Telecom Power Systems Market

Telecom Power Systems Market Size, Share & Trends Analysis Report by Fuel Type (Renewable, and Non-renewable), By Type of Tower (Lattice Tower, Guyed Tower, Monopole Towers, and Stealth Towers), By Installation (Rooftop, and Ground-based), and By Ownership (Operator-owned, Joint Venture, Private-owned, and MNO Captive) Forecast Period (2025-2035)

Industry Overview

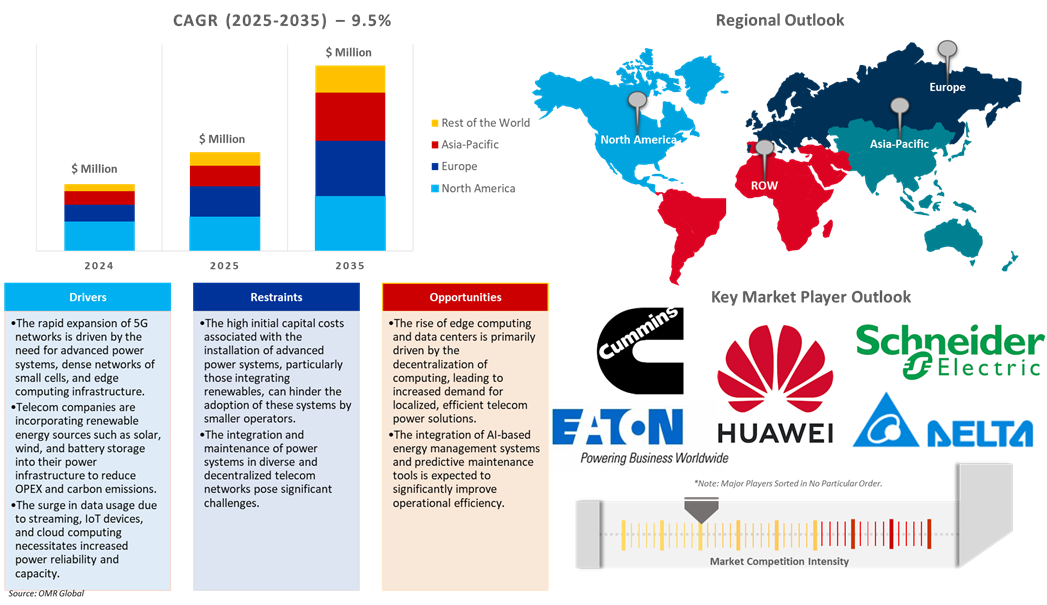

Telecom power systems market was valued at $4,570 million in 2024 and is projected to reach $12,278 million by 2035, growing at a CAGR of 9.5% from 2025 to 2035. Governments across the globe are investing in telecommunications infrastructure to facilitate economic growth, digitalization, and national security, increasing the demand for telecom towers. The National Telecommunications and Information Administration (NTIA) of the Department of Commerce revealed $930 million to develop middle-mile high-speed Internet infrastructure in 35 states and Puerto Rico as part of President Biden's Investing in America agenda. Under the Biden-Harris Administration’s Internet for All Initiative, the Enabling Middle Mile Broadband Infrastructure Program invests in projects that build regional networks that connect to national Internet networks.

Market Dynamics

Expansion of 5G networks

The expansion of the telecom tower industry is being driven by the expansion of 5G networks, increasingly adopting tower sharing models, rapid urbanization and the development of smart cities, an increasing number of Internet of Things (IoT) devices, and increasing focus on reducing energy consumption and adopting energy-efficient technologies. As the demand for greener practices increases, telecommunications companies are focusing more on sustainability. Telecom tower companies are implementing energy-saving technologies, harnessing renewable energy sources such as solar and wind, to save energy, lower expenses, and mitigate the environment. For instance, in April 2024, Indus Towers Ltd. (ITL) signed a Memorandum of Understanding (MoU) with NTPC Green Energy Ltd (NGEL) for the joint development of renewable energy projects to power its business operations spread across the country. Under the MoU, Indus Towers and NGEL explore joint development of grid-connected renewable energy-based power projects, including solar, wind, and energy storage solutions. The ITL portfolio of over 211,775 telecom towers makes it one of the largest tower infrastructure providers in India, with presence in all 22 telecom circles. The company has been the industry pioneer in adopting green energy initiatives for its operations.

Sustainability & Low-Carbon Goals

The increasing demand for sustainable and low-carbon goals, along with the overview of All-Scenario Smart Solutions that promote enhanced green energy integration and high-efficiency performance, has led to the market high demand for solar-powered and hybrid systems. For instance, in May 20245, Huawei introduced its All-Scenario Smart Telecom Power Solutions, a solution that aims to address operators' requirements for one-time deployment, ten-year evolution. Its solutions have a modular architecture, supporting on-demand configuration and elastic capacity expansion using a single set. It supports multi-energy inputs and outputs, allowing operators to develop diversified services. The solution employs intelligent circuit breakers, enhancing flexibility, accuracy, and efficiency. Moreover, it provides up to 98% rectifier efficiency, enabling hybrid power utilization and facilitating low-carbon network development.

Market Segmentation

- Based on the fuel type, the market is segmented into renewable and non-renewable.

- Based on the type of tower, the market is segmented into lattice tower, guyed tower, monopole towers, and stealth towers.

- Based on the Installation, the market is segmented into rooftop and ground-based.

- Based on the ownership, the market is segmented into operator-owned, joint venture, private-owned, and MNO captive.

Renewable: A Key Segment in Market Growth

Telecom operators are shifting towards green sources of energy, such as solar, in order to meet ESG goals, particularly in emerging economies like India, Africa, and Southeast Asia. For instance, in February 2024, Tata Power Renewable and Tata Communications signed a solar power deal worth $12.6 million, involving a solar plant in Aachegaon, Maharashtra, operated by Nivade Windfarm Ltd. This plant is expected to generate around 40 million units of power annually that resulting in a decrease of more than 30,000 tons of CO2 emissions. This alliance is expected to encourage the utilization of renewable energy in the corporate world, contributing to the efforts of minimizing environmental footprint and fostering a sustainable energy culture.

Regional Outlook

The global telecom power systems market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Affordable, High-Speed Internet Access in North America

Middle-mile internet infrastructure transmits large volumes of data over extended distances, enhances the capacity of local networks, strengthens network resilience, reduces the cost of delivering high-speed internet to underserved households, and facilitates the connection of remote areas to the broader internet backbone. Furthermore, in October 2024, America’s broadband industry invested a record $94.7 billion in US communications infrastructure in 2023, reflecting broadband providers’ determination to help achieve the national objective of affordable, reliable high-speed connectivity for all.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share, owing to the 5G deployment, fueled by higher density infrastructure, lower latency, and higher data throughput, which is driving market growth, especially in urban and remote areas such as China. According to the Ministry of Industry and Information Technology, in January 2024, China invested $26.6 billion in 5G networks, up 5.7% from the previous year (2023). This investment is more than 45% of the country's total telecom fixed assets investments. As of last year, China invested $101.69 billion in 5G base stations, with operators such as China Telecom, China Unicom, China Mobile, and China Tower all spending $58.56 billion on fixed assets, a 0.3% rise from the previous year. The nation had 11.6 million mobile communication base stations, 3.4 million of which were 5G base stations, which accounted for 29% of the total.

Market Players Outlook

The major companies operating in the global telecom power systems market include Cummins Inc., Delta Electronics, Inc., Eaton Corp. plc, Huawei Technologies Co., Ltd., and Schneider Electric, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In December 2024, CelcomDigi renewed its strategic partnerships with Edotco Group, Edgepoint Infrastructure, D’Harmoni Telco Infra, and PDC Telecommunication Services to future-proof its infrastructure as part of its ongoing nationwide network integration and modernization exercise. Through collaborations with the country’s four tower companies, CelcomDigi is rolling out its network coverage across urban landmarks like the Tun Razak Exchange and Merdeka 118 to remote locations in Sabah and Sarawak.

- In October 2024, The Bases Conversion and Development Authority (BCDA) entered into a MOU with independent telecommunications tower operator LBS Digital Infrastructure Corporation (LDIC) to pursue a digital infrastructure project aimed to increase internet connectivity in New Clark City in Tarlac, Morong Discovery Park in Bataan, Camp John Hay in Baguio, and portions of Bonifacio Global City in Taguig. The MOU is additionally intended to hasten negotiations with mobile network operators and obtain their endorsement of the deployment and subleasing of common towers in those areas.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global telecom power systems market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Telecom Power Systems Market Sales Analysis – Fuel Type | Type Of Tower| Installation | Ownership ($ Million)

• Telecom Power Systems Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Telecom Power Systems Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Telecom Power Systems Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Telecom Power Systems Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Telecom Power Systems Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Telecom Power Systems Market Revenue and Share by Manufacturers

• Telecom Power Systems Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Cummins Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Delta Electronics, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Eaton Corp. plc

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Huawei Technologies Co., Ltd..

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Schneider Electric

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Telecom Power Systems Market Sales Analysis by Fuel Type ($ Million)

5.1. Renewable

5.2. Non-renewable

6. Global Telecom Power Systems Market Sales Analysis by Type Of Tower ($ Million)

6.1. Lattice Tower

6.2. Guyed Tower

6.3. Monopole Towers

6.4. Stealth Towers

7. Global Telecom Power Systems Market Sales Analysis by Installation ($ Million)

7.1. Rooftop

7.2. Ground-based

8. Global Telecom Power Systems Market Sales Analysis by Ownership ($ Million)

8.1. Operator-owned

8.2. Joint Venture

8.3. Private-owned

8.4. MNO Captive

9. Regional Analysis

9.1. North American Telecom Power Systems Market Sales Analysis – Fuel Type | Type Of Tower | Installation | Ownership | Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Telecom Power Systems Market Sales Analysis – Fuel Type | Type Of Tower| Installation | Ownership | Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Telecom Power Systems Market Sales Analysis – Fuel Type | Type Of Tower| Installation | Ownership | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Telecom Power Systems Market Sales Analysis – Fuel Type | Type Of Tower| Installation | Ownership | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Alpha Technologies Inc.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. American Tower Corp.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. AT&T

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Cellnex Telecom, S.A.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Ciena Corp.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Crown Castle Inc.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Cummins Inc.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Delta Electronics, Inc.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Eaton Corp. plc

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Exide Technologies

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. GTL Infrastructure Ltd.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Hebei Kelingyizhi Communication Technology Co., Ltd.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Huawei Technologies Co., Ltd.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Nexans

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. SBA Communications Corp.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Schneider Electric

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Stealth Power

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. TAWAL.com.sa

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Toshiba Europe Ltd.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Vertiv Group Corp.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

1. Global Telecom Power Systems Market Research And Analysis By Fuel Type, 2024-2035 ($ Million)

2. Global Renewable-Based Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Non-renewable Based Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Telecom Power Systems Market Research And Analysis By Type Of Tower, 2024-2035 ($ Million)

5. Global Lattice Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Guyed Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Monopole Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Stealth Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Telecom Power Systems Market Research And Analysis By Installation, 2024-2035 ($ Million)

10. Global Rooftop Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Ground-based Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Telecom Power Systems Market Research And Analysis By Ownership, 2024-2035 ($ Million)

13. Global Operator-owned Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Joint Venture Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Private-owned Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global MNO Captive Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Telecom Power Systems Market Research And Analysis By Geography, 2024-2035 ($ Million)

18. North American Telecom Power Systems Market Research And Analysis By Country, 2024-2035 ($ Million)

19. North American Telecom Power Systems Market Research And Analysis By Fuel Type, 2024-2035 ($ Million)

20. North American Telecom Power Systems Market Research And Analysis By Type Of Tower, 2024-2035 ($ Million)

21. North American Telecom Power Systems Market Research And Analysis By Installation, 2024-2035 ($ Million)

22. North American Telecom Power Systems Market Research And Analysis By Ownership, 2024-2035 ($ Million)

23. European Telecom Power Systems Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European Telecom Power Systems Market Research And Analysis By Fuel Type, 2024-2035 ($ Million)

25. European Telecom Power Systems Market Research And Analysis By Type Of Tower, 2024-2035 ($ Million)

26. European Telecom Power Systems Market Research And Analysis By Installation, 2024-2035 ($ Million)

27. European Telecom Power Systems Market Research And Analysis By Ownership, 2024-2035 ($ Million)

28. Asia-Pacific Telecom Power Systems Market Research And Analysis By Country, 2024-2035 ($ Million)

29. Asia-Pacific Telecom Power Systems Market Research And Analysis By Fuel Type, 2024-2035 ($ Million)

30. Asia-Pacific Telecom Power Systems Market Research And Analysis By Type Of Tower, 2024-2035 ($ Million)

31. Asia-Pacific Telecom Power Systems Market Research And Analysis By Installation, 2024-2035 ($ Million)

32. Asia-Pacific Telecom Power Systems Market Research And Analysis By Ownership, 2024-2035 ($ Million)

33. Rest Of The World Telecom Power Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

34. Rest Of The World Telecom Power Systems Market Research And Analysis By Fuel Type, 2024-2035 ($ Million)

35. Rest Of The World Telecom Power Systems Market Research And Analysis By Type Of Tower, 2024-2035 ($ Million)

36. Rest Of The World Telecom Power Systems Market Research And Analysis By Installation, 2024-2035 ($ Million)

37. Rest Of The World Telecom Power Systems Market Research And Analysis By Ownership, 2024-2035 ($ Million)

1. Global Telecom Power Systems Market Share By Fuel Type, 2024 Vs 2035 (%)

2. Global Renewable-Based Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

3. Global Non-renewable Based Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

4. Global Telecom Power Systems Market Share By Type Of Tower, 2024 Vs 2035 (%)

5. Global Lattice Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

6. Global Guyed Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

7. Global Monopole Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

8. Global Stealth Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

9. Global Telecom Power Systems Market Share By Installation, 2024 Vs 2035 (%)

10. Global Rooftop Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

11. Global Ground-based Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

12. Global Telecom Power Systems Market Share By Ownership, 2024 Vs 2035 (%)

13. Global Operator-owned Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

14. Global Joint Venture Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

15. Global Private-owned Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

16. Global MNO Captive Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

17. Global Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

18. Global Telecom Power Systems Market Share By Region, 2024 Vs 2035 (%)

19. US Telecom Power Systems Market Size, 2024-2035 ($ Million)

20. Canada Telecom Power Systems Market Size, 2024-2035 ($ Million)

21. UK Telecom Power Systems Market Size, 2024-2035 ($ Million)

22. France Telecom Power Systems Market Size, 2024-2035 ($ Million)

23. Germany Telecom Power Systems Market Size, 2024-2035 ($ Million)

24. Italy Telecom Power Systems Market Size, 2024-2035 ($ Million)

25. Spain Telecom Power Systems Market Size, 2024-2035 ($ Million)

26. Russia Telecom Power Systems Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Telecom Power Systems Market Size, 2024-2035 ($ Million)

28. India Telecom Power Systems Market Size, 2024-2035 ($ Million)

29. China Telecom Power Systems Market Size, 2024-2035 ($ Million)

30. Japan Telecom Power Systems Market Size, 2024-2035 ($ Million)

31. South Korea Telecom Power Systems Market Size, 2024-2035 ($ Million)

32. ASEAN Telecom Power Systems Market Size, 2024-2035 ($ Million)

33. Australia and New Zealand Telecom Power Systems Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Telecom Power Systems Market Size, 2024-2035 ($ Million)

35. Latin America Telecom Power Systems Market Size, 2024-2035 ($ Million)

36. Middle East And Africa Telecom Power Systems Market Size, 2024-2035 ($ Million)

FAQS

The size of the Telecom Power Systems market in 2024 is estimated to be around $4,570 million.

Asia Pacific holds the largest share in the Telecom Power Systems market.

Leading players in the Telecom Power Systems market include Cummins Inc., Delta Electronics, Inc., Eaton Corp. plc, Huawei Technologies Co., Ltd., and Schneider Electric, among others

Telecom Power Systems market is expected to grow at a CAGR of 9.5% from 2025 to 2035.

The Telecom Power Systems Market is growing due to rising 5G deployment, increasing data traffic, and demand for reliable, energy-efficient telecom infrastructure.