Fine Arts Logistics Market

Fine Arts Logistics Market Size, Share, and Trends Analysis Report by Services (Art Storage Services, Packing and Case making, and Shipping Services), By End-Users (Art Dealers and Galleries, Auction Houses, and Museumsand Art Fairs), Forecast Period (2023–2030)

Fine arts logistics market is anticipated to grow at a considerable CAGR of 4.5% during the forecast period. Transportation, packing, storage, and import authorization of fine arts porcelains such as arts, paintings, antiques, and sculptures are all part of fine arts logistics. The artworks are stored in specialized humidity and temperature-controlled facilities outfitted with secure web-enabled cameras and closed-circuit televisions. Art dealers, auction houses, galleries, and museums contribute significantly to the worldwide fine arts market's sales revenue. Fine arts logistics is presently used by art galleries, museums, and other art collections, which is projected to drive the fine arts logistics market throughout the forecast period.

Segmental Outlook

The global fine arts logistics market is segmented by services and end-users. Based on services, the market is sub-segmented into art storage services, packing and casemaking, and shipping services. Based on end-users, the market is sub-segmented into art dealers and galleries, auction houses, and museums and art fairs. Among these, the art dealers and galleries segment is expected to hold the largest market share. Art dealers and galleries often use fine art logistics services to transport artworks to and from exhibitions, art fairs, and clients' homes or businesses. They also use these services to transport artworks to and from other galleries for collaborative exhibitions or to ship artworks to clients who purchase them online.

The Packing and Casemaking Segment Holds a Prominent Share in the Global Fine Arts LogisticsMarket

Based on services, the market is sub-segmented into art storage services, packing and casemaking, and shipping services. Among these, the packing and casemaking segment is expected to hold a significant market share during the forecast period. Fine art objects such as paintings, sculptures, and other decorative objects are often one-of-a-kind, irreplaceable, and expensive. Therefore, the safe and secure transportation of these objects is critical, and packing and casemaking can help ensure their safe arrival at their destination.This helps to maintain the value of the artworks and protect the investment of their owners.

Regional Outlook

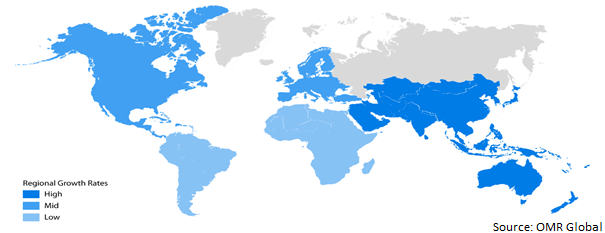

The global fine arts logisticsmarket is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the North American region is expected to generate the highest market share, followed by theAsia-Pacific and European markets. The rising number of art galleries, auction houses, and museums in China, India, France, Germany, and Japan can be ascribed to the Asia-Pacific and European markets’ expansion. Additionally, increased demand in these nations for modern and contemporary art would propel the regions’ market even further.

Global Fine Arts Logistics Market Growth, by Region (2023-2030)

The North American Region is Expected to Dominate the Global Fine Arts Logistics Market

The key driver of the region’s market is the high number of museums. According to UNESCO, the US has the most museums in the world, with roughly 33,082 institutions as of March 2021. Additionally, The Fine Art Group, a global art advisory and investment firm, stated that the number of high-net-worth individuals (HNWIs) in North America has grown significantly in recent years. This has led to an increase in the number of art collectors in the region, driving demand for fine art logistics services.According to recent reports published by the National Endowment for the Arts (NEA) and the Bureau of Economic Analysis (BEA) in March 2023, at the end of 2021, the arts and cultural sectors accounted for 4.4% of the US GDP, with an all-time high of just over $1 trillion, while the economic worth of the arts increased by 13.7% between 2020 and 2021.Besides,several new fine art logistics companies have entered the North American market in recent years, attracted by the growing demand for these services. For instance, Maquette Fine Art Services, a New York-based fine art logistics company, expanded its operations to Toronto in 2020 to meet growing demand from Canadian art collectors.

Market Players Outlook

The major companies serving the global fine arts logistics market include Fine Art Logistics, Four Winds, Isca Forwarding Ltd., Katolec Corp., Lotus Fine Arts, and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new product launches to stay competitive in the market. For instance, in March 2023, the Hasenkamp Group, one of the world's top art transport businesses, recently launched arca: Made to Protect, an uncompromisingly ecological art case. It is a reusable art case composed of locally obtained materials such as wood from the Paulownia tree. Its Kiri wood can store up to 35 kilos of CO2 per year and regrowth after harvesting like fruit on plantations.

The Report Covers-

- Market value data analysis for 2023 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fine arts logisticsmarket. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fine Arts Logistics Market by Services

4.1.1. Art Storage Services

4.1.2. Packing and Casemaking

4.1.3. Shipping Services

4.2. Global Fine Arts Logistics Market by End-Users

4.2.1. Art Dealers and Galleries

4.2.2. Auction Houses

4.2.3. Museums and Art Fairs

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agility Public Warehousing Company K.S.C.P.

6.2. Asian Tigers

6.3. Cadogan Tate

6.4. Cosmos International Freight Ltd.

6.5. Crown Worldwide Group

6.6. DB Schenker

6.7. Deutsche Post AG

6.8. Fine Art Logistics

6.9. Four Winds

6.10. Isca Forwarding Ltd.

6.11. Katolec Corp.

6.12. Lotus Fine Arts

6.13. Masterpiece International

6.14. Nippon Express Co., Ltd.

6.15. Star Worldwide Group

6.16. Transworld Group

1. GLOBAL FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

2. GLOBAL FINE ARTS LOGISTICS FOR ART STORAGE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL FINE ARTS LOGISTICS FOR PACKING AND CASEMAKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FINE ARTS LOGISTICS FOR SHIPPING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2022-2030 ($ MILLION)

6. GLOBAL FINE ARTS LOGISTICS FOR ART DEALERS AND GALLERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL FINE ARTS LOGISTICS FOR AUCTION HOUSES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL FINE ARTS LOGISTICS FOR MUSEUMS AND ART FAIRS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. NORTH AMERICAN FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

11. NORTH AMERICAN FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

12. NORTH AMERICAN FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2022-2030 ($ MILLION)

13. EUROPEAN FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. EUROPEAN FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

15. EUROPEAN FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2022-2030 ($ MILLION)

19. REST OF THE WORLD FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. REST OF THE WORLD FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

21. REST OF THE WORLD FINE ARTS LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2022-2030 ($ MILLION)

1. GLOBAL FINE ARTS LOGISTICS MARKET SHARE BY SERVICES, 2022 VS 2030 (%)

2. GLOBAL FINE ARTS LOGISTICS FOR ART STORAGE SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL FINE ARTS LOGISTICS FOR PACKING AND CASEMAKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL FINE ARTS LOGISTICS FOR SHIPPING SERVICES BY MARKET SHARE REGION, 2022 VS 2030 (%)

5. GLOBAL FINE ARTS LOGISTICS MARKET SHARE BY END-USERS, 2022 VS 2030 (%)

6. GLOBAL FINE ARTS LOGISTICS FOR ART DEALERS AND GALLERIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL FINE ARTS LOGISTICS FOR AUCTION HOUSES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL FINE ARTS LOGISTICS FOR MUSEUMS AND ART FAIRS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL FINE ARTS LOGISTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. US FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

11. CANADA FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

12. UK FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

13. FRANCE FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

15. ITALY FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

16. SPAIN FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

17. REST OF EUROPE FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

18. INDIA FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

19. CHINA FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

20. JAPAN FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

21. SOUTH KOREA FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF ASIA-PACIFIC FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF THE WORLD FINE ARTS LOGISTICS MARKET SIZE, 2022-2030 ($ MILLION)