILIZATION EQUIPMENT FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL STERILIZATION EQUIPMENT FOR PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL STERILIZATION EQUIPMENT FOR FOOD AND BEVERAGES COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL STERILIZATION EQUIPMENT FOR OTHERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

1. GLOBAL STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

2. NORTH AMERICAN STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

3. NORTH AMERICAN STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE,2023-2031 ($ MILLION)

4. NORTH AMERICAN STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

5. EUROPEAN STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

6. EUROPEAN STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

7. EUROPEAN STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

8. ASIA-PACIFIC STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

9. ASIA-PACIFICSTERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE,2023-2031 ($ MILLION)

10. ASIA-PACIFICSTERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

11. REST OF THE WORLD STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. REST OF THE WORLD STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. REST OF THE WORLD STERILIZATION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

1. GLOBAL STERILIZATION EQUIPMENT MARKETSHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL HEAT STERILIZATION EQUIPMENT MARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL LOW-TEMPERATURE STERILIZERS MARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL STERILE MEMBRANE FILTERSMARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL RADIATION STERILIZATION DEVICESMARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBALSTERILIZATION CONSUMABLES & ACCESSORIESMARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL STERILIZATION EQUIPMENT MARKET SHAREANALYSIS BY END-USER, 2023 VS 2031 (%)

8. GLOBAL STERILIZATION EQUIPMENT FOR HOSPITALS AND CLINICS MARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL STERILIZATION EQUIPMENT FOR PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES MARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL STERILIZATION EQUIPMENT FOR FOOD AND BEVERAGES COMPANIESMARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL STERILIZATION EQUIPMENT FOR OTHERSMARKET SHARE ANALYSIS BY REGION, 2023 VS 2031 (%)

12. US STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

14. UK STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC STERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICASTERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICASTERILIZATION EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)