Indirect tax management Market

Global Indirect tax management Market Size, Share & Trends Analysis Report by Deployment Type (Cloud-Based and On-Premises) by Vertical (Banking Financial Services and Insurance (BFSI), Information Technology (IT) and Telecom, Energy & Utilities, Healthcare & Life Science, Government, Retail and Consumer Goods, and Others) Forecast Period (2019-2025)

The indirect tax management market is projected to grow at a considerable CAGR of around 12% during the forecast period (2019-2025). The ongoing globalization, increasing competition, an ever-increasing regulatory compliance burden have created a need for advanced software that can maintain all the indirect tax legislation to maintain continuity of the business processes. The continuous increase in the number of financial transactions in different industrial verticals is further driving the growth of the global indirect tax management market. Furthermore, the intensity and volume of the indirect taxes are more, therefore there exists a requirement for highly advanced software to perform faster and more accurate calculations. The indirect tax management software provides a standard single platform for effective tax management and to determine compliance responsibilities.

The indirect tax management software solution offers several advantages over the conventional method of manual calculation related to taxation. The manual methods of indirect taxation are more error-prone and costly in comparison to the highly advanced automatic solution method. The proper utilization of the indirect tax management solution simplifies the growing complexity of the indirect tax-related transactions. This solution meets the changing requirements of businesses by ensuring compliance with the rules and regulations by meeting up the most up-to-date tax content. This solution enables different verticals to gain insights & devise smart tax strategies. The automation of tax management intends to meet the overall objectives of the corporate.

Segmental Outlook

The indirect tax management market is classified on the basis of deployment type and vertical. Based on type, the market is bifurcated into cloud-based and on-premises indirect tax management software. Based on the deployment type, the on-premises segment is estimated to hold considerable market share during the forecast period. Cloud-based indirect tax management solutions are anticipated to grow at a significant growth rate during the forecast period. The growth is attributed to the rising adoption of cloud services across the globe owing to its cost efficiency and other benefits. Based on the verticals, the market is segmented into Banking Financial Services and Insurance (BFSI), Information Technology (IT) and telecom, energy & utilities, healthcare & life sciences, government, retail and consumer goods, and others.

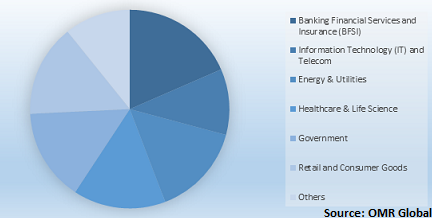

BFSI will be considerable segment by Vertical

Operations in BFSI are decentralized and distributed by their nature. Hence, in order to enhance their reach and access, the BFSI sector has to manage a wide variety of customers in several regions under different rules and regulations. As a result, a document management system for the BFSI industry is much more complex and critical. Therefore these organizations are actively adopting these solutions to perform business process management, KYC and risk management, record management & OCR, and security & confidentiality. Hence, the high adoption of this solution in the BFSI sector to improve the performance of their activities, is a major factor to promote the growth of this market segment.

Global Indirect Tax Management Market Share by Vertical, 2018 (%)

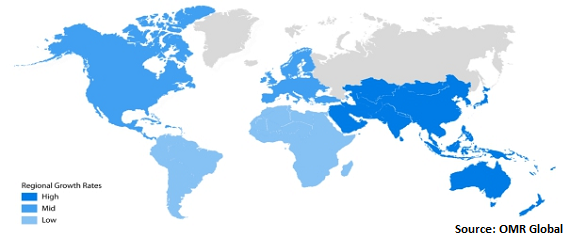

Regional Outlook

The global indirect tax management market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and Rest of the World. North America is projected to hold a considerable market share in the global indirect tax management market during the forecast period. The US is known to have the most developed taxation system across the globe. Oracle Corp., SAP SE, and Intuit Inc. in the region are the major players operating in the country. The strict government policies related to tax filing along with the presence of key software vendors are the key factors promoting the growth of the indirect tax management market in North America.

Global Indirect Tax Management Market Growth, by Region 2019-2025

Asia-Pacific will augment with the significant growth rate in the indirect tax management market

Asia-Pacific is anticipated to showcase a considerable CAGR during the forecast period. The factors attributing towards the growth of the Asia-Pacific region include a considerable increase in the penetration of digital payment systems, and digital accounting applications. Moreover, the emergence of small and medium enterprises is likely to promote the activities that involve the management of indirect taxes which in turn will drive the growth of the indirect tax management market in the Asia-Pacific region. The shift of the Indian government towards the adoption of the GST scheme has further propelled the adoption of such type of software in the region. Moreover, China is a major player in the SaaS platform which is again promoting the adoption of indirect tax management in the country.

Market Players Outlook

The global indirect tax management market is mainly influenced by product development and advancements conducted by the key players operating in the market. The major companies operating in the indirect tax management market include Avalara Inc., Oracle Corp., Intuit Inc., Thomson Reuters, SAP SE, and Wolters Kluwer N.V. among others. These players are actively adopting different growth strategies such as merger & acquisitions, partnership, and collaboration. Technological advancement and new product launches are the core strength of the market players to remain competitive in the market place.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global indirect tax management market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Indirect Tax Management Market by Deployment Type

5.1.1. Cloud Based

5.1.2. On-Premises

5.2. Global Indirect Tax Management Market by Vertical

5.2.1. Banking Financial Services and Insurance (BFSI)

5.2.2. Information Technology (IT) and Telecom

5.2.3. Energy & Utilities

5.2.4. Healthcare & Life Science

5.2.5. Government

5.2.6. Retail and Consumer Goods

5.2.7. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acumatica, Inc.

7.2. Avalara, Inc.

7.3. Blucora, Inc.

7.4. CrowdReason, LLC

7.5. Drake Enterprises, Inc.

7.6. H&R Block, Inc.

7.7. Intuit, Inc.

7.8. Oracle Corp.

7.9. Paychex, Inc.

7.10. Rethink Solutions, Inc.

7.11. Sage Intacct Inc.

7.12. SAP SE

7.13. SAXTAX Software

7.14. Shoeboxed, Inc.

7.15. Sovos Compliance, LLC

7.16. Wolters Kluwer N.V.

1. GLOBAL INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL CLOUD BASED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ON PREMISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

5. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION,2018-2025 ($ MILLION)

7. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN ENERGY & UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN HEALTHCARE & LIFE SCIENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN RETAIL AND CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL INDIRECT TAX MANAGEMENT SOFTWARE IN OTHERS VERTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. NORTH AMERICAN INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

15. EUROPEAN INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

21. REST OF THE WORLD INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD INDIRECT TAX MANAGEMENT MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL INDIRECT TAX MANAGEMENT MARKET SHARE BY DEPLOYMENT TYPE, 2018 VS 2025 (%)

2. GLOBAL INDIRECT TAX MANAGEMENT MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

3. GLOBAL INDIRECT TAX MANAGEMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. THE US INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. UK INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD INDIRECT TAX MANAGEMENT MARKET SIZE, 2018-2025 ($ MILLION)