Sugar Confectionery Market

Global Sugar Confectionery Market Size, Share & Trends Analysis Report, By Product (Chocolate, Sugar Based Food, and Snack Bars), By Distribution Channel (Online and Offline), and Forecast, 2020-2026

The global sugar confectionery market is estimated to grow at a CAGR of 3.5% during the forecast period. Rising demand for snack bars and increasing launches of healthier confectionery products are some pivotal factors encouraging market growth. The significant presence of millennials has led to the increased adoption of snack bars as a healthier snack which supports busy lifestyles and offers a healthy dose of fiber and protein. As per the Organization for Economic Cooperation and Development (OECD), in 2018, the percentage of the working-age population (15-64) in the UK, Germany, France, Italy, and Sweden was 63.8%, 65.0%, 62.1%, 64.0%, and 62.4%, respectively. A large number of these age group populations are primarily focused on exercise and dietary habits, which leads to increasing demand for energy and cereal bars to meet their nutritional requirements.

As a result, several companies are focusing on launching new snack bars to cater to the needs of increased demand. For instance, in March 2020, CORE Foods, a provider of fresh, refrigerated snacking, declared the introduction of CORE ENERGY BARS. It is a new line of plant-based bars which is filled with probiotics, prebiotic fiber, natural caffeine, and protein to offer balanced nutrition. This new line of energy bars is available in three coffee shop-inspired flavors, including Caramel Coffee Crunch, Mocha Chip Espresso, and Strawberry Basil Tea. Such new products comprise 65 mg of natural caffeine and complement the brand’s current portfolio of fresh snacking options that allow consumers to enjoy these snack bars on-the-go.

Further, in June 2018, Clif Bar & Co. launched three new products, including CLIF Energy Granola, CLIF Fruit Smoothie Filled Energy Bar, and CLIF BAR Sweet & Salty. CLIF Fruit Smoothie Filled is the first United States Department of Agriculture (USDA) Certified organic energy bar which is inspired by blending bright, fruit flavors with nut and seed butter, and classic smoothie ingredients, to develop a deliciously creamy filling packed in the energy bar. CLIF Energy Granola brings a nutritious breakfast solution to the cereal aisle. It is produced with dried fruit, organic oats, seeds, almonds, and eight grams of plant-based protein. These are available in four tasty flavors, including Cocoa Almond, naturally flavored White Chocolate Macadamia Nut, Blueberry Crisp, and Cinnamon Almond. This energy bar contains 25 grams of whole grains and is gluten-free.

Market Segmentation

The global sugar confectionery market is segmented based on product and distribution channels. Based on the product, the market is classified into chocolate, sugar based food, and snack bars. Chocolate segment is further segmented into white and milk chocolate and dark chocolate. Sugar based food segment is further segmented into boiled sweets, caramels and toffees, mints, gums and jellies, and others. Snack bars are further segmented into energy bars, cereal bars, and others. Based on the distribution channel, the market is segmented into an online and offline distribution channel. Offline distribution channels are further segmented into supermarket/hypermarket, convenience stores, and others.

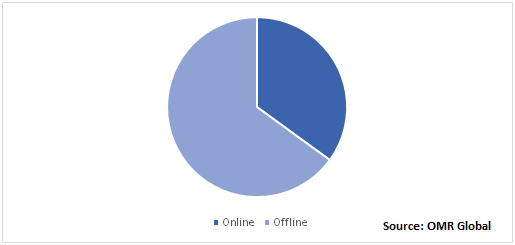

Online Distribution Channels to Witness Significant Growth During the Forecast Period

The online distribution channel is expected to grow at the fastest CAGR during the forecast period. The rising trend towards online shopping coupled with the busy lifestyle and convenience is encouraging providers of confectionery products to increase their online presence. Market players are actively seeking to get a bigger space in the online market. For instance, in July 2017, Mondel?z India declared strategic collaboration with Amazon.in, India’s largest online marketplace, for the establishment of the first virtual Chocolate & Sweet Store in India. The collaboration is offering a new opportunity for Mondelez to tap into the e-commerce market by offering an additional channel for consumers.

Global Sugar Confectionery Market Share by Distribution Channel, 2019 (%)

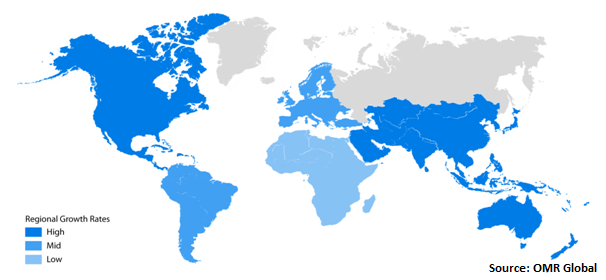

Regional Analysis

Geographically, the North America sugar confectionery market is primarily driven by the increasing demand for low sugar and calorie confectionery products and rising new product launches. The presence of some crucial players such as Mondel?z International, Inc. and Mars, Inc. is driving new innovative launches of confectionery products in the region. Asia-Pacific sugar confectionery market is being significantly driven by the significant availability of millennials and increasing shift towards healthier snack bars in the region. In addition, a significant prevalence of obesity is leading to an increasing demand for nutritional bars with low calories and adequate nutrition levels.

Global Sugar Confectionery Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Mondel?z International, Inc., Ferrero International S.A., Nestlé S.A., Mars, Inc., and Meiji Holdings Co., Ltd. Mergers and acquisitions and product launches are considered as some key strategies used by the market players to increase their market share. For instance, in July 2019, Mondel?z International completed its acquisition of Perfect Snacks, offers a range of refrigerated nutrition bars segment which include Perfect Snacks’ other lines of organic, non-GMO, nut-butter based protein bars and bites, The Original Refrigerated Protein Bar, and Perfect Bar. The acquisition of majority interest in Perfect Snacks further expands the Mondel?z leadership position in broader snacking, which includes the emerging segments of refrigerated and well-being snacking.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sugar confectionery market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Mars, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Ferrero International S.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Nestlé S.A.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Meiji Holdings Co., Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Mondel?z International, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Sugar Confectionery Market by Product

5.1.1. Chocolate

5.1.1.1. White and Milk

5.1.1.2. Dark

5.1.2. Sugar-Based Food

5.1.2.1. Boiled Sweets

5.1.2.2. Caramels and Toffees

5.1.2.3. Mints

5.1.2.4. Gums and Jellies

5.1.2.5. Others

5.1.3. Snack Bars

5.1.3.1. Energy Bars

5.1.3.2. Cereal Bars

5.1.3.3. Others

5.2. Global Sugar Confectionery Market by Distribution Channel

5.2.1. Online

5.2.2. Offline

5.2.2.1. Supermarket/Hypermarket

5.2.2.2. Convenience Stores

5.2.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arcor Group

7.2. August Storck KG

7.3. Bourbon Corp.

7.4. Chocoladefabriken Lindt & Sprüngli AG

7.5. Chocolat Frey AB

7.6. Cloetta AB

7.7. Crown Confectionery Co., Ltd.

7.8. Dongguan Hsu Chi Food Co., Ltd.

7.9. DS Group

7.10. Ezaki Glico Co., Ltd.

7.11. Ferrero International S.A.

7.12. General Mills, Inc.

7.13. Grupo Bimbo, S.A.B. de C.V.

7.14. HARIBO GmbH & Co. KG

7.15. Kerr Bros, Ltd.

7.16. Lindt & Sprungli AG

7.17. Lotte Corp.

7.18. Mars, Inc.

7.19. Meiji Holdings Co., Ltd.

7.20. Mondel?z International, Inc.

7.21. Morinaga & Co., Ltd.

7.22. Nestlé S.A.

7.23. Orion Corp.

7.24. Parle Products Pvt., Ltd.

7.25. Perfetti Van Melle Group B.V.

7.26. Pladis Foods, Ltd.

7.27. The Hershey Co.

7.28. The Kellogg Co.

7.29. Unilever PLC

7.30. Zertus GmbH

1. GLOBAL SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL CHOCOLATE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SNACK BARS CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

6. GLOBAL CONFECTIONERY PRODUCTS FROM ONLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL CONFECTIONERY PRODUCTS FROM OFFLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

11. NORTH AMERICAN SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

12. EUROPEAN SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

14. EUROPEAN SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

18. REST OF THE WORLD SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

19. REST OF THE WORLD SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL SUGAR CONFECTIONERY MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

3. GLOBAL SUGAR CONFECTIONERY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

6. UK SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD SUGAR CONFECTIONERY MARKET SIZE, 2019-2026 ($ MILLION)