Algorithmic Trading Market

Algorithmic Trading Market Size, Share & Trends Analysis Report by Trading Type (Institutional Investors, Retail Investors, Long-term Trading, and Short-term Trading), By Components (Solutions and Services), By Deployment (Cloud and On-Premises), By Organization Size (Small and Medium Enterprises and Large Enterprises, Forecast Period (2025-2035)

Industry Outlook

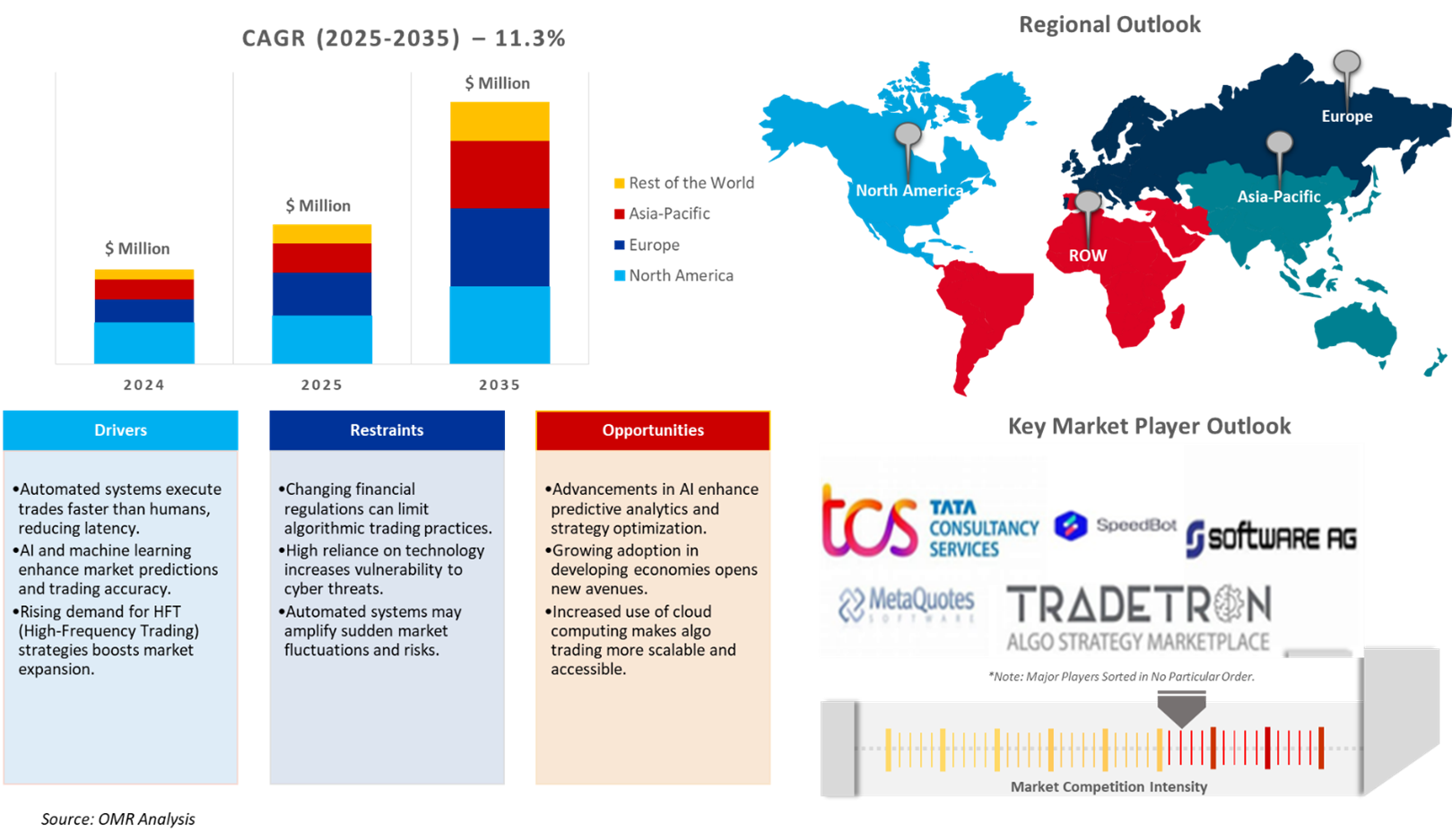

Algorithmic trading market was valued at $18.3 billion in 2024 and is projected to reach $59.4 billion by 2035, growing at a CAGR of 11.3% during the forecast period (2025-2035). The growth of the algorithmic trading market is primarily driven by the increasing demand for automation in trading processes across financial institutions and individual investors. Algorithmic trading enables faster and more accurate trade execution by utilizing complex mathematical models and advanced computational algorithms. The market is further fueled by the rising adoption of innovative technologies such as artificial intelligence (AI), machine learning, and cloud computing, which enhance trading strategies, predictive analytics, and risk management.

Segmental Outlook

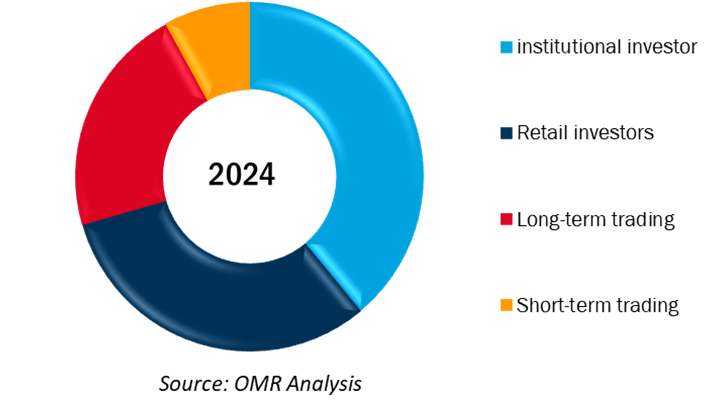

- Based on the trading type, the market is segmented into institutional investors, retail investors, long-term trading, and short-term trading.

- Based on the deployment, the market is segmented into cloud and on-premises.

- Based on the components, the market is segmented into solutions and services.

- Based on the organization, the market is segmented into small and medium enterprises and large enterprises.

- Institutional Investors Segment to Hold a Prominent Market Share in the Global Algorithmic Trading Market.

The institutional investor segment is expected to dominate the global algorithm trading market owing to several major factors. Hedge funds, mutual funds, pension funds, and insurance companies enable large-scale trading volume algorithm trading, enabling efficient order execution and reducing market effects. The demand for high-speed execution further accelerates this trend, as institutions take advantage of advanced algorithms to increase trading accuracy and reduce delays. Additionally, algorithm trading helps with cost efficiency by breaking large orders into smaller ones, which leads to significant, rapid market growth. Regulatory compliance and risk management also play an important role, encouraging the use of refined trading algorithms with structures such as MiFID II and the Dodd-Frank Act. Integration of AI and machine learning further strengthens institutional dominance, allowing advanced market trend analysis and future trading.

Global Algorithmic Trading Market Share By Trading Type, 2024 (%)

Regional Outlook

The global algorithmic trading market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). The Asia-Pacific market is anticipated to experience considerable growth over the forecast period.

North America to Hold a Considerable Share in the Global Algorithmic Trading Market

The North American algorithmic trading market is growing owing to the rising need for financial trade automation. Technology adoption, such as AI and ML, is improving trading effectiveness and decision-making. Support from regulation towards algorithmic trading practices is also propelling market expansion. High-frequency trading (HFT) methods are growing popular, driving market growth. The increasing intertwinement of cloud computing and big data analytics is streamlining trading operations. Also, the increasing presence of institutions is driving the need for advanced algorithmic trading platforms.

Market Players Outlook

The major companies serving the algorithmic trading market include Tradetron, Software AG, Metaquotes Software Corp, Tata Consultancy Services (TCS), Algo Trader AG, Speedbot, and others. These market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In December 2024, Broadridge Financial Solutions, Inc. announced the launch of an innovative AI-powered algorithm insights service for NYFIX. Driven by real-time liquidity mapping, the service is designed to empower asset managers, hedge funds, and other buy-side firms to achieve unprecedented accuracy, seamless workflow integration, and proven cost-efficiency.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global algorithmic trading market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Algorithmic Trading Market Sales Analysis – Traders | Deployment | Component | Organization Size | ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Algorithmic Trading Industry Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Algorithmic Trading Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Algorithmic Trading Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard –Algorithmic Trading Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Algorithmic Trading Market by Trader ($ Million)

5.1. Institutional Traders

5.2. Retail Traders

5.3. Long-term Investors

5.4. Short-term Investors

5.5. Other

6. Global Algorithmic Trading Market by Deployment ($ Million)

6.1. Cloud-Based

6.2. On-Premises

7. Global Algorithmic Trading Market by Component ($ Million)

7.1. Services

7.2. Solution

8. Global Algorithmic Trading Market by Organization Size ($ Million)

8.1. Large Organization

8.2. Small & Medium Organization

9. Regional Analysis

9.1. North American Algorithmic Trading Market Sales Analysis – Traders | Deployment | Component | Organization Size| Country ($ Million)

9.1.1. United States

9.1.2. Canada

9.2. European Algorithmic Trading Market Sales Analysis – Traders | Deployment | Component | Organization Size| Country ($ Million)

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Algorithmic Trading Market Sales Analysis – Traders | Deployment | Component | Organization Size| Country ($ Million)

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Algorithmic Trading Market Sales Analysis – Traders | Deployment | Component | Organization Size| Country ($ Million)

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Algo Trader AG

10.2. AlgoBulls

10.3. AlphaGrep

10.4. Citadel Enterprise Americas LLC

10.5. DRW Holdings, LLC.

10.6. Jane Street Group, LLC

10.7. Metaquotes Software Corp

10.8. QuantConnect Corp.

10.9. Software AG

10.10. SpeedBot

10.11. Susquehanna International Group, LLP

10.12. Symphony Fintech Solutions Pvt Ltd

10.13. Tata Consultancy Services (TCS)

10.14. Tethys

10.15. TradeStation

10.16. Tradetron

10.17. Trading Technologies International, Inc.

10.18. Two Sigma Investments, LP.

10.19. WorldQuant, LLC

10.20. XTX Markets Ltd.

1. Global Algorithmic Trading Market Research And Analysis By Traders, 2024-2035 ($ Million)

2. Global Algorithmic Trading For Institutional Traders Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Algorithmic Trading For Retail Traders Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Algorithmic Trading For Long-term Investors Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Algorithmic Trading For Short-term Investors Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Algorithmic Trading For Other Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Algorithmic Trading Market Research And Analysis By Deployment, 2024-2035 ($ Million)

8. Global On-Premises Algorithmic Trading Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Cloud-Based Algorithmic Trading Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Algorithmic Trading Market Research And Analysis By Component, 2024-2035 ($ Million)

11. Global Algorithmic Trading Service Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Algorithmic Trading Solution Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Algorithmic Trading Market Research And Analysis By Organization Size, 2024-2035 ($ Million)

14. Global Algorithmic Trading For Large Organization Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Algorithmic Trading For Small & Medium Organizations, And Analysis By Region, 2024-2035 ($ Million)

16. Global Algorithmic Trading Market Research And Analysis By Region, 2024-2035 ($ Million)

17. North America Algorithmic Trading Market Research And Analysis By Country, 2024-2035 ($ Million)

18. North American Algorithmic Trading Market Research And Analysis By Traders, 2024-2035 ($ Million)

19. North American Algorithmic Trading Market Research And Analysis By Deployment, 2024-2035 ($ Million)

20. North American Algorithmic Trading Market Research And Analysis By Component, 2024-2035 ($ Million)

21. North American Algorithmic Trading Market Research And Analysis By Organization Size, 2024-2035 ($ Million)

22. European Algorithmic Trading Market Research And Analysis By Country, 2024-2035 ($ Million)

23. European Algorithmic Trading Market Research And Analysis By Traders, 2024-2035 ($ Million)

24. European Algorithmic Trading Market Research And Analysis By Deployment, 2024-2035 ($ Million)

25. European Algorithmic Trading Market Research And Analysis By Component, 2024-2035 ($ Million)

26. European Algorithmic Trading Market Research And Analysis By Organization Size, 2024-2035 ($ Million)

27. Asia-Pacific Algorithmic Trading Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific Algorithmic Trading Market Research And Analysis By Traders, 2024-2035 ($ Million)

29. Asia-Pacific Algorithmic Trading Market Research And Analysis By Deployment, 2024-2035 ($ Million)

30. Asia-Pacific Algorithmic Trading Market Research And Analysis By Components, 2024-2035 ($ Million)

31. Asia-Pacific Algorithmic Trading Market Research And Analysis By Organization Size, 2024-2035 ($ Million)

32. Rest Of The World Algorithmic Trading Market Research And Analysis By Region, 2024-2035 ($ Million)

33. Rest Of The World Algorithmic Trading Market Research And Analysis By Traders, 2024-2035 ($ Million)

34. Rest Of The World Algorithmic Trading Market Research And Analysis By Deployment, 2024-2035 ($ Million)

35. Rest Of The World Algorithmic Trading Market Research And Analysis By Component, 2024-2035 ($ Million)

36. Rest Of The World Algorithmic Trading Market Research And Analysis By Organization Size, 2024-2035 ($ Million)

1. Global Algorithmic Trading Market Share By Traders, 2024 Vs 2035 (%)

2. Global Algorithmic Trading For Institutional Traders Market Share By Region, 2024 Vs 2035 (%)

3. Global Algorithmic Trading For Retail Traders Market Share By Region, 2024 Vs 2035 (%)

4. Global Algorithmic Trading For Long-term Investors Market Share By Region, 2024 Vs 2035 (%)

5. Global Algorithmic Trading For Short-term Investors Market Share By Region, 2024 Vs 2035 (%)

6. Global Algorithmic Trading For Other Investors Market Share By Region, 2024 Vs 2035 (%)

7. Global Algorithmic Trading Market Share By Deployment, 2024 Vs 2035 (%)

8. Global On-Premises Algorithmic Trading Market Share By Region, 2024 Vs 2035 (%)

9. Global Cloud-Based Algorithmic Trading Market Share By Region, 2024 Vs 2035 (%)

10. Global Algorithmic Trading Market Share By Component, 2024 Vs 2035 (%)

11. Global Algorithmic Trading Service Market Share By Region, 2024 Vs 2035 (%)

12. Global Algorithmic Trading Solution Market Share By Region, 2024 Vs 2035 (%)

13. Global Algorithmic Trading Market Share By Organization Size, 2024 Vs 2035 (%)

14. Global Algorithmic Trading For Large Organization Market Share By Region, 2024 Vs 2035 (%)

15. Global Algorithmic Trading For Small & Medium Organization Market Share By Region, 2024 Vs 2035 (%)

16. Global Fuel Cell Market Share By Region, 2024 Vs 2035 (%)

17. US Algorithmic Trading Market Size, 2024-2035 ($ Million)

18. Canada Algorithmic Trading Market Size, 2024-2035 ($ Million)

19. UK Algorithmic Trading Market Size, 2024-2035 ($ Million)

20. France Algorithmic Trading Market Size, 2024-2035 ($ Million)

21. Germany Algorithmic Trading Market Size, 2024-2035 ($ Million)

22. Italy Algorithmic Trading Market Size, 2024-2035 ($ Million)

23. Spain Algorithmic Trading Market Size, 2024-2035 ($ Million)

24. Russia Algorithmic Trading Market Size, 2024-2035 ($ Million)

25. Rest of Europe Algorithmic Trading Market Size, 2024-2035 ($ Million)

26. India Algorithmic Trading Market Size, 2024-2035 ($ Million)

27. China Algorithmic Trading Market Size, 2024-2035 ($ Million)

28. Japan Algorithmic Trading Market Size, 2024-2035 ($ Million)

29. South Korea Algorithmic Trading Market Size, 2024-2035 ($ Million)

30. Australia And New Zealand Algorithmic Trading Market Size, 2024-2035 ($ Million)

31. ASEAN Algorithmic Trading Market Size, 2024-2035 ($ Million)

32. Rest Of Asia-Pacific Algorithmic Trading Market Size, 2024-2035 ($ Million)

33. Rest Of The World Algorithmic Trading Market Size, 2024-2035 ($ Million)

FAQS

The size of the Algorithmic Trading market in 2024 is estimated to be around $18.3 billion.

North America holds the largest share in the Algorithmic Trading market.

Leading players in the Algorithmic Trading market include Tradetron, Software AG, Metaquotes Software Corp, Tata Consultancy Services (TCS), Algo Trader AG, Speedbot, and others.

Algorithmic Trading market is expected to grow at a CAGR of 11.3% from 2025 to 2035.

Growing demand for speed, efficiency, and AI-driven strategies is fueling the growth of the algorithmic trading market.