Credit Insurance Market

Global Credit Insurance Market Size, Share, and Trends Analysis Report, by Coverage (Whole Turnover Coverage and Single Buyer Coverage), By Application (Domestic and International), and By Industry Verticals (Food & Beverages, IT & Telecom, Metals & Mining, Healthcare, Energy & Utilities, Automotive, and Others), Forecast Period (2022-2028)

The global credit insurance market is anticipated to grow at a considerable CAGR of 7.5% during the forecast period. Credit insurance or trade credit insurance facilitates cross-border commerce and investment by defending export markets and banks against the possibility of a payment default. Today, the majority of all global trade relies on some form of credit insurance or guarantee issued by a bank, insurer, or other financial institution which clearly shows the depth of the market. Credit insurance acts as a catalyst that provides financing to the real economy across the globe.

Moreover, by protecting exporters and banks against the risk of non-payment, credit insurance enables cross-border trade and investment which will provide an additional thrust to the market growth. With the rising import and export activities, organizations are widely investing in various financial tools, such as TCI and letters of credit (LC), to safeguard themselves from financial losses. In line with this, the increasing number of small and medium-sized enterprises (SMEs) is also contributing to the growth of the market.

Various technological advancements, such as the launch of artificial intelligence (AI) and the Internet of Things (IoT)-enabled insurance solutions, are acting as other growth-inducing factors. These technologies aid in running automated business rules, self-learning models, network analysis, predictive analytics, and device identification, which are highly beneficial for predicting risks. Other factors, including rapid digitization of the insurance sector, along with the implementation of favorable government policies promoting fair trade practices, are anticipated to drive the market toward growth.

However, Despite promising vaccinations globally, the Covid-19 pandemic threatens to cause chaos across industries and countries. Present times have caused a lot more claims across Credit Insurance that have led to increases in premiums and even refusal by a lot of Insurers to provide cover against a certain segment of Buyers that are affected by the pandemic. In addition, credit insurance is vital to a small corporation’s long-term survival. There is a greater emphasis on trade credit protection for SME Exporters.

The COVID-19 pandemic had increased the demand for trade credit insurance owing to the increased uncertainty and protectionism in global trade. Moreover, the financial instruments were severely affected due to the lockdowns imposed to curb the spread of the virus. Therefore, trade credit insurance products are gaining momentum during the pandemic situation to safeguard users' investments. This, in turn, has become one of the major growth factors for the credit insurance industry during the health crisis.

Segmental Outlook

The global credit insurance market is segmented based on the coverage, application, and industry verticles. Based on the coverage, the market is sub-segmented into whole turnover coverage and single buyer coverage. Based on application, the market is sub-segmented into domestic and international. Based on industry verticles, the market is sub-segmented into food & beverages, IT & telecom, metals & mining, healthcare, energy & utilities, automotive, and others. These segments can further be customized as per the requested research requirements.

Regional Outlooks

The global credit insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can also be analyzed for a particular region or country level as per the requirement.

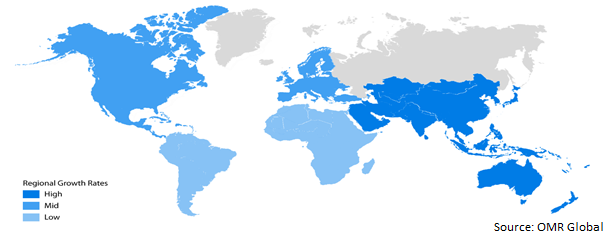

Global Credit Insurance Market Growth by Region, 2022-2028

The Europe Region Holds the Major Share in the Global Credit Insurance Market

Europe accounted for the largest market share followed by the North America region. Europe is the hub of leading companies that provide various services related to the credit insurance market. Euler Hermes, Atradius, and Coface is now known as Natixis Group are some of them. Moreover, due to the ongoing war between Russia-Ukraine and various sanctions applied on Russia; the credit insurance market is seeing a lot of turbulence which is affecting the market.

Market Players Outlook

The major companies serving the global credit insurance market include Allianz Trade (Euler Hermes), American International Group Inc., Atradius N.V., China Export & Credit Insurance Corp., Chubb Group, Coface Group, Export-Import Bank of the United States (EXIM), and Zurich Insurance Group. Ltd. among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2021, American International Group, Inc. acquired Willkie client Glatfelter Insurance Group, a full-service broker and the insurance company providing services for specialty programs and retail operations.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global credit insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Credit Insurance Market

• Recovery Scenario of Global Credit Insurance Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Credit Insurance Market by Coverage

4.1.1. Whole Turnover Coverage

4.1.2. Single Buyer Coverage

4.2. Global Credit Insurance Market by Application

4.2.1. Domestic

4.2.2. International

4.3. Global Credit Insurance Market by Industry Verticles

4.3.1. Food & Beverages

4.3.2. IT & Telecom

4.3.3. Metals & Mining

4.3.4. Healthcare

4.3.5. Energy & Utilities

4.3.6. Automotive

4.3.7. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Allianz Trade (Euler Hermes)

6.2. American International Group Inc.

6.3. Aon plc

6.4. Atradius N.V.

6.5. Axa S.A.

6.6. China Export & Credit Insurance Corp.

6.7. Chubb Group

6.8. Coface Group

6.9. Credendo Group

6.10. Empresas Grupo Cesce

6.11. Export Development Canada

6.12. Export-Import Bank of the United States (EXIM)

6.13. FCIA Management Co., Inc.

6.14. GreenLife Insurance Broking Pvt. Ltd.

6.15. HDFC ERGO

6.16. QBE Insurance, Ltd.

6.17. National Insurance Co. Ltd.

6.18. Nexus Underwriting Management Ltd.

6.19. Willis Towers Watson Pub. Co. Ltd.

6.20. Zurich Insurance Group. Ltd.

1. GLOBAL CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

2. GLOBAL CREDIT INSURANCE WITH WHOLE TURNOVER COVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CREDIT INSURANCE WITH SINGLE BUYER COVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL DOMESTIC CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL INTERNATIONAL CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICLES, 2021-2028 ($ MILLION)

8. GLOBAL FOOD & BEVERAGES CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL IT & TELECOM CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL METALS & MINING CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL HEALTHCARE CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL ENERGY & UTILITIES CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL AUTOMOTIVE CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL OTHER CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. NORTH AMERICAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICLES, 2021-2028 ($ MILLION)

20. EUROPEAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

22. EUROPEAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

23. EUROPEAN CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICLES, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICLES, 2021-2028 ($ MILLION)

28. REST OF THE WORLD CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

31. REST OF THE WORLD CREDIT INSURANCE MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICLES, 2021-2028 ($ MILLION)

1. GLOBAL CREDIT INSURANCE MARKET SHARE BY COVERAGE, 2021 VS 2028 (%)

2. GLOBAL CREDIT INSURANCE MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

3. GLOBAL CREDIT INSURANCE MARKET SHARE BY INDUSTRY VERTICLES, 2021 VS 2028 (%)

4. GLOBAL CREDIT INSURANCE WITH WHOLE TURNOVER COVERAGE MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL CREDIT INSURANCE WITH SINGLE BUYER COVERAGE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL DOMESTIC CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL INTERNATIONAL CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL FOOD & BEVERAGES CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL IT & TELECOM CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL METALS & MINING CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL HEALTHCARE CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL ENERGY & UTILITIES CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL AUTOMOTIVE CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL OTHER CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL CREDIT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. US CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. UK CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD CREDIT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)