Sugar-free Confectionery Market

Global Sugar-free Confectionery Market Size, Share & Trends Analysis Report by Product Type (Chocolates, Chewing Gums, Candies, Biscuits/Cookies, Cakes & Pastries, and Others), by Packaging (Sachet, Box, and Others), and by Distribution Channel (Online Channel, and Offline Channel) Forecast Period (2022-2028)

The global sugar-free confectionery market is anticipated to grow at a considerable CAGR of 5.3% during the forecast period. Changing food preferences among consumers due to increasing health consciousness is the major factor driving the growth of the sugar-free confectionery market. Consumers are becoming more aware of the benefits of maintaining oral health. The growing concerns over dental problems caused due to excess consumption of conventional sweets and candy are expected to force the buyers to incline toward alternative confectionery products such as sugar-free confectionery. Sugar-free confectionery products are consumed as a healthy alternative to sugar-based confectionery products and hence reduce the risk of decay and erosion of teeth. Moreover, Parents promoting the consumption of sugar-free sweet and candy confectionery among kids to reduce the risks of decay and erosion of teeth is leading to rising demand for the product. Apart from concerns over dental problems, the rising concern relating to managing weight by consuming reduced-calorie and sugar-free food products is further influencing the market positively. Thus, increasing consumer preference for sugar-free confections owing to tooth-friendliness and calorie-reduction is driving the market growth.

Segmental Outlook

The global sugar-free confectionery market is segmented based on product type, packaging, and distribution channel. Based on the product type, the market is segmented into chocolates, chewing gums, candies, biscuits/cookies, cakes & pastries, and others. Based on the packaging, the market is sub-segmented into a sachet, box, and others. Further, based on distribution channels, the market is categorized into online channels and offline channels. Among the product type segment, the chocolates confectionery sub-segment is expected to cater to a prominent market share over the forecast period owing to high demand and adoption of chocolate confection diets among consumers.

The Chocolates Confectionery Sub-Segment is Anticipated to Hold Prominent Share in the Global Sugar-free Confectionery Market

Sugar-free chocolate confection is being highly in demand and consumed type of sugar-free confectionery item due to the growing popularity of healthy diets among consumers. Moreover, apart from consumers, public health bodies are becoming increasingly concerned about the sugar content of foods and in particular about the sugar content of confectionery products, especially chocolate. Thus, chocolate confections comprising less sugar and fewer calories are growing in popularity. Major market players are viewing this demand as a business opportunity and are focusing on developing an advanced process for manufacturing chocolate with reduced sugar. For instance, in January 2020, Mondelez International patented a process for manufacturing chocolate using soluble corn fiber to help reduce the sugar and calorie content. According to the patent, the process will cut the sugar in chocolate products by up to 50%, at the same time keeping the sweet taste consumers expect. The patent was filed under Kraft Foods, but the intellectual property belongs to Mondelez, a reflection of the fact that both companies were together at one time.

Regional Outlooks

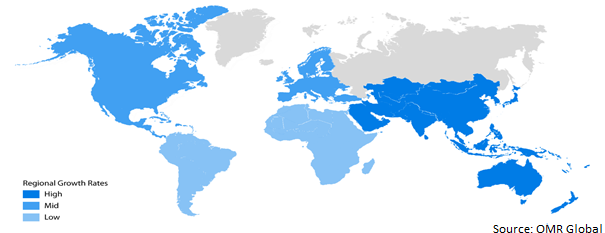

The global sugar-free confectionery market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to prominent growth over the forecast period. However, the Asia-Pacific region is expected to experience considerable growth in the sugar-free confectionery market

Global Sugar-free Confectionery Market Growth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global Sugar-free Confectionery Market

The North American region is expected to hold a prominent share in the global sugar-free confectionery market owing to the large base of the health-conscious population in North American countries such as the US and Canada. According to Food & Health Survey from the International Food Information Council (IFIC), 80% of Americans have shifted from added sugar products to sugar-free products in 2019. North America has more health-conscious people when compared to other regions and the continual innovations in the region’s healthy food industry are likely to show the surge in demand for sugar-free confectionery products. The top players and manufacturers are making moves towards expanding their presence in this region which gives them an edge over the new entrants. For instance, in April 2022, The Yumy Candy Company Inc. announced that it is expanding into the U.S. market with its low-sugar better-for-you confectionery, specifically partnering with the largest U.S. distribution networks that align with the core principles of the company. Expansion into the U.S. will work as the company's first step into the international market, which is important for its successful global growth.

Market Players Outlook

The major companies serving the global sugar-free confectionery market include Abdallah Candies Inc., Asher’s Chocolate Co., Diabetic Candy.com, LLC, Lily’s Sweets, LLC, The Hershey Co., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2022, Cocomels, announced that the company is expanding its popular <1g sugar line and launching new <1g Sugar chocolate-covered sea salt and crispy bites with less than 1g of sugar and 100 calories per serving. Moreover, the product is free from dairy, gluten, corn syrup, cholesterol, artificial ingredients, sugar alcohols, and palm oil. Cocomels new bites are made with 60% dark chocolate sweetened with an all-natural sugar alternative, allulose.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sugar-free confectionery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Sugar-Free Confectionery Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abdallah Candies Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Asher’s Chocolate Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. Diabetic Candy.com, LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Lily’s Sweets, LLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. The Hershey Co.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Development

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Sugar-Free Confectionery Market by Product

4.1.1. Chocolates

4.1.2. Chewing Gums

4.1.3. Candies

4.1.4. Biscuits/Cookies

4.1.5. Cakes & Pastries

4.1.6. Others

4.2. Global Sugar-Free Confectionery Market by Packaging

4.2.1. Sachet

4.2.2. Box

4.2.3. Others

4.3. Global Sugar-Free Confectionery Market by Distribution Channel

4.3.1. Online Channel

4.3.2. Offline Channel

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Albanese Candy

6.2. Artinci Artisanal Foods Pvt. Ltd.

6.3. Atkinson's Candy Co.

6.4. BENEO GmbH

6.5. B Healthy Ltd.

6.6. Chocoladefabriken Lindt & Sprüngli AG

6.7. ChocZero, Inc.

6.8. Continental Candy Industries B.V

6.9. De Villiers Chocolate

6.10. Dr. John's Healthy Sweets

6.11. GoodSam Foods, LLC

6.12. La Nouba

6.13. Nestlé S.A.

6.14. NOVA NOVA

6.15. Perfetti Van Melle Group B.V.

6.16. ROY chocolatier

6.17. Russell Stover Chocolates, LLC

6.18. See’s Candies

6.19. SmartSweets Inc.

6.20. Yumy Bear Goods Inc.

1. GLOBAL SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL SUGAR-FREE CHOCOLATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SUGAR-FREE CHEWING GUMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SUGAR-FREE CANDIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SUGAR-FREE BISCUITS/COOKIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL SUGAR-FREE CAKES & PASTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SUGAR-FREE OTHERS PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2021-2028 ($ MILLION)

9. GLOBAL SUGAR-FREE CONFECTIONERY BY SACHET PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SUGAR-FREE CONFECTIONERY BY BOX PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL SUGAR-FREE CONFECTIONERY BY OTHER PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

13. GLOBAL SUGAR-FREE CONFECTIONERY BY ONLINE CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL SUGAR-FREE CONFECTIONERY BY OFFLINE CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

18. NORTH AMERICAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2021-2028 ($ MILLION)

19. NORTH AMERICAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

20. EUROPEAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

22. EUROPEAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2021-2028 ($ MILLION)

23. EUROPEAN SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

28. REST OF THE WORLD SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

30. REST OF THE WORLD SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2021-2028 ($ MILLION)

31. REST OF THE WORLD SUGAR-FREE CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1. GLOBAL SUGAR-FREE CONFECTIONERY MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL SUGAR-FREE CHOCOLATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL SUGAR-FREE CHEWING GUMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL SUGAR-FREE CANDIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL SUGAR-FREE BISCUITS/COOKIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL SUGAR-FREE CAKES & PASTRIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL SUGAR-FREE OTHER PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL SUGAR-FREE CONFECTIONERY MARKET SHARE BY PACKAGING, 2021 VS 2028 (%)

9. GLOBAL SUGAR-FREE CONFECTIONERY BY SACHET PACKAGING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL SUGAR-FREE CONFECTIONERY BY BOX PACKAGING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL SUGAR-FREE CONFECTIONERY BY OTHER PACKAGING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL SUGAR-FREE CONFECTIONERY MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

13. GLOBAL SUGAR-FREE CONFECTIONERY BY ONLINE DISTRIBUTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL SUGAR-FREE CONFECTIONERY BY OFFLINE DISTRIBUTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL SUGAR-FREE CONFECTIONERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

18. UK SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD SUGAR-FREE CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)