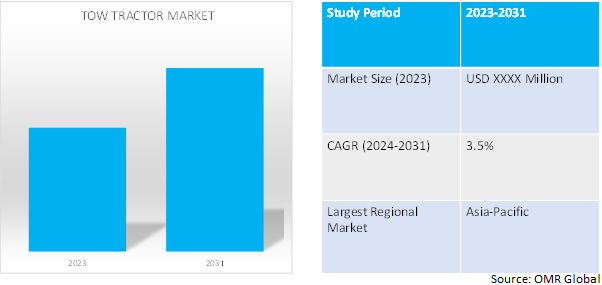

Tow Tractor Market

Tow Tractor Market Size, Share & Trends Analysis Report by Type (Rider-Seated Towing Tractor, Stand-In Towing Tractor, and Pedestrian Towing Tractor), by Propulsion (Electric and Fuel), and by Application (Airports, Railway Stations, Supermarkets, Industries, and Warehouses) Forecast Period (2024-2031)

Tow tractor market is anticipated to grow at a CAGR of 3.5% during the forecast period (2024-2031). Tow tractors are energy-efficient vehicles that are used in the transportation of goods and loads in warehouses, distribution centers, industries, and several other places. Towing tractors offer safety and high efficiency for picking and transportation operations of various types of goods such as stacked goods or unstacked goods, and roller caged goods.

Market Dynamics

Rise in awareness about environmental protection driving demand for electric tow tractors

Rise in awareness about environmental protection across the globe and enactment of stringent emission norms are the major factors boosting the adoption of electric tow tractors. Preference for these tractors are increasing in the industrial application for material handling operations due to advantages such as environmental friendliness, cost-effectiveness, enhanced efficiency & productivity, noise reduction, flexibility, and adaptability. The tow tractor industry is experiencing substantial growth, propelled by a heightened emphasis on sustainability, particularly through the widespread adoption of eco-friendly power sources such as lithium-ion batteries. As industries prioritize environmental considerations, the shift towards cleaner energy solutions aligns with eco-conscious practices and positions tow tractors as integral components in the evolving landscape of sustainable material handling, driving their increased demand and market growth.

Increase in automation in manufacturing

Globally, the rise in automation in industries, that have extensive multidisciplinary engineering and project management experience in fixed plant, mobile plant, autonomous mining, and manufacturing, is expected to bolster autonomous tow tractors market demand. For instance, in October 2023, Gotting KG's automated electric tow tractors set new standards in efficiency, flexibility, and safety. Designed to meet the ever-changing demands of modern production facilities, AGVs are revolutionizing the way material handling is done in businesses. AGV automated P250 electric tow tractor seamlessly adapts to different environments, whether in manufacturing, warehousing, or logistics.

Market Segmentation

Our in-depth analysis of the global tow tractor market includes the following segments by type, propulsion, and application:

- Based on type, the market is sub-segmented into rider-seated towing tractors, stand-in towing tractors, and pedestrian towing tractors.

- Based on propulsion, the market is bifurcated into electric and fuel.

- Based on application, the market is augmented into airports, railway stations, supermarkets, industries, and warehouses.

Rider-Seated Towing Tractor is Projected to Emerge as the Largest Segment

Based on the type, the global tow tractor market is sub-segmented into rider-seated towing tractors, stand-in towing tractors, and pedestrian towing tractors. Among these, the rider-seated sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes their widespread use in factories and big industries for transporting cargo and goods within the premises. The rider-seated towing tractors are more comfortable and more powerful than the other types because they can tow heavy loads in one trip. In addition, they are more convenient for transportation because they are more comfortable for the driver.

Warehousing Tow Tractor Sub-segment to Hold a Considerable Market Share

The rising usage of tow tractors for supply chain management is a major factor propelling segmental growth. Tow tractors use different power sources, some employing traditional combustion engines while others run on electric battery packs. The growing industrial and commercial trades are anticipated to propel the demand for storage and transportation facilities. These factors are the prominent factors driving the demand for tow tractors significantly during the forecast period. For instance, in May 2023, Toyota Material Handling broadened its material handling solutions with three new electric forklift models - an Industrial Tow Tractor, a Center Rider Stacker, and a Side-Entry End Rider. Prioritizing operator comfort, these additions deliver enhanced efficiency and versatility. The Industrial Tow Tractor and Center Rider Stacker seamlessly integrate with Toyota's lithium-ion batteries, and each of these models provides customizable features such as PIN code access and cold storage conditioning, ensuring enhanced security.

Additionally, the new electric Side-Entry End Rider, available in both 6,000 and 8,000-pound models, is perfect for cross-warehouse transportation and order picking, increasing uptime while reducing energy costs with a host of features, including an automatic parking brake and standard power steering.

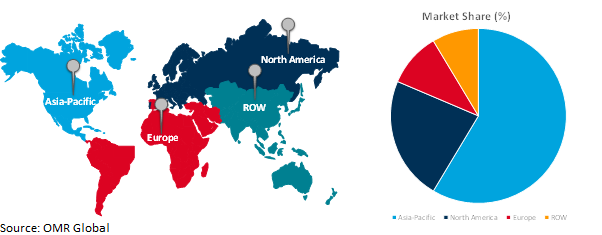

Regional Outlook

The global tow tractor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in biofuels and biorefineries

- Germany is the key investor and user of tow tractor around the globe due to rise in warehousing activities.

- The UK stringent regulation regarding zero carbon emission by government is leading to increased investment in tow tractor market.

Global Tow Tractor Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rising demand for tow tractor due to the strategic market penetration, extensive technological advancements, and responsive solutions tailored to diverse business needs. The region's robust economic growth is in line with a focus on sustainable practices, contributed to its substantial market share. Asian companies capitalized on these trends, establishing a strong foothold and shaping the industry landscape, thus positioning the region as a major contributor to the market development.

For instance, in April 2023, Tata-sons owned Air India (AI) has become the latest airline in the country to announce eco-friendly taxiing through robot tractors, also known as TaxiBots, at Delhi and Bengaluru airports for some of its Airbus A320 family of aircraft. AI said the switch-over will help it save almost 15,000 tonnes of fuel consumption in three years. AirAsia India and Air India Express, which are now being merged under the Air India group, along with SpiceJet, as well as cargo airlines BlueDart and Amazon Prime Air have already switched to TaxiBot operations in the country.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global tow tractor market include Hyster-Yale Materials Handling Inc., Jungheinrich AG, Husqvarna AB, Stanley Black & Decker, Inc., and John Bradshaw Limited, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2021, Japan's largest airline, All Nippon Airways (ANA), collaborated with Toyota Industries Corp. to initiate a trial of their newest autonomous tow tractor within the restricted premises of Tokyo Haneda Airport.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global tow tractor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Husqvarna AB

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hyster-Yale Materials Handling Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Jungheinrich AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Tow Tractor Market by Type

4.1.1. Rider-Seated Towing Tractor

4.1.2. Stand-in Towing Tractor

4.1.3. Pedestrian Towing Tractor

4.2. Global Tow Tractor Market by Propulsion

4.2.1. Electric

4.2.2. Fuel

4.3. Global Tow Tractor Market by Application

4.3.1. Airports

4.3.2. Railway Stations

4.3.3. Supermarkets

4.3.4. Industries

4.3.5. Warehouses

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Alke s.r.l

6.2. Eagle Tugs

6.3. Helge Nyberg AB

6.4. John Bradshaw Ltd.

6.5. Kalmar Motor AB

6.6. KION GROUP AG

6.7. Komatsu

6.8. Linde Material Handling GmbH

6.9. Mitsubishi Logisnext Co., Ltd.

6.10. Motrec International Inc.

6.11. SIMAI S.p.A

6.12. Stanley Black & Decker, Inc.

6.13. Taylor-Dunn Manufacturing, LLC

6.14. The Raymond Corp.

6.15. Toyota Material Handling, Inc.

1. GLOBAL TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL RIDER-SEATED TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL STAND-IN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PEDESTRIAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

6. GLOBAL ELECTRIC TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FUEL TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL TOW TRACTOR FOR AIRPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TOW TRACTOR FOR RAILWAY STATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TOW TRACTOR FOR SUPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TOW TRACTOR FOR INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL TOW TRACTOR FOR WAREHOUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. EUROPEAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

22. EUROPEAN TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD TOW TRACTOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL TOW TRACTOR MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL RIDER-SEATED TOW TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL STAND-IN TOW TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PEDESTRIAN TOW TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL TOW TRACTOR MARKET SHARE BY PROPULSION, 2023 VS 2031 (%)

6. GLOBAL ELECTRIC TOW TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FUEL TOW TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL TOW TRACTOR MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL TOW TRACTOR FOR AIRPORTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL TOW TRACTOR FOR RAILWAY STATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL TOW TRACTOR FOR SUPERMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TOW TRACTOR FOR INDUSTRIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL TOW TRACTOR FOR WAREHOUSES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL TOW TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

17. UK TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

29. THE MIDDLE EAST AND AFRICA TOW TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)