Workspace as a Service Market

Global Workspace as a Service Market Size, Share & Trends Analysis Report by Deployment Mode (Public, Private, and Hybrid), by Solution (Desktop as a Service (DaaS) and Application as a Service (AaaS)), and by Vertical (BFSI, IT & Telecom, Retail, Government, and Others) and Forecast 2019-2025

The global workspace as a service market is growing significantly, at a CAGR of 14.3% during the forecast period (2019-2025). Workspace as a service (WaaS) is the desktop virtualization service hosted on the cloud in which, Virtual Desktop Infrastructure (VDI) is outsourced to a third-party service provider along with all the responsibilities of maintaining upgrades, storage, security, and data backup. The increasing proliferation of endpoint devices coupled with the rising adoption of cloud and the consumerization of IT has made the management of desktop more complicated than ever before. Workspace as a service offers an efficient solution for the companies preferring cloud-based solutions over conventional solutions, which, in turn, has increased the adoption of workspace as a service among enterprises.

The key factors that influence the growth of the market includes the increasing adoption of cloud-based services, shifting trend toward BYOD and increasing concern regarding data security and privacy. In addition, the increased demands for virtual solutions and services in small as well as large organizations. The consumers are frequently shifting towards desktop virtualization to address the challenges and opportunities of the evolving workplace. It offers a broad range of benefits to the enterprises such as strong security, data protection, and desktop access from multiple devices and others that propel the demand of workspace as a service. Besides, the significant rise in the costs of the hardware is due to a shortage of dynamic random-access memory (DRAM) owing to the lack of novel wafer capacity. Also, the larger screens and more graphic boards lead to the rising cost that contributes to the increased prices of hardware materials. Thus, increased hardware prices positively affect market growth during the forecast timeframe. However, factors such as high bandwidth requirements hampering the growth of the workspace as a service market during the forecast timeframe.

Segmental Outlook

The workspace as a service market is classified on the basis of deployment mode, solution, and vertical. Based on deployment mode, the market is segmented into public, private, and hybrid. Based on the solution, the market is segmented into desktop as a service (DaaS) and application as a service (AaaS). Based on vertical, the market is segmented into BFSI, IT & telecom, retail, government, and others.

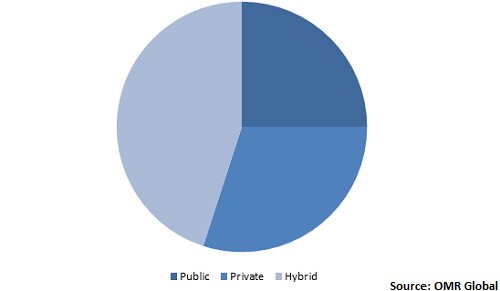

Global Workspace as a Service Market Share by Deployment Mode, 2018 (%)

Hybrid cloud contributes a significant share in the workspace as a service market

Hybrid cloud is widely adopted owing to the fact that it enables storage of legacy information or backup of data to be stored for a long-term. Further, hybrid cloud can transform conventional IT infrastructure to service model with enhanced flexibility, decreased operational tasks with the assistance of automated administrative tasks, self-service infrastructure access and applications, and optimal utilization of IT resources. With the deployment of a hybrid cloud, the organization’s workload is contained within a private cloud while also retaining the ability to spontaneously increase the workload and perform the spikes of usage on the public cloud. Additionally, the hybrid cloud also offers the benefit of being cost-effective as the organization’s pay for the public cloud portion of its infrastructure only when it is required. Owing to these, adoption of this server model is gaining more traction across various industry verticals.

Regional Outlook

The global workspace as a service market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America is estimated to have considerable share in the global workspace as a service market. The growth is attributed to the increased dependency of the individuals in the region on digital devices which has an increased number of devices such as smartphones and laptops. Further, the presence of a large number of enterprises in the region, particularly in the US further gives a boost to the growth of the market in the region. For instance, as per the Organisation for Economic Co-operation and Development (OECD), there were around 34,000 enterprises in the US in 2017. The growing number of enterprises raises the demand for hardware; thereby the companies are widely adopting this technology in order to reduce expenditure on the IT hardware. Also, the presence of key service providers in the region such as Amazon Web Services Inc. and Citrix Systems Inc., further drives the growth of the workspace as a service market.

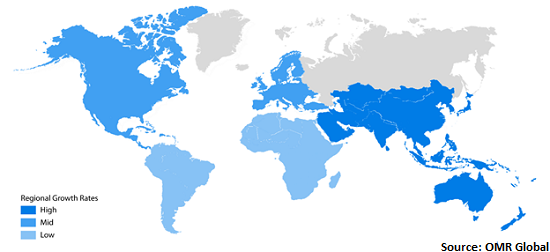

Global Workspace as a Service Market Growth, by Region 2019-2025

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the workspace as a service market during the forecast period. This growth is attributed to rising number of small enterprises and increasing digitization in emerging economies in the region. The workspace as a service market in Asia-Pacific is mainly driven by the contribution of major countries such as China, India, Japan, and South Korea and so on. Increasing digitalization in emerging economies such as India and China are further estimated to drive the growth of the market. In addition, SMEs constitute the most significant percentage of the private sector in Asia-Pacific. Technological innovation can act as the driver towards SMEs enhancing the global economy, which in turn, will drive the growth of workspace as a service among SMEs in Asia-Pacific.

Market Players Outlook

The key players in the workspace as a service market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global workspace as a service market include Amazon Web Services, Inc., VMware, Inc., Cisco Systems, Inc., Microsoft Corp., and Oracle Corp. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global workspace as a service market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amazon Web Services, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Microsoft Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Cisco Systems, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. VMware, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Oracle Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Workspace as a Service Market by Deployment Mode

5.1.1. Public

5.1.2. Private

5.1.3. Hybrid

5.2. Global Workspace as a Service Market by Solutions

5.2.1. Desktop as a Service (DaaS)

5.2.2. Application as a Service (AaaS)

5.3. Global Workspace as a Service Market by Vertical

5.3.1. BFSI

5.3.2. IT & Telecom

5.3.3. Retail

5.3.4. Government

5.3.5. Others (Education and Healthcare)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amazon Web Services, Inc.

7.2. Axiom IO, Inc.

7.3. Cisco Systems, Inc.

7.4. Citrix Systems, Inc.

7.5. Cloudalize NV

7.6. Dizzion, Inc.

7.7. Eaton Corp.

7.8. Evolve IP, LLC

7.9. Fujitsu Ltd.

7.10. IBM Corp.

7.11. Microsoft Corp.

7.12. MTM Technologies, Inc.

7.13. Navisite, LLC

7.14. NetApp Inc.

7.15. Nutanix, Inc.

7.16. Oracle Corp.

7.17. PC Connections, Inc.

7.18. Tocario GmbH

7.19. Unisys Corp.

7.20. VMware, Inc.

1. GLOBAL WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2018-2025 ($ MILLION)

2. GLOBAL PUBLIC WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PRIVATE WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL HYBRID WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

6. GLOBAL DESKTOP AS A SERVICE (DAAS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL APPLICATION AS A SERVICE (AAAS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

9. GLOBAL WORKSPACE AS A SERVICE FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL WORKSPACE AS A SERVICE FOR IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL WORKSPACE AS A SERVICE FOR RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL WORKSPACE AS A SERVICE FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL WORKSPACE AS A SERVICE FOR OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2018-2025 ($ MILLION)

17. NORTH AMERICAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

18. NORTH AMERICAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

19. EUROPEAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2018-2025 ($ MILLION)

21. EUROPEAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

22. EUROPEAN WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

27. REST OF THE WORLD WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2018-2025 ($ MILLION)

28. REST OF THE WORLD WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

29. REST OF THE WORLD WORKSPACE AS A SERVICE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL WORKSPACE AS A SERVICE MARKET SHARE BY DEPLOYMENT MODE, 2018 VS 2025 (%)

2. GLOBAL WORKSPACE AS A SERVICE MARKET SHARE BY SOLUTION, 2018 VS 2025 (%)

3. GLOBAL WORKSPACE AS A SERVICE MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

4. GLOBAL WORKSPACE AS A SERVICE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. USWORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

7. UKWORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD WORKSPACE AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)