Core Banking Software Market

Global Core Banking Software Market Size, Share & Trends Analysis Report By Solution Type (Enterprise Customer Solutions, Loans, and Deposits), and by Service Type (Professional Service and Managed Service), By Deployment Type (On-premise and Cloud), and by End User (Banks, Financial Institutes and Others) Forecast Period (2022-2028).

The global core banking software market is anticipated to grow at a significant CAGR of 8.5% during the forecast period. The primary factor driving the core banking software market is the growing consumer demand for banking through online channels. As online banking helps to make transactions easy, check account balances, and make transfers with the help of smartphones. Further, it eliminates the need to wait for banking hours to complete their banking task. Banks are involved in bringing more facilities to their existing mobile applications. For instance, in March 2021, ICICI launched an instant EMI facility on its internet banking platform, which is known as EMI @ Internet Banking. The new facility is dedicated to allow pre-approved customers to convert high-value transactions up to Rs. 5 lakh into EMIs. With rising internet banking facilities, customers are expected to further attract towards more banking solutions.

Impact of COVID-19 Pandemic on Global Core Banking Software Market

The COVID-19 pandemic has spread to almost every country globally. Governments across the globe imposed stringent lockdown which affected every business including the banking sector. However, it resulted in the growth of online banking software as consumers were restricted to stay at their places, and banking transactions cannot be avoided due to which they adopted online banking solutions. Online banking was available before COVID-19, however, it has given a rise in the demand for online solutions after the COVID-19 as many people used online banking services for the first time during COVID-19. According to a survey by Deloitte, out of 1500 working individuals 20% of retail banking customers used at least one online banking service during COVID-19 for the first time. Further, most first-time users agreed to continue the online services after COVID-19, which shows the growth of the banking software market in the future.

Segmental Outlook

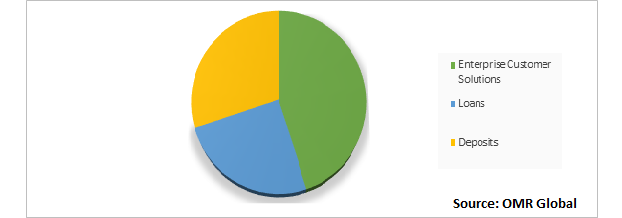

The global core banking software market is segmented based on the solution type, service type, deployment type, and end-user. Based on the solution type, the market is sub-segmented into enterprise customer solutions, loans, and deposits. Based on the service type, the market is sub-segmented into the professional service and managed service. Based on the deployment type, the market is sub-segmented into on-premise and cloud. Based on the end-user, the market is sub-segmented into the banks, financial institutes, and others. Out of solution type, enterprise customer solution is expected to witness significant growth during the forecast period. ?

Global Core Banking Software Market Share by Solution Type, 2021 (%)

The Enterprise Customer Solutions Segment is Projected to Show Significant Growth in the Global Core Banking Software Market.

The enterprise customer solutions is expected to show significant growth during the forecast period due to their ability to modernize current business processes with advanced banking technology. Enterprise customer solutions integrate with CRM and ERP systems to administrate management tools and customer information through the central database of a bank due to which banks are offering more solutions in this segment. For instance, in October 2021, HSBC launched Banking as a Service (BaaS) to provide customers with business banking services through their own platform. HSBC and Oracle NetSuite worked together to provide customers with international payments and expense management services embedded with NetSuite’s new SuiteBanking solution.

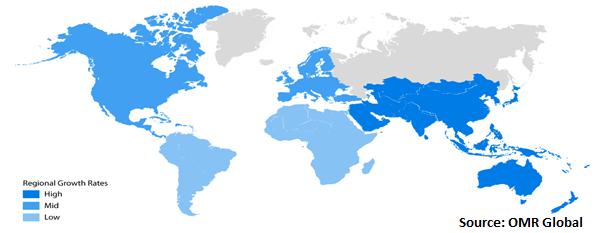

Regional Outlooks

The global core banking software market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). ?

Global Core Banking Software Market Growth, by Region 2022-2028

The North America Region Accounted for Major Share in the Global Core Banking Software Market.

The North America region accounted for a major share in the global core banking software market due to the presence of various banking software providers and leading banks in that region. A number of small and medium enterprises are encouraged to implement banking solutions for effective financing activities in that region. Further, numerous strategies are being formed by banking software providers to play an essential role in the growth of the market in North America. For instance, in December 2021, Temenos relocated its North American headquarters to the Helmsley Building on Park Avenue in New York City. Us is the key to Temenos strategy addressing 40% of Temeno’s market.

Market Players Outlook

The major companies serving the global core banking software market include Capgemini., C-Edge Technologies, Computer Services, Inc., EdgeVerve Systems Ltd., Finastra, FIS, Fiserv, Inc., HCL Technologies Ltd., IBM, Infrasoft Technologies, Jack Henry & Associates, Inc, Microsoft, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2022, M2P Fintech signed an agreement to acquire BSG ITSOFT, which provides core banking solutions. The acquisition boosts M2P Fintech’s approach to provide a new generation cloud-native platform and positions to offer a fully integrated banking and payments stack that is built on API-first infrastructure.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global core banking software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Core Banking Software Market

• Recovery Scenario of Global Core Banking Software Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Capgemini SE

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Finastra Ltd

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Oracle Corp

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Temenos AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Wipro Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Core Banking Software Market By Solution Type

4.1.1. Enterprise Customer Solutions

4.1.2. Loans

4.1.3. Deposits

4.2. Global Core Banking Software Market by Service Type

4.2.1. Professional Service

4.2.2. Managed Service

4.3. Global Core Banking Software Market By Deployment Type

4.3.1. On-premise

4.3.2. Cloud

4.4. Global Core Banking Software Market by End User

4.4.1. Banks

4.4.2. Financial Institutes

4.4.3. Others (Credit Unions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. C-Edge Technologies

6.2. Computer Services, Inc.

6.3. EdgeVerve Systems Ltd.

6.4. Fern Software Ltd.

6.5. FIS

6.6. Fiserv, Inc.

6.7. HCL Technologies Ltd.

6.8. IBM Corp

6.9. Infrasoft Technologies Ltd

6.10. Jack Henry & Associates, Inc

6.11. Microsoft Corp

6.12. NCR Corp.

6.13. SAP SE

6.14. Tata Consultancy Services Ltd.

6.15. Unisys Corp

6.16. VSoft Technologies Pvt. Ltd.

LIST OF TABLES

1. GLOBAL CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SOLUTION TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ENTERPRISE CUSTOMER SOLUTIONS IN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LOANS IN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL DEPOSITS IN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

6. GLOBAL PROFESSIONAL SERVICE IN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MANAGED SERVICE IN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2021-2028 ($ MILLION)

9. GLOBAL ON-PREMISE CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CLOUD CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12. GLOBAL CORE BANKING SOFTWARE IN BANKS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL CORE BANKING SOFTWARE IN FINANCIAL INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL CORE BANKING SOFTWARE IN OTHERS END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SOLUTION TYPE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

19. NORTH AMERICAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. EUROPEAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. EUROPEAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SOLUTION TYPE, 2021-2028 ($ MILLION)

23. EUROPEAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

24. EUROPEAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2021-2028 ($ MILLION)

25. EUROPEAN CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SOLUTION TYPE, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

31. REST OF THE WORLD CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

32. REST OF THE WORLD CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SOLUTION TYPE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD CORE BANKING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

LIST OF FIGURES

1. IMPACT OF COVID-19 ON GLOBAL CORE BANKING SOFTWARE MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL CORE BANKING SOFTWARE MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL CORE BANKING SOFTWARE MARKET, 2022-2028 (%)

4. GLOBAL CORE BANKING SOFTWARE MARKET SHARE BY SOLUTION TYPE, 2021 VS 2028 (%)

5. GLOBAL ENTERPRISE CUSTOMER SOLUTIONS IN CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL LOANS IN CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL DEPOSITS IN CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL CORE BANKING SOFTWARE MARKET SHARE BY SERVICE TYPE, 2021 VS 2028 (%)

9. GLOBAL PROFESSIONAL SERVICE IN CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL MANAGED SERVICE IN CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL CORE BANKING SOFTWARE MARKET SHARE BY DEPLOYMENT TYPE, 2021 VS 2028 (%)

12. GLOBAL ON-PREMISE CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL CLOUD CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL CORE BANKING SOFTWARE MARKET SHARE BY END-USER, 2021 VS 2028 (%)

15. GLOBAL CORE BANKING SOFTWARE IN BANKS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL CORE BANKING SOFTWARE IN FINANCIAL INSTITUTES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL CORE BANKING SOFTWARE IN OTHER END-USERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL CORE BANKING SOFTWARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. US CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

20. CANADA CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

21. UK CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

22. FRANCE CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

23. GERMANY CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

24. ITALY CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

25. SPAIN CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF EUROPE CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

27. INDIA CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

28. CHINA CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

29. JAPAN CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

30. SOUTH KOREA CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF ASIA-PACIFIC CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)

32. REST OF THE WORLD CORE BANKING SOFTWARE MARKET SIZE, 2021-2028 ($ MILLION)