Chemical Sensor Market

Chemical Sensor Market Size, Share & Trends Analysis Report by Type (Electrochemical, Optical, Pellistor/Catalytic Bead, and Other), and by End-User Industry (Industrial, Healthcare, Environmental Monitoring, Defense, and Oil & Gas Industry) Forecast Period (2024-2031)

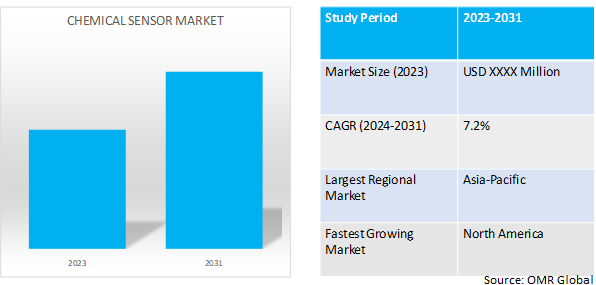

Chemical sensor market is anticipated to grow at a considerable CAGR of 7.2% during the forecast period (2024-2031). Chemical sensors are devices that detect and convert chemical information (such as concentration, pressure, activity of particles) into an electrical signal to obtain qualitative or quantitative time- and spatial-resolved information about specific chemical components. The high application of these sensors in the end-user industries is a key factor driving the growth of the global chemical sensor market.

Market Dynamics

Advancement in Sensing Technology

Technological advancements such as emergence of nanotechnology micro-electromechanical system (MEMS), and AI are shaping the global chemical sensor market. Miniaturization and improved sensitivity of sensors have led to them in integration in devices of various shapes, enhancing their capabilities. The adoption of smart sensors with wireless connectivity and data analytics is a current market trend. In October 2023, the UK Ministry of Defense (MoD) has awarded Smiths Detection an 88-million-pound ($107.6 million) contract to develop and deliver next-generation chemical sensors for the British armed forces. The project supports the UK’s effort to modernize its military’s chemical detecting capabilities, sustaining awareness over numerous hazardous materials and ensuring immediate action to protect defense personnel as well as civilians.

Growing Demand for Healthcare & Medical Diagnostics

The growing demand for personalized medicines and point-of-care diagnostics in the healthcare sector is a key factor driving the demand for miniaturized, portable, and precise chemical sensors for drug detection and disease diagnosis. With the increasing number of diagnostics procedures, the demand for chemical sensor is anticipated to grow during the forecast period. The integration of chemical sensors in medical devices enhances its diagnostic capacity. Enhanced diagnostic capabilities enable healthcare professional to make informed decision and optimize treatment plans according to the patient needs.

Market Segmentation

Our in-depth analysis of the global chemical sensor market includes the following segments by equipment type:

- Based on type, the market is sub-segmented into electrochemical, optical, pellistor/catalytic bead, and other. Other include magnetic.

- Based on end-user, the market is sub-segmented into industrial, healthcare, environmental monitoring, defense, and oil & gas industry.

Electrochemical Holds Major Share in the Global Market

Based on the type, the global chemical sensor market is sub-segmented into electrochemical, optical, pellistor/catalytic bead, and other. Other include magnetic. Electrochemical sensor holds major share in the global market. These sensors take leverage of chemical reactions to create electrical signals for accurate and sensitive detection. Low cost, rapid analytical response, simplicity, and ease of use are the key benefits of these chemical sensors. The rapid analytical response makes them ideal for flow analysis and alert systems. Simplicity allows for a virtually limitless variety of geometries, electrode materials, and configurations. The large-scale adoption of these sensors owing to their offered benefits is a key factor driving the growth of this market segment.

Environmental Monitoring to Exhibit Considerable Market Growth

The increasing concerns regarding air and water quality among different countries owing to growing pollution has a created demand for these sensors to continuously monitor these parameters. Presence of stringent government regulation in this area is further aiding to the demand of these sensors. Key industries and regulatory bodies are increasingly inclined towards adoption of advanced sensing technologies to ensure compliance with environment standards and mitigate the impact of industrial activities on environment.

Regional Outlook

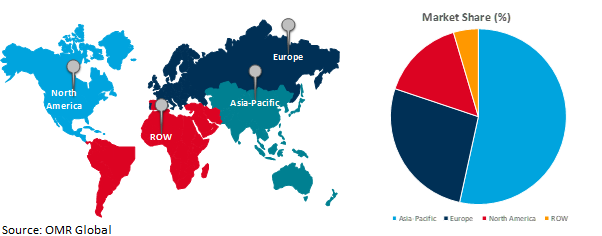

The global chemical sensor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Ongoing R&D in Asia-Pacific to Drive Market Growth

- In December 2022, researchers of Delhi-NCR have developed a new cost-effective sensor that can detect toxic chemicals such as formalin in food samples like preserved meat, fish and honey.

Global Chemical Sensor Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of several well-established end-user industries of chemical sensors across the region. The high investment in the oil & gas sector of the region is further fueling the demand for advanced chemical sensors across the region. For instance, in February 2024, The Canadian Association of Petroleum Producers (CAPP) has projected capital expenditures for the upstream oil and natural gas sector to increase to $29.9 billion (CAD 40.6 billion) in 2024 from an estimated $28.72 billion (CAD 39 billion) in the previous year. The presence of key market players along with growing investment in R&D of advanced chemical sensors is further aiding to the regional market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global chemical sensor market include Smiths Detection Inc., General Electric Co., MSA Safety Inc., Pepperl+Fuchs Group, and Honeywell International Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2023, Soter Technologies has signed a partnership agreement with Assek Technologies to provide Soter's FlySense FS286L sensor (a vape sensor) equipped with an integrated LoRaWAN network communication radio to schools across Canada.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global chemical sensor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. General Electric Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Honeywell International Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. MSA Safety Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Pepperl+Fuchs Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Chemical Sensor Market by Type

4.1.1. Electrochemical

4.1.2. Optical

4.1.3. Pellistor/Catalytic Bead

4.1.4. Other (Magnetic)

4.2. Global Chemical Sensor Market by End-User Industry

4.2.1. Industrial

4.2.2. Healthcare

4.2.3. Environmental Monitoring

4.2.4. Defense

4.2.5. Oil & Gas Industry

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.4. Rest of Asia-Pacific

5.5. Rest of the World

6. Company Profiles

6.1. ABB Ltd.

6.2. AirTest Technologies Inc.

6.3. Alpha MOS

6.4. Delphi Automotive PLC

6.5. Denso Corp.

6.6. Emerson Process Management

6.7. Halma plc.

6.8. Hoffman La-Roche

6.9. Nova Biochemical Corp.

6.10. Siemens AG

6.11. Smiths Detection Inc.

6.12. Yokogawa Electric Corp.

1. GLOBAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ELECTROCHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OPTICAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PELLISTOR/CATALYTIC BEAD CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER CHEMICAL SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

7. GLOBAL CHEMICAL SENSOR IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CHEMICAL SENSOR IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CHEMICAL SENSOR IN ENVIRONMENTAL MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CHEMICAL SENSOR IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CHEMICAL SENSOR IN OIL & GAS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

16. EUROPEAN CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

19. ASIA- PACIFIC CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA- PACIFIC CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. ASIA- PACIFIC CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

22. REST OF THE WORLD CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ELECTROCHEMICAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL OPTICAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL PELLISTOR/CATALYTIC BEAD CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023 VS 2031 (%)

6. GLOBAL CHEMICAL SENSOR IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL CHEMICAL SENSOR IN HEALTHCARES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL CHEMICAL SENSOR IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL CHEMICAL SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. US CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

12. UK CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

25. THE MIDDLE EAST & AFRICA CHEMICAL SENSOR MARKET SIZE, 2023-2031 ($ MILLION)